“This shows once again how the traditional Swiss approach of having principle-based laws that give a lot of discretion to citizens and regulatory agencies are much more innovation-friendly than overly detailed European-style laws.”

Luzius Meisser

Key Takeaways

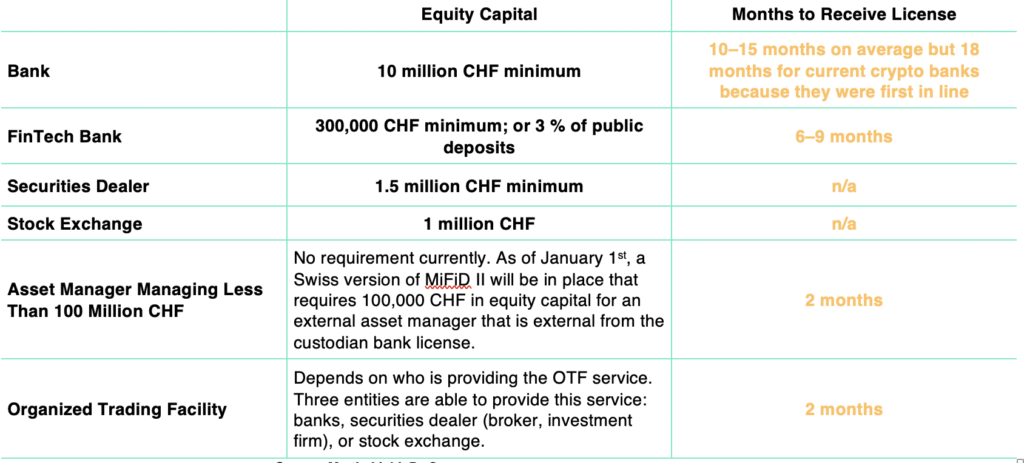

- Traditional banks require $10 million in equity. Crypto banks can apply for FinTech Bank License as of January 1, 2020. This license only requires $300,000 in equity. Startups that want to be licensed to trade security tokens require $1.5 million in equity.

- Switzerland has already introduced the standards on Virtual Asset Service Providers (VASP), and it has done it more restrictively than the recommendations set forth.

| We want to sincerely thank Dr. Martin Liebi and Silvan Thoma from PwC Switzerland for contributing this chapter. Dr. Martin Liebi: Martin is director and the head of capital markets at PwC Legal Switzerland. Contact Martin for any further information and guidance: [email protected] Silvan Thoma: Silvan Thoma is manager in the Regulatory & Compliance Team of PwC Legal Switzerland. Contact Silvan for any further information and guidance: [email protected] |

Cryptocurrencies, which are based on distributed ledger technology, have gained importance in financial services in the recent past. This primer seeks to give an overview of the key obligations under Swiss regulatory laws related to:

- Trading in cryptocurrencies

- Initial coin offerings (ICOs)

- Entities trading in cryptocurrencies

- Anti-money laundering obligations

When Regulation Applies

Trading in cryptocurrencies is increasingly subject to regulation on multiple levels, namely:

- Trading

- ICOs

- Entities trading in cryptocurrencies

- Asset management related to cryptocurrencies

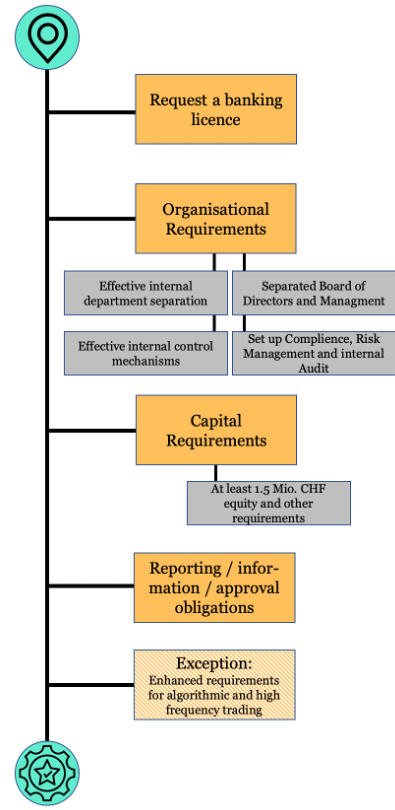

Table 1: Requirements for Swiss Licenses

Source: Martin Liebi, PwC

Payment tokens, exchange of cryptocurrencies into fiat money, custody wallets, banks, securities dealers, and asset managers are generally subject to anti-money laundering requirements, such as registration, supervision, and identification of counterparty requirements. Anti-money laundering obligations are the basic regulatory requirements that apply to most entities trading in cryptocurrency markets. Depending on their additional activities, they might require a license as a bank, securities dealer (Swiss version of an investment firm), bilateral organized trading facility (OTF) or asset manager, or a combination of these licenses. Switzerland is also planning to introduce a new license category in the near future, called fintech bank. Licenses are required in the cases listed below.

