“Digital gold and physical gold make a highly interesting combination as a portfolio. Excess volatility is dampened by gold, while you still can participate in much of Bitcoin’s optionality.”

Mark Valek

Key Takeaways

- Practical problems and structural hurdles have so far prevented most institutional investors from entering the crypto asset arena. A generally low level of expertise and exorbitant volatilities, among other things, were decisive factors in this wait-and-see attitude.

- The two assets Gold and Bitcoin have partly similar characteristics but different patterns of price movement. In combination, volatility can be reduced disproportionately due to the diversification effect.

A rebalancing strategy with broad rebalancing bands and an option overlay can further improve the risk-adjusted return significantly and together this combination of assets represents an uncorrelated portfolio building block for a traditional portfolio.

Where are the Institutional Crypto-

Investors?

The crypto-community has been asking this question for a few years now. Given the last hype of 2016-2017, the interest in the young asset class has naturally increased dramatically even among professional investors. However, not many conventional investment vehicles were available for this class of investors during the boom time. This has changed in the meantime. Certificates, futures and regulated funds are now on the market. With falling prices, however, the appetite for the asset class has somewhat disappeared again. At least for now.

An announcement of the investment manager Morgan Creek Capital recently has attracted some attention (1): its Blockchain Venture Capital Funds is backed by USD 40 million coming from traditional investors. These include two public pension funds, a university endowment fund, a network of hospitals and an insurance company. Nevertheless, investments by traditional institutions still seem to be rare.

In our view, this is due on the one hand to special features of the asset class, which cause practical problems for institutional investors. On the other hand, structural hurdles within the asset management sector are also responsible for the current reluctance of many institutional investors.

Practical Problems for Institutional Investors

The following practical issues can be identified in the context of digital asset classes:

► Legal (un)certainty

► Custody

► Liquidity

► Investable vehicles

These practical problems inherent to the new asset class are not trivial, but in our view, are already largely solved.

Legal certainty regarding crypto-assets is of course crucial for institutional investors. The rise of digital assets meant that a whole range of legal issues had to be identified and regulated. First of all, legislators and regulators – as well as the entire investment industry – had to become familiar with and understand the phenomenon of crypto-assets and where necessary create appropriate legal foundations. For a long time, it was unclear whether cryptocurrencies should be treated as securities, cash or commodities. Meanwhile, many regulators have decided that distinctions must be made. The Swiss authority FINMA, for example, has commented on this topic and has provided an important foundation stone for the classification of crypto assets with the FINMA ICO guidelines. For corporate financing Security Token Offerings (STO) have to be used instead of the Initial Coin Offerings (ICO), which were misused in the early years. In the case of STO the rights of investors are better protected. Apart from these rulings, legislators by now have decided on the tax treatment of cryptocurrencies and have thus solved the central elements of previously prevailing legal uncertainty.

Custody of digital assets is an essential issue. Traditional securities investments have a settled infrastructure that has grown over decades, which has now become a standard procedure for the seamless transfer and safekeeping of assets. The new phenomenon of digital asset management industry is once again facing challenges in terms of safekeeping. In particular, the phenomenon of “cybersecurity” is inherent in this context. In recent years, however, many companies have offered safe and professional solutions for this area. Some of them have already developed so far that they have been approved by the regulators of the European fund industry as safe custody solutions. In our last Crypto Research Report, we dealt with different custody solutions (2).

