Since we have been quite involved with the topics of Gold and Bitcoin for several years, we have already held several discussions on the subject of investing in Gold and Bitcoin. In the form of a (fictitious) debate between a proponent of gold investments (XAU) and a proponent of the cryptocurrency Bitcoin (BTC), we want to dialogue some frequently discussed points such as the similarities, differences and opportunities of these two forms of investment.

BTC: Dear GOLDBUG, I am pleased that we have met here today. I am quite curious if I can convince you that there are some parallels between gold and Bitcoin, and that Bitcoin definitely has a place in the market or will become much more important.

| Gold has fascinated humanity for thousands of years |

Source: Unsplash.com

XAU: Thanks for the invitation! As you know, as a rather conservative investor I am very critical of the crypto world, but I am always open to a good argument.

BTC: This is a good basis on which we can build our conversation. Let us start by discussing the differences and similarities between Bitcoin and gold. What are your thoughts?

XAU: That’s a great idea! While I did notice that there is a huge trend towards digitalization these days, it stops with me when it comes to the investment of value. This is because gold is a precious metal. You can touch it and it has always imposed an almost mystical fascination on people– especially my wife.

BTC: Sure, but there is a fundamental difference. gold is a chemical element, it exists physically, it can be touched as you say, and admittedly it does have rather interesting properties. But Bitcoin on the other hand, is an open protocol that only exists digitally as bits and bytes. Bitcoin is ultimately a groundbreaking innovation and has managed to successfully give digital information scarcity for the first time!

| Bitcoin is a relatively new technology. Is it becoming the gold of the digital world? |

Source: Unsplash.com

XAU: What does that mean?

BTC: For example, if you send someone an email, you are not actually transferring your own data. You send a copy of your data. Ultimately the data will be available to both you and the recipient afterwards. Until the invention of Bitcoin and the associated blockchain technology, it was not possible to make digital information definitively transferable, i.e. that it “goes from me to you and is no longer with me afterwards”.

XAU: Okay, I’m following so far. I can even concede that this is indeed a groundbreaking invention. But how do I know this transmission will work safely? Everything on the Internet is hackable!

BTC: The inventor of Bitcoin created a very intelligent reward system for the people involved in securing the network. These so-called “miners” fulfill the task of verifying that each transaction is valid and is only actually executed once. The same Bitcoin can never be spent twice simultaneously. With the computing power provided by the miners, they ultimately make the network secure. In return, for compensation they receive newly mined Bitcoins. The more Miners are involved, the more difficult it becomes for Miners to conspire to validate a fraudulent transaction.

XAU: Okay, I can imagine that Bitcoins can be transmitted relatively safely over the Bitcoin network. I have never transferred a Bitcoin, but surely someone by now would have noticed if a secure transmission was compromised?

| “Bitcoin is considered to be hack-proof because the Bitcoin blockchain is constantly being monitored by the entire network. Therefore, attacks on the blockchain itself are highly improbable.” BitPanda.com |

BTC: Exactly! Since the network was established, every single transaction has been transferred securely.

XAU: Still, why exactly would Bitcoin prevail? There are supposedly thousands of such cryptocurrencies in existence today! Whereas the element gold only exists once, guaranteed!

BTC: Well, I have to admit, 100% I can’t rule out the possibility that there won’t be another crypto currency at some point.

XAU: You see!

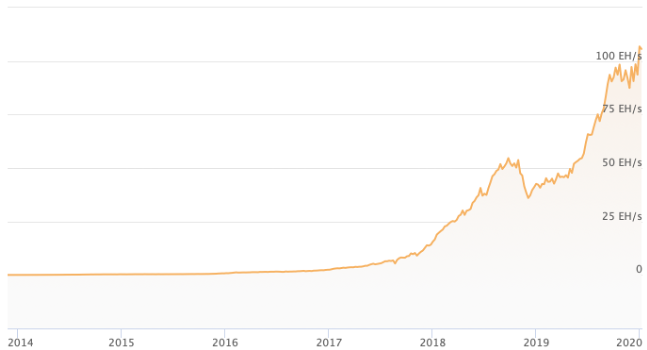

BTC: Regardless of this, since the launch of Bitcoin, the likelihood of another cryptocurrency becoming established as a store of value has already decreased significantly. This is primarily due to the enormous spread of its network and thus the high level of Bitcoin security. The computing power that secures the Bitcoin network is now gigantic. No other cryptocurrency has even come close to achieving similar computing power. This can be observed by looking at Bitcoins hashrate.