| “FINMA – supervised institutions are thus not permitted to receive tokens from customers of other institutions or to send tokens to such customers.” FINMA |

- Accepting client deposits, in particular when issuing OTC derivatives which are not securities, generally requires a banking license. The banking license is the highest regulated category of financial market participation. Cryptocurrencies and their associated private keys may be deposits under the Swiss Banking Act.

| Critical Point: A bilateral systematic internalization is when brokers take clients’ trades on their own book. Brokers that engage in this type of activity are subject to higher regulation regarding transparency including the need to show the clients the quote prior to the trade. More information on the regulation of BSI can be found on FINMA website. |

Trading in cryptocurrencies which are securities, either on behalf of clients or on one’s own account (if certain turnover thresholds are being exceeded), generally requires a securities dealer license. The licensing requirements also apply to the entity’s public issuing of derivatives. Bilateral systematic internalization of cryptocurrencies and related derivatives or financial instruments is subject to additional regulatory requirements under the Swiss Financial Market Infrastructure Act (FMIA).

| Critical Point: When a manager has the power of attorney to manage a client’s account at a bank, they do not need a license currently. This changes in the beginning of 2020. The new regulatory regime is called the Swiss Financial Services Act and Swiss Financial Institutions Act. The acts come into force on January 1, 2020; however, existing asset managers have up to three years to comply. |

Asset management activities related to Swiss and foreign collective investment schemes regarding cryptocurrencies and related financial instruments generally require a license. The distribution of collective investment schemes and the representation of foreign collective investment schemes also require a license. Individual portfolio management and advisory activities are, under the current regulatory regime, not subject to a licensing requirement (except for AML registration). However, this is likely to change under the new regulatory regime planned to enter into force soon.

| Critical Point: If a broker, such as Bitcoin Suisse, or a Crypto Fund, such as Incrementum’s Crypto Fund, wants to trade a Bitcoin call or put an option with a counterparty through an over-the-counter trade, they would agree on a price for the option, and then they would need to report this to FINMA and also show their collateral that they can use over time to prove their ability to sell or buy the coins, depending on what side of the option they are on. Natural persons do not need to report options trading positions. |

Trading in derivatives based on cryptocurrencies that can be considered derivatives may be subject to multiple obligations depending upon the status of the counterparties involved, such as reporting and risk mitigation. For example, GenTwo’s structured products based on cryptocurrencies or Lykke’s platform that has coins that are linked to a colored coin, which is a small fraction of the underlying coin.

The Regulation of Cryptocurrency Trading

Categories of Cryptocurrencies

There is a rich variety of cryptocurrencies available. There is no generally recognized classification of ICOs and the tokens that result from them, neither in Switzerland or internationally. Switzerland does not yet have an established legal doctrine or case law on cryptocurrencies.

| “In Switzerland, according to FINMA’s characteristic, an asset token represents assets such as participation in real physical underlings, companies, or earnings streams, or an entitlement to dividends or interest payments. In terms of their economic function, these tokens are analogous to equities, bonds, or derivatives.” Marcel Hostettler, Partner at MME Legal AG |

As we discussed in the January 2019 Edition of the Crypto Research Report, the Swiss Financial Market Supervisory Authority (FINMA) differentiates between three types of tokens. These are utility tokens, payment tokens, and asset tokens. This classification uses an economic approach, applying the concept of “substance over form,” meaning it is all about what the real purpose of the token is, after you scratch on its surface. That is why a token may have characteristics of multiple types of tokens and the classifications of tokens is not mutually exclusive. Asset and utility tokens could also be classified as payment tokens, which will then be referred to as hybrid tokens. In such cases, the requirements are cumulative and therefore more complex.

