“Only when the tide goes out do you discover who’s been swimming naked.”

Warren Buffett

Key Takeaways

- Bitcoin’s price recovered 63% from its low of $3,125 in December. JP Morgan, Fidelity, Nasdaq, Goldman Sachs, Swissquote, Vontobel, and Twitter are preparing the drinks and food for guests in preparation of a new bull market.

- Investors have historically priced in each Bitcoin halving 458 days prior to the halving. We are currently about 400 days away from the May 2020 halving.

New bull market gains even more momentum if negative interest rates are charged on personal bank accounts held by retail investors as recommended by the International Monetary Fund.

It’s still chilly in cryptoland, but with the Twitter founder and the bosses of Fidelity and Nasdaq, the circle of Bitcoin fans is getting bigger and bigger. Even JP Morgan is doing crypto now.

Back to the Roots

What’s the purpose of Bitcoin This question is often answered with far reaching visions. The word “revolution” is often used. “Blockchain” of course. But sometimes a news item surfaces that makes things much clearer. Bitcoin’s purpose is to give financial sovereignty; not for a state or a company, but for the smallest of all minorities: the individual.

In February, the International Monetary Fund once again raised the question of how negative interest rates could be implemented in the event of the next recession. You should know that conventional monetary policy has only one answer to a crisis: cheap(er) money, i.e. lower interest rates. But since the great financial crisis we have reached a limit. If the interest falls below zero, someone has to pay. Either the banks or their customers, the savers. They can tolerate negative real interest rates. It’s not so obvious. But when it comes to actually losing money from their account, they get restless. This has not yet happened for private individuals, but it has happened for companies in Europe. Their reaction: they started stashing cash in vaults.(1)(2)

In the next crisis, when the negative interest rates become even more extreme and also hit private customers, they will react similarly, according to the experts of the Monetary Fund. Their “solution” is to massively restrict the use of cash in order to make it more difficult to escape expropriation through interest rate policy. Ironically, they even want to introduce an “electronic currency”. With that in place, negative interest rates can be easily implemented according to economists. At the same time, they have in mind a two-tier society.

Anyone who wants to pay cash in the supermarket could do so – but with a penalty

surcharge. This “nudging” will herd us all into the clutches of the state electronic

monetary system that they have in mind.(3)

Luckily, nothing is eaten as hot as it is cooked. These ideas are neither economically sound nor politically feasible. But the proposal should serve as a warning to us. By now it should be clear why Bitcoin is here to stay. Why it’s needed. It’s the antidote to such crazy ideas. Bitcoin makes it possible to get out of a system that is becoming increasingly hostile towards the users.

Of course: Bitcoin is still young. The extreme volatility is a deterrent. The technical difficulties, the hacks, scams and criminal cases as well. All these are growing pains that are to be expected when building a completely new, alternative monetary system. The Crypto Research Report has been documenting these developments for almost two years now and our sister report, In Gold we Trust has been covering cryptocurrencies since 2014. We offer an alternative explanation to the mainstream media’s fixation on Bitcoin’s price.

The falling price since January 2018 has curbed Bitcoin’s attractiveness and the crypto winter is still underway. The industry is bleeding. More and more companies have to reduce their staff. We are not even talking about the big and small investors who have lost a lot of money – at least on paper. The comparison with the dotcom bubble is certainly fitting. Too many people have invested too much money in ambitious projects that have often failed to deliver on any of their promises. But where there’s shade, there’s also light. And we can see some big rays shining through. But first we have to talk about the shadow.