Figure: The Development of Bitcoin’s Hashrate

Source: Coinwarz.com, EH/s Stands for Exahash per Second.

XAU: Okay, so you’re claiming I can transmit Bitcoins safely and securely on the blockchain because the most processing power is behind the Bitcoin network. But this security method is extremely power consuming! Isn’t that a disaster in these times of global climate change?

| “If the Bitcoin system were a country, its electricity consumption would put it in 43rd place in the world – between Switzerland and the Czech Republic, and the trend is growing.” Zeit.de |

BTC: I’m sure we could spend a very long time debating this specific topic, but I think the most important point is that the electricity used to produce Bitcoin is often excess electricity that would otherwise be wasted.

XAU: What do you mean? The power used to operate the Bitcoin network must be taken from someone else!

BTC: It is well known that electricity is very difficult to store and can only be transported over long distances with huge losses in power. To mine Bitcoin economically, it is essential to use the cheapest sources of electricity. These are usually remote hydroelectric power plants, as there is often no way to store the electricity. Therefore, many of the Bitcoin farms are located in Scandinavia and Iceland, for example. In both of these places there is large surplus of electricity and it is cheap to use hydroelectric power. Various electricity suppliers have already recognized this and are using Bitcoin mining in some cases to deal with the surplus of electricity. In places with electricity shortages you couldn’t even consider mining, because the electricity prices are too high making mining not cost effective. Even at an average electricity price point it is still not possible to mine economically!

XAU: Wow, I really didn’t know that. Still, why invest in Bitcoin now? With gold, I know there’s a finite amount on earth. So, gold will always be worth something. But Bitcoin is so speculative. And it pays no interest, either.

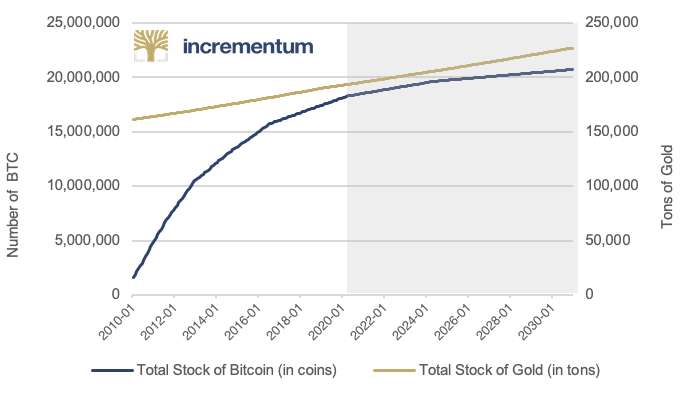

Figure: Stocks of Bitcoin and Gold Compared with Future Outlook – An Indicator of Inflation

Source: Incrementum AG

BTC: Okay, let’s get this straight. Both gold and Bitcoin are two investments that yield no interest. Both are “unproductive” assets whose value originates in the investment itself. Shares are invested in order to participate in the success of the company. Or, via government bonds, one participates to a certain extent in the development of the entire economy.

XAU: I understand your argument, but I would still not consider gold and Bitcoin to be equivalent. This is because gold is strong and stable. Gold is only available in limited quantities and is therefore valuable. Every year the amount of gold mined grows very steadily by about 1.5 percent. Even after large price increases, mining companies have not been able to expand their production significantly. Central banks, on the other hand, have been siphoning off vast amounts of money since the financial crisis, amounts that I can no longer even imagine because of the many zeros. Surely, they will go bankrupt at some point!

BTC: On that point we are in complete agreement. The number of Bitcoin cannot be increased arbitrarily at will! Gold and Bitcoin could therefore be two ways of protecting against the dangers of the central banking system.

XAU: But with digital currencies, you could also add the numbers zero and one to somewhere in the code and thus create new “currency”.