1.) Trading in Utility Tokens

Utility tokens are tokens which are intended to provide digital access to an application or service by means of a blockchain-based infrastructure. For example, Timicoin is a utility token which enables access to a shared database for the exchange of health information. Utility tokens are currently not treated as securities by FINMA if their sole purpose is to confer digital access rights to an application or service when issued. There is no connection with capital markets, which is a typical feature of securities. Utility tokens will, however, also be treated as asset tokens if they also have an investment purpose when issued.

2.) Trading in Payment Tokens

| Critical Point: Some scholars argue that asset-backed stablecoins are securities similar to ETFs; however, other scholars argue that asset-backed coins, like the metal-backed Tiberius Coin, are not securities. Similar to physical ownership of a precious metal, a token is a representation of physical ownership that gives the owners the right to the underlying. |

Payment tokens, commonly known as cryptocurrencies are tokens which are intended to be used, now or in the future, as a means of payment for acquiring goods or services or as a means of money or value transfer. Cryptocurrencies give rise to no claims on their issuer. Payment tokens are most similar to currencies. Given that payment tokens are designed to act as a means of payment and are not analogous in their function to traditional securities, FINMA currently does not treat payment tokens as securities.

3.) Trading in Asset Tokens

Asset tokens represent assets such as a debt or equity claim on the issuer. Asset tokens promise, for example, a share in future company earnings or future capital flows. In terms of their economic function, therefore, these tokens are analogous to equities, bonds, or derivatives. FINMA generally treats asset tokens as securities. Tokens which enable physical assets to be traded on the blockchain also fall into this category, meaning that, for example, real estate companies which use tokens on a blockchain would have to deal with asset token regulations.

Table 2: FINMA Token Categorization System

Source: Martin Liebi, PwC, * Hybrids consist of at least two categories of token-categories.

Asset tokens constitute securities if:

- they represent an uncertificated security (meaning that the security has no physical representation, either in the form of being printed on paper or being stored on a memory stick),

- they represent a derivative (i. e. the value of the conferred claim depends on an underlying asset), there was a pre-financing or pre-sale phase of an ICO which confers claims to acquire tokens in the future.

| Critical Point: The Lykke model and structured products from Vontobel, Leontec, GenTwo, and Amun represent derivatives on cryptocurrencies. |

| “It’s crucial for an ICO issuer to write a formal request to FINMA including the information required according to the ICO Guidelines and await the ‘no-action letter’ from FINMA before proceeding with the ICO.” Pascal Sprenger, KPMG |

All of the above require the token to be standardized and suitable for mass standardized trading. Being suitable for standardized trading means they are publicly offered for sale in the same structure and denomination or are placed with more than 20 clients insofar as they have not been created especially for individual counterparties.

In addition to regulatory requirements and obligations (see below), securities are subject to prospectus requirements under the Swiss Code of Obligations if they are analogous to equities or bonds.

4.) Trading in Tokens That Are Derivatives

Trading in asset tokens that are derivatives is generally subject to the regulatory obligations applicable to conventional derivatives. These are the reporting obligation, risk mitigation obligations, and, at least in theory, the clearing obligation and the platform trading obligation under the Swiss Financial Market Infrastructure Act (FMIA). All of these obligations under the FMIA have been developed tailored to a bilateral relationship between two counterparties trading in derivatives.

| Critical Point: It is, however, difficult to clearly identify the counterparties to tokens that are derivatives due to the decentralized nature of blockchain-based tokens and the anonymity of the holders of the tokens. Fulfilment of regulatory obligations applicable to derivatives can, thus, be cumbersome. |

