“LAST NIGHT’S U.S. STRIKE, KILLING IRANIAN GENERAL SOLEIMANI, IS THE SORT OF EVENT THAT GETS MARKETS MOVING. AS ONE MIGHT EXPECT, OIL JUMPED AND SO DID GOLD. OIL IS UP 3% AND GOLD JUMPED 2%. IN THIS NEW WORLD THERE IS A THIRD SAFE HAVEN ASSET, BITCOIN (BTC). IT IS UP 5%.”

Clem Chambers, Forbes

Is Bitcoin currently acquiring a new status as a safe haven asset, as digital gold? There is some evidence for this, the Iran crisis provides interesting clues. The Halving could help too.

Bitcoin and The Iran Conflict

| “Luck in the crisis? The Iran-conflict could trigger the next Bull Run (on Bitcoin).” BTC-ECHO |

Suddenly the price of Bitcoin took a leap. And then another one. The reason for the first leap was the targeted killing of Iranian General Qasem Soleimani on January 3, 2020 by the US. The Bitcoin price then took its second leap due to the Iranian counterattack against Western military bases in Iraq. Twice the world held its breath. Twice Bitcoin shot up together with gold. And twice it all looked like a new safe haven was born. But is Bitcoin really the new digital gold?

The correlation between the two assets has rarely been as high as it was in early 2020, and some analysts see a clear connection between the shiny precious metal and the digital coin. Others urge patience. One event does not make a safe haven.

But the growing tension between Washington and Tehran is a Bitcoin story – in more ways than one. It was not the first time that the cryptocurrency has reacted sensitively to a political event – and it will not be the last. Comparison with gold is also understandable: For in the daily practice of Iranians (or Venezuelans before them) the two assets play a very similar role. And Bitcoin has not only just arrived with the current worsening of the situation in Iran. Cryptocurrencies have long been part of everyday life there.

Here is what Brian O’Hagan had to say about his experiences in Iran in 2018:

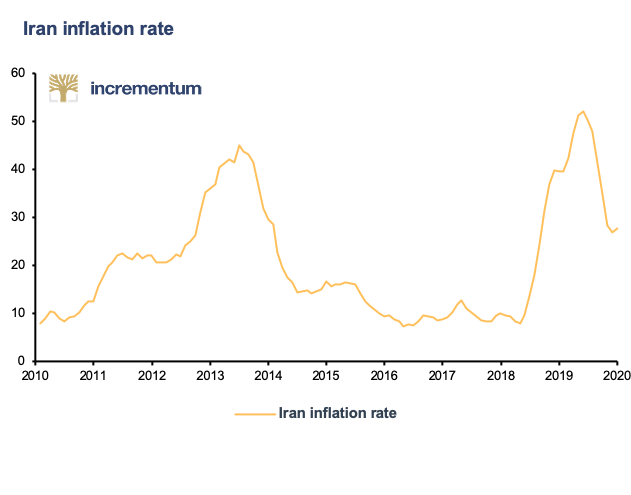

“People who own savings in rials see their purchasing power diminish every day. They are looking for ways to protect their wealth, and find a refuge for what little cash they have. They are looking for stores of value to survive the economic collapse: dollars (but they can’t find any in Iran) or gold. People in Iran are increasingly turning to cryptocurrencies to protect themselves from an economic collapse and to evade the financial repression. And the government is noticing.”[1]

Figure 1: Inflation Rate Iran

Source: Reuters Eikon, tradingeconomics.com, Incrementum AG

| “Iran removes four zeros from the national currency.” Haldelsblatt.com |

The US sanctions have been making it difficult for Iranian companies and private individuals to trade with foreign countries for years. In addition, there is high inflation in the country, which has a negative impact on the purchasing power of Iranians. Perfect conditions for the adoption of Bitcoin, as we have also seen in Venezuela. Another parallel: thanks to extremely low energy costs, mining in these countries is much cheaper than elsewhere.