How Long Will This Bear Market Last

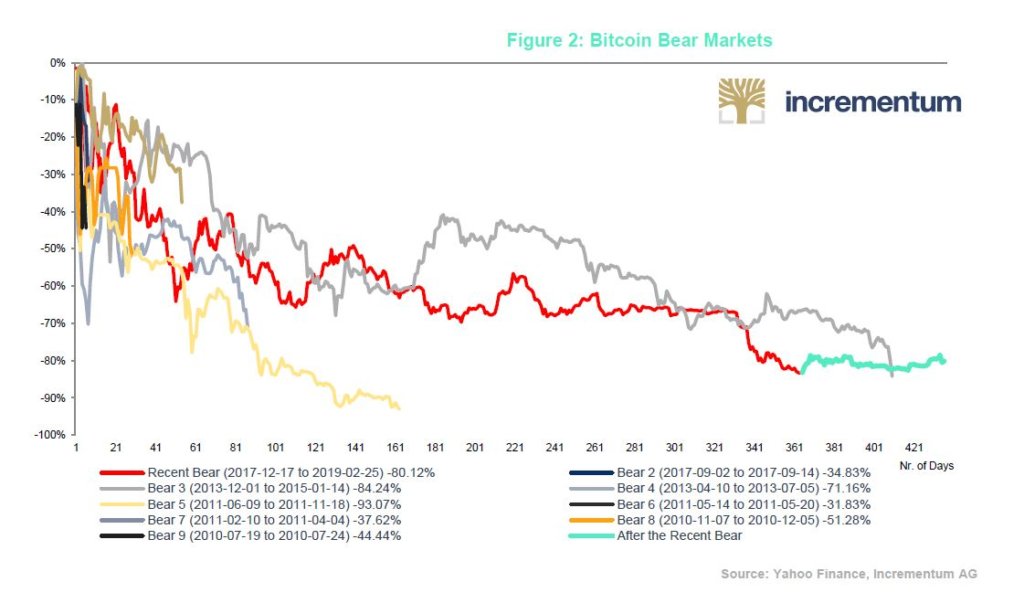

According to Coindesk, Bitcoin is officially in the longest bear market in its history.(4) However, this is very hard to estimate. Since December 2017, when the price of one Bitcoin briefly rose to $19,764, the price fell for 360 days before reaching its most recent trough at $3,125 in December of 2018. Shortly after, Bitcoin actually surpassed $4,000, realizing a gain of over 29.92%. Although, the price dropped down shortly afterwards. Defining a bear market by a percentage loss or gain in cryptocurrencies is difficult because of the strong volatility associated with the asset class. Talking about stock markets usually the beginning of a bear or bull market is defined by losses or gains of 20%, respectively. Empirically, Bitcoin has only had three downturns that lasted more than three months, and each saw a loss of over 80%. In contrast, Bitcoin has only had several bull markets with returns over 1000%, but only two of them lasted longer than five months. In the Crypto Research Report, we define a bear market as a drawdown of over 30%. We define a bull market as a gain of 30%. Therefore, we have officially begun a new Bitcoin bull market.

The crypto winter saw a maximum drawdown of 84%. In contrast, the first bear market lasted only 163 days. This was in 2011, when the price fell from $31.50 to $2.01, which equates to a loss of 93%. Between 2013 and 2015, prices fell by 86%. Although we are hopeful that the movement from $3,125 to the current price around $5,000 is the beginning of a new bull market, we will only know in hindsight whether or not the tide has come back in. However, a hint may lie in the Bitcoin’s monetary policy.