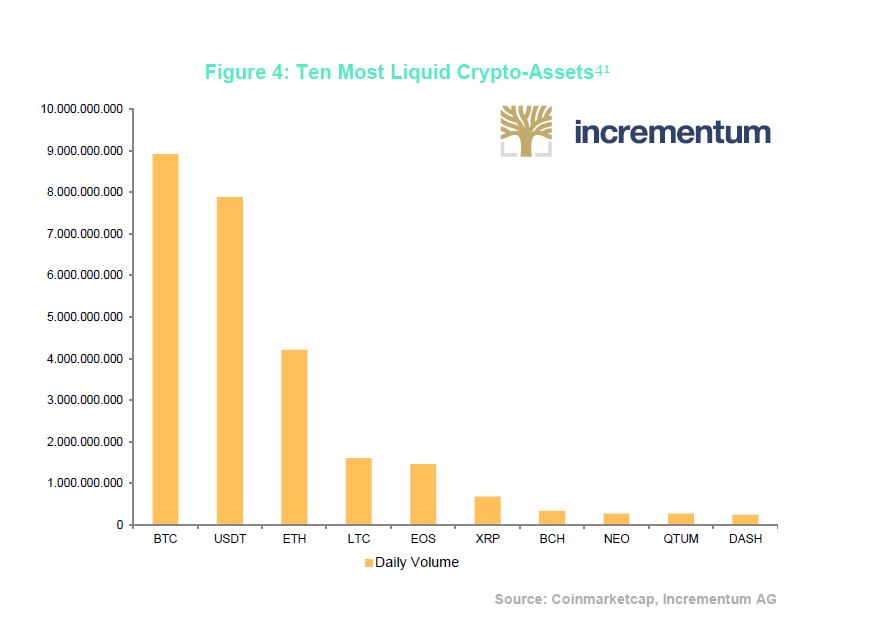

Cryptocurrency liquidity is also of great importance to institutional investors. They have to make sure that the large volumes they manage can be invested without significant impact on prices (slippage). The measurement of liquidity in this area, however, is problematic. Many large transactions are processed OTC (“over the counter”) and not through an exchange. As a result, existing liquidity is underestimated. However, when looking at exchange-traded liquidity, it is probably too high. The background is that crypto exchanges have an incentive to identify their own market share as high as possible. In any case, apart from the difficulties of accurately measuring liquidity it is remarkable how different the liquidity between the individual cryptocurrencies is. By far the most liquid is Bitcoin. For liquidity reasons Bitcoin is by far the most attractive for an institutional investor, perhaps even the only realistic form of investment within the crypto universe in the current market environment.

Investment products could not be found in the regulated area until a few years ago. Although in principle, a direct investment in cryptocurrencies would also be an option from the prevailing perspective, from the point of view of institutional investors there is much to be said for investing securitized securities in this asset class. Thus, the custody does not have to be dealt with independently. Furthermore, consolidating crypto-assets with the remaining portfolio values becomes a much easier task.

If anything, crypto-investment for institutional investors was originally only possible via moderately regulated offshore hedge fund vehicles, which often do not separate the depositary from the manager. In the meantime, investment in cryptoassets can be done through an increasing number of conventional investment products. For instance, already regulated blockchain and crypto-funds, certificates and ETPs have appeared on the market. Below some examples.

Blockchain & crypto-funds:

► Polychain Capital

► Pantera Bitcoin Fund

► Galaxy Digital Assets

Certificates:

► VONCERT on Bitcoin by Vontobel

► Tracker certificate on Bitcoin by Leonteq

► Bitcoin Tracker One – SEK (COINXBT – ETF type)

ETP:

► Amun Crypto Basket Index

► Amun Bitcoin ETP

► Amun Ethereum ETP

As we can see, many of the practical issues surrounding legal uncertainty, custody and investment products have already been defused or resolved. As far as liquidity is concerned Bitcoin is currently primarily suitable for institutional investors. Speaking of which, learn some of the easiest ways to buy Bitcoin, and be ready when there is an opportunity available.

Structural Hurdles within the Asset Management Sector

Even more relevant than the initial practical problems today are probably structural hurdles within the asset management industry, which slow down the entry of many players. This includes in particular

► The expertise and the decision-making structures within the asset management

► The extraordinary volatility of most cryptocurrencies

► The principal agent dilemma

Expertise and decision making structures within large organizations such as asset managers are highly relevant when it comes to the question of adding a new asset class into the investment universe. In principle, new asset classes do not often emerge during the career of a portfolio manager. The asset management industry’s last asset-class “revolution” was probably the spread of hedge funds in the late 1990s and early 2000s. At that time, endowment funds at universities in the US were among the first institutional investors regarding hedge funds as an own asset class. Only gradually institutional investors followed and introduced hedge funds or alternative investments asset classes.

Over the next few years, players in the asset management industry will gradually have to come up with answers to how they handle the phenomenon of digital assets. The majority of institutional investors will for the time being ignore or negate it. However, the longer crypto assets are in the market, the more professional investors will make strategic allocations in this area.