As far as the official side is concerned, Iran is very ambivalent. That’s understandable. On the one hand, Bitcoin can help circumvent US sanctions. On the other hand, it also provides the population with a way to get money out of the country. This then leads to excesses such as a significantly inflated Bitcoin price within Iran. In September 2018, there were reports of an Iranian Bitcoin exchange rate of almost 26,000 dollars.[2]

| “Now Iranian President Hassan Rouhani demands a crypto-currency for the entire Muslim world in order to make itself less dependent on the US dollar.” Cryptomonday.de |

Like China and other US antagonists, the Iranian regime has a great fear of capital flight. The country’s banks have therefore been forbidden to engage in the crypto business. Mining is handled with a more pragmatic approach. The industry is now recognized by the government and it cannot even be ruled out that the regime itself is active in mining to fill its coffers.[3] At the same time, Iran is working on a state cryptocurrency – just like Venezuela and China. More on this later.

And it is not only Tehran that is taking the issue seriously- Washington is too. At the end of 2018, the Iran sanctions were extended for the first time to the Bitcoin wallets of two individuals. Even the “New York Times” has already been to Iran to visit the Bitcoin mines there: “Iran’s economy has been hobbled by banking sanctions that effectively stop foreign companies from doing business in the country. But transactions in Bitcoin, difficult to trace, could allow Iranians to make international payments while bypassing the American restrictions on banks.”[4]

This brings us to the three megatrends we see for 2020:

| “Bitcoin is going to be a safe haven.” FinanzundWirtschaft.ch |

- Bitcoin will be talked of as a safe haven and escape route – and will increasingly be compared to gold.

- The Halving will bring attention – but not necessarily higher prices.

- While Facebook’s Libra project is running into more and more problems, some central banks will launch government cryptocurrencies.

Bitcoin as Safe Haven and Friend of Gold

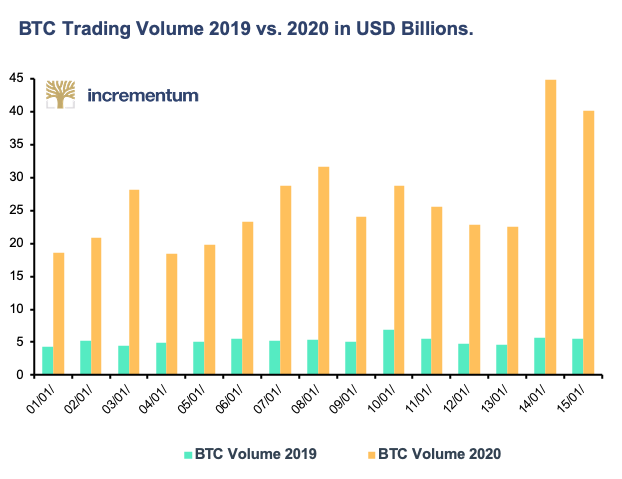

In the first few days of the year, volumes in Bitcoin markets doubled. In the midst of an ongoing bear market, investors and fans saw a silver lining on the horizon. Around the escalation of tensions between Iran and the USA, Bitcoin was traded as a safe haven asset. The correlation with gold was stronger than it has been for years. The mood on the Bitcoin market has also improved as a result, with sentiment no longer being bad but neutral.[5]

Figure 2: Trading Volume of Bitcoin in the Beginning of 2019 Compared to 2020

Source: coinmarketcap.com, Incrementum AG

However, the vast majority of analysts agree that one data point is not enough, that the safe haven story must stand up to further scrutiny – and that the prevailing downward trend has not yet been broken. One analyst doesn’t believe the Iran story at all and speaks of a technical rally.[6]

Be that as it may, the comparisons between Bitcoin and gold will now be heard more often. Bloomberg analysts even see gold as a proxy for the Bitcoin price because the assets are so similar. Both are scarce in quantity and are particularly suitable for value storage. Bitcoin has the advantage of simplified transport and dominates in the digital world. Gold has the advantage of a history going back several thousand years – and dominates in the real world. Find out more about the similarities and differences of Gold and Bitcoin in the article “Bitcoin vs. Gold – a Fictitious Debate” in this episode of the CRR.