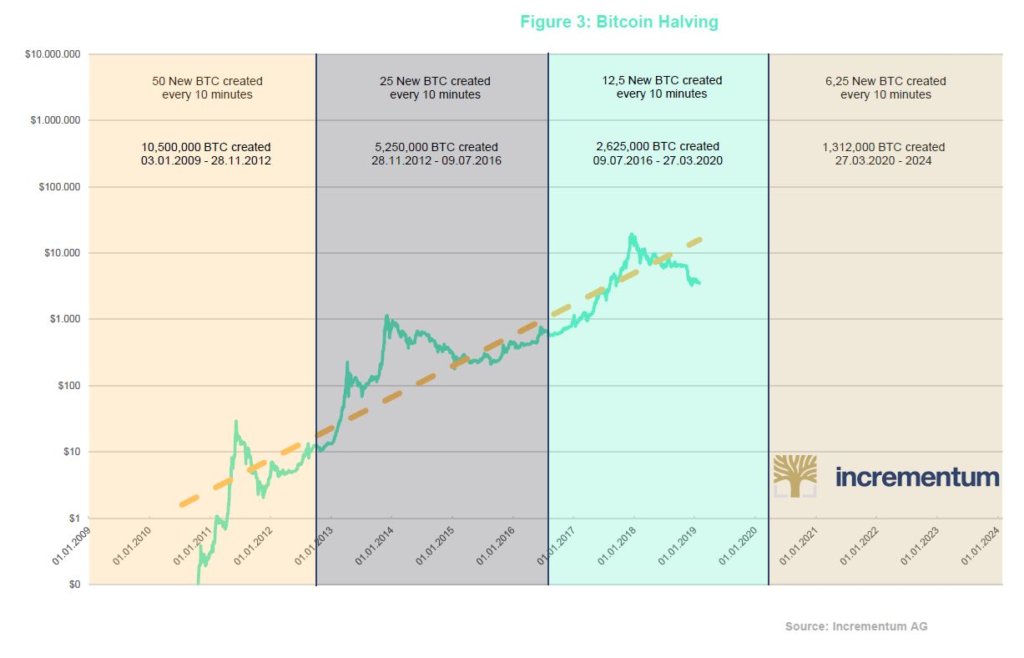

Every 210,000 blocks, the reward the miners receive per block is halved. This roughly corresponds to a four-year cycle. Observers pay very close attention to the schedule, because the so-called “halving” is regarded as an important indicator of price movement. There is only little experience so far, since there have been only two such “halvings”. But they show that the price has always risen in the months before the actual event. Specifically, the Bitcoin price found its bottom in the first bear market exactly 378 days before the first halving. And in the second bear market 539 days before the second halving.

This equals an average of 458 days, and we are currently approximately 400 days from the next halving. The next halving will probably take place towards the end of May 2020. If the pattern observed so far is confirmed, the bottom should occur somewhere between December 2018 and May of 2019. So far so good, but again: in retrospect, we’ll be smarter.(5)

A Tragic Story Traverses the World

Since the megaboom at the end of 2017, no Bitcoin story has been as present in the mainstream media as the one about the mysterious death of Gerry Cotten. The founder and CEO of Canadian crypto exchange Quadriga CX died unexpectedly at the beginning of December on a trip to India. Complications with his chronic bowel disease were given as a cause of death. Quadriga had money problems before, after their bank had frozen nearly $26 million of their funds. But what followed Cotton’s death was much worse. His widow told the Canadian authorities that Cotten had used his encrypted laptop to handle all the finances of the exchange. And that, despite the involvement of experts, she has not yet succeeded in cracking the laptop.(6)

As a result, almost $140 million in client funds are no longer available. It is understandable that major customers now want to take legal action. There is also wild speculation within the community. After so many cases of frauds and rip-offs that the crypto world has seen in the past months, the distrust is enormous. Is Gerald Cotten still alive? Does his wife pretend she doesn’t have access to the money? There are more than 20,000 Bitcoin and a number of Altcoins missing. The Reddit community watches the well known Quadriga wallets with eagle eyes.(7)(8)

On a meta-level, the case underlines two things: crypto exchanges are a damn bad place to store your coins. If you don’t want to take responsibility for your own funds, you should fall back on professional providers of custodianship solutions that are insured by regulated insurance agencies.(9) Or even stay away from cryptoassets altogether. Quadriga was not the first and probably not the last case in which an exchange did not deal professionally with its customers’ funds. Many exchanges have experienced rapid and tremendous growth. Their systems did not always grow with them. Scaling problems affect not only the blockchains themselves but also the infrastructure of the market.

When the tide goes out…

“Only when the tide goes out do you discover who’s been swimming naked.”

Warren Buffett

It was to be expected that scams and half-baked projects would be uncovered and disappear in a bear market. This is what happened in the “normal” market after the great financial crisis in 2009. But now a second wave is also hitting the crypto sector. A phase that was also to be expected: it is shrinking. Jobs are being cut from companies that want to slim down for winter so that they can still exist at the end of the crypto winter.

