“XRP Recently in Green, But Outsized Risks Prevail. XRP’s recent rally is unlikely to endure, in our view. Ripple’s litigation risks and the prospect of XRP being classified as a security were largely ignored over the past three months as XRP staved off the effects of the broader crypto-price collapse. This stalling has helped to make XRP the second-largest asset of its kind by market capitalization.”

Bloomberg Crypto Outlook

Key Takeaways

- Ripple Labs Inc. claims that they are not the creators of the coin XRP. However, the company Ripple Labs Inc. has earned over $890 million in revenue from selling XRP coins on the market. In June 2019, the company Ripple moved 1,000,000,000 XRP from their escrow account to the market, which could generate approximately $300 million more in revenue from selling XRP.

- Ripple was created by Jed McCaleb, the creator of Mt. Gox. McCaleb has since sold most of his 9 billion XRP coins, and he has abandoned the project. McCaleb now is the leader of Stellar and owns approximately 1 billion lumens.

- The coin XRP does not need to be used by the Ripple Network for settling transactions. Various investment reports value XRP at close to zero in worth, and XRP could be an unregistered security in the US.

Soaring 3000 %, XRP was one of the ultimate high-flyers during the 2017 crypto boom. At USD 0.31 the cryptocurrency lost 89 % since its all-time high of USD 3.31 in January of 2018.[1] Ripple has been on the Forbes Fintech 50 List for three years in a row by Laura Shin; however, Shin recently changed her position on Ripple and XRP. In episode 39 of the Unchained podcast, Shin discusses the main problems with Ripple and XRP.[2] We highly recommend the interview. The main questions that were discussed include:

- What is Ripple?

- What is XRP’s Elevator Pitch?

- Is XRP an unregistered security?

- Who owns and uses XRP?

- Is XRP centralized?

We will be addressing these questions in this article.

Ripple Came Before Bitcoin

Most investors do not know this, but the concept for Ripple came in 2004 from Ryan Fugger, way before Bitcoin was created in 2008. However, the Ripple we know today, Ripple Labs Inc., was handed over in 2012 to Chris Larsen and Jed McCaleb.

Source: BitMEX Research.

If Jed McCaleb sounds familiar, it’s because he was the original founder of the infamous Mt. Gox Bitcoin exchange. When McCaleb sold Mt. Gox to Mark Karpelès, 80,000 Bitcoin were missing.[3] However, the contract of a sale stated that Karpelès could not hold McCaleb legally accountable. Years later, McCaleb’s login details for the backend of Mt. Gox were still valid, and they were used to hack into Mt. Gox in order to steal Bitcoin.[4] To this day, the perpetrator of those hacks remains unknown.

XRP Ledger, RippleNet, xCurrent, xRapid, and xVia

The first information to untangle is what exactly is XRP? XRP coins are accounting units in an open source distributed database called the XRP Ledger (XRPL). In contrast with XRP and the XRP Ledger, Ripple Labs Inc. is a company that provides a closed source software called RippleNet to companies, and Ripplenet contains a suite with three tools: xCurrent, xRapid, and xVia. The myriad of products and information surrounding the products befuddles investors and distracts them from understanding what XRP is. We briefly describe each of the three products in this section.

XRP Ledger

The XRP Ledger is a distributed ledger that stores information regarding XRP transactions and balances. The main question: Is XRP Ledger’s consensus mechanism decentralized? We searched for a comprehensive technological analysis of XRP’s consensus mechanism, but one does not currently exist. A plethora of articles exists online, with answers ranging from the XRP Ledger consensus mechanism is centralized to decentralized and everywhere in between. What is clear is that RippleNet’s xCurrent and xVia are not using the XRP Ledger, so they have centralized consensus.

According to the latest whitepaper written by Ripple Research by Brad Chase and Ethan MacBrough, to come to consensus on what transactions are valid and what transactions are invalid, the XRP Ledger uses the XRP Consensus Protocol, which is “a Byzantine Fault tolerant agreement protocol over collectively trusted subnetworks.”[5] Binance Academy explains in simple terms how XRP Ledger’s consensus works,

“The XRPL is managed by a network of independent validating nodes that constantly compare their transaction records. Anyone is able to not only set up and run a Ripple validator node but also to choose which nodes to trust as validators. However, Ripple recommends its clients to use a list of identified, trusted participants to validate their transactions. This list is known as the Unique Node List (UNL).

The UNL nodes exchange transaction data between each other until all of them agree on the current state of the ledger. In other words, transactions that are agreed upon by a supermajority of UNL nodes are considered valid and the consensus is achieved when all these nodes apply the same set of transactions to the ledger.”[6]

However, as BitMEX claims this entire process is unnecessary because, in order for a node to support a proposal for a new set of transactions, a node must download private keys from a server that is controlled by Ripple.[7]

“The software indicates that four of the five keys are required to support a proposal in order for it to be accepted. Since the keys were all downloaded from the Ripple.com server, Ripple is essentially in complete control of moving the ledger forward, so one could say that the system is centralised. Indeed, our node indicates that the keys expire on 1 February 2018…, implying the software will need to visit Ripple.com’s server again to download a new set of keys.”

According to BitMEX Research, XRP’s Ledger is unable to achieve distributed consensus:

“For example, one user could connect to five validators and another user could connect to five different validators, with each node meeting the 80% thresholds, but for two conflicting ledgers. The 80% quorum threshold from a group of servers has no convergent or consensus properties, as far as we can tell. Therefore, we consider this consensus process as potentially unnecessary.”

Another problem regarding the single point of failure aspect of XRP Ledger’s consensus mechanism is that there is no fee for validating transactions. This means there is no incentive for becoming a validator in the Ripple network. According to Ripple, institutional participants will be incentivized to run nodes at their expense for the health of the network.[8] For some, this assumption seems arduous: One could argue that large financial institutions will not run an XRP node because of potential legal recourse that could ensue. As Joe Kendzicky points out:

“Imagine the PR backlash a bank would receive if it came out that one of its UNL peers was a darknet market, and the bank themselves played a direct role relaying drug and money laundering related transactions.”[9]

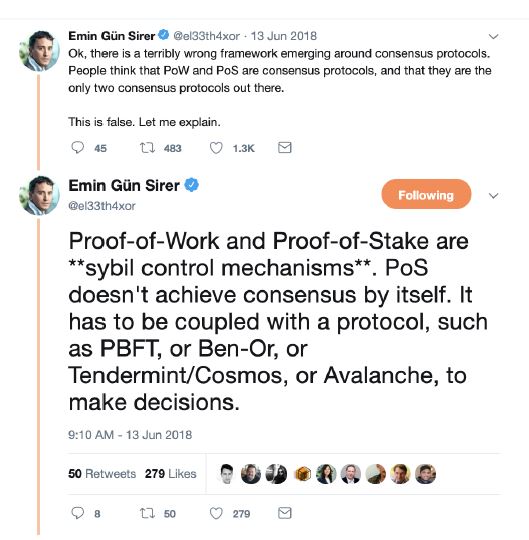

In general, Byzantine Fault Tolerant consensus mechanisms are more centralized than Bitcoin’s proof-of-work and longest chain consensus mechanism. Since XRP Ledger’s is expected to migrate to a different consensus algorithm called Cobalt at a date that has not been determined yet, we will leave the discussion on consensus here and hope for an unbiased analysis of exactly how decentralized XRP’s consensus really is.[10] Moving on from the XRP Ledger is RippleNet, which is a closed source software that contains three main products: xCurrent, xRapid, and xVia.

xCurrent

xCurrent’s peer-to-peer structure is similar to the Lightning Network discussed in The Crypto Research Report March 2018 edition. If Bank A wants to pay Bank B with US dollars, but Bank B wants to be paid in euros, the xCurrent protocol layer could route the transaction. Bank A would submit a transaction to convert the US dollars to euros (in the form of an IOU) to a global order book. xCurrent then acts as a path-finding algorithm to find the cheapest route for the US dollars amount to be exchanged to euros.

