“Bitcoin will do to banks what email did to the postal industry.”

Rick Falkvinge

Key Takeaways

- Coinbase is estimated to control about four percent of all Bitcoins, which would amount to more than 850,000. The asset manager Grayscale, provider of the “Bitcoin Trust,” manages around three billion USD in crypto assets. At BitGo, it’s two billion USD.

- PayPal has already withdrawn from the Facebook Libra consortium. Visa and Mastercard are also shaking in their boots. Heads of the Bank of England and European Central Bank have expressed grave concerns regarding Libra. The project appears to be at a standstill for the moment.

- US authorities are investigating a German company that offered an alleged gold-backed cryptocurrency called “KaratGold Coin.” The company had previously sold gold products – and had been the subject of repeated warnings from authorities in Canada, the Netherlands, and Namibia even before entering the crypto space.

- Demand for Bitcoin is slumping. The number of addresses from which users send Bitcoin to the major stock exchanges BitFinex and Binance is falling. However, demand for Altcoins has slumped even more. Altcoins never left the 2018 crypto winter.

Libra Meets Resistance Everywhere

| “We believe that no private entity can claim monetary power, which is inherent to the sovereignty of Nations.” French and German Governments |

While Bitcoin is gladly dismissed and smirked at by politicians and central bankers, they immediately took Libra seriously. This is interesting because the founders of Libra were strongly inspired by Bitcoin and Ethereum and have borrowed heavily from these projects.[1]This makes sense, too. Where else should they look for ideas and concepts for a cryptocurrency? Be that as it may, there is obviously great fear on the part of the state when it comes to private competition on the currency market.

France, the USA, and China are particularly active. All for different reasons. Paris put Libra on the global agenda during its time chairing the G7 group and set up a working group on stablecoins.[2]Central bankers from all over the world openly show their skepticism. Mark Carney, the head of the Bank of England, said that Libra would have to submit to the “highest regulatory standards.” The head of the European Central Bank ECB, Mario Draghi, who has since retired from office, expressed himself in an almost identical manner. The finance ministers of France and the USA also voiced grave concern.

The state actors have two main problems with Libra: Facebook’s market power and the impending loss of the state monopoly in the money market. Facebook can access a network of more than one billion users on its own. In addition, more than 20 partner companies are involved in the Libra consortium. A huge starting advantage. “I think that’s really what’s gotten the regulators quite in a furor about what’s happening around Libra, as opposed to bitcoin,” said Zennon Kapron, founder and director of consulting firm Kapronasia, to CNBC. Governments could gradually lose power over monetary policy if Libra ever goes live.[3]

| “U.S. lawmakers are calling for Facebook to halt Libra development.” The Block Crypto |

And it’s not just about interest rates and inflation expectations but about tough power politics, says Kapron: “Right now, the U.S. dollar has a lot of power, and the U.S. government has a lot of power because oil is priced in U.S. dollars. And, the U.S. government controls which banks can interact with the U.S. dollar, so using that sphere of influence, they’re able to really control the direction of global economics and the global political situation.” Experienced crypto investors should be perplexed by these words. How come the same state actors haven’t been as nervous about Bitcoin? Was it not Satoshi Nakamoto’s stated intention to undermine the state currency monopoly?

The answer is yes. But unlike Bitcoin, Libra has an address and backers that you can subpoena in Congress. And that’s exactly what’s happening. American senators of both parties have been extremely harsh on Facebook at public hearings on the subject. The tech giant with the ambitious crypto plans also offers an excellent target for politicians because of its battered image. Facebook is like a “little child playing with fire,” it was said in July. “Do you really believe that people should trust Facebook with their hard-earned money?” asked Sherrod Brown, the democratic senator from Ohio rhetorically. His answer: “I just think that is delusional.”[4]

Facebook’s Libra manager David Marcus defended himself, assuring that Libra will not compete with government currencies and that the privacy of users will be protected. Senator Brown nevertheless urged Facebook to simply stop the development of Libra. Summarized in one sentence: States don’t like Libra (and Bitcoin) because they endanger the money monopoly.[5]