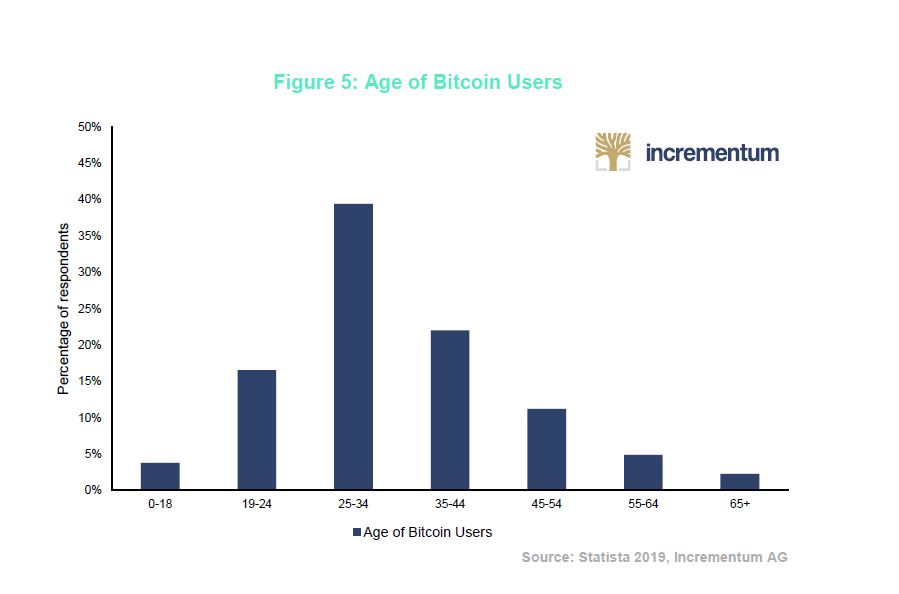

One of the reasons for the sluggish entry into established institutions is probably that crypto-affine individuals within the organizations tend to be younger while the decision makers tend to be older. Of course, a young person does not automatically have to be comfortable with the crypto phenomenon, but an affinity may be more likely because younger generations as “digital natives” are more likely to be in touch with the developments in the crypto-world and therefore better able to understand it. Even though there are counterexamples, there is one thing that catches your eye: young crypto-savvy employees repeatedly come up with suggestions and ideas about crypto-assets in the executive team of many traditional institutions, as conveyed at any rate by anecdotal accounts of their experiences.

In addition, as everywhere, even among the asset managers the average level of knowledge is still quite low. It takes time for the executive levels of these organizations to allocate resources to educate their staff or set up their own departments that are committed to cryptocurrency. The number of banks and asset managers that are dealing with the issue on a project-related basis is growing. Some entities have recognized cryptocurrency and blockchain technology as a strategic business and openly admit to it. These include banks such as Bank Frick in Liechtenstein, Falcon Private Bank and SEBA Crypto AG in Switzerland, SolarisBank and Fidor Bank in Germany, but also Fidelity Investments in the US.