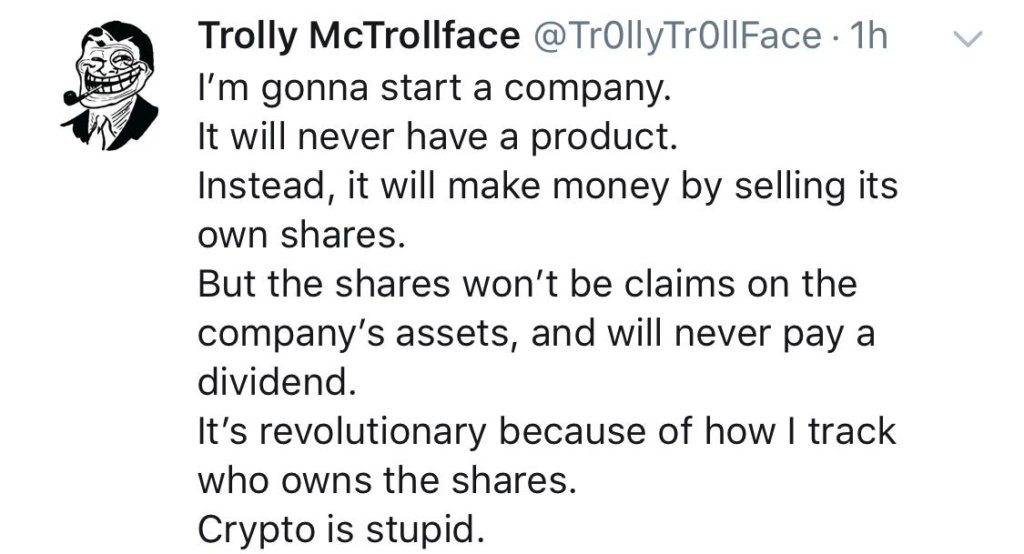

One of the most interesting and at the same time most widely ignored features of Ripple are the fact that transactions on Ripple’s xCurrent software do not need to be denominated in the network’s native currency, namely XRP.[11] Contrary to common belief, the network can manage IOUs denominated in any type of asset.

“The use of XRP is totally independent of the Ripple network in general; that is, banks don’t actually need XRP to transfer dollars, euros, etcetera which is what many small investors might be missing when they are buying the token.”[12]

While the xCurrent protocol layer is currency-agnostic, there is a small transaction fee (~.00001XRP) to access the exchange.[13] This transaction fee is not collected by anyone, but rather destroyed once payed. The stated idea behind the fee is to prevent spamming on the network.[14] However, burning XRP also makes Ripple Labs richer. When the network burns the transaction fee in XRP, the remaining amount of XRP in existence are worth more because the supply is decreasing with constant demand, ceteris paribus. Since the developers and Ripple Labs own the majority of Ripple, each transaction fee makes the developers and Ripple Labs wealthier.

xRapid

xRapid is built on top of the XRP Ledger and can be used to settle transactions denominated in the native XRP token. xRapid is the only one of RippleNet’s three-suite software package that is built on top of the XRP Ledger, which means that as xRapid gains more adoption, there is more demand for XRP.

In order to use xRapid, banks or other participants either need to hold XRP reserves, as the bridge currency, on their balance sheets, or have dedicated liquidity lines operating on the xRapid layer, which is what the Ripple Lab Inc. would like to see because this would give value to XRP, of which they own approximately 60 % of currently. But why would banks just give away their wealth away to Ripple Labs by buying up XRP off of the open market in order to settle international payments? In order for banks to use xRapid, they would need to invest in XRP and potentially hold reserves of XRP. Why would banks accept the currency risk of holding on to XRP reserves in order to use xRapid, when they can just use a stablecoin or central bank cryptocurrency?

One reason is if the bank also owns XRP or is a private investor in Ripple Labs equity shares. One of the banks that is often cited as a user of XRP, Strategic Business Innovator (SBI) Remit Co. Ltd., is actually invested in the private equity shares of Ripple Labs Inc., and has a financial incentive to promote positive news headlines regarding the company and XRP because when more banks are shown as using XRP, then Ripple Labs Inc. earns more in quarterly sales revenue from XRP sales.[15]

xVia

Various YouTube videos and Twitter tweets state that Ripple is a competitor to the Society for the Worldwide Interbank Financial Telecommunications (SWIFT) network. However, many investors do not even understand how the SWIFT network works. Actually, SWIFT does not settle a single transaction. SWIFT is only a messaging system between banks and settlement systems, such as the Clearing House Interbank Payments System (CHIPS). xVia is the messaging application for RippleNet users that need to send invoices or other information to other users. This is the part of the technology that would compete with the SWIFT network.

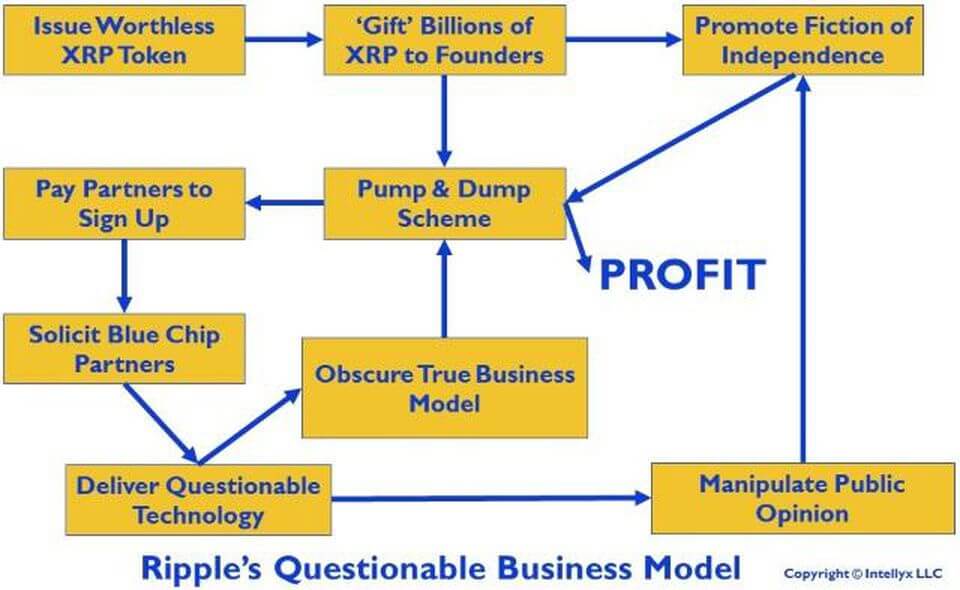

Unlike SWIFT, Ripple Labs is an enterprise software company that has a negative customer acquisition cost because they can pay people in XRP to use XRP. In Ripple’s 2017 October market report, they explain that they offer a 300 % rebate on integrating the Ripple software.[16] The rebate is paid in XRP. This means that any costs that a firm has for integrating RippleNet into their system will be rewarded with a 300 % return. They seeded a $300 million accelerator fund that helps cover the costs of integrating RippleNet into existing companies.[17] They are willing to lend XRP to market makers at zero cost, which allows market makers to add millions in revenue to their bottom line.[18] Although, this encourages firms to work with the Ripple network and with XRP, some financial analysts say that Ripple’s free distribution of XRP to banks that are willing to experiment with RippleNet borders a bribe.[19] The current security problems that SWIFT has regarding fraud and hacks would be the same with xVia because xVia is part of RippleNet, which is closed source and has centralized consensus and is a single point of failure.

