“If you contact multiple desks to source your trade, you are leaking a lot of information to the market, and desks will often ‘pre-hedge’ ahead of consummating the trade. That is very expensive as it amounts to legal ‘frontrunning’ that will move the price against you.”

David Weisberger, CoinRoutes

Key Takeaways

- There are two main ways that large-scale investors such as high net worth individuals, crypto brokers, and digital currency funds execute large trades in the cryptocurrency space. Agency models attempt to get the best price via smart-order-routing, but are prone to slippage from the benchmark price, generally charge a commission and usually pass on exchange fees and other transaction costs. In contrast, principal models shift execution risk away from the investor, but need to be financially compensated in order to do so, meaning that transaction costs will be incorporated into a spread between what is obtained in the market and then shown to the client.

- Crypto hedge funds are outperforming Bitcoin in bear markets. Since BTC normally holds over 50 % of the crypto market capitalization, 66.7 % currently, it is commonly used as a benchmark for market performance. Most of the funds have a high beta with Bitcoin (~0.75 or higher) but have realized fewer losses in 2018 (-46 % average for funds vs. -72 % for BTC).

When an investor wants to buy $100 million worth of Bitcoin, how do they actually do it? What are the steps that they follow and the risks that they need to keep in mind? This article covers what crypto funds are and how they source liquidity, who the players are, including B2C2, Grayscale, Galaxy Digital, FalconX, Tagomi, SFOX, CoinRoutes, Omniex, Caspian, and Koine, what their strategies are, and how much they manage.

Four Models for Sourcing Liquidity

| “Statistical arbitrage has been a widely adopted trading strategy among traditional asset classes for quite some time.” Gabriel Wang, Aite |

Large investors want to make sure that their own orders do not move the price. This price of Bitcoin fluctuates based on the global market of supply and demand for Bitcoin on exchanges on over-the-counter markets. Imagine an exchange such as Kraken is quoting at a bid-ask spread of $10,000 on the bid side and $10,010 on the ask side. Let’s say that the bid side has a buy wall of $10 billion at various strike prices and the ask side has a sell wall of 1 million Bitcoin at various strike prices. If an investor comes in and wants to buy $1 million worth of Bitcoin, what is the best to execute their trade so that they do not lose out to slippage, the spread, and transaction fees?

There are two main ways that whales, such as high-net-worth individuals, crypto brokers, and crypto funds, execute large trades in the cryptocurrency space. Agency models are risky because the exchanges and brokers can easily front-run investors. In contrast, principal models shift execution risk away from investors and need to be financially compensated to do so. Agency brokers needs to be compensated as well. The difference is that an agency broker will trade with principal-at-risk brokers, and will offer wider (i.e. worse) prices in order to reap their financial reward. So cryptocurrency investors that go directly to principal-at-risk brokers can receive better prices for their cryptocurrency investments, especially if they connect to more than one principal-at-risk broker.

1.) Account with Exchanges and/or OEMS (Order & Execution Management System) platforms

The most common method that retail investors use is the agency model with multiple accounts at several exchanges. This is called an agency model because the investor is the principal and they are relying on an agency to execute their trade for them. For example, when the investor wants to buy, they simply send their money to an exchange and buy at the spot price.

First, the investor will lose money because of slippage, which is the price that the investor saw the ask at and the price that the trade was actually executed at. For example, they might have clicked “buy” when the asking price was $10,010, but in their account, they notice that the price they actually got was $10,012 because the price changed slightly in between the time he clicked and the time the trade was received and executed. This occurs often with highly volatile assets like Bitcoin and can result in significant losses in the aggregate for high frequency traders. There are two main causes of slippage:

- Technical Architecture of the Exchange: The website should optimize the number of page loads per millisecond and have servers that have stable and rapid response to site traffic. This enables transactions to occur at high speeds, which enables traders to mitigate the risk of significant price changes.

- Liquidity on the Exchange: Low liquidity means that orders will not be filled for a single price. Instead, large orders will be distributed over several smaller orders, with an increased price for each tranche of the order.