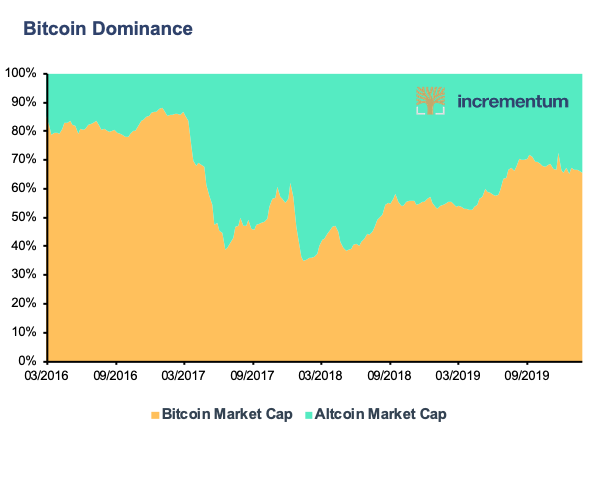

At the same time, Bloomberg does not speak highly of Altcoins, whose market share continues to shrink: “The fact that a store-of-value asset with fixed supply and increasing adoption is more likely to appreciate in price will keep Bitcoin supported in 2020. We expect movements in gold to remain a proxy for Bitcoin. The broader crypto market is at risk of more mean reversion of the parabolic 2017 rally and depends on advancing Bitcoin for buoyancy. Our takeaway is straightforward: Bitcoin is winning the adoption race, notably as a store-of-value in an environment that favors independent quasi-currencies.”[7]

Figure 3: Bitcoin Dominance in Comparison to Altcoins

Source: coinmarketcap.com, Incrementum AG

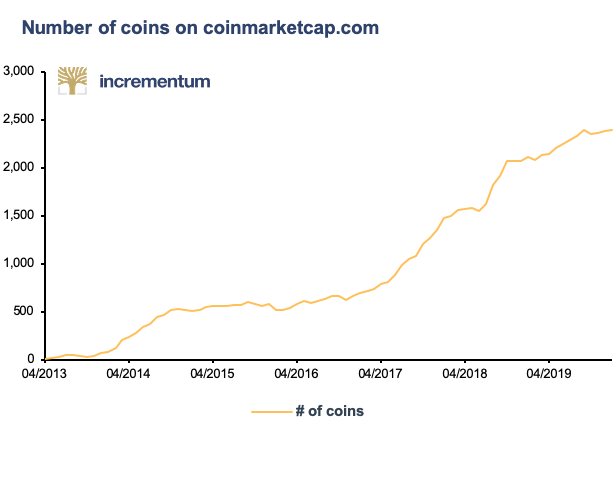

Unlike Bitcoin itself, which benefits from its scarcity, Altcoins suffer from a constantly growing oversupply. We have already examined this process in our previous reports and do not see any change in the trend.” Just too many crypto-assets competing for adoption will keep broad market prices biased to the downside, in our view. A future of appreciating prices for cryptocurrencies is unlikely until rapidly increasing supply is curtailed. In 2019, the number of tradable crypto assets listed on Coinmarketcap.com increased by about 3,000 – up to 5,078, the most ever.”[8]

Figure 4: Number of Altcoins Over Time

Source: coinmarketcap.com, Incrementum AG

In the first week of the year alone, Bitcoin increased its market share by 1.0 percent, while both ETH and XRP fell by 2.6 percent. Interestingly enough, the tense Iranian situation had a positive effect on the anonymous cryptocurrencies Dash and Monero, which increased their market share by 15 percent each. In our eyes, this is proof that the crypto sector also has a meaning in real events and that these coins are not just bought for speculative purposes.[9]

This development, the experience from Iran and the price movements in early 2020 clearly show in the eyes of Bloomberg analysts that Bitcoin is establishing itself on the market as a store of value. Again, the similarity to gold is striking. Unlike many in the crypto-community, analysts do not see gold and Bitcoin as enemies, but as friends: “Gold prices will keep climbing in 2020 and so should Bitcoin, in our view. The digital version of the metal is in the maturing process of consolidating the rapid price appreciation of its youth. Bitcoins’ ever-more inverse relationship with the U.S. dollar indicates the maturation process of the new quasi-currency toward a digital version of gold.”[10]

| “The (Peterson) correlation between gold and BTC rose to 0.217, last seen in October 2016.” Coin News Telegraph.com |