What is XRP’s Elevator Pitch?

Ripple and Libra are both effectively trying to become a global private central bank. The main investment argument made by XRP enthusiasts is that retail investors can front-run banks that eventually will adopt XRP for cross-border settlements. Since the banks will rush in and buy reserves of XRP to use as a bridge currency, the price will go up, rewarding early investors with an XRP appreciation. But why would banks give up their market share to XRP voluntarily? Banks currently settle international payments and incur a cost of approximately 20 basis points per transaction.[20] Ripple noted that their system could reduce settlement costs by six basis points, and an additional two basis points if XRP is used on the xRapid network.[21] As CEO and founder of Messari pointed out, Ryan Selkis, there is a negligible benefit of using XRP for cross border settlement compared to the cost banks will have to incur to hedge fluctuations in the exchange rate of XRP.[22]

Furthermore, the token XRP is volatile, which impedes its ability to compete with the US dollar as a global reserve currency. To manage XRP’s volatility, professional market makers ensure that sell walls in XRP order books on cryptocurrency exchanges are reduced when good news are released and buy walls in the order books are built-up when bad news are released.[23] This makes XRP less volatile than other cryptocurrencies that do not have professional market makers.

The addendum to this article discusses how interbank settlement works in order to explain the business of banks that Libra and XRP are both vying to takeover.

Is XRP an Unregistered Security?

The first important clarification is that XRP coins do not convey ownership because Ripple Labs Inc., is a privately-owned company with a valuation of USD 410 million.[24] Unfortunately, many retail investors falsely believe that if Ripple the company makes profits, their XRP coins will go up in value because they think of XRP coins as equity shares of the company’s balance sheet. XRP coins are not equity shares.

Despite the fact that XRP coins are not tokenized equity shares of Ripple Labs Inc., XRP coins can be considered investment contracts according to the Howey Test, which is a tool used by US regulators at the Securities Exchange Commission to determine if a company falls under their jurisdiction or not. Former Chairman of the Commodities Future Trading Commission Gary Gensler explained that Ripple coin is a security according to the Howey Test[25], and Ripple is facing their third security fraud court case in the United States.

Why is this?

This is because Ripple’s XRP coin sales are similar to an initial coin offering that never ends. Izabella Kaminska wrote that Ripple’s issuance of XRP is like an exchange-traded fund:

“It is entirely centrally controlled, operating more like an ETF unit than anything else since the issuer has the capacity to release or absorb (pre-mined) tokens in accordance with their valuation agenda. More egregiously though, the token plays little part in Ripple’s central business case.”

Figure 3: XRP Price Did Not Respond to Coinbase Listing.

According to the latest Bloomberg Crypto Outlook, Ripple is at risk of being classified as a security.

“Ripple’s risk in suits by XRP buyers is a court ruling that XRP is a security, which would subject XRP to stricter SEC regulation that could curb transactions. Classification as a security could allow purchasers to rescind buys, would require Ripple to register or find exemptions for XRP sales, and would hinder XRP’s ability to be listed on U.S. virtual marketplaces, which have reportedly been reluctant to list XRP due to the risk of facilitating the sale of a potentially unregistered security.”

When Bloomberg’s report came out in 2018, the two largest exchanges in the US, Coinbase and Gemini, did not list XRP, despite Ripple offering an interest-free loan of $100 million worth of XRP to Coinbase and a $1 million direct payment to Gemini.[26] However, Coinbase did decide to finally list XRP on Coinbase Pro, formerly known as GDAX, earlier this year in February. They reportedly did not receive any compensation from Ripple in order to list XRP.

But Ripple Labs is now claiming that XRP does not belong to the company. During a hearing in front of the British Parliament regarding Ripple, Ripple’s Director of Regulatory Relations claimed that Ripple Labs Inc. did not even create the coin XRP.

“XRP is open source and it was not created by our company, so that existed as an open source technology. We created a company that was interested in modernizing payments and then began using that open-source tech to do so … We didn’t create XRP … What we do have is we do own a significant amount of XRP, it was gifted to us by some of the open-source developers that created it. But there’s not a direct connection between Ripple the company and XRP.”

Ryan Zagone,

Ripple director of regulatory relations

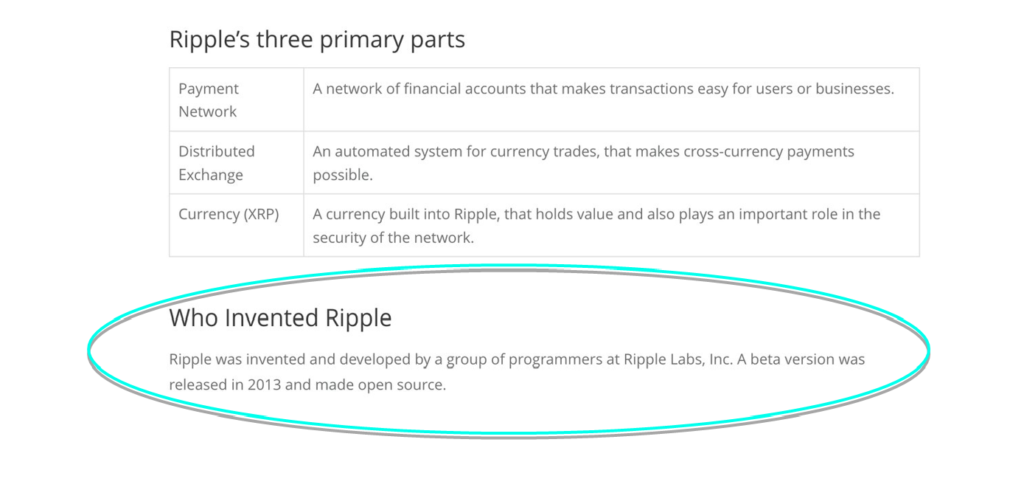

However, Zagone’s claim is strange given Ripple used to state explicitly on their website that they created XRP. This image was found on an Internet archive explorer because Ripple has removed this statement from their website.

Figure 4: Ripple Originally Claimed That They Invented XRP.