There is more resistance. The banks are nervous too. Because – and this applies to Libra and Bitcoin – before cryptocurrencies can change the monetary system, they will endanger the banks’ business model. At a meeting between bank representatives and the US Federal Reserve in September, the banks stated: “Facebook is potentially creating a digital monetary ecosystem outside of sanctioned financial markets — or a ‘shadow banking’ system. As consumers adopt Libra, more deposits could migrate onto the platform, effectively reducing liquidity, and that disintermediation may further expand into loan and investment services.”[6]

| “Bitcoin is still too unstable.” UBS |

The bank representatives seem to have overlooked the part of the Libra white paper that describes the process of creating new coins. It is true that Bitcoin is indeed a completely independent monetary system. But not Libra, because its coins are to be covered by a basket of traditional assets. Put simply, the more money goes into the Libra system, the more traditional securities the Libra Foundation has to buy for its reserve. But the main message still stands: Banks don’t like Libra (and Bitcoin) because they endanger their business model.

The Special Case of China

China goes one step further. The government also sees danger for the control over the Chinese population by the state. Bitcoin has long been targeted by China because the regime has a general fear of capital flight. The fact that the ongoing protests in Hong Kong have again boosted Bitcoins popularity in the former British colony has certainly caused little enthusiasm in Beijing.[7]

But China also has another approach. It is much more open than other countries to the idea of launching its own, state-issued cryptocurrency. Cash is generally frowned upon in this vast empire anyway. Such a state-issued cryptocurrency could further accelerate the path to a cashless society. A pleasant side effect from the point of view of the communist government in Beijing is that such a digital state currency would also facilitate the total control of the population. It could even be integrated into the Orwellian “Social Credit” system of the People’s Republic. In addition, China wants to curb the dominance of the dollar – but not by bringing in a new currency from American “production” like Libra. To sum up: China really doesn’t like Libra (and Bitcoin) because cryptocurrencies provide Chinese citizens with a way out for their capital.[8]

The resistance against Libra is not without consequence. PayPal has already withdrawn from the Libra consortium. The credit card giants Visa and Mastercard are also becoming increasingly nervous in the face of political pressure. According to the Wall Street Journal, they recently refused to openly express their support for the project – even though they had already promised to invest millions in the Libra reserve.

According to the plan, Libra should start sometime in 2020. But from today’s point of view, at least delays are to be expected – if not a total derailment of the plans.

King Bitcoin Rules Over Altcoins

For Bitcoin investors, this is all a sideshow, a distraction. But from the fate of Libra some important conclusions can be drawn for the future of the crypto sector. You can’t subpoena the makers of Bitcoin, but you can subpoena those of some other crypto projects. In addition, the Bitcoin price has always responded to major Libra-related news. There is a connection – even if it is perhaps only seen on the market.

| “It is clear that Bitcoin isn’t a safe haven asset today.” CoinDesk |

The crypto market cooled off considerably recently. Prices for Bitcoin fell from around $10,000 to just $8,000 at the end of September. The climb that began in April has been slowed down – perhaps even stopped. The number of addresses from which users send Bitcoin to the major stock exchanges Bitfinex and Binance is falling, according to data from London-based analyst TokenAnalyst. This signals “a lack of retail interest in general currently in crypto,” said TokenAnalyst co-founder Sid Shekhar. “If we go by the ‘Bitcoin as safe haven in times of recession’ narrative, the number of new users/buyers should actually be increasing.”[9]

This is a sore subject for the crypto space. This year, Bitcoin has not succeeded in establishing its reputation as a “hard” asset. The story of the alleged “safe haven” may apply to individuals and families in crisis-ridden countries, such as Venezuela or Turkey. And in these countries, you can also see a strong acceptance of Bitcoin. But from a global market perspective, Bitcoin is certainly not on a par with gold today. Perhaps the asset is simply still too young and has to earn this status.

