“Useful groundwork has already been done in all these areas in Switzerland. But the time for pioneers is over: Switzerland now has to take the next step in the development of DLT, morphing from the much-vaunted ‘Crypto Valley’ into a fully-fledged DLT nation.”

Avenir Suisse, Blockchain after the Hype Report

Key Takeaways

- Crypto Francs (XCHF) is fully backed by physical bank notes and there is no negative interest rate. Storage costs make 100 % backed circulating bearer instruments not possible unless the issuing company charges subscription and redemption fees as well.

- Swiss Crypto Tokens has issued more than 10 million XCHF on the Ethereum blockchain using the ERC-20 token smart contract.

- Swiss Crypto Tokens does not see Swiss National Bank Coin as competition, as the underlying private blockchain and purposes are fundamentally different.

Everyone Can Hold Digital Swiss Francs Now

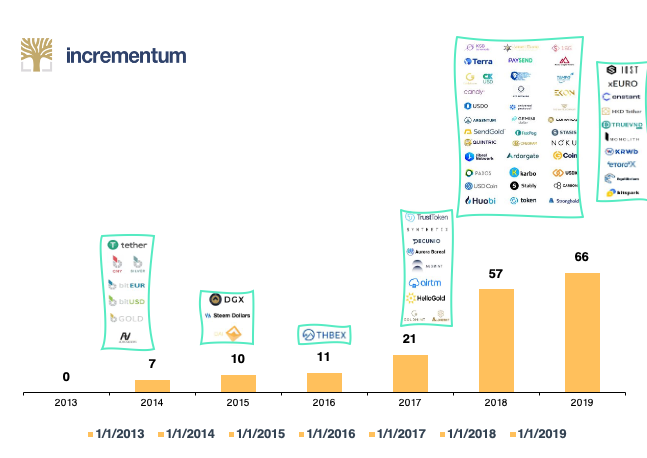

The most common form of stablecoins are fiat-backed and fiat-pegged stablecoins. For this edition of the Crypto Research Report, we interviewed Armin Schmid from Swiss Crypto Tokens (SCT) AG that issues the Crypto Franc (XCHF) to answer a few unanswered questions from our readers. The tokens themselves represent an underlying transferable bond based on Swiss law.

| Armin Schmid joined Bitcoin Suisse in April 2018 as Head Strategic Projects. In July 2018, he became CEO of the newly founded daughter company Swiss Crypto Tokens AG. Armin previously worked for eBay, PayPal, and SIX Payment Services. He holds a Master in Materials Engineering from ETH Zurich and an MBA from University of St. Gallen. |

Each ERC-20 token represents a zero-coupon Crypto Franc bond. Swiss Crypto Tokens is “borrowing” money for one month from investors. In exchange for borrowing the money, Swiss Crypto Tokens issues a stablecoin to them as a type of receipt. If the token is not returned before maturity, the token rolls over to the next bond period free of charge. When the XCHF ERC-20 is sent back to Swiss Crypto Tokens and the customer is fully onboarded with KYC & AML documentation, the Swiss francs are redeemed. Swiss Crypto Tokens burns the XCHF ERC-20 token and does not further trade it.

- Are all Crypto Franc (XCHF) ERC-20 tokens fully backed with reserves?

Armin: All holdings (currently more than 10 million CHF) are backed 100 % in physical banknotes, that’s right.

- If you stored this cash in a bank, would you have to pay negative interest rates on this money?

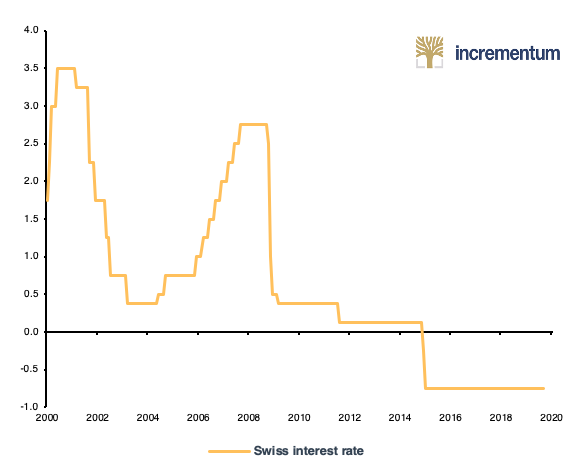

Armin: Most probably yes. Banks usually have a certain threshold, where they don’t charge, but at this level, they would charge negative rates for business customers. This might be different for private customers. But especially with this volume in cash, no investments = full -0.75 % interest would apply.