Most XRP Coins Are Owned by Ripple Labs

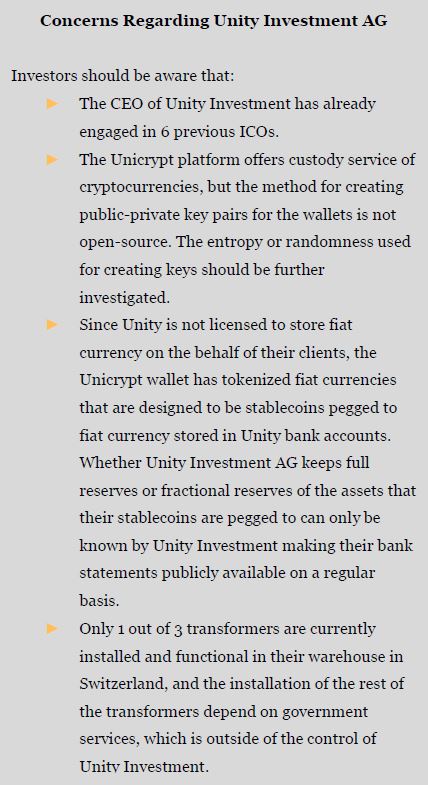

XRP coins were created all at once in the genesis block in 2012. This was possible because the protocol does not use proof-of-work mining. The initial distribution of the coins was extremely centralized, and still is centralized today. The creators kept 20 billion XRP coins for themselves (20 %). The remaining 80 % or 80 billion XRP were gifted to Ripple Labs Inc.

If you look closely at the XRP listing on Cointmarketcap.com, you can see that the circulating supply and the total supply are very different. This is because the company Ripple is forcibly keeping coins off the market. Ceteris paribus, when the supply of a scarce good is restricted given a constant level of demand, the price can be kept artificially high. If you imagine that the coins locked away are also worth $0.31 each, then XRP’s real market capitalization is closer to $30 billion.

However, the price of XRP would most likely decline if Ripple sold more than 1 billion per month, which is their stated limit on monthly XRP sales. Ripple the company was valued by investors as being worth $410 million, which begs the question: Why would investors value Ripple at $410 million when they own 60% of the outstanding XRP, worth approximately $8 billion in current prices? Overall, the fact that Ripple Inc. effectively controls a large part of the XRP supply opens up non-systematic risks unique to Ripple.

Figure 5: Ripple’s Real Market Capitalization Would Be USD 31 Billion.

In 2018, Ripple Labs decided to partly lock up 55 billion XRPs in an escrow-like account that releases 1 billion XRP per month to Ripple Labs Inc. to be used as they wish. The remaining XRP coins that Ripple owns are distributed “methodically” to incentivize market maker activity.[27] XRP’s official supply metrics are tracked on their homepage; however, some data is missing.[28]

Ripple has sold on average 300 million XRP tokens per month since 2016. This money goes directly to Ripple Labs’ revenues. In January of 2018, the creators of Ripple were billionaires.[29] Ripple’s executive chairman, Chris Larsen, owns 17% of the private company and controls 5.19 billion XRP. Larsen was estimated to be one of the richest men in the world worth $60 billion when XRP hit an all-time high of $3.31 in early 2018. Ripple CEO, Brad Garlinghouse, is estimated to have $10 billion in personal wealth.

Several of the 2018 court cases regarding Ripple are because of the escrow account. The news of the escrow account made the price shoot up, and many investors are claiming that Ripple Labs profited financially by manipulating the price and investors. However, the Ripple founders are notorious for selling large amounts of their Ripple coins. Jed McCaleb wrote online in May of 2014 that he was selling 9 billion of his XRP coins.

“I plan to start selling all of my remaining XRP beginning in two weeks. Because I have immense respect for the community members and want to be transparent, I’m publicly announcing this before I start. So just fyi… xrp sales incoming.”

The price dropped by 60 % following his post. He has now moved onto his third project, Stellar, which is like Ripple but with smart contracts. In 2015, McCaleb got into trouble for trying to sell more Ripple on Bitstamp than he was allowed to.

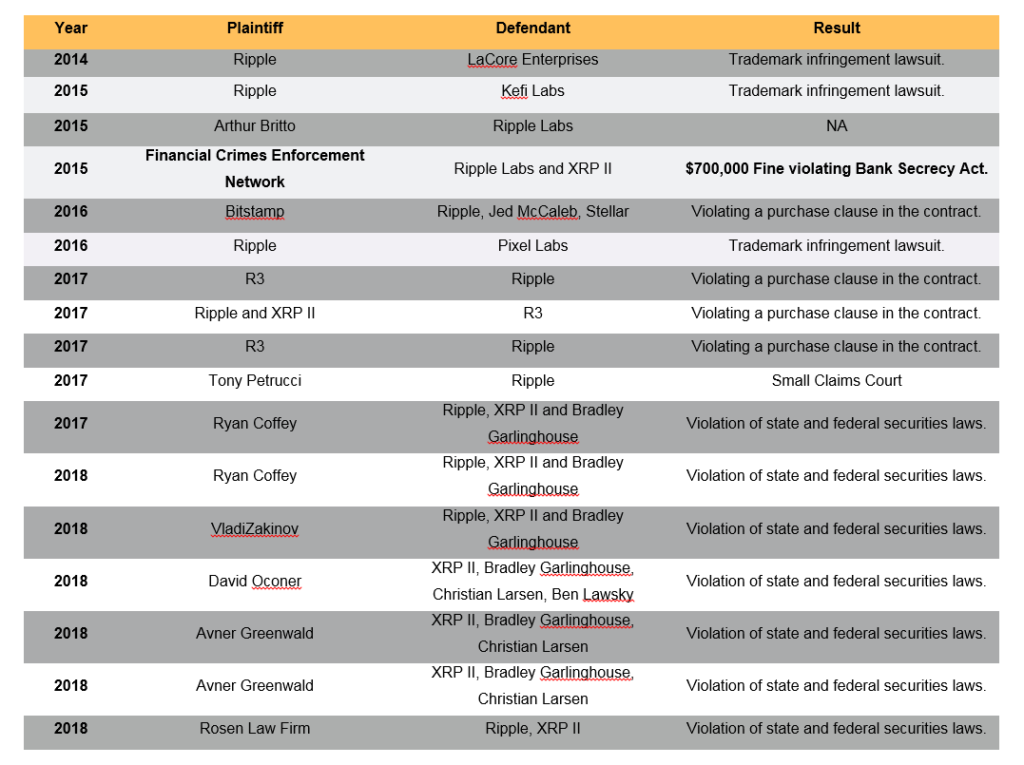

All of Ripple Labs Inc.

shenanigans has led to 16 court cases in the United States and multiple

encounters with regulators in other countries. Table 1 outlines the major

cases that Ripple Labs has fought in the US.

Table 1: Court Cases and Fines Involving Ripple.

Who Owns and Uses XRP?