The most prominent case is probably ConsenSys. This “decentralized company” serves as a kind of umbrella fund for around 50 Ethereum projects, which Ethereum co-founder Joe Lubin himself has selected. Lubin announced in December 2018 that 13 percent of the 1200 employees will leave the company and that the entire project will be restarted as “ConsenSys 2.0”. This also fits in with the plans to rebrand Ethereum as “Ethereum 2.0”

Lubin himself is considered one of the richest men in the scene because he has a large amount of ETH at his disposal. But that is not enough to keep ConsenSys running in the form of 2017 and 2018. According to Forbes, the “decentralized company” consumes about $100 million a year. And developers report that they never had to present a business model to get money. All it took was a thumbs up from Uncle Joe.(10)

Even the Chinese crypto giants Bitmain and Huobi are not getting off scot-free. Bitmain is the world’s largest manufacturer of mining hardware. The company will experience “some adjustments in the workforce”, according to a press release. Followed by a phrase that is often used in bad times. Bitmain says that they want to concentrate again on “their core business”. Bitmain denied rumors that more than half of the employees had to leave.(11) Bitmain also closed a research center in Israel and fired 20 employees there. Huobi, one of the world’s largest exchanges, also announced that it would “optimize” its workforce. The employees with the worst performance would have to leave. Bitmain had almost 2600 employees in its prime, Huobi more than 1000.

Other prominent victims of the bear market were the decentralised social media platform SteemIt and the NEM Foundation, which is behind the cryptocurrency XEM. SteemIt had to reduce staff. The NEM Foundation slipped into a real bankruptcy – only to ask the community for the equivalent of $8 million in order to be able to continue until February 2020. AKA, in order to make a “restart”. That’s a very popular word in the scene at this stage: restart. Soon it’ll all be “2.0.”

“Downsizing is a natural cycle in new, rapidly growing industries and blockchain is unfortunately no exception.”

Jehan Chu

Jehan Chu, the co-founder of Kenetic Capital in Hong Kong said in an interview with the South China Morning Post “We have also seen this with the Internet in the early 2000s. But this period has also produced some companies that are today the largest in this sector. I’m looking forward to a better, more focused version 2.0 of the blockchain industry.”

Admittedly, this is a dream for the future. At the present time, we must tighten our belts in Europe too. In the famous Crypto Valley in the Swiss city of Zug many cutbacks have already been announced. During the boom, too many start-ups had generously hired people who they can no longer afford or want to pay. Shapeshift, which is based in Switzerland, let about 37 employees go – a third of the workforce.(12) Locally, Crypto Finance in Switzerland had to lay off seven staff members mostly coming from their sales team.(13) In Liechtenstein, the Binancesupported exchange LXC is rumored to be having major problems.

Some crypto projects, such as Hosho’s Smart-Contract auditors, had to reduce up to 80 percent of their employees to get through the cryptowinter.(14) But there are also success stories: Blockdaemon, for example, which hosts nodes for blockchains, had a good year: “This is the most productive phase we have ever been in,” said CEO Konstantin Richter. Many start-ups have to step on it to deliver what they promised – and they are turning to service providers such as Blockdaemon: “The projects now have to show what they are made of. The time is up of raising a lot of money and talking a lot of talk.” Some investors are even happy about the cryptowinter. Many projects that were previously overvalued can now be entered at more reasonable prices.(15)

A State Cryptocurrency?

Bitcoin was originally invented to offer people an alternative to state currencies. Therefore, we are sometimes very surprised when the crypto fans absorb every message of an alleged “state crypto currency” as if it were honey. Especially since the nations in question are often a little questionable. We are not talking about the “electronic currency” that the IMF experts have in mind, but about Venezuela and Iran. The allegedly planned “crypto rial” is currently fascinating the media. In Venezuela, it was the Petro. The motivation is the same for both countries: they want to avoid US sanctions. Neutrally speaking, that is understandable. But the “Petro” of Venezuela can be considered a grandiose by most accounts.