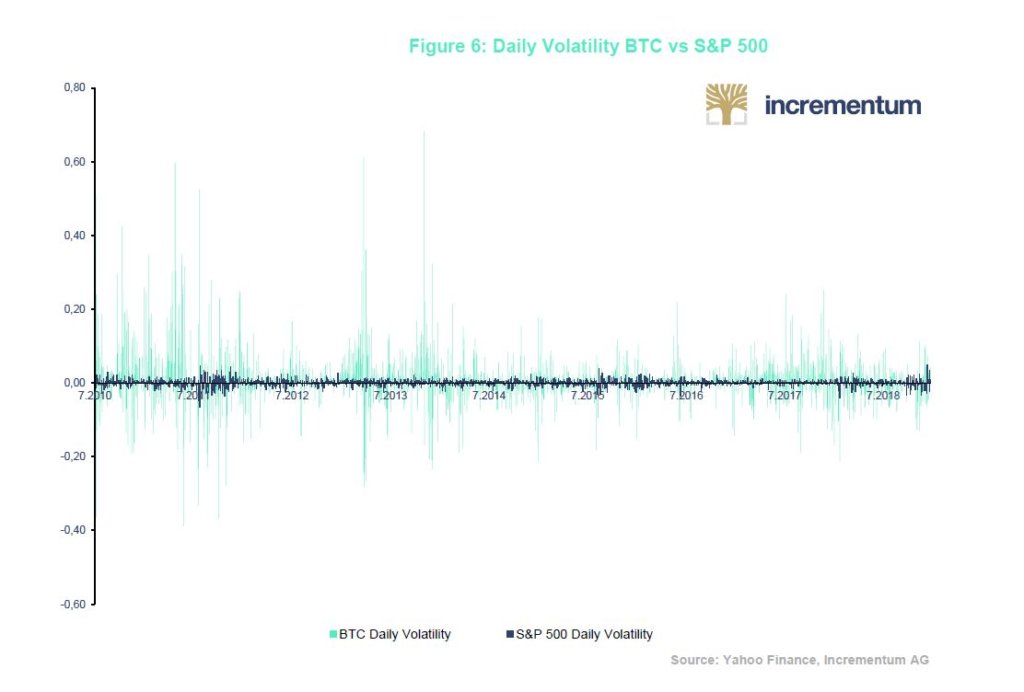

One of the largest obstacles for institutional investors is the exorbitantly high volatility of most cryptocurrencies. Fluctuations in prices of up to twenty percent within just a few hours have been recurring in Bitcoin over the past few years, while other cryptocurrencies have shown even more excessive volatility. When US stocks dipped by just five percent in February 2018 Wall Street was already in turmoil. Handling such high price fluctuations is also difficult for institutional investors and poses some problems.

The volatility or risk weighting of a single position in the portfolio context can actually be easily managed by adjusting the portfolio weighting accordingly. A position with high volatility should correspondingly have less weight if one wants to control the influence on the overall portfolio. For risk-return reasons, rightskewed asset classes such as Bitcoin should be particularly attractive as an addition since a large impact can be achieved with a small positioning.

From the point of view of the responsible portfolio manager, however, despite all this there is a weighty reason against even a small position in the crypto sector: the principal-agent dilemma. (4) If well-paid asset managers do not manage their own capital, they have an incentive not to take higher risks on a single position, even if from a capital theory perspective these are endowed with attractive risk-return ratios despite high volatility. The motto is: even with satellite positions one does not want to justify oneself as “agent” with the “principal” for high losses if they become striking.

Gold and Bitcoin – Stronger Together?

Market timing is difficult for any asset class. With such a volatile asset class as cryptocurrencies, one would like a favorable entry and exit time all the more. In practice, however, it can almost be ruled out that investors choose the ideal deadline to make their investments or to realize the gains.

Here we want to introduce our proprietary investment strategy, which defuses the volatility problem or even converts it to the benefit of the investor. In order to achieve this, our strategy draws on an old wisdom in portfolio management: Rebalancing. More on that later.

We already discussed in last year’s sister report, the In Gold we Trust report, that gold and Bitcoin cannot be seen as enemies but rather as complementary friends. (5) At a philosophical level, the investment assets are very similar because:

► Their stock cannot be inflated and devalued by a central bank

► They are nobody else’s obligation (no counterparty risk)

► They are easily transferable

► They represent liquid assets outside the fiat system

In addition, both forms of investment are difficult to confiscate and have a good chance of succeeding in an environment of over indebtedness, impending negative interest rates and financial repression. To a certain degree, this also applies to other “payment tokens” or “store of value tokens”. This strategy can be implemented with gold and an index of store of value tokens instead of gold and bitcoin. This would ensure that potential competitors of Bitcoin are on the radar and in the investment strategy in the future. For the sake of simplicity, we will examine the combination of Bitcoin and gold below.

To a certain extent, this also applies to other “payment tokens” or “store of value tokens”. This strategy can therefore be implemented with gold and bitcoin or gold and an index of store of value tokens. Including other “store of value tokens” would ensure that potential competitors of Bitcoin are on the radar and part of the investment strategy in the future. For the sake of simplicity, we will examine the combination of Bitcoin and gold below.

The Diversification Effect

Despite these similarities, the returns of gold and Bitcoin show low and sometimes negative correlation. This situation is welcome for an investor because the fluctuation of a combined strategy is reduced.

Of course, the volatility and thus the price risk of a crypto strategy will change significantly if gold is added to the investment strategy. Since gold is subject to significantly lower price fluctuations, the overall volatility decreases as the share of gold increases. In addition, the low correlation due to the well-known diversification effect helps to reduce fluctuations disproportionately.

The Rebalancing Bonus

In addition to exploiting the diversification characteristics of gold and Bitcoin, this investment strategy allows unlike any other to benefit from the “rebalancing bonus”.