The correlation between Bitcoin and gold had already been on an upward trend since the beginning of 2019 and, according to the analysts of Arcane Research, reached a peak in January 2020, which was last seen in the summer of 2016.[11]

But there is another correlation that should make Bitcoin investors less happy. We’re talking about Tether. In recent months two studies have come to the conclusion that the price of Bitcoin, at least in the past, has been very strongly dependent on the development of the stablecoins money supply.[12]

The accusations of the US researchers John Griffin (University of Texas) and Amin Shams (Ohio State University) are particularly blatant. They have written a paper to prove that only Tether and the stock exchange Bitfinex alone were behind the huge price increase at the end of 2017. They talk of massive manipulation. Griffin told Bloomberg: “Our results suggest instead of thousands of investors moving the price of Bitcoin, it’s just one large one. Years from now, people will be surprised to learn investors handed over billions to people they didn’t know and who faced little oversight.” Tether and Bitfinex categorically deny the allegations.[13] Now the controversy around Tether is by no means new. We have reported on this on several occasions, and for the sake of completeness, we list the study and the allegations here. Unfortunately, we cannot judge whether there is something behind it or not.

The Halving as a Big Non-Story?

Another factor that accompanies Bitcoin and will become acute this year is the story of the Halving. Bloomberg has collected quotes by industry leaders on the event, which is expected to take place in May 2020. The conclusion: Some hope for price increases, others consider the halving to be priced in, and yet others see it as the best way to educate people about Bitcoin. We are most likely to be found in this third camp. The fact that we even know that the supply of fresh coins will be cut back this year is a great victory for the transparency of Bitcoin’s monetary policy. It is also the basis of the comparisons to gold that we cited in the previous chapter. Find out more about the Halving in the Article “The Stock to Flow Model Mark Valek held an Exclusive Interview with “Plan B” in this episode.

Taking a look at past halvings, you quickly understand why many enthusiasts are looking forward to 2020: “In a halving, Bitcoin rewards that go to the so-called miners that support the coin’s network drop in half in order to prevent inflation from eroding the purchasing power of the coins. In the previous reductions, the price rose about 8,000% in the year after the 2012 decrease and around 2,000% in the 18 months following the 2016 cut, according to data compiled by Bloomberg.”[14]

What do the pros say?

“Unlike most Bitcoiners, I don’t think the halving is particularly bullish. I am of the view that most people with a Bitcoin position understand that it’s capped in supply, so the issuance change shouldn’t make a difference. Also, the halving is perfectly forecastable, so I have a hard time believing that it constitutes an informational shock. Bitcoin supply has been described and understood from January 2009 and has followed the ordained trajectory ever since.”

Nic Carter, Co-founder of Coin Metrics

“As Bitcoin is often influenced by momentum thinking — and the halving is magnified by a transformation of the economic structure — I’d estimate it will have a positive influence on price.”

Dave Balter, Chief Executive Officer of Flipside Crypto

“Many market participants have been asking the question — is the Bitcoin halving priced in? That’s the wrong way to frame it. A small single digit percentage of the world currently owns Bitcoin. For those that currently own Bitcoin, a large portion of them understand that Bitcoin’s newly issued supply is cut in half every four years. This is likely a significant reason why they own it — because of Bitcoin’s provable scarcity. For the many billions of people around the world that do not own Bitcoin, few understand this provable scarcity characteristic. So for those billions, it cannot be priced in. To the extent those billions of people discover Bitcoin in the future and decide to buy some, there will be less new available supply to satisfy that increased demand to purchase Bitcoin.”

Travis Kling, Founder of Ikigai Asset Management

We find the perspective of Kling particularly interesting. How can one assume an efficient market if the market has so few participants so far? The halving will in any case give the media the opportunity to point out the positive sides of Bitcoin and to explain the functioning of the original cryptocurrency in detail once again. This could further strengthen the Bitcoin-as-Safe-Haven narrative and further weaken the Altcoins.

But it would also be the perfect time for a state actor to enter the field of cryptocurrencies. Even if that has little to do with Bitcoin per se.