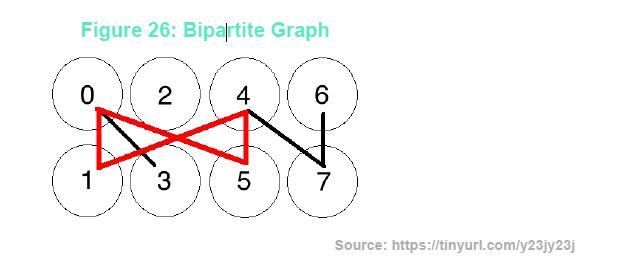

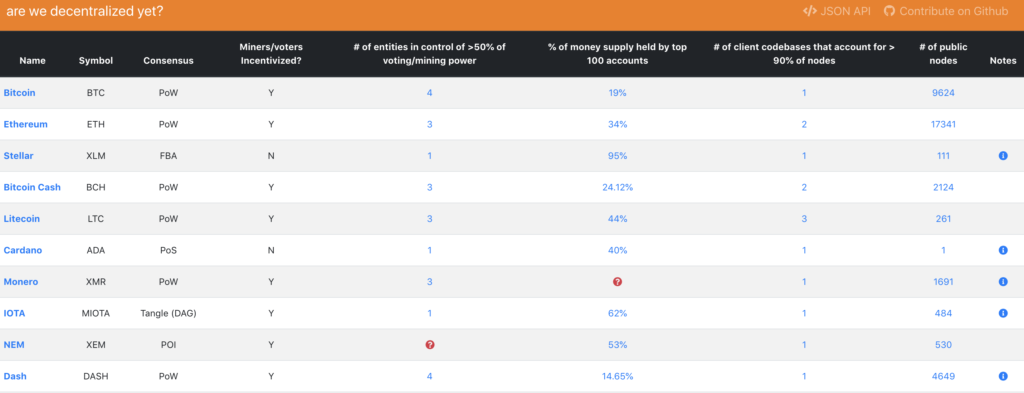

The 100 most active XRP wallets own an estimated 97 % of the existing XRP. Dogecoin creator, Jackson Palmer, created the website arewedecentralizedyet.com and showed XRP as being by far the most centralized coin. McCaleb’s project after XRP, Stellar, is also very centralized.

Figure 6: Ripple is Considered to be Centralized.

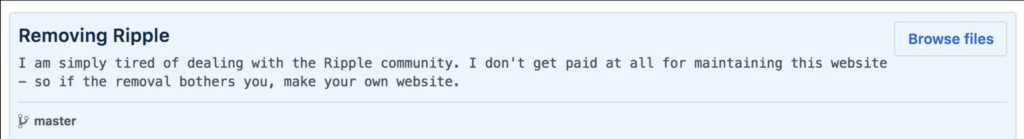

However, Palmer received so many messages from XRP users that he removed XRP from the website entirely.

Figure 7: XRP Army Attacked Are We Decentralized Yet Website Owner.

The XRP Army

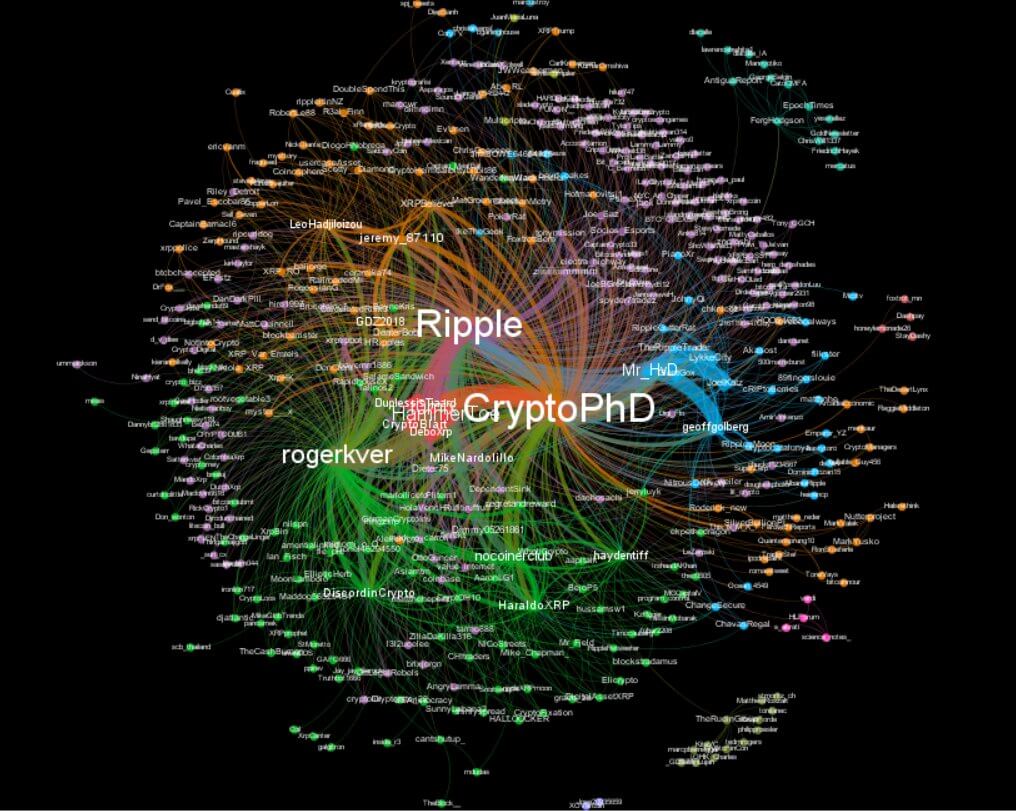

After Demelza Hays expressed her disapproval of XRP on Twitter, she received nearly a thousand comments in favor of XRP, including several harassing comments that attacked Demelza personally. It is well known among crypto Twitter that the “XRP Army” is one of the most toxic communities. Although the community includes many real XRP supporting enthusiasts, the XRP Army benefits from automation and thousands of inauthentic accounts—that ultimately function to create the illusion of a larger, more robust community than is reality. Collectively, the XRP Army engages in “coordinated inauthentic behavior” (this activity violates Twitter Rules; more specifically, around platform manipulation).

Figure 8: Twitter Accounts that Commented on Demelza’s Tweet.

The XRP Army is notorious for attacking accounts which share anything that opposes the narrative they are pushing. One of the more frequent targets of their attacks has been Geoff Golberg, a social media manipulation researcher and founder of SocialCartograph, a social media mapping firm. Geoff dissected the XRP Army in great detail in this August 2018 post. His research has helped surface social media manipulation across the world, including that of India’s Bharatiya Janata Party (BJP; link 1; link 2), and, more recently, People’s Mujahedin of Iran (MEK; link), among others. More on his work may be found here.

Specific to the XRP Army, Geoff has received death threats simply for posting data-driven analyses that highlight how the group violates Twitter Rules. In the case of the MEK, Geoff’s research has even resulted in him being doxed. Doxxing is the process of attacking someone online with private details of that person’s life.