In addition to currency risk from slippage, this model also has counterparty risk because they must trust the exchange. As long as their assets are on the exchange, either fiat or crypto, they risk losing their 100 % of their wealth if the exchange goes bankrupt.

In this model, how do investors know which exchange is offering the best price?

| “With $130 trillion of assets under management worldwide, institutional investors could have a huge positive impact if they moved even a tiny fraction of those funds into crypto, whose market cap remains under $300 billion.” Gerrit van Wingerden, Caspian |

There are three main companies in this space that help investors determine which exchange has the best price using routing protocols that consolidate liquidity.

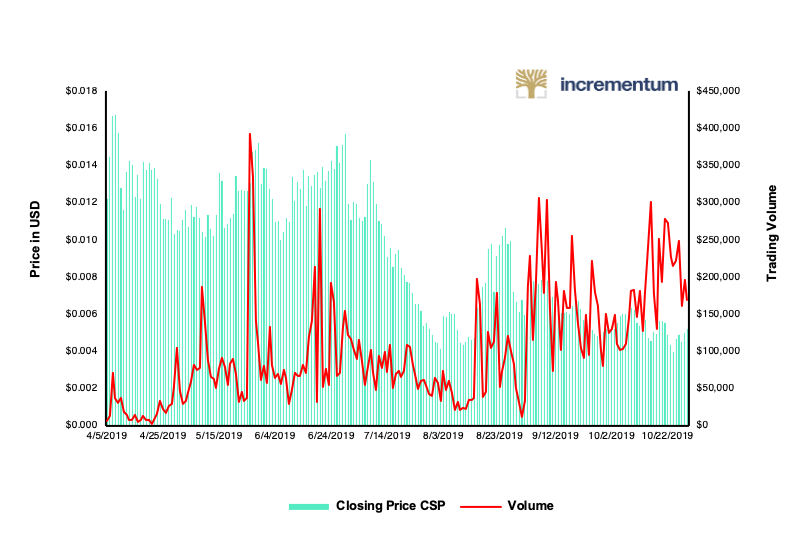

- CASPIAN. Backed by Novogratz’s Galaxy Digital Capital and offshoot of Tora Trading Services from the traditional equity space, Caspian provides a single user interface software that allows investors to see the order books on 30 spot crypto exchanges and seven crypto derivative exchanges.[1] A large order, called the parent order, is broken down into child orders, or slices of the order, that can be executed within the software at various exchanges in order to try to get the best price. The company raised $16 million in fall of 2018 in a pre-sale of their token called CSP. The coin’s all-time high was on its first day of exchange trading on April 8, 2019 at $0.019 and its all-time low is set newly almost every day with the latest prior to publication of this report being on October 24, 2019 at $0.005. The year-to-date return is -73.68 %.

- OMNIEX. Founded by ex-State Street senior VP for emerging tech, Hu Liang, Omniex is an order- and execution-management system for trading. Although they are very similar to Caspian, they have one difference – which is, they are crypto native.[2]

- COINROUTES. Recently invested in by Bitcoin Suisse for an amount of $3 million, CoinRoutes plugs into the APIs of 35 exchanges, aggregates the information, and then allows investors to access these 35 exchanges by simply accessing just one software. CoinRoutes has a patent pending called Smart Order Router that allows clients to retain complete control over their exchange keys and wallets.[3]

Figure 7: Caspian Return on Investment Since Launch

Source: Coinmarketcap.com, Incrementum AG

The main problem with non-custodial cryptocurrency trade optimization routing software is that investors will have to open up several accounts on several exchanges because routing software do not take custody of the coins. They simply allow traders to trade where the traders have already done KYC/AML and made deposits of collateral. Not only is it a hassle to KYC/AML on 30+ exchanges, but there is the opportunity cost of keeping liquidity on many exchanges. By avoiding custody of assets, this software also avoids having to apply for money services business (MSB) licenses at the federal level and money transmitter licenses (MTLs) at the state level in each state where the software company sells their product.