Central Banks Are Coming

Anyone who belittles the efforts of central banks in the crypto area could overlook important points. One thing is true, though: Neither China, nor the Eurozone or Sweden are planning any real competition to Bitcoin. The new digital currencies will be just that: currencies – no digital store of value.

| “The preparation for the e-Krone (Sweden) is well advanced.” Business Insider.de |

State cryptocurrencies, which also allow state surveillance, could even drive some users into the arms of Bitcoin, Dash and Monero, which at least partially guarantee anonymity. But: “Politicians are looking to destroy this competitive advantage for non-state digital currencies by making them less secure. Governments are investing heavily in a technology that could one day – in theory – crack the public-key cryptography underpinning Bitcoin: Quantum computing. The Trump administration has committed $1.2 billion to this endeavor. China is active too.”[15]

China even takes a particularly nefarious approach. In November 2019, President Xi even caused a 30 percent increase in Bitcoin prices, because he had spoken positively about the blockchain and expressed the government’s interest in the technology: “The irony is striking, considering Bitcoin’s anarchic origins. But there’s something broader going on here. The future of digital money is being shaped increasingly by national governments. Politicians are under pressure to make electronic payments more efficient, to neutralize the threat of cryptocurrencies to their sovereignty and to crack down on illicit money flows. None of that is good news for the blockchain’s true believers, however much a Beijing stamp of approval boosts the price of a Bitcoin.”[16]

Meanwhile, Chinese media report that the state cryptocurrency is almost ready. What exactly this digital yuan will look like and when it will be launched is still unclear. According to reports, China has been working on the project since 2014. What we do know: The currency is to be put into circulation via the commercial banks in the same way as the paper currency. Users can then open accounts with these banks and use the crypto-yuan. The first pilot projects are to start in Shenzhen and Suzhou.[17]

| “Switzerland cannot authorise Libra in its present form.” Swiss Federal Council Ueli Maurer |

It is a certain irony that Mark Zuckerberg, of all people, warned of precisely this development. If the West is not open to new blockchain projects like its Libra-Coin, China will take the lead in this area, Zuckerberg told the US Congress: “China is moving quickly to launch a similar idea in the coming months. We can’t sit here and assume that because America is today the leader that it will always get to be the leader if we don’t innovate.”[18]

Zuckerberg sees Libra as the western counterpart to China’s plans, where cryptocurrency is to be combined with close monitoring of the population. But Libra is severely handicapped in the West. The skepticism is huge in the USA and in Europe. Recently, Switzerland has also bowed to the pressure. Libra will not receive permission to set up the headquarters of its consortium in Switzerland in the foreseeable future, the government said. The status of the project is open, its future remains uncertain.[19] Recently, some of the most important supporters have backed out: Mastercard, Visa, E-Bay and Stripe.[20]

At the same time, however, according to the Bank of International Settlements, almost three quarters of all international central banks are working on some form of digital currency.[21] But: Only five projects are in the pilot phase. It is highly unlikely that a digital Euro or digital Pound will be introduced the day after tomorrow. It is true that individual countries in Europe, such as Sweden, have already made great strides on the road to a cashless society – and are therefore very interested in a state cryptographic currency. However, the so-called “E-Krona” is still a long way off it seems.

In the EU, the focus so far has been on the further development of existing systems. However, there is a joint crypto project that the ECB is running with the Bank of Japan: “Project Stella”. As an individual state, France wants to position itself particularly prominently and wants to “test” a digital currency in 2020. But that’s all it will ever be, because France, as a member of the Euro, is not allowed to introduce its own currency.[22] In a position paper at the end of October, the German Banking Association also spoke out in favor of a European digital currency. But the ECB only wants to make plans for a digital Euro if the private sector does not manage to make international transfers cheaper and faster.[23]

Within the Bank of International Settlements, a Frenchman will be responsible for the digitization of money: Benoît Cœuré, a former member of the ECB’s Executive Board, heads a new department which is charged with developing public alternatives to projects such as Libra. “The first task facing Mr Cœuré, who starts in January and will serve a five-year term, will be to co-operate with the Swiss National Bank to create a central bank digital currency for wholesale use between banks, safeguarded by so-called distributed ledger technology (DLT)”.[24]

Conclusion

| “Facebook has 2.4 billion active users. And it’s planning its own digital currency called Libra. Politicians in Europe – including Germany’s finance minister – fear for their currency power.” Zeit.de |

The efforts of the central banks have made one thing very clear: From an economic perspective, this is not about Bitcoin. It’s about the danger posed by Libra. It is about the possibilities of saving on cash logistics. And it is – unfortunately – about the surveillance of citizens.