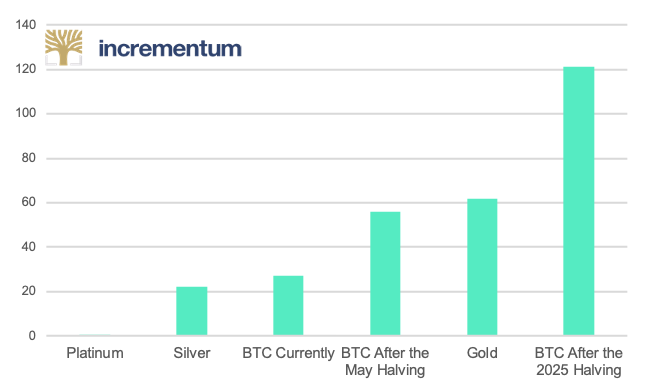

BTC: [Laughs] I’m so glad you brought that up. You’re kind enough to play into my hands. In fact, Bitcoin will become even “stronger” than gold over time, because the maximum number of Bitcoins available is exactly 21 million. That’s all there is, and that’s all there will ever be, the Bitcoin protocol stipulates this. Every four years the inflation rate of Bitcoin is therefore halved. In May of this year, Bitcoin’s inflation rate will fall roughly to that of gold and in the future Bitcoin will be even “stronger”, even less inflationary than gold. See also the different stock-to-flow ratios in comparison [chart on the next page, Figure 5]. Simply changing a few numbers in the code is absolutely impossible. There would have to be a 95 percent approval of the miners to do this. But Bitcoin thrives on the fact that it is a scarce commodity, so broad approval for such a change is almost impossible.

Figure: Various Stock-to-Flow Ratios in Comparison

Source: Incrementum AG

XAU: But what about the opportunity then to just create a new cryptocurrency? I’ve heard that one could basically just copy Bitcoin, and everyone could create their own version. Isn’t that called hard fork? Wouldn’t that just double the maximum number of Bitcoins in seconds?

| What is a Hard Fork? Simply put: a fork is the further development of a software. A hard-fork, i.e. a backward-compatible change to the rules on the blockchain, results in a blockchain becoming two blockchains. At the time the hard fork is published, the blockchain users have to decide whether they want to stay with the old blockchain or whether they want to switch to the new one. This decision must be made actively. A hard fork always leads to a split, but the blocks remain the same until the split. A detailed explanation can be found on the Crypto Research Report’s website under the following Link. |

BTC: Technically, while this sounds quite simple in theory, it is extremely unlikely that a copy of Bitcoin would be widely adopted:

First of all, the survival of a new cryptocurrency depends on whether there is any interest in it at all. Why would Bitcoin investors, who probably also trust Bitcoin because the system has limited inflation, want to switch to a new cryptocurrency system? There has to be added value here. If there is not, the hard fork will be very difficult. This has been seen with all Bitcoin hard forks so far. Secondly, the Miners who secure the system would have to go along with it and make their computing power available to the new Bitcoin version in the future. But the Miners don’t do that, because they have a far greater incentive to mine the most valuable asset. Without high computing power this “new version” of Bitcoin would be very insecure and thus is not an attractive investment.

XAU: Okay. You know, I keep hearing that Bitcoin has a scaling problem. If you want to use it as a widespread currency it’s way too expensive, right?

| The “Scalability” Problem of Bitcoin Bitcoin’s current version allows for a maximum of seven transactions per second. If Bitcoin really wants to be used as a means of payment in the long term, at some point that rate will be too little. |

BTC: You are correct, there is currently a scaling problem that is caused by the size and decentralization of the Bitcoin network. There is a trade-off between the security of the network and the speed of transactions. One perspective is that Bitcoin does not have to become a mass payment medium to be valuable. This is true for gold as well. The smaller the quantity of gold, the higher the transaction costs in terms of the price difference between buying and selling. It is questionable whether one should really invest in gold if one only wants to buy 1 gram of gold. With larger quantities of gold, the transaction costs are hardly significant. From a cost perspective, gold is therefore well suited as a store of value for larger investment amounts. Bitcoin can be viewed in the exact same way. From a cost point of view Bitcoin is store of value for larger amounts, i.e. digital gold, but it admittedly can be a volatile one.

XAU: Interesting. But Bitcoin’s ultimate claim was to be the advanced electronic payment system. Is that now unfulfilled because of this scaling problem?