Be that as it may, Iran is allegedly in talks with eight states from Europe and Africa (including Switzerland, Austria and Russia).(16) The content of the talks is whether international transactions could be carried out with cryptocurrencies. At the same time, there are reports of a “crypto rial” that may be linked to gold. Iran has been cut off from the international monetary and banking system for months. Europe, on the other hand, has a strong interest in circumventing the new US sanctions. and maintaining trade relations. Even an own agency was founded, the INSTEX. It is intended to facilitate trade between European countries and Iran. At the same time Tehran signals to consider everything that could harm the “great Satan” USA.(17)(18)

Against this background we ask ourselves: Why does it need a “crypto rial”? Is this all about propaganda? Misinformation? Which European country, which Russian company should accept such a new coin? If Tehran were really serious about using cryptocurrencies, wouldn’t the Iranians immediately resort to Bitcoin? Especially since the First Mover would have enormous advantages in such a scenario. As long as no such plans are known, we will not take the news from Iran too seriously. A “crypto rial” would probably have the same success as the “Petro” from Venezuela. None at all.

The Swedish plans for an E Krona are of course different. They are to be taken quite seriously. Especially since Sweden is a test laboratory for the “cashless society”. But here, too, we are still years away from implementation. And if it comes in the end, it will be a kind of cash substitute on a blockchain basis, not a cryptocurrency with its own monetary policy.(19)

Meanwhile in Europe, central banker Ardo Hansson has attracted attention – as a harsh critic of cryptocurrencies: “I think we will come back in a few years from now and say how could we ever have gotten into this situation where we believed this kind of a fairy-tale story”, Estonia’s central bank chief said in January. Crypto currencies are a “complete nonsense” and will probably disappear, says Hansson.

We need to point out that there are 19 national central bank governors and one ECB president in the euro zone.(20) These 20 people do not always agree and do not automatically speak for the Eurosystem when they express an opinion. It’s also not surprising that a central bank chairman, no matter which country, has nothing good to say about Bitcoin. Let us recall the IMF story we mentioned at the beginning of the report. Bitcoin is not only the enemy of state fiat money, but also hinders the implementation of extreme monetary policy elements. But it is a pity, nevertheless, that an ECB man is so derogatory. For the economists of the ECB were the first of a large central bank to deal with the advantages and disadvantages of Bitcoin in detail as early as 2012. It would be a pity if such a differentiated point of view from a serious source was forgotten, because the bosses prefer to make pithy remarks. That is why we recommend that everyone read the two ECB reports on Bitcoin. These come from a time when the central banks did not yet see the cryptocurrency as a threat, but as an enrichment.(21)(22)

Support is Increasing

Economists and central bank leaders who reject Bitcoin are truly no new phenomenon. What is striking, however, despite the ongoing bear market, is that the number of celebrity names that openly support Bitcoin is growing strongly. There’s Twitter’s CEO Jack Dorsey who said in a podcast,

“I believe the internet will have a native currency and I don’t know if it’s bitcoin. I think it will be bitcoin given all the tests it has been through and the principles behind it, how it was created. It was something that was born on the internet, was developed on the internet, was tested on the internet, and it is of the internet.“(23)

Dorsey even went so far as to say that in the end the world knew only one currency, and that Bitcoin was that currency. The timeframe he has set for this unique revolution is very ambitious: Ten years, maybe faster. Of course, Dorsey is also behind Square and its Cash App, where Bitcoin can be traded. Like all other proponents (and opponents), he therefore has a certain self interest. Dorsey also recently confirmed that he wants to integrate the Lightning Network into his cash app as soon as possible.(24)

Not only the Twitter founder, but also another social media giant is playing with the idea of integrating cryptocurrencies into his apps. We are actually talking about Mark Zuckerberg. He already said at the beginning of 2018 that he wants to deal more closely with cryptocurrencies. It was a New Year’s resolution back then. What has come of it now? Less than a year later, reports appear that Facebook is developing its own cryptocurrency to enable money transfers via WhatsApp.