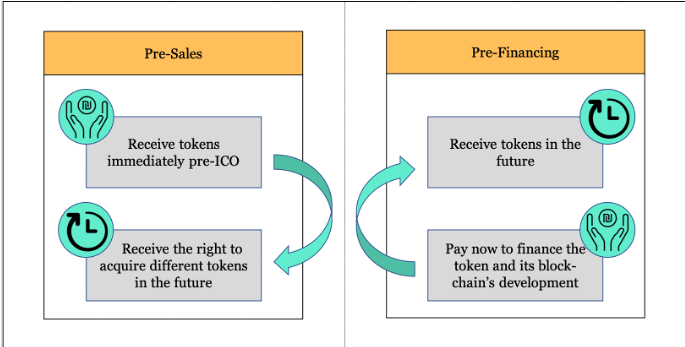

5.) Initial Coin Offerings

There are currently no specific financial market regulations in Switzerland that cover initial coin offerings (ICOs) explicitly. ICOs are, hence, currently treated in accordance with the generic categorization of tokens into payment, utility, and asset tokens. Thus, only asset tokens qualifying as securities are subject to treatment under financial market regulations and are, in particular, subject to the prospectus requirement if they are economically equivalent to a share or bond. The placement of securities and the issuance of securities in the form of derivatives, along with trading in securities, may be subject to licensing requirements (see below). Securities are also tokens that are put into circulation at the point of fundraising. Pre-financing is a situation in which the investors have the prospect of receiving tokens at some point in the future, while the tokens or the underlying blockchain remain to be developed. Tokens that are issued pre-ICO and which entitle investors to acquire different tokens at a later date are called pre-sales.

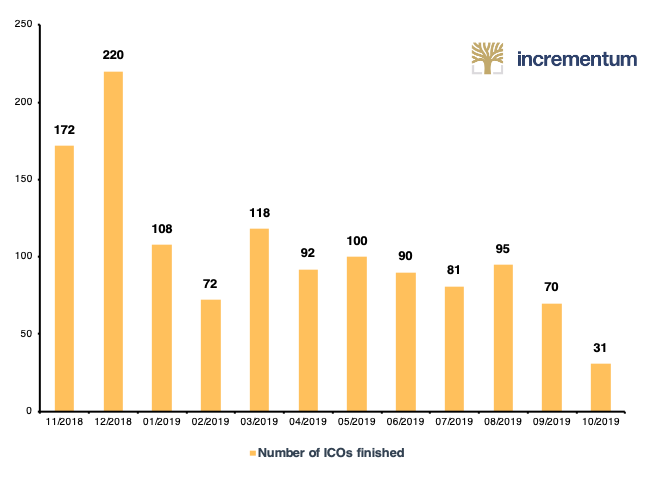

Figure: Number of ICOs per Month

Source: Icobench.com, Incrementum AG

The Licensing of Entities Trading in Cryptocurrencies

- Asset Tokens

1.) Registration with Self-Regulatory Organization

Payment tokens and utility tokens can be traded on a bilateral and multilateral basis just on the basis of a registration for AML (anti-money laundering) purposes with a self-regulatory organization. As long as the operator of such activities will be fully compliant with the applicable AML obligations, no other obligations will apply to such trading activities. The registration with a self-regulatory organization for AML purposes is for many operators the first step in the build-up process of their trading activities and can be done with little effort and costs.

2.) Registration as a Swiss Bank

(1) Banking License

The professional acceptance of public deposits generally requires a banking license, unless an exemption applies. Generally, all liabilities qualify as deposits. This is also true for derivatives that do not qualify as securities, for example, because they are tailor-made and not appropriate for mass trading. Professional acceptance of public deposits generally means more than 20 depositors or public promotion of the willingness to accept deposits.

| Critical Point: Unlike most other regulatory sandboxes globally, Switzerland has a static sandbox where companies can try and test new business ideas without triggering a licensing requirement. However, you cannot pay interest or invest these assets on the deposit of under 1 million CHF. |

| Critical Point: If there is an investor deposit with a crypto broker and the money is only there for 60 days, then this does not trigger a licensing requirement for the crypto broker. This exemption also applies to brokers that take public deposits for security transactions, such as buying or selling stocks. |

There are currently different scholarly opinions on whether cryptocurrencies and the transfer of the private key qualify as a deposit. Even if considered a deposit, there might be multiple exemptions applicable, and thus no banking license would be necessary. Typical exemptions are:

Not qualifying as professional activity: Swiss sandboxes accepting deposits of up to 1 million CHF is not considered to be professional activity if these are not invested and not subject to interest payments and if the clients are pre-informed about the lack of FINMA supervision and deposit insurance.

- Deposits with precious metals dealers, asset managers, or similar enterprises that are not subject to interest payments and made for the sole intention of settling transactions, as long as the settlement occurs within 60 days. Securities dealers benefit from a longer settlement period determined on a case-by-case basis.

| Critical Point: If you are a very wealthy person with a family office, you do not need a license to invest in cryptocurrencies because there is no third-party counterparty risk. The bank or family office is investing in cryptocurrencies with their own skin and not the skin of someone else. |

Non-qualifying deposits: Deposits are not public if deposited by banks or qualified shareholders having at least 10 % of the votes or the capital and related third parties and institutional investors having at least one person dealing full time with asset management matters (professional treasury).