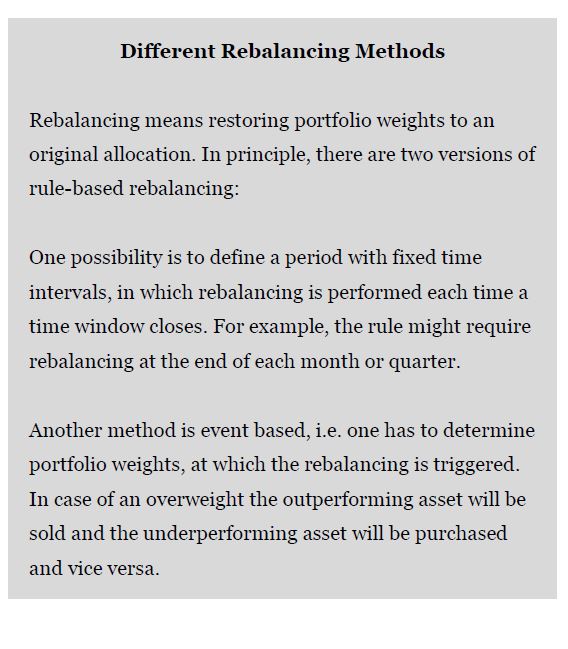

What exactly is the rebalancing bonus, and what is the best way to receive it? Price fluctuations cause portfolio components to change dynamically over time. Thanks to so-called “rebalancing”, shifts in the portfolio are balanced out by resetting the portfolio to the original, strategic asset allocation.

In order to benefit from the rebalancing bonus, a strategic allocation and a rebalancing method must be defined for both assets. For example, an institutional investor may choose to assign 30% to Bitcoin and 70% to gold as a strategic allocation, as this mix creates an overall risk that is familiar to professional investors. As a rebalancing method, one can either set a fixed time interval or make adjustments only on an ad hoc basis when predefined portfolio shifts are reached (see info box). Our comprehensive quantitative analysis has shown that event-based rebalancing is more useful, especially considering transaction costs. In the strategy presented here, we have provided a wide range of Bitcoin allocations between 15% and 60%. The method therefore calls for the strategic allocation (or the initial allocation) to be restored through corresponding buy and sell transactions as soon as the Bitcoin allocation falls below 15% of the total portfolio or exceeds 60% due to price fluctuations. In case Bitcoin develops better than gold, it has to be sold and replaced by gold and vice versa.

Various studies confirm that the more the asset classes fluctuate in value and the lower their correlation, the stronger the rebalancing bonus.(6) (7) This circumstance must be taken into account against the background of the high price fluctuations in Bitcoin.