2.) Agency Model – Account with Broker

The second type of agency model is where investors only open up one account with a broker instead of 30 accounts with various exchanges. Brokers such as Bitcoin Suisse in Switzerland or BitPanda in Austria would typically take custody of the coins and execute the investor’s order by sourcing liquidity from their network of counterparties and their own internal order book. This is considered an agency model because the broker is acting on the behalf of the fund or high-net-worth individual (HNWI).

| Do Selfish Brokers Increase the Overall Credit Risk? Although reducing the broker’s counterparty risk by paying after receiving sounds appealing, this arrangement actually increases the overall systematic risk of the entire market. For example, imagine that Tagomi wants to buy $100,000 from Kraken and Tagomi has an agreement with Kraken that Kraken will send the 10 Bitcoin to Tagomi first and then Tagomi will send the money. Now imagine that Tagomi receives the 10 Bitcoin but then goes bankrupt before sending the $100,000. This leaves the exchange empty handed with losses of $100,000 that they may try to socialize over all of their clients’ accounts, leading to a downward pressure on the price of Bitcoin overall. Now imagine the opposite, Tagomi buys $100,000 worth of Bitcoin from Kraken and Kraken makes Tagomi send the funds upfront by posting collateral. Now, if Tagomi goes bankrupt, the exchange is fine because they have the funds already. The only clients that will suffer are the clients of the broker that went bankrupt. The impact is localized to the investors that took on the risk in the first place in this model. The common model in traditional FX is settling through a central clearing company. An example of such a company is the CLS. Centralizing settlement helps to eliminate a risk called the “Herstatt Risk”, which is named after the Bank Herstatt fiasco. Bank Herstatt failed to deliver their side of the settlement. There is no CLS in crypto, because it would be centralized (by definition) and therefore goes against the ethos of crypto. Therefore, brokers and banks in the cryptoasset industry often use the first model when the credit risk of the exchange is larger than the credit risk of the broker or bank. Credit risk determines who will have to post collateral first. The reason some brokers have this privilege is because their trading volume and credit worthiness makes them an important client for the exchange. Therefore, this option is not available to retail traders. Retail traders must first post collateral on the exchange, and then the exchange will deliver cryptocurrencies. Another option that is quickly becoming a standard is delayed settlement with 1–2 basis points charged per extra day of settlement. |

The largest firms in this space are Tagomi and SFOX. SFOX even has Federal Deposit Insurance on fiat deposits with them up to $250K. Since brokers take custody of client funds, they normally need to be licensed. For example, in the US the common licenses required for this activity include MSBs and MTLs.

There are two main ways that brokers and exchanges handle the counterparty risk of cryptocurrency trades:

- Exchanges send the cryptocurrency to the broker prior to the broker paying the exchange for the cryptocurrency.

- Brokers post collateral or pay for the cryptocurrency prior to the exchange sending the cryptocurrency.

Brokers can have contractual agreements with exchanges that state that the exchange must send the cryptocurrency first to the broker before the broker sends the fiat to the exchange in order to pay for the cryptocurrency they bought. Essentially, the broker wants to ensure that they have received the cryptocurrency in their wallet before they settle the trade with the exchange by sending the money.

Some firms are trying to become institutional brokers, such BCB Group in the United Kingdom and Falcon X in the US. The idea is to offer the lowest spread possible on trades without slippage. The model heavily relies on the network effect and is a race to connecting the disparate exchanges and agency OTC desks. By selling at cost, these companies hope to build a network that they can later sell peripheral services to, such as derivatives, margin trading, and lending. Currently, many startups are entering into this market.

Entrance from a traditional institutional broker such as State Street Corporation or Northern Trust would bring much needed legitimacy to the entire cryptocurrency market. However, clarity on the insurance of custodied assets would need to come first. Insurance firms such as Lloyds, Aon, and Zurich are dappling in cryptocurrency products; however, the market is immature. For example, BitGo’s $100 million insurance policy with Lloyds only covers cold storage meanwhile, other insurance policies only cover hot storage insurance.