This is not about Bitcoin, but about a stablecoin that is supposed to be pegged to the dollar. In any case, Zuckerberg is fully in line with the trend. The competition of Kik and Telegram is also tinkering with its own currency. And in China, WeChat has long since dominated the market for mobile payment.(25)

We also can report remarkable news from Samsung. It has equipped its new top smartphone, the Galaxy S10, with a crypto wallet.(26) This is a big step towards user friendliness for Bitcoin. And the South Koreans are also putting massive pressure on Apple. In any case, it seems appropriate, because in South Korea cryptocurrencies are still extremely popular despite the crypto winter.(27)

Preparations are also underway by the major financial institutions. Vontobel and Swissquote from Switzerland have both just introduced custodianship solutions for banks and asset managers. Bank Vontobel says it is the first in the world to meet all the standards of financial institutions and regulators. The product is called Digital Asset Vault and enables other banks and asset managers to offer their customers the purchase and sale of cryptocurrencies. Vontobel positioned itself early on as a Bitcoin-friendly bank and has been offering a Bitcoin certificate for some time, enabling traditional investors to bet on the Bitcoin price.(28)

In March, Fidelity Investments wants to follow up and enter the market with its own solution for the storage of Bitcoin and other cryptocurrencies. Fidelity’s CEO, Abigail Johnson, is a supporter of Bitcoin and has repeatedly advocated making digital assets available to a wider range of investors. It’s convenient that she’s in the executive chair of a giant in the financial industry. Fidelity is currently testing the technology with a small group of investors and their own employees. They want to start with Bitcoin, then follow up with Ether. Fidelity is one of the largest fund providers in the US with $7 trillion in assets under management, and they already work with 13,000 financial institutions. If this company gives its customers access to Bitcoin once, you can confidently call it a game changer.(29)

Nasdaq boss Adena Friedman also outed herself as a Bitcoin fan in early 2019. “Cryptocurrencies can still become the global currency of the future,” Friedman wrote in a blog post in the run-up to the World Economic Forum in Davos. Cryptocurrencies “deserve the chance to take a sustainable future place in our economy.” Bitcoin’s invention is “great evidence of human resourcefulness and creativity”. The ups and downs of Bitcoin’s price are due to the classic life cycle of a new invention and are no longer worrying, according to the Nasdaq boss. But the well-known technology exchange has a lot of catching up to do.(30)

More than a year after the introduction of Bitcoin futures, Nasdaq still has no such product on offer. We already reported in our last report that Nasdaq wanted to introduce such a system soon. Little has happened since then. It almost seems as if players like Nasdaq and the Bakkt project (of ICE, the operator of the New York Stock Exchange) are taking their time because they don’t want to risk embarrassment of launching a flop in the middle of the crypto winter. Only when prices recover can they be sure to receive full attention for their new products. After all, the Nasdaq boss’s comments show that the path is clear, it’s only a question of timing.

Speaking of Bakkt, on December 31, 2018, the new digital assets platform raised $180 million in investor funds. Among the donors were the Boston Consulting Group and Microsoft’s Venture Capital Arm, M12. A company called Horizons Ventures has also joined. Behind this one is a certain Li Ka-shing. The billionaire is number 23 on the global list of the super-rich. But Ka-shing is no stranger in the Bitcoin scene. He invested in BitPay with Horizon Ventures in 2013 and in Blockstream in 2016.(31)

Most recently, Jeremy Allaire, CEO and co-founder of the crypto company Circle, said in an AMA session on Reddit: “In my view, crypto is a much more significant and disruptive innovation than the web, and its impact on society, politics, economics, governance will be far, far greater for humanity over time.” Circle was making waves last year when the startup bought the established crypto exchange Poloniex. The company is also behind the Stablecoin USDC, which is operated jointly with the Bitcoin giant Coinbase. But what makes Circle special: None other than Goldman Sachs is heavily invested in Circle. Rumor has it that Circle is Goldman’s crypto experiment.(32)

And then shortly before the editorial deadline of this issue, an almost unbelievable message fluttered in: JP Morgan is the first large bank to develop its own cryptocurrency. Even if Jamie Dimon, the boss of JP Morgan, is known as a particularly vocal Bitcoin opponent. Admittedly, JPM Coin is not a competitor to the number one cryptocurrency Bitcoin. Instead, JPM is supposed to be a cheap vehicle for money transfers between banks and companies. Therefore, JPM Coin is more of a competition for Ripple than for Bitcoin.