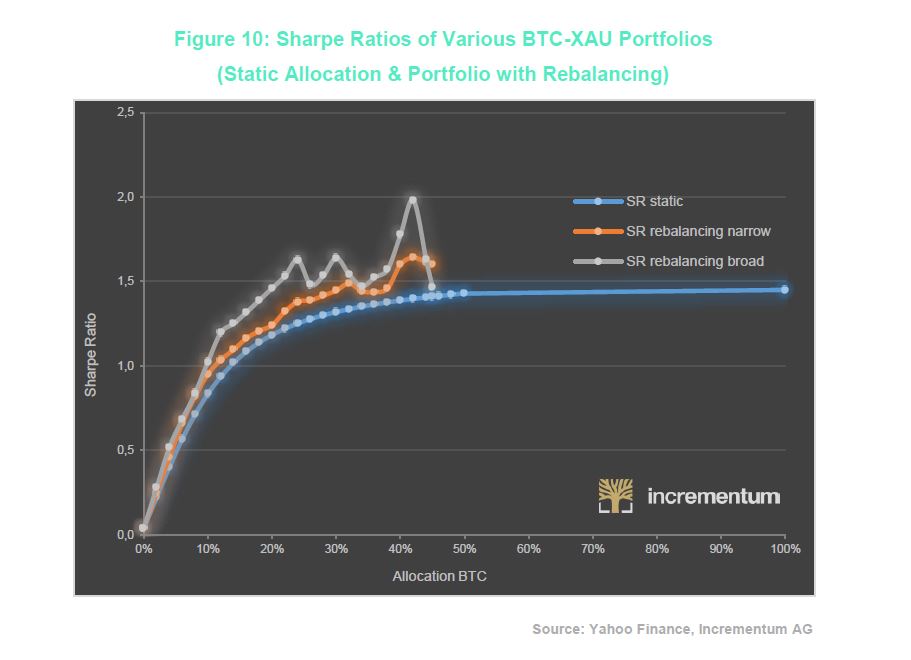

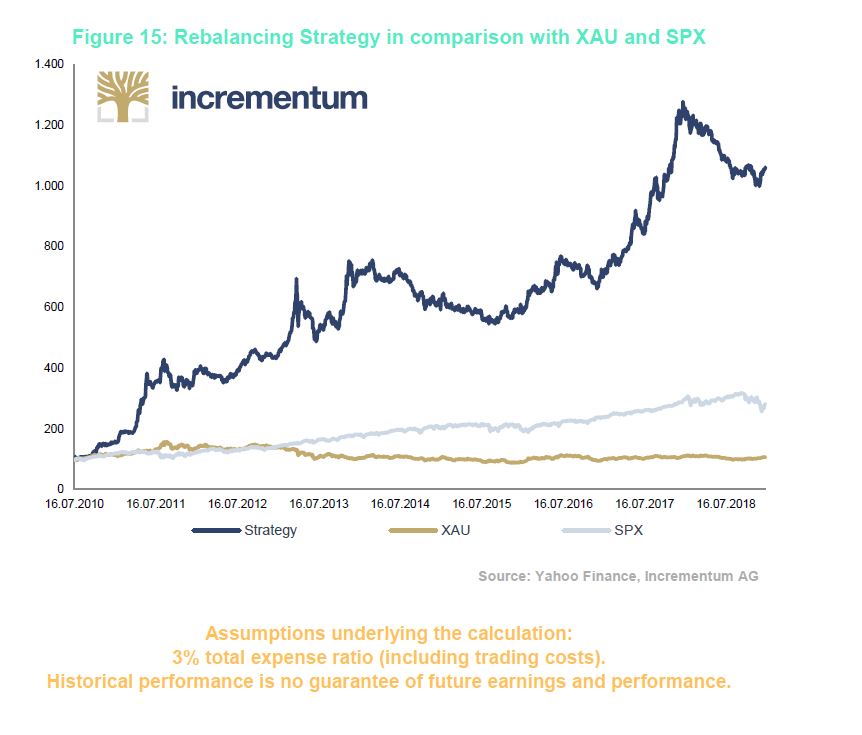

In a comprehensive quantitative analysis, we tested this investment strategy in several variants. As the graph below shows, rule-based rebalancing can significantly improve the risk-return ratio. Correspondingly, the Sharpe Ratio could be consistently improved with the help of the rebalancing strategy, irrespective of the Bitcoin allocation. (8)