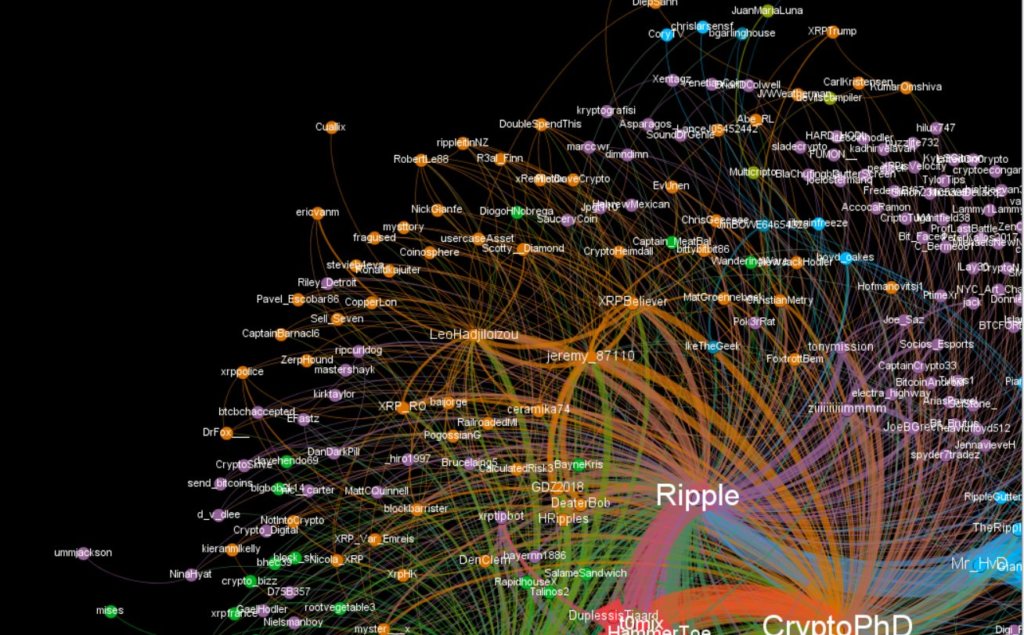

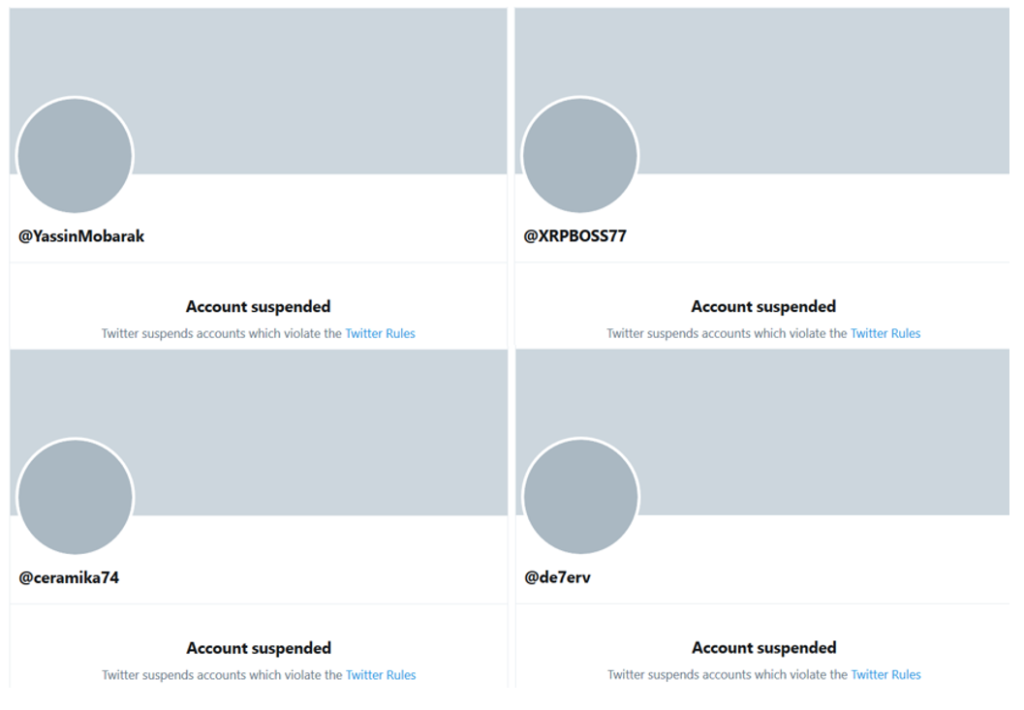

Figure 9: Many Twitter Bot Accounts Suspended Since Posting

Source: @geoffgolberg

In addition to @ceramika74, there are several other XRP-focused accounts from this dataset that have been suspended since the data was collected (December 2018). Here are a few examples:

Figure 10: Many Twitter Bot Accounts Suspended For Being Fake.

Source: Twitter.

One common tactic employed by the XRP Army, according to Golberg, is to create XRP-focused sockpuppet accounts (personas) around locations (cities, states, countries). Their goal, effectively, is placing XRP-branded billboards all over Twitter to create the illusion that the XRP community is larger – and more geographically represented – than is reality. Examples include @XRP_Europe, @XRP_Norway, and @XRP_Spain_Army (to name a few). Then you have accounts on Twitter that do not even try to hide that they are a bot just retweeting XRP whale tweets like @XRPRetweeter.

Twitter’s Platform Manipulation and Spam Policy states that “you may not use Twitter’s services in a manner intended to artificially amplify or suppress information or engage in behavior that manipulates or disrupts people’s experience on Twitter.” One such tactic employed by the XRP Army, states Golberg, are inauthentic engagements—more specifically, engagements (follows, retweets, likes, replies) that “attempt to make accounts or content appear more popular or active than they are.”

The first step to determining if the accounts are fake or not is to see if they were all created in and the around the same time period. The second step is to look at the patterns in the bio section. Many of the bots will contain the same words in their bio section, in the case of XRP, the main word to contain for a bot is XRP. This helps bots find which other bots they should follow and retweet from. The second step is to see how often they tweet. Some accounts tweet on average of 700 tweets a day, which is about once every two minutes. The next step is to look at the clustering of accounts. This means that all accounts are only following and retweeting posts from other accounts within their group, and they are not following or retweeting posts from other non-XRP related Twitter accounts. For example, a normal person that likes XRP should also be following a certain percentage of famous Bitcoiners accounts or regulators in their country. However, Twitter bots will only follow and retweet what they are programmed to follow and retweet. The final step is to go on to the Twitter profile and actually looking at their feed for signs that they are fake.

Conclusion

As the US dollar’s reserve status becomes increasingly challenged, more and more banks will lose their USD correspondent bank for settlement, and there could be demand for an alternative reserve currency and global private bank. Many articles online claim that large banks will use XRP as a global bridge currency or reserve currency to settle international transactions. However, banks can create their own native assets to settle transactions on the network with as well. Although settlement times and fees for Ripple transactions are lower than Bitcoin or Ethereum’s, banks will prefer to settle in whichever cryptocurrency establishes itself as a global reserve currency. Lightning network on top of Bitcoin, proof-of-stake coins, directed acyclic graph coins such as Byteball and Iota, and masternode structures, like Dash, are all attempting to make fast, reliable, and cheap transactions in order to become global stores of value and medium of exchange. However, all of these are volatile and will not be used as units of account, which is a requirement of a global bridge currency.

Bottomline, XRP will be competing with Apple Pay, Facebook’s Libra, JP Morgan coin, and all of the other proof-of-authority ledger monies that will be directly competing with the US dollar. However, all of the other global reserve and bridge currencies have a stable value. There is absolutely no reason to use a medium of exchange that is volatile like XRP for interbank settlement. XRP’s purchasing power is not backed by any reserves. When Facebook announced Libra, the stock price of Facebook went up, not the purchasing power of Libra. The purchasing power of Libra is expected to be stable because the Libra coin is not meant to be an investment. XRP will most likely not reach its stated goal of becoming a bridge currency, but that does not mean that XRP does not have any use case. XRP can be used as a digital store of wealth that is similar to a numbered 1980’s Swiss-style bank account, although, there are probably better technologies out there for that application like Monero, Dash, and Bitcoin.