The JPM coin is a currency tied to the dollar, i.e. it is a stablecoin. The idea seems to be to make it easier, faster and cheaper for large corporate customers to move dollars around the globe. “Pretty much every big corporation is our client, and most of the major banks in the world are, too,” says Umar Farooq, who heads the blockchain projects at JP Morgan. “Even if this was limited to JPM clients at the institutional level, it shouldn’t hold us back.”[33]

Spring setting in?

So, there is also a lot of good news from the sector, despite crypto winter, layoffs, and deaths. We suspect that the recent low of $3,125 is the trough of the last bear market, and that we are actually beginning the next bull market. However, we will only be able to tell in hindsight if this premonition was correct. The well-known Bitcoin bull Mike Novogratz recently said,

“There’s 118 elements on the periodic table, and only one gold […] Bitcoin is going to be digital gold, a place where you have sovereign money, it’s not U.S. money, it’s not Chinese money, it’s sovereign. Sovereignty costs a lot, it should.”(34)

What does that mean for the price? Well, Novogratz, has often been wrong here. But for the sake of completeness: he sees $8,000 dollars as an acceptable value in the medium term, which would make sense if investors price in the 2020 halving. Since bitcoin’s inflation rate will half, a doubling of the value is what is required in order to keep miners online.

What we know: Mark Dow, a trader who opened his Bitcoin shorts at an almost perfect time at the height of the last bubble, closed this short at the end of 2018. As it looks today that was great timing. However, as we have just seen, there are good reasons to stay with Bitcoin. Not only because a number of institutional investors are thinking about entering positions and more and more prominent names are standing behind crypto currencies but because the original fundamentals of Bitcoin have not changed. The original use case for Bitcoin – i.e. its use as an independent, censorship resistant currency – is still intact, and we don’t know how many of the current competitors to Bitcoin really have a future.(35) To see that, we just have to look at Venezuela again. There, Bitcoin transactions have recently reached new all-time highs. People do not trust the already broken Bolivar or the state crypto currency Petro. They want Bitcoin. And they buy Bitcoin.(36)

Bitcoin is needed in a world full of crazy money experiments. We also know that Bitcoin as a currency and digital gold is still at the beginning of its life cycle(37). That technical innovations such as the Lighting Network will be needed to start the next phase. That the next halving, i.e. the halving for block rewards, is due in less than two years. The charts are already circulating on the web today. Bitcoin cycles slow down over time. In other words: The halving alone does not guarantee a new all-time high. But if Bitcoin continues to evolve as before, some calculations suggest that the price will be between $100,000 and $200,000 per Bitcoin by 2023.(38)

Is that a prognosis on our part? Not at all. A buy recommendation? No! But that is the basis for those who are continuing to work on the infrastructure even in a prolonged bear market and for those who plan to buy now – or at least soon, when the bottom is really reached, somewhere between $2,000 and $3,000 dollars. And it is also the reason why we will continue to document the development of this sector until 2020 and beyond.

(1) See “Bargeld soll in den Tresor statt zur EZB”, Handelsblatt, June 8, 2016

(2) See “Immer mehr Schweizer Firmen bunken Bargeldberge”, Die Presse, September 13, 2016

(3) See “Cashing In: How to Make Negative Interest Rates Work”, IMFBlog, February 5, 2019

(5) See “Bitcoin is Now Officially In Its Longest Bear Market Ever”, Coindesk, February 2, 2019

(6) See “QuadrigaCX Shutters, Claiming It Lost Access to Crypto Accounts After CEO’s Mysterious Death”, BREAKERMAG, February 1, 2019

(7) See “Digital exchange loses $137 million as founder takes passwords to the grave”, Arstechnica, February 2, 2019

(8) See “Zwei mysteriöse Todesfälle erschüttern die Bitcoin-Welt”, Die Presse, February 5, 2019

(9) Last Crypto Research Report we had a closer look at different custody solutions.