- Current setup: XCHF > Swiss Crypto Tokens AG > banknotes in bunker

- If stored on bank account: XCHF > Swiss Crypto Tokens AG > bank XYZ

We would announce any changes to the interest rate 3 months in advance. So token holders have the chance to redeem them, so they do not have to pay negative interest. This is just a nice feature that we announce early. The goal is to keep the interest rate at 0 %.

| “Volatility has become an obstacle to the wider adoption of cryptocurrencies. In general, an effective currency should at least function as a medium of exchange and a store of value.” Armin Schmid, CEO Swiss Crypto Tokens AG |

- Is this why you write “The interest rate for the next 3 months of the bond issuance is set at 0 %.” Why would Swiss Crypto Tokens need to charge a negative interest rate on the bond if the money is stored in a vault outside of the banking system?

Armin: Storing banknotes is not free: Vault, insurance, cash handling, monthly auditing by Grant Thornton of SCT have running costs. The idea is to make up for losses with issuance & redemption fees.

The bank notes belong to Swiss Crypto Tokens and the XCHF product. XCHF token holders know that we have the assets stored in a bunker and have this audited on a monthly basis by Grant Thornton.

- If interest rates go up, will SCT pay a positive interest rate or will this be a profit margin for BS in the future?

Armin: Based on the prospectus, we would not pay positive interest rates. And yes, this would be our margin.

Figure: Swiss Interest Rate Since 2000

Source: OENB, Incrementum AG

- Why did you need to make this into a bond?

Armin: If you’re not a bank and you’d like to accept money from customers, there are only a handful of exemptions based on Swiss law. Bond with prospectus is one of them.[1]

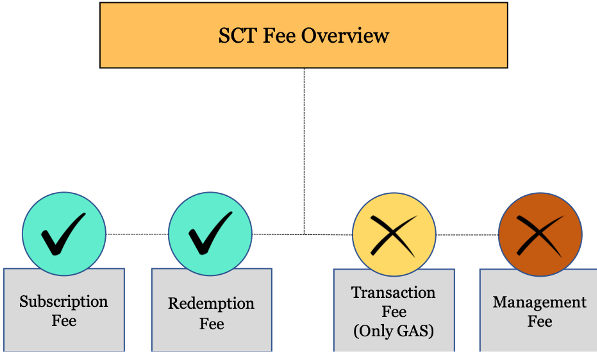

- Is there a subscription fee?

Armin: Yes.

- Is there are redemption fee?

Armin: Yes.

- Is there a transaction fee?

Armin: (No – only GAS Fee from Ethereum Network.)

- Is there a management fee?

Armin: No.

- How many redemptions have you had?

Armin: 2 major redemptions with 5 million CHF volume in total.

- Is it open to retail investors? What is the minimum investment?

Armin: Any customer segment is welcome. We have lowered the threshold for issuance from Swiss Crypto Tokens to 1,000 CHF. For lower volumes, we recommend using exchanges like Bitfinex, Ethfinex, IDEX or Uniswap, where XCHF can be traded against Bitcoin, Ether, Dai or USD.

- The ERC-20 tokens can be traded freely as any Swiss-based bond can be traded peer-to-peer with anyone. The target customers are Swiss investors. If a customer outside Switzerland wants to invest, Swiss Crypto Tokens must look at each case one-by-one and each investor needs to do KYC/AML with Swiss Crypto Tokens in order to invest. Is this correct?

Figure: Number of Stablecoins Launched Per Year

Source: Blockdata.tech, Incrementum AG

Armin: Swiss bond = Swiss customers, any other customer is welcome, and we would check individually. We would like keep the website setup simple, not to request from each visitor to identify themselves: Where are you from? What are the legal requirements for country XYZ? Are you a qualified investor? …

| “It is very difficult to determine which is a better mechanism to achieve stability but what we do know is this — the race for a truly decentralized, stable and transparent cryptocurrency is alive and well, and this will be a welcome solution to many of the problems inherent in the market currently.” Armin Schmid, CEO Swiss Crypto Tokens AG |

- Do you have a whitelist of people who can hold the coins?

Armin: No.

- What happens if someone loses the private key to their tokens?

Armin: No recovery, the token is 100 % linked with customer wallet.

- Does Swiss Crypto Tokens have a backup of the private keys?

Armin: No, no backdoors, no freezing of funds.

- Is the ERC-20 token considered a security in Switzerland?

Armin: Based on Swiss law (FINMA), the underlying bond is clearly seen as an asset token, a security.

- If the SNB launches a private ledger token that represents Swiss francs, what will this mean for the Swiss Crypto Tokens’ Crypto Franc (XCHF)?

Armin:

Crypto Franc is a token issued on the public blockchain Ethereum. If SNB would

launch a CHF stablecoin on a private blockchain, it is not different from a

centralized ledger. Only limited participants would be able to use it. E. g., banks.

SIX Digital Exchange (SDX) have announced to work with SNB but only for

settlement of SDX internal transactions. So, I see it as a completely different

product from the current Crypto Franc (XCHF).

[1] https://www.admin.ch/opc/de/classified-compilation/20131795/index.html#a5.