3.) Principal Model – Client-Facing Market Maker

Some market makers face clients directly and use their own principal to take the other side of the client’s trade. However, market makers are in business to make money and may have directional bias (wanting to either go long or short) based on their view of the crypto market. For example, if an investor is buying Bitcoin and the market maker is also wanting to be long, the sell quote from the market maker will likely not be advantageous for the investor. In this model, quotes shown to the client can be attractive if they line up with the market maker’s positioning, but might not be of great quality otherwise. As long as a client is connected to more than one principal-at-risk broker, the investor can benefit from the inside spread of all their principal-at-risk brokers. Clients will periodically see great prices as / when their brokers are “axed” (meaning they have a position, long or short, and are therefore skewing their prices to flatten). The barriers to entry are quite high for firms looking to become a market maker, because they require large balance sheets that they can use to offer bid-ask spreads on exchanges and to OTC clients.

In this category is B2C2 in the UK. They are a market maker that also has an OTC desk that faces clients. They aggregate the price of a cryptocurrency from many exchanges, and then internally create a price for that cryptocurrency. Once they have their internal price for the cryptocurrency, they create bids and asks around that price on exchanges, and they quote these bids and asks to clients. For example, the current price of Bitcoin on Kraken Pro is $6,120.40 with an ask of 6121.5 and bid of 6,119.10, then this would put the spread at $2.40 or .03% or 3 bips. Since B2C2 is plugged into the APIs of several exchanges, B2C2 may calculate that their internal price is $6,123.5. They will then offer a bid – ask spread around this price on Kraken Pro. If their internal price is wrong, then their principal is at risk of loss.

4.) Principal Model – Trading Desk or Bank

A bank acting as a principal means that they execute a trade with their client directly, taking the execution risk on their books. In turn, they would hope to warehouse or lay off that risk via another trade. This is the same service provided by market makers in model 3, but instead of the service being provided by market makers, the service is provided by banks and trading desks at large prime brokers.

Future Outlook of Principal-Agent Models in Liquidity Sourcing

The way financial intermediaries source cryptocurrency liquidity is rapidly evolving, but the market increasingly resembles the historical development of foreign exchange and equity markets.

| “The spot FX trading industry is rapidly heading toward an agency-only trading model, but for the time being principal spot FX trading models are still widely utilized.” Solomon Teague, Euromoney |

In traditional foreign exchange markets, large trades occur in over-the-counter markets instead of on exchanges. This is because the largest foreign exchange traders on exchanges, such as the world’s largest banks, have access to information regarding the depth of order books, and they can make well-informed trades against small banks, brokers, and trading desks.

Agent models are not a bad option for investors, as long as the aggregate order book that the broker has access to is deep and the bid-ask spread is low. For example, the US equities market averages spreads of 20 basis points. However, cryptocurrency markets have high spreads and order books with fake liquidity created by wash trades in order to manipulate investor perceptions.

Insights from seasoned foreign exchange traders can help startups in the cryptocurrency space professionalize their services and prepare the market for institutionals. We greatly thank Glenn Barber from FalconX, Dan Fruhman from BCB Group, and Simon Heinrich from B2C2 for sharing how crypto brokers source liquidity in this edition of the Crypto Research Report.

Who Needs to Source Liquidity?

Agents that execute trades on the behalf of their clients need to source liquidity, so that is primarily cryptocurrency funds and brokers.

Cryptocurrency Funds

Crypto Funds is a catch-all term to refer to a type of investment fund which pools capital from multiple investors with the goal of investing in a variety of crypto assets. There are several types of legal investment vehicles that fall under this category and several legal investment vehicles that do not follow under this category but are still labeled as cryptofunds by misinformed media outlets.