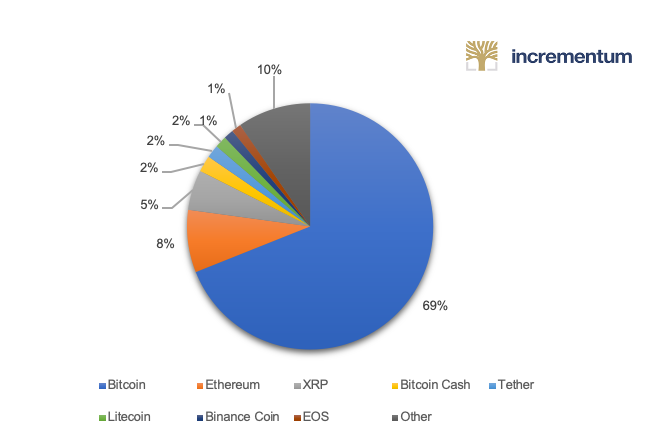

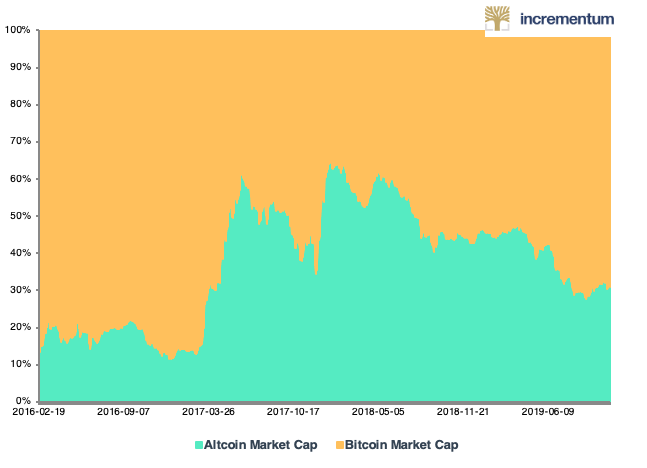

There is definitely no danger for “King Bitcoin” coming from Altcoins at the moment. Alts experience a continuous bloodbath in 2019. The vast majority have already been unable to benefit from the Bitcoin rise – and now that the king is going downhill, the peasants have to suffer even more. Bitcoin’s market dominance in October was 66 percent – and thus at the level of March 2017. Anyone who looks at the market capitalization of Altcoins in isolation (i. e. without Bitcoin) will notice that the bear market was probably never abandoned here. There is no other way to put it: If this trend continues, a (partial) destruction of the Altcoin sector is to be expected. This would probably be a positive cleansing process for the market, as many scams and fraudulent projects are still running – disguised as Altcoins. But it can’t be good for crypto’s image.

Figure: Eight Coins Make Up 90% of Cryptocurrency Market

Source: Coinmarketcap.com, Incrementum AG

Figure: Bitcoin Dominance

Source: Coin.dance, Incrementum AG

In any case, further reports on scams and warnings to investors are expected. In recent months, we have seen the implosion of the PlusToken pyramid scheme, which started in Asia (probably China). US authorities are meanwhile investigating a German company that offered an alleged gold-backed crypto currency called “KaratGold Coin.” The company had previously sold gold products – and had been the subject of repeated warnings from authorities in Canada, the Netherlands and Namibia even before entering the crypto space.[10]

In the USA, three men are on trial who are said to have sold drugs such as MDMA, Ketamine, and Xanax for Bitcoin on the DarkWeb. That alone is certainly not newsworthy. But in the run-up to the trial, the court decided to release only two of the three men on bail. The alleged leader must wait behind bars for his trial. Why? He has considerable Bitcoin assets at his disposal – and that leads to a flight risk, the court says. In this context, the authors at The Block are asking: “When will criminals learn that Bitcoin is an open payment system that can be traced by anyone?” The answer to this question would also be of interest to us.[11]

What Will BAKKT Bring to the Table?

| “Facebook’s alliance crumbles as the controversial digital currency loses important partners.” Manager-Magazine |