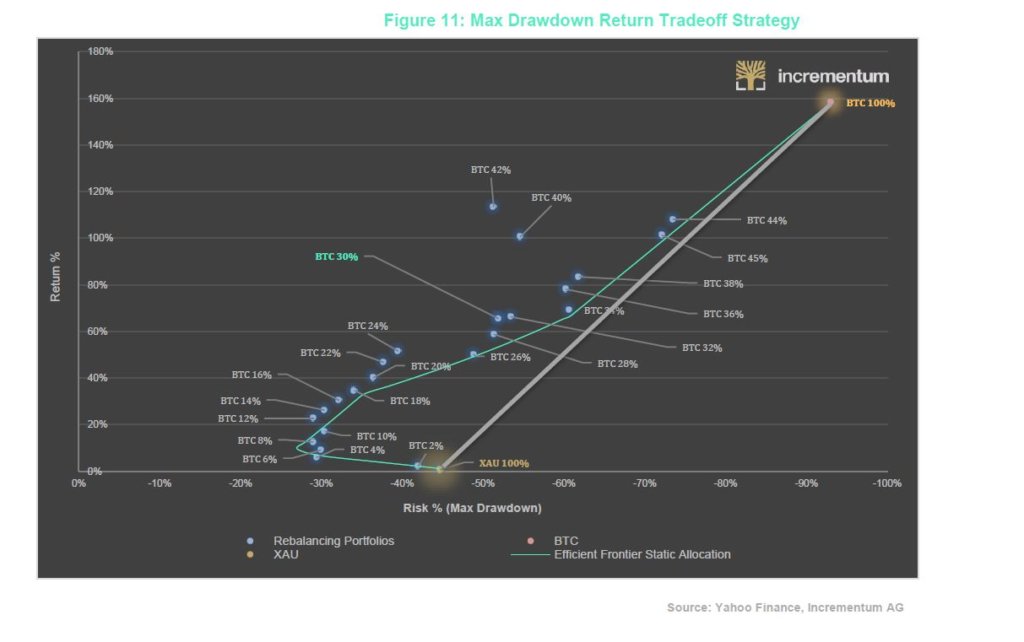

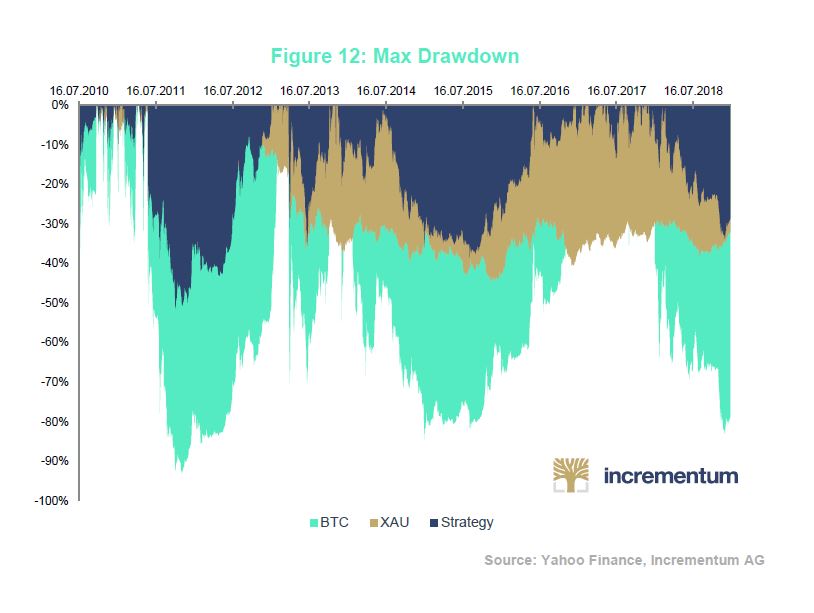

The fact that the risk-return ratio can be significantly improved with this strategy becomes particularly evident when considering the maximum drawdown as a risk indicator.

A drawdown in financial literature refers to the price loss that lies between a high and a subsequent low in a given period. The maximum drawdown is the total loss that an investor has to accept for a period after investing at the time of peak.

Additional Income through “Covered Call Writing” and “Put Writing”

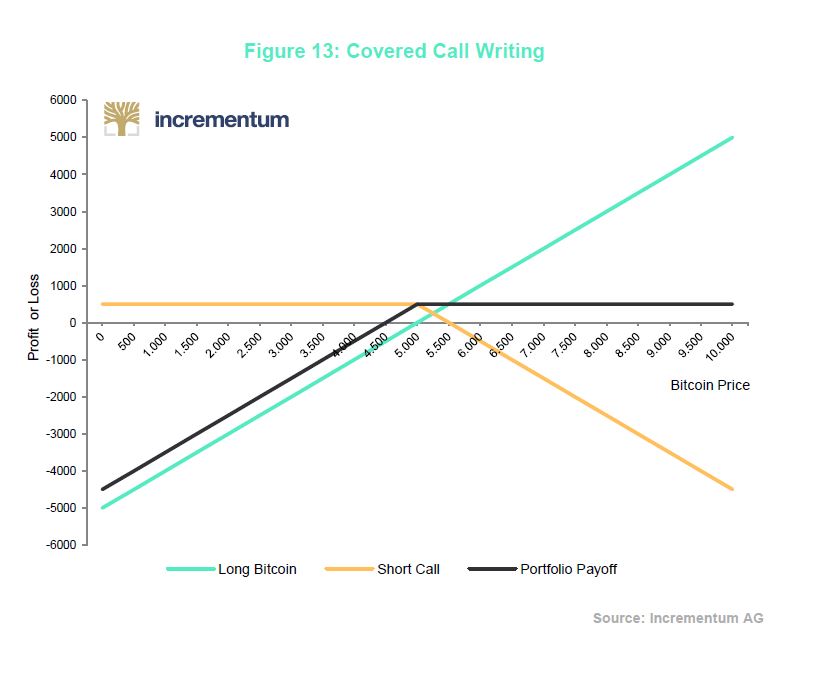

In addition to the diversification effect and the rebalancing bonus, a third element allows the investor to profit from high volatilities and thereby further improve the strategy. To achieve this, one uses the options market, which already exists for Bitcoin. On exchanges such as Ledger X or deribit one can trade options for over a year. Options can be used as a speculative element, for hedging or generating yield. The decisive factor is whether you write options without holding the underlying (“naked”) or in combination with the underlying.