(10) See “Insiders Say ConsenSys Faces a Hurdle to 2019 Rebound: Joe Lubin’s Grip”, Coindesk, January 9, 2019

(11) See “China’s Bitmain Technologies and Huobi plan lay-offs as cryptocurrency crunch begins to bite”, South China Morning Post, December 26, 2018

(12) See “Schweizer “Crypto Valley”: Bitcoinkrise bringt viele Jobverluste”, Futurezone, February 1, 2019

(13) See “Swiss Crypto Firm Pares Staff”, Finews, February 5, 2019

(14 )See “Smart Contract Auditor Lets Go 80% of Staff in Crypto Winter Cutbacks”, Coindesk, February 1, 2019

(15) See “Crypto Winter Isn’t Fatal For All ‘Picks and Shovels’ Makers”, Bloomberg, January 16, 2019

(16) See “Talks with 8 countries over using cryptocurrency in monetary transactions going on”, TehranTimes, January 28, 2019

(17) See “Iran’s Crypto Experiments Are a Shield Against Trump’s Unilateralism”, BREAKERMAG, February 1, 2019

(18) See “Europa legt sich mit König Dollar an”, Die Presse, February 2, 2019

(19) See “Difference between e-krona and crypto-assets”, Sveriges Riksbank, October 18, 2018

(20) See “Virtual Currencies To Go Down as ‘Load of Nonsense,” Says ECB’s Hansson”, Bloomberg, January 7, 2019

(21) See “Virtual Currency Schemes”, European Central Bank, October, 2012

(22) See “Virtual currency schemes – a further analysis”, European Central Bank, February, 2015

(23) See “Twitter CEO Jack Dorsey Has Made A Bold Prediction About Bitcoin”, Forbes, February 4, 2019

(24) See “Square CEO Jack Dorsey Says Bitcoin’s Lightning Is Coming to Cash App”, Coindesk, February 11, 2019

(25) See “Facebook Is Developing a Cryptocurrency for WhatsApp Transfers, Sources Say”, Bloomberg, December 21, 2018

(26) See “Blockchain Goes Mainstream? Samsung Confirms Digital Wallet Integration for Galaxy”, Cryptovest, April 2019

(27) See “Cryptocurrency Was Their Way Out of South Korea’s Lowest Rungs. They’re Still Trying.”, The New York Times, February 10, 2019

(28) See “Swiss Multi-Billion Dollar Bank Vontobel Launches Regulated Crypto Custody”, Cointelegraph, January 14, 2019

(29) See “Fidelity Is Said to Plan March Launch of Bitcoin Custody Service”, Bloomberg, January 29, 2019

(30) See “„Potenzial zur globalen Währung der Zukunft“ – Nasdaq-Chefin outet sich als Bitcoin-Fan”, Handelsblatt, January 23, 2019

(31) See “World’s 23rd Richest Man Invests in Cryptocurrency Exchange Bakkt’s First Funding Round”, Cryptoslate, January 8, 2019

(32) See “Circle CEO Says Crypto Is a “Much More Significant” Innovation Than the Web”, BREAKERMAG, January 10, 2019

(33) See “JP Morgan is rolling out the first US bank-backed cryptocurrency to transform payments business”, CNBC, February 14, 2019

(34) See “Mike Novogratz: Bitcoin Will Be Digital Gold, “Sovereignty Should Cost A Lot””, February 13, 2019

(35) See “The Trader Who Nailed the Bitcoin Top Just Covered His Short”, Bloomberg, December 18, 2018

(36) See “Bitcoin trading in crisis-stricken Venezuela has just hit an all-time high”, CNBC, February 14, 2019

(37) See “The Original Crypto Bull Thesis, Revisited & Reinvigorated”, Zerohedge, January 2, 2019

(38) See “Bitcoin’s journey to the new peak will be longer this time”, Tradingview