BTC: Quite correct. The title of the so-called white paper was even “Bitcoin: A Peer-to-Peer Electronic Cash System”. And there are intensive efforts to fulfill this claim. There are various approaches to enabling more transactions per second. Hard forks are just one approach, which we have already seen with Bitcoin Cash, for example. Other possibilities exist in the areas of off-chain transactions, such as the Lightning-Network. There, transactions outside the blockchain are processed quickly and securely. In any case, thousands of programmers worldwide are working on the solution to this issue. There is an incredible amount of human capital behind this, which is also responsible for the fact that the hurdles that have been overcome so far have been handled quite effectively. If the scaling problem is actually still being resolved, it would not only be digital gold, but also a strong digital currency! So, another difference between gold and Bitcoin is that Bitcoin can be used as a means of payment and a store of value at the same time. This is a huge advantage of Bitcoin over gold, because gold is hardly suitable as a means of payment.

XAU: Well, I must strongly object here. In the days of the classic gold standard, gold was indeed used as a means of payment! Today’s central banks tend to overlook the period from 1870-1914, when there was slight deflation and very high growth rates. But I think that is a different debate. In any case, I don’t understand why you, as a Bitcoin fan, keep talking about Bitcoin being a store of value like gold, considering the high level of volatility?

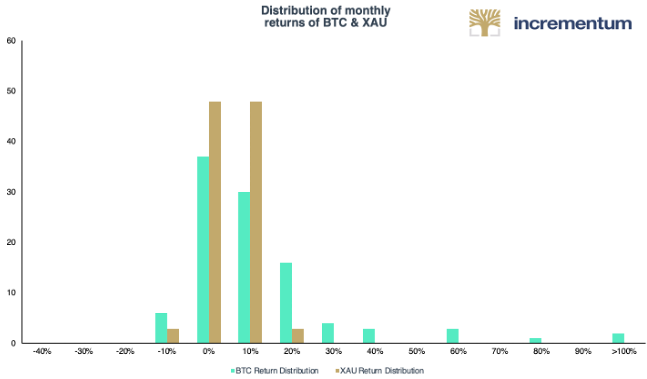

BTC: I think I have already been able to give you some solid arguments, such as limited inflation or the security of the system through the hashrate. I would also like to highlight the fact that Bitcoin is still in its early stages. The market capitalization as of January 9, 2020, at $ 144 billion, is only a fraction of that of gold. The significant price fluctuations are therefore also offset by an exorbitantly high potential profit. In fact, Bitcoin is an extremely asymmetric asset class, as Bitcoin either succeeds in the medium term and asserts itself as a global digital store of value or – for whatever reason – fails and becomes worthless.

Figure: Comparison of Market Capitalization Gold vs. Bitcoin 2013 – 2020

Source: Incrementum AG

XAU: Hmmm, I never thought of it that way. Bitcoin has a different payout profile than gold. I mean, gold really can’t drop to zero, or do you disagree with me on this point?

Figure: Number of Months of Different Returns of Bitcoin and Gold

Source: Incrementum AG

BTC: No, we are in agreement on this! Gold cannot become worthless. But the appreciation potential of gold is of course limited, since gold is known to everyone. Bitcoin is still extremely small and very young. The Internet has only been around for 30 years and Bitcoin for only 10 years. The vision is that Bitcoin will become the universal and digital value standard in an increasingly digitalized world. Very little of this has been taken into account so far. Why shouldn’t the central banks hold digital assets in 10 years? They are already thinking about digital currencies today, why shouldn’t they invest in “digital gold” at that point in time? When Bitcoin becomes established as the strongest digital currency, the central banks will hold Bitcoin as a currency reserve in addition to gold. I don’t think that’s so far-fetched. The world is changing!

XAU: Okay. Assuming you have piqued my interest, what would your investment advice be? I’ll tell you one thing right off the bat. I certainly won’t sell my gold, at least not all of it!

BTC: There are indeed crypto enthusiasts who swear by cryptocurrencies and have invested all their savings. This is of course extremely risky! On top of that, things usually turn out the way they’re supposed to! They buy in euphoria and sell in panic. But it is precisely the asymmetric payout profile that makes a small addition of Bitcoin interesting. And the high volatility can be used to your advantage through rule-based rebalancing!

XAU: Well, it seems that Gold and Bitcoin are more alike than one might think, don’t they? Together the two asset classes form a thoroughly dynamic duo.