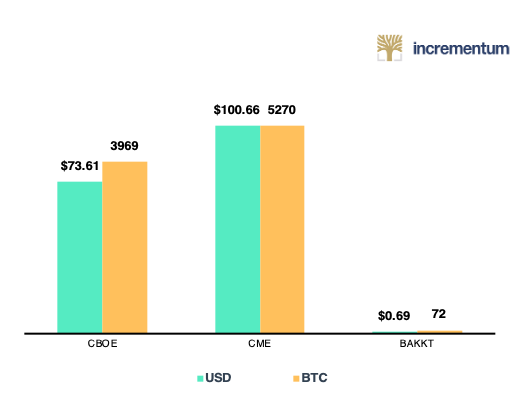

But it’s not all bad news. The professionalization of the Bitcoin market, which we have documented in detail in previous reports, continues to progress. In addition to players such as Coinbase and Fidelity, Bakkt plays a major role here. Bakkt is the crypto project of Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE). Apart from Fidelity’s entry into the crypto sector, there is probably no other project with more significance. The Bitcoin futures promised by Bakkt, which, unlike those of CME, are ‘physically’ settled, were eagerly awaited by the market. But the start at the end of September was disappointing. On the first day, Bakkt traded only 72 Bitcoin via futures. For comparison: On the first day of CME futures at the end of 2017, the figure was 5,298.[12]

Figure: BAKKT vs. CME vs. CBOE (Trading Volume on First Trading Day in Million USD)

Source: BAKKT, CBOE, CME, The Block, Incrementum AG

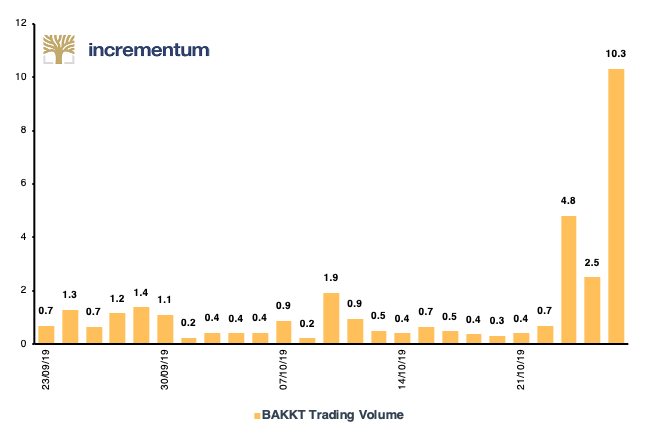

Figure: BAKKT Trading Volume Over One Month (In Million USD)

Source: BAKKT, CBOE, CME, The Block, Incrementum AG

Some observers, including JP Morgan analysts, even blame the weak start of Bakkt on the fall in Bitcoin prices in the preceding weeks. The reason: Miners and other owners of physical Bitcoin may have taken shorts to hedge against falling prices. Seen like this, the launch of Bakkt futures was indeed a self-fulfilling prophecy – but from the point of view of the shorter and not that of the broad market. We know that the expectations of the broad masses are rarely fulfilled in the markets in general and in the crypto markets in particular. The continuing dominance of the “dumb money” of retail investors plays an important role here.[13]

| “It’s too soon to write off Bakkt.” Wall Street analyst |

We therefore consider it appropriate to think beyond short-term headlines and price movements. Bakkt is by no means just introducing futures or another crypto exchange. Instead, ICE is working on a complete solution for the professionalization of the Bitcoin markets. Put simply: They try to prepare the crypto market in such a way that institutional investors can also get involved. The futures are an important step, as Bitcoin’s pricing still takes place on the spot markets today, which is unusual for other assets or commodities. “What Bakkt fundamentally believes is that price discovery is going to happen in an end-to-end regulated market,” said Bakkt COO Adam White, “Most of that price discovery is happening in the spot market, but it is going to switch to the futures markets.”[14]But there is a second step that is at least as important from Bakkt’s point of view: Custodianship.