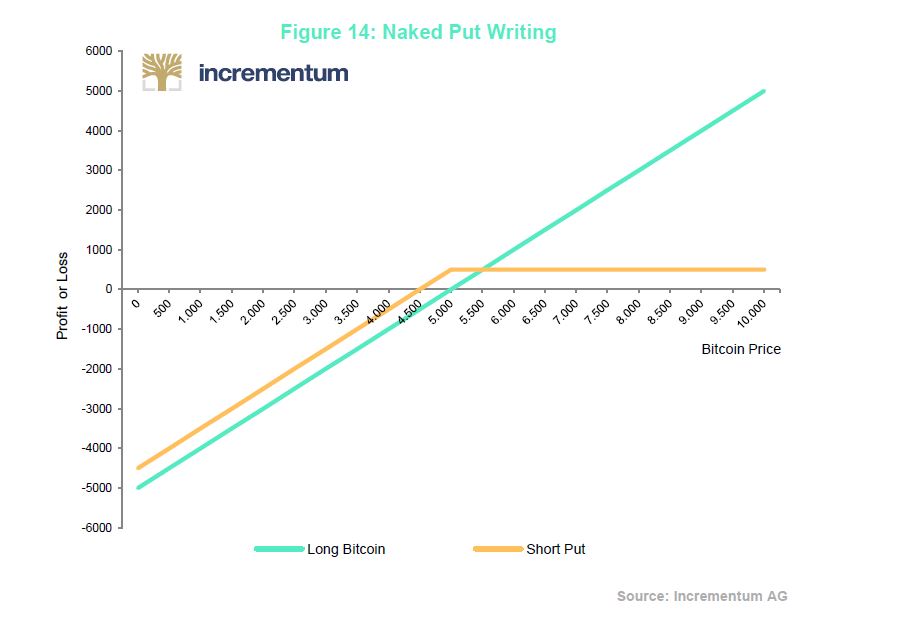

Covered call writing is a well known strategy that can be used to exchange the upside potential of a position (or part of a position) for a premium. If you have a position in the portfolio that you want to hold or even sell, you can write a call option on it and thus generate the option premium. In the worst case, you no longer benefit from the full upside of the underlying, but at least you still generate the premium.

Conversely, selling puts is a good way to build a position. In this case, a contract obliges you to buy an underlying at a certain point in time at a given price. In this case, you also receive the option premium for it. If you execute, you will receive a net purchase price (taking into account the generated option premium) that is more favorable than the one that you would have been able to obtain by purchasing the underlying in the normal way. If the option is not exercised due to the price movement, then you will collect the entire option premium and the contract expires. The risk of this strategy is that the option will not be exercised and the price later explodes.

The prices of the option premiums are based on the expected fluctuations of the underlying and the volatilities implied in the option prices. As the price of Bitcoin has an exorbitantly high volatility, the option premiums are correspondingly high. According to our calculations, assigning a 10% share of the portfolio to at themoney options would produce an annualized additional return of 10 to 15%.

Conclusion

Bitcoin and gold are similar in certain characteristics and can be an attractive investment strategy as a portfolio. By combining both assets, investors benefit on the one hand from the low correlation of both assets. On the other hand, they can use the volatility of Bitcoin to their advantage through a rule-based rebalancing and thus reap the rebalancing bonus. In addition, option strategies generate an interesting return by collecting option premiums. Overall, this approach allows for a strategy that, in view of its volatility, seems to be better suited for institutional investors than highly volatile pure crypto strategies.

(1) In December, we had the honor of holding an exclusive Advisory Board Meeting with Mark Yusko of Morgan Creek.

(2) See January 2019 Crypto Research Report: Crypto Concepts: Cryptocurrency Custody Solutions

(3) Average daily trading volume in March 2019

(4) See https://en.wikipedia.org/wiki/Principal%E2%80%93agent_problem

(5) See https://ingoldwetrust.report/download/1373/?lang=en, pages 177 following.

(6) See “When Does Portfolio Rebalancing Improve Returns?”, HodlBot, October 26, 2018

(7) See “THE REBALANCING BONUS”, www.efficientfrontier.com

(8) Obviously past performance is no guarantee for future returns.