A lot of members of the crypto community have received large payments of XRP from Ripple Labs Inc. in order to test XRP; however, this also may incentivize these members of the community to be quiet regarding XRP’s myriad of problems. Ripple Labs Inc. is also attempting to make inroads into Switzerland by inviting politicians and high-net-worth individuals to special events, such as the dinner at the Dolder Grand that occurred in early summer 2019. The strategy may even remind readers of the original formation of the US Federal Reserve on Jekyll Island in November 1910.[30]

Addendum: How Financial Transaction Settlement Works

The cross-border payment market is estimated to settle USD 180 trillion every year in volume.[31] To put this huge number into perspective, the entire annual economic production of Switzerland, as measured by the GDP, is USD 0.705 trillion.[32] According to Ripple research, cross-border payments are estimated to cost senders and receivers of cross border payments USD 1.6 trillion per year.[33]. For example, PayPal charges a fee of 2.9 % for payments plus an additional transaction fee will be charged for international payments, which is the spread in exchange rates that accrues to market makers. These costs for consumers translate into to profit centers for banks and financial intermediaries. Recent entrants like TransferWise or Revolut offer international transfers to retail investors at substantially lower costs, but the field of traditional payments is still dominated by long-established banks with little transparency and close to no competition.

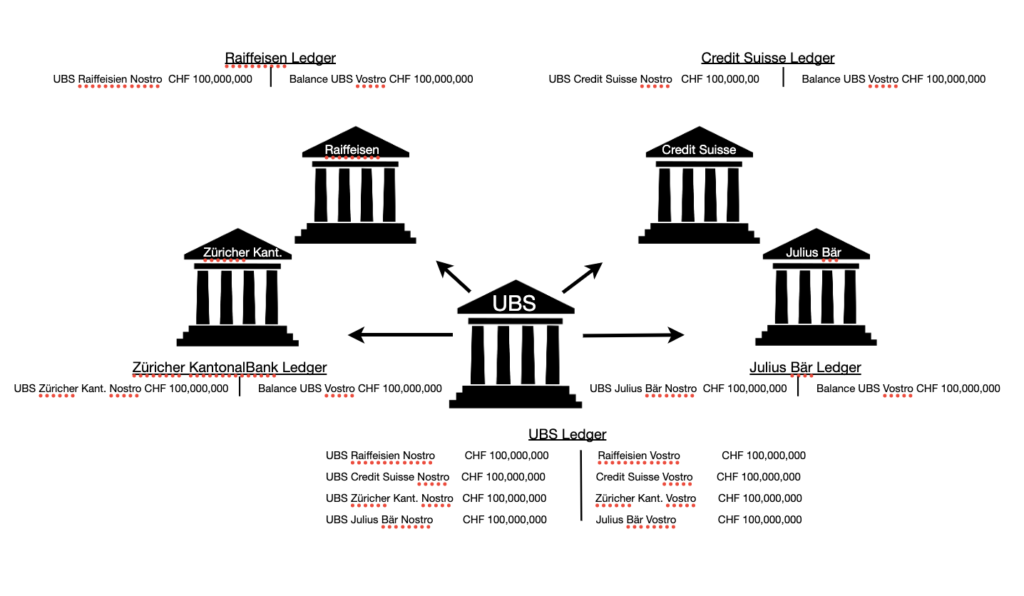

How a Domestic Transaction is Settled

If UBS has an account at the SNB, this is referred to as a nostro account because it means “our” account at “their” bank. Nostro is also referred to as “Due from Bank Account” in accounting terms. As shown in Figure 11, UBS has nostro accounts showing up as credits on their balance sheet because this is UBS’s money held at other banks. In contrast, UBS’s nostro accounts show up as vostro accounts on each of the other bank’s balance sheets, and this why it is shown as debit or liability. In contrast, vostro means “our” or “Due to Bank Account” in accounting terms.

Imagine that Alice is a customer of Bitcoin Suisse (and Bitcoin Suisse’s July 2019 application for a Swiss banking license is approved), and she has a bank account with a balance of 500 CHF. If Alice wants to send 100 CHF to Bob’s bank account at Falcon Private Bank, then Bitcoin Suisse’s balance sheet would show their nostro account with Falcon Bank being debited 100 CHF, which means their assets are being decreased. Falcon Bank’s balance sheet would show Bitcoin Suisse’s vostro account as debited 100 CHF as well because this is 100 less of a liability for Falcon Bank to Bitcoin Suisse. The complimentary transactions would appear on Falcon Bank’s balance sheet in order to finalize the transaction.[34]

Figure 11: An Expensive Way to Settle a Domestic Transaction.

However, this is a very expensive way to settle a domestic transaction because this means that each bank has to have an account with cash deposits at every single other bank. This opens the bank to counterparty risk in the case that the bank where their account is can go bankrupt. The liquidity also has an opportunity cost. Instead of just leaving the cash deposits idle in a bank account at another bank, the bank could be using that money to earn interest from lending.

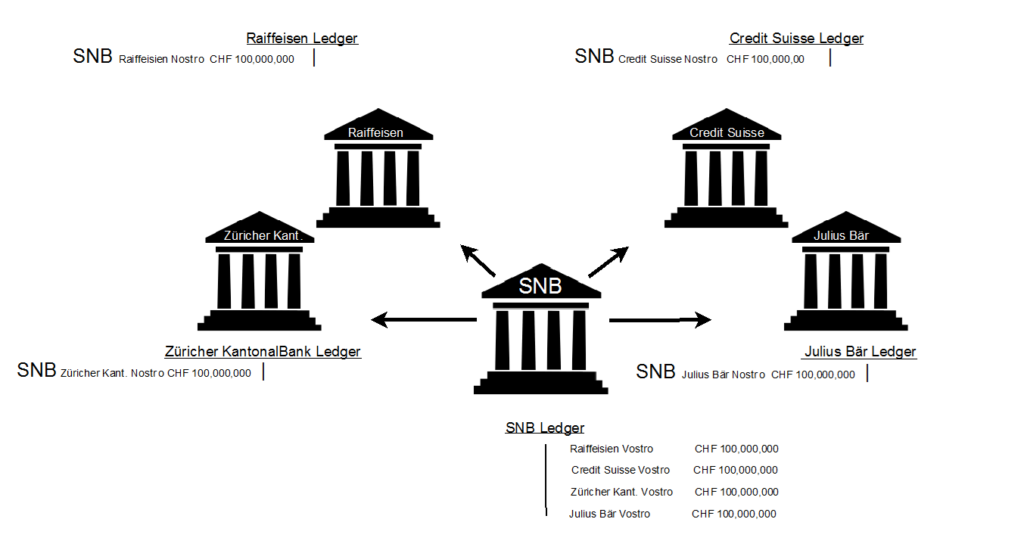

Instead of a bilateral model, all banks could just have one bank account at the central bank as shown in Figure 12.[35] This would reduce the counterparty risk and liquidity required each bank.