The question of professional storage of Bitcoin and other crypto assets on behalf of institutional investors remains unanswered. We have described this problem several times in previous reports. Actors such as BitGo, Coinbase Custody, and Fidelity are working on their own solutions. At Bakkt, the custody question is at the center. The main focus here is on the New York location, the connection to the NYSE and the experience in working with regulators. On Bakkt’s website, they say that they want to set a new standard in the custody of digital assets by using the tools that are also responsible for NYSE cyber security.[15]

If you look at the history of the Intercontinental Exchange and its surprising acquisition of the iconic New York Stock Exchange, you immediately see that an innovative and highly ambitious team is at work here. Bakkt is apparently intended to secure the dominance of the NYSE in traditional markets for the future. “You can’t ignore ICE,” writes Frank Chaparro on “The Block” – and he’s certainly right about that.[16]

But in one crucial area, Bakkt is far behind other actors. The popularity of futures has increased significantly in recent weeks and the rather embarrassing first day has been forgotten. But companies such as Coinbase and BitGo have long had large amounts of physical Bitcoin in their “safes.” Bakkt’s still lagging behind. Chaparro suspects that Coinbase controls about four percent of all Bitcoins, which would amount to more than 850,000. The asset manager Grayscale, provider of the “Bitcoin Trust,” manages around three billion USD in crypto assets. At BitGo, it’s two billion USD.

No ETF Yet, but the Central Banks Are Printing Again

With its “Trust,” Grayscale offers one of the few products that enable traditional investors to profit from Bitcoins price movements. Recently there has been a strong increase in interest from institutional investors, Grayscale said recently. For the first time in months, money did also flow into Altcoins again.

What is still not available is a Bitcoin ETF. The reasons for this do not shed a good light on the current crypto markets and also explain why Bakkt is aiming at the establishment of a fully regulated futures market. The ETF is like the Holy Grail for some Bitcoin investors. These exchange-traded funds allow investors to invest in virtually any market. For example, the launch of the largest gold ETF to date in the 2000s is often associated with the rise in the gold price since then. The logic is simple and also applies to Bitcoin: Whoever buys an ETF does not have to worry about the custody and security of his/her assets.

But the US Securities and Exchange Commission (SEC) rejected another ETF application in mid-October, that of Bitwise Asset Management. A month earlier, the SEC had done the same with an ETF application from VanEck. The SEC’s justification is a slap in the face for every Bitcoin fan: The applicants have stated that “95 percent” of the Bitcoin spot market could possibly be fake, according to the SEC: Moreover, it has not been possible for Bitwise to identify the “real” Bitcoin market or to prove that it can be distinguished from fraudulent or manipulative activities, the regulator stated. The application must therefore be rejected, according to the SEC.[17]

It is therefore in the interest of all professional players in the Bitcoin sector to create a regulated crypto market as quickly as possible. What Bakkt and others are working on seems to be a basic prerequisite for the further development of Bitcoin and Co. Only when there is a transparent and legitimate market, which has also taken over pricing, will the authorities approve a Bitcoin ETF. It could be years before we see something like this. This would also explain why major players in the ETF market, such as Blackrock or Vanguard, have so far shown no interest in the Bitcoin sector. And this despite the fact that there is a permanent race for first place in the ETF market.

Investors who have already invested should also know that an ETF decision by the SEC is headline news but currently has no fundamental significance. The prices of Bitcoin, Ethereum, and other cryptoassets shot up after the negative decision in mid-October.

Easy Money is Good for Bitcoin

Many analysts and investors are now looking primarily at the development of the global economy and monetary policy to determine where Bitcoin might go next. The recent easing by central banks in Europe and the USA is generally interpreted as positive for Bitcoin prices. “We know that loose monetary policy has always historically helped Bitcoin,” said Joe DiPasquale, head of BitBull Capital, to Coindesk.[18]Analysts of Deutsche Bank also see this trend continuing.[19]

| “There are only 3 million Bitcoin left to be mined.” Anthony Pompliano |

It seems that Bitcoin returned to its roots in October. The cryptocurrency was introduced more than a decade ago as an alternative to government money when central banks announced the biggest easing in history to date. After a brief period of normalization over the past two years, fears of an economic downturn have led to a new round of easing. This inflation of the economy drives money into various asset classes: Stocks, real estate, gold and even Bitcoin.