Crypto Hedge Funds

For regulatory reasons, the main category of cryptocurrency funds are still cryptocurrency hedge funds. The main goal of these funds is to outperform the cryptocurrency market as a whole in the long run. It is worth noting that traditional hedge funds (e. g., ones not invested in crypto) have generally failed to consistently outperform traditional index funds. They are often based in Cayman, British Virgin Islands, or Switzerland.

PricewaterhouseCoopers (PwC) reports[4] that the median fees collected by crypto hedge funds are a 2 % management fee (annually, based on the total investment) and 20 % performance fee (annually based on the profit realized). At the same time, the average with the traditional hedge funds is 1.3 %/15.5 %.[5] Despite the higher average fees and the recent crypto bear market, PwC reports that the crypto hedge funds grew over three times in assets under management (AUM) in 2018.

PwC further reports that on average crypto hedge funds outperformed Bitcoin in 2018. Since BTC normally holds over 50 % of the crypto market capitalization, 66.7 % currently, it is commonly used as a benchmark for market performance. Most of the funds have a high beta with Bitcoin (~0.75 or higher) but realized fewer losses in 2018 (-46 % avg. for funds vs. -72 % for BTC). The exception seems to be quant funds, which have both a positive return (+8% and a negative beta -2.33); however, this is explained in the report with the fact that the majority of those funds had early investment in initial coin offerings (ICOs) and managed to exit some of those positions in the first half of 2018.

Here are some of the largest players in the cryptocurrency hedge fund arena:

- Pantera Capital is one of the largest crypto investment firms with investments across five cryptocurrency funds (Venture Fund, Digital Asset Fund, ICO Fund, Bitcoin Fund, Long-Term ICO Fund). Current assets under management (AUM) are around $450 million, due to the recent crypto winter, although they previously had $700 million. The investments range from VC investments in blockchain companies, including some big ones (like Ripple, Zcash, Civic, Harbor, Bitstamp) to investments in ICOs (like Wax, OmiseGo, 0x, Funfair, FileCoin). There is a minimal investment requirement of $100,000. According to NewsBTC, the fund has recorded a 40 % loss since its inception and a 72 % loss year-to-date.[6]

- CoinCapital is even more restrictive, looking for individuals with a net worth over $2.1 million. Similar to Pantera Capital, this fund invests in a combination of blockchain startups, ICOs, and cryptocurrencies. It holds a portfolio of over 40 cryptocurrencies, including the major ones – Ethereum, Litecoin, Bitcoin, Ripple, and Dash. The fund does not report AUM and fees; however, third-party sources report that they are currently raising $25 million from accredited investors under a 2/20 fee structure.[7]

- BitcoinsReserve was a specialized crypto hedge fund in the field of arbitrage. Like many cryptocurrency hedge funds, they have already gone out of business. Essentially, they looked for inefficiencies (price discrepancy) on the price of cryptocurrencies across different exchanges and leverages this to realize profit.

- General Crypto is a smaller crypto hedge fund with $25 million in assets. The firm takes a venture capital approach to investing. Its main focus is coins that offer solutions to real-world problems. For instance, General Crypto is invested in Golem due to its decentralized computing capabilities and Ripple because of its international wire transfer technology.

- Bitbull is a cryptocurrency hedge fund that invests in crypto assets and startups. In essence, this is an umbrella fund which offers various options, including BitBull Fund, a crypto fund of funds, and BitBull Opportunistic Fund, which directly invests in crypto assets. The fund of funds operates under a 1/10 structure with $100,000 minimum investment and a 10 % hurdle. The standard fund is a classic 2/20 with $25,000 minimum investment. The strategy employed in the standard fund is described as “Opportunistic; current focus is market-neutral volatility strategy.” Both funds are only open to accredited investors.