When a domestic bank has an account at the central bank, this is called a correspondent bank. When a domestic bank does not have an account at the central bank, then they are called a respondent bank. Settlement at the central bank between correspondent banks occurs in two main ways. The first is DNS systems, which settles transactions at the end of the day, for example, CHIPS in the US. The second is real-time gross settlement systems (RTGS), which have instantaneous settlement. An example of an RTGS system is Fedwire in the US.

Banks that have an account at the domestic central bank (correspondent banks) can charge fees to lower status banks (respondent banks) that need to use a clearing bank to access RTGS/DNS systems. This introduces substantial fixed costs, transaction fees, and time delays, which is why payments are both costly and slow.

Figure 12: A More Efficient Way to Settle a Domestic Transaction.

How an International Transaction is Settled

Banks can open a branch in a foreign country by getting a banking license in that foreign country or if a bank does not want to deal with the cost associated with getting a banking license in a foreign country, then a bank can open an account with a bank in a foreign country or open an account domestically with a bank that has a branch in foreign country.

For example, UBS can have a nostro account denominated in Swiss francs at the SNB in Switzerland, but they can also have a nostro account at Citibank in the US denominated in dollars. Both are “our” accounts at other banks. UBS can also use SNB’s nostro account at the Federal Reserve in the US to clear US dollar transactions.

There are several different ways that a foreign transaction can occur. First, it is important to understand that dollars do not leave the US during a foreign exchange transaction. Instead, all that happens is basically accounting wizardry.

The most common way to settle a foreign exchange transaction is for an international bank to have branches in two different countries. When the international bank receives $100 in their US branch, they make a liability and show the $100 as an amount payable in the future to the home branch of the bank in Switzerland. In the Swiss branch of the international bank, they credit the accounts receivable for the Swiss franc amount of the $100 at the spot rate, which, for example, could be 98 CHF.

Until the bank closes the accounts payable, the bank has exposure to currency risk from the spot price of the exchange rate changing. If the Swiss branch needs the Swiss francs right away, then the bank must settle the accounts payable in their American branch with the accounts receivable in their Swiss branch. In order to close the accounts payable, they must go to the foreign exchange market and sell their $100 and buy the CHF. When the Swiss branch buys CHF, this means that a counterparty bank is willing to sell them CHF. For example, if Citi Bank in Switzerland wants to sell 98 CHF Swiss francs to UBS for $100, then Citi reduces the asset side of their balance sheet by 98 CHF.

The SNB reduces its liability to Citi by subtracting Citi’s account at the SNB by 98 CHF. SNB shows UBS’s bank account as having more CHF in it after the sale, and that represents a new liability for the SNB to UBS of 98 CHF. On UBS’s own balance sheet, they use the recently purchased Swiss francs to clear out their accounts receivable on the asset side and simultaneously increase their reserves on the asset side. The New York branch of UBS clears out the Accounts Payable, since it has now been paid and they must reduce their asset side of $100 in reserves because they sold the reserves to Citi. This shows up on the Federal Reserves balance sheet as $100 less in liabilities to UBS and $100 more in liabilities to Citi. Citi show their asset side of their balance sheet increase by $100 in the capital account.

This is an example of a swap, and each bank is dealing with the central bank in their domestic country for final settlement. No Swiss francs or US dollars actually leave the country.

About 85 % of all global transactions are settled in US dollars through the Federal Reserve System in the US. Therefore, the Federal Reserve is not only a central bank for the US, it is also a central bank for the whole world. Citi Bank is able to charge foreign exchange fees to settle an international transaction even if they do incur any fees themselves because they have bank accounts in foreign currencies all around the world. However, the fees that Citi incur are somewhat justified from the fact that Citi has to keep liquidity tied up in foreign currencies available for settling transactions, which has an opportunity cost. This is the market that Ripple Labs Inc. argues that XRP can disrupt. However, XRP would need stable purchasing power, and Ripple would need to be a lender of last resort. In order for XRP to really gain adoption as a bridge currency, that would mean that we also need to trust XRP and Ripple Labs Inc. more than we trust the US dollar and the Federal Reserve.

[1] See “Why XRP’s Price Didn’t Explode After Coinbase Listing,” Charles Bovaird, Forbes, March 1, 2019.

[2] See “Ripple’s XRP: Why Its Chances of Success Are Low” [Podcast], Laura Shin, Unchained, May 8, 2018.

[3] See Cracking Mt. Gox: Investigating one of the biggest digital heists in digital history – from the outside, Kim Nilsson, WizSec, 2018.

[4] Ibid.

[5] See “Analysis of the XRP Ledger Consensus Protocol,” Brad Chase and Ethan MacBrough, Ripple Research, February 21, 2018.

[6] See “What is Ripple?,” Binance Academy, December 24, 2018.

[7] See “The Ripple Story,” BitMEX Research, BitMEX, February 6, 2018.

[8] See “Technical FAQ,” XRP Ledger Developer Portal, 2018.

[9] See “Ripple (XRP) Analysis,” Joe Kendzicky, Medium, May 4, 2018.

[10] See “Analysis of theXRP Ledger Consensus Protocol,” Brad Chase and Ethan MacBrough, Ripple Research, February 21, 2018.

[11] See “What is Ripple?,” Binance Academy, December 24, 2018.

[12] See “What is Ripple?,” Shawn Gordon, Bitcoin Magazine, n. d.

[13] See “Transaction Cost, “XRP Ledger Developer Portal, 2018.

[14]See “Reserves,” XRP Ledger Developer Portal, 2018.

[15] See “Ripple’s XRP: Why Its Chances of Success Are Low” [Podcast], Laura Shin, Unchained, May 8, 2018.

[16] Ibid.

[17] Ibid.

[18] Ibid.

[19] ibid.

[20] See “The Cost-Cutting Case for Banks,” Ripple, February 2016.

[21] Ibid.

[22] Ibid.

[23] See “Bitcoin $11,000 Next? Stock Market Crash, Whale Dump Recovery, BITMEX Manipulation” [YouTube video, minute 21:30], Ivan on Tech, May 19, 2019.

[24] See “Ripple’s Chris Larsen: Meet the Richest Person in Cryptocurrency,” Laura Shin, Forbes, February 7, 2018.

[25] See “Former CFTC Head Says Big Cryptocurrencies Could Be Classified as Securities,” Camila Russo, Bloomberg, April 23, 2018.

[26] See “Ripple’s XRP: Why Its Chances of Success Are Low” [Podcast], Laura Shin, Unchained, May 8, 2018.

[27] See “Market Performance,” Ripple, 2018.

[28] See “Market Performance,” Ripple, 2018.

[29] See “Who is the ripple founder?,” Joshua Warner, IG, January 22, 2018.

[30] The Creature of Jekyll Island, G. Edward Griffin

[31] See “Blockchain In Banking: 14 Possible Use Cases,” Sam Mire, Disruptor Daily, October 17, 2018.

[32] See “Switzerland GDP,” Trading Economics, 2019.

[33] See “The Cost-Cutting Case for Banks,” Ripple, February 2016.

[34] For the best explanation of a domestic transaction see “Flow of Money – Payment System” [YouTube video], Wayne Vernon, October 1, 2015.

[35] For the best explanation of a foreign exchange transaction see “Flow of Money – Foreign Exchange” [YouTube video, Wayne Vernon, September 17, 2016.