It is, if you like, the global version of a trend that can be observed on a small scale in crisis countries. When their own currency weakens, people look for alternatives. Unlike Facebook’s Libra, Bitcoin has long since established itself as such an alternative. And even if the fundamental professionalization of the sector is likely to continue for a long time to come, many investors have long regarded Bitcoin as a serious asset that can flourish and prosper at least in an environment of cheap money – an environment that could be with us for many years to come.

This article has been sponsored by Jelvix, and they recently wrote an article on how to choose what blockchain APIs to pull pricing data from for blockchain projects.

[1] See” Libra White Paper Shows How Facebook Borrowed From Bitcoin and Ethereum,” Brady Dale, CoinDesk, June 18, 2019.

[2] See “Paris will Facebook-Geld stoppen,” Oliver Grimm, Die Presse, September 12, 2019.

[3] See “Facebook’s dream of a global cryptocurrency raises political stakes — for the regulators themselves,” Elizabeth Schulze & Saheli Roy Choudhury, CNBC, August 25, 2019.

[4] See “Libra’s Biggest Challenge May Be Facebook’s Tarnished Reputation,” Kurt Wagner, Bloomberg, July 16, 2019.

[5] See “Facebook’s Crypto Plan Called ‘Delusional’ as Senate Digs In,” Robert Schmidt et al. Bloomberg, July 16, 2019.

[6] See “American Banking Giants Sound Off Against Libra as Monetary Threat,” David Pan, CoinDesk, October 3, 2019.

[7] See “Hong Kong protests are accelerating bitcoin adoption,” Adriana hamacher, yahoo!finance, September 2, 2019.

[8] See “China’s Digital Currency Will Be Two-Tiered, Replace Cash: Binance”, William Foxley, CoinDesk, August 2019, 2019.

[9] See “Fewer People Are Sending Bitcoin to Largest Crypto Exchanges,” Olga Kharif, Bloomberg, September 5, 2019.

[10] See “‘Gold-Backed’ Crypto Token’s Promoter Investigated by Florida Regulators”, Leigh Cuen, CoinDesk, October 4, 2019.

[11] See “Defendant’s sizable bitcoin transactions cited in drug defendant’s bail denial order,” Nelson Rosario, theblockcrypto.com, October 6, 2019.

[12] See “Bakkt Exchange’s Bitcoin Futures See Slow Start on First Day of Trading,” Sebastian Sinclair, CoinDesk, September 23, 2019.

[13] See “JP Morgan Chase Pins Bitcoin Price Plunge on Bakkt and BTC Futures,” Daily Hodl Staff, THE DAILY HODL, September 29, 2019.

[14] See “Calling Bakkt a ‘crypto exchange’ misses the mark on what they’re actually doing,” Frank Chaparro, theblockcrypto.com, August 19, 2019.

[15] See “Bakkt.com – About”, Bakkt Staff, October 11, 2019.

[16] See “Calling Bakkt a ‘crypto exchange’ misses the mark on what they’re actually doing,” Frank Chaparro, theblockcrypto.com, August 19, 2019.

[17] See “SEC not convinced a ‘real’ Bitcoin market exists, denies Bitwise Bitcoin ETF,” Rakesh Sharma, Decrypt, October 10, 2019.

[18] See “Bitcoin Jumps to 3-Week High Near $8,600 as Fed Plans New Round of Reserve Increases,” Brad Keoun, CoinDesk, October 9, 2019.

[19] See “Bitcoin could be rising due to central bank easing, Deutsche Bank says | Street Signs Europe”, Jim Reid, CNBC International TV, June 26, 2019.