Against this background, Bitcoin should actually find fertile soil in which a new bull market can flourish. The story of Bitcoin as a store of value, of “digital gold”, becomes more credible with each crisis. It’s also simpler and better digestible for the masses than the hype about blockchain, from which, apart from Bitcoin itself, not many useful applications have emerged so far.

The combination of these factors should make for a good year for Bitcoin. Even though we do not know when the downward price trend will really end. In the days after the short Iran crisis, when the price of gold was long since on the way down again, the Bitcoin price did actually continue to rise. A sign of life, if you will. From a market that is still in its infancy.

We must not forget that. Just around the last pump to around

8,650 dollars per Bitcoin, public television in Germany even reported with a

positive undertone about the introduction of Bitcoin options at the CME stock

exchange. “Bitcoin reaches the mainstream,” was the headline. We

share this opinion. We have stated the same many times.[25]

[1] https://hackernoon.com/how-donald-trump-is-helping-bitcoin-grow-in-iran-331ee7445bd8

[2] https://hackernoon.com/why-is-bitcoin-trading-at-a-253-premium-price-in-iran-45f9a2f30017

[3] https://www.aljazeera.com/ajimpact/iran-government-recognises-cryptocurrency-mining-caveat-190804193912792.html

[4] https://www.nytimes.com/2019/01/29/world/middleeast/bitcoin-iran-sanctions.html

[5] Arcane Research Weekly Update 2/2020

[6] https://www.ccn.com/bitcoin-price-bounce-has-nothing-to-do-with-iran-situation/

[7] Bloomberg Crypto Outlook – January 2020 Edition

[8] Bloomberg Crypto Outlook – January 2020 Edition

[9] Arcane Research Weekly Update 2/2020

[10] Bloomberg Crypto Outlook – January 2020 Edition

[11] Arcane Research Weekly Update 2/2020

[12] https://www.bloomberg.com/news/articles/2019-10-03/bitcoin-gains-correlate-with-tether-issuance-researcher-says?srnd=technology-vp

[13] https://www.bloomberg.com/news/articles/2019-11-04/lone-bitcoin-whale-likely-fueled-2017-price-surge-study-says

[14] https://www.bloomberg.com/news/articles/2020-01-08/bitcoin-halvening-isn-t-until-may-but-nothing-else-matters-now?srnd=cryptocurrencies

[15] https://www.bloomberg.com/opinion/articles/2019-11-04/bitcoin-s-government-enemies-will-have-their-sweet-revenge

[16] https://www.bloomberg.com/opinion/articles/2019-11-04/bitcoin-s-government-enemies-will-have-their-sweet-revenge

[17] https://www.theblockcrypto.com/linked/52616/chinas-central-bank-says-it-has-completed-top-level-design-of-digital-currency

[18] https://cointelegraph.com/news/libra-could-serve-as-counter-to-chinese-digital-currency-says-zuckerberg

[19] https://www.nzz.ch/schweiz/bundesrat-maurer-libra-hat-derzeit-keine-chance-auf-bewilligung-ld.1530913

[20] https://www.ft.com/content/a3e952dc-ec5c-11e9-85f4-d00e5018f061

[21] https://www.ledgerinsights.com/bis-70-percent-central-bank-digital-currency-cbdc/

[22] https://www.derstandard.at/story/2000111883615/frankreich-will-ab-2020-digitalwaehrung-testen

[23] https://www.bloomberg.com/news/articles/2019-12-04/ecb-says-own-digital-euro-may-be-answer-if-payment-efforts-fail?srnd=premium-europe

[24] https://www.ft.com/content/c7739de6-03e7-11ea-a984-fbbacad9e7dd?sharetype=blocked

[25] https://www.tagesschau.de/wirtschaft/boerse/bitcoin-153.html