- Brian Kelly Capital Management currently manages over $50 million in assets and provides its investors with a three-pronged approach: buy-and-hold with 50 %, ICOs for 20 %, and actively manage the remaining 30 %. Investments in the BKCM consists primarily of cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, Zcash, and Stellar. Additionally, the fund invests in more risky tokens like Golem, Siacoin, and Augur.[8]

- Ember Fund can be thought as more of an advisory service rather than a traditional hedge fund. The fund offers portfolio rebalancing and optimization strategies which are not carried out by the fund itself but supplied as tips to its customers. There are both pre-defined portfolios and customer-defined ones. Currently supported currencies are BAT, BCH, BTC, DENT, ENJ, LTC, TUSD, and XRP. A customer can have up to three portfolios. The fund charges a fixed fee of 1.5 % on every trade.

- Prime Factor Capital was the first crypto hedge fund approved as a full-scope alternative investment fund manager by the Financial Conduct Authority, according to Bloomberg. There is no information publicly available regarding the firm’s investment strategy. The team is comprised of former employees from Blackrock, Legal & General, Goldman Sachs, and Deutsche Bank.

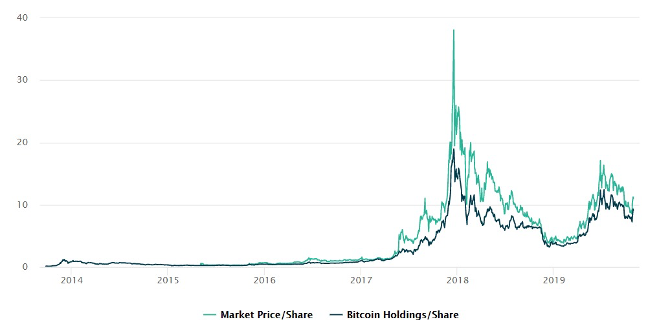

Index Funds

- Grayscale Bitcoin Trust (GBTC) is a publicly listed company, holding its assets in Bitcoin and thus allowing traditional investors to have exposure to BTC without buying it directly. GBTC is basically “a single-asset index fund” which runs at a premium (around 22.5 %), in addition to annual fees of two percent. The price of Bitcoin is up 123 % year-to-date, and the Grayscale Bitcoin Trust (OTC: GBTC) is up 143.3 %. Currently, Grayscale Bitcoin Trust is up over 2,700 % since its inception in 2015.

Figure: Grayscale Premium Roughly Constant Over Time

Source: Grayscale, Incrementum AG

AIF- and UCITS-Regulated Cryptocurrency Funds

- Postera’s Fund is regulated in Liechtenstein and based in Germany. The fund invests in a wide range of cryptocurrencies and for professional investor’s only.

- Crypto Finance’s Fund is regulated in Liechtenstein and based in Germany. The strategy is long-short on a single asset, Bitcoin, with a cash buffer. This fund is for professional investors only and is the one of the best performing funds of the year that are based in Liechtenstein.

Products that are not funds but are often called funds are exchange-traded products, such as Amun tracker certificate that is actually a bond and not a fund. Other products that are not legally fund structures include all of the cryptocurrency-based certificates issued by companies, such as Bank Vontobel and GenTwo Digital. Although cryptocurrency certificates have similar fees and trading strategies compared to cryptocurrency funds, the legal distinction mostly refers to whether the assets are held on a balance sheet of a bank and who is liable if the assets get stolen or hacked.

[1] Information retrieved in October 2019, from Caspian’s website.

[2] See “Omniex Adds Additional Top-Tier Institutional Crypto Clients And Launches Executable Streaming Prices To Fuel Growth Of Institutional Crypto Trading,” Omniex, July 16, 2019.

[3] Information retrieved in October 2019, from CoinRoutes’ website.

[4] See 2019 Crypto Fund Hedge Report, PwC & Elwood, 2019.

[5] See “Hedge funds see fee increases in 2018,” Charles McGrath, Pensions&Investments, January 30, 2019.

[6] See “Pantera Capital’s Crypto Fund Reports 40.8% Loss Since Launch,” David Babayan, News BTC, 2018.

[7] Information retrieved in October 2019 from Security Token Network’s website.

[8] See “Top 10 Crypto Hedge Funds: Investment Guide,” Tom Alford, Total Crypto, October 9, 2018.