FINMA treats cryptocurrency client dealers that engage in similar activities to client FX (foreign exchange) dealers as such. Client cryptocurrency dealers that accept fiat money for cryptocurrencies from clients on accounts and are themselves party to cryptocurrency transactions with their clients generally do require a banking license. This is not the case if an asset manager has sole power of attorney, allowing the management of cryptocurrency positions.

| Critical Point: A Swiss FinTech license is similar to a Liechtenstein e-money license. A privileged deposit in Switzerland is a deposit of at least 100,000 CHF. In Liechtenstein, a privileged deposit is only 30,000 CHF. |

(2) FinTech Banking License

On January 1, 2020, Switzerland will introduce a new licensing category called FinTech license that should put FinTechs, and in particular entities trading in cryptocurrencies, under more adequate supervision. The FinTech license will allow holding public deposits, e. g., in the form of payment tokens or utility tokens or fiat similar to a bank up to an amount of 100 million CHF. It will, however, not be possible to do business with these deposited assets, e. g., by lending them to third parties, and no interest can be paid on these public deposits. The deposited assets are, unlike a bank, not subject to the legal privilege of privileged deposits. On the positive side, the regulatory capital required is much lower than that required by banks (300,000 CHF as a minimum or 3 % of the public deposits).

| “The Fintech license allows institutions to accept public deposits of up to CHF 100 million, provided that these are not invested and no interest is paid on them. A further requirement is that an institution with a FinTech license must have its registered office and conduct its business activities in Switzerland.” The Federal Council of Switzerland |

The FinTech license allows also for additional alleviations, such as accounting rules according to the Swiss Code of Obligations. An entity wishing to receive a FinTech license will have to undergo a licensing process with FINMA.

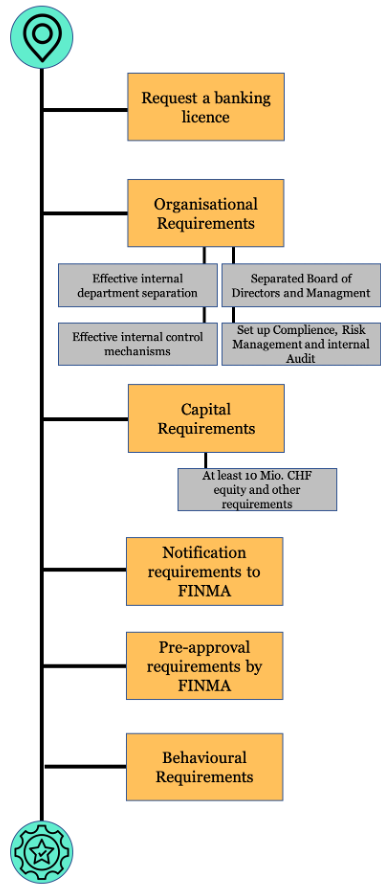

Assume you are the new CEO of a bank and you have the idea of entering the crypto market. These are the requirements you have to fulfill to trade tokens which are not securities.

- Requesting a License

Dealers in cryptocurrencies that require a banking license have to file an application to get a banking license with the Swiss Financial Market Supervisory Authority, FINMA.

- Organizational Requirements

Any bank needs to have a board of directors with at least three members and a separate management team. A bank also needs a compliance and risk management function as well as an internal audit function, along with the business function. The bank must implement an effective separation between the trading desk, credit business, settlement, and the control functions (risk and compliance). The outsourcing of internal audit, compliance, and risk management is generally possible. Any bank must also have an effective internal control system in place.

(3) Capital Requirements

Any bank must have equity of at least 10 million CHF and is subject to additional capital requirements depending upon its business activity and risk profile. Banks are also subject to special regulatory accounting rules.

(4) Notification Requirements

Banks have to inform FINMA about the fact that they are initiating operations in a foreign jurisdiction. Furthermore, the acquisition or divestment of subsidiaries, representations or branches in a foreign jurisdiction must be reported to and pre-approved by FINMA. FINMA must also be informed about qualified holders of shares in the bank and about any decrease, increase, or reaching of the related qualified holdings of 10 %, but also 20 %, 33 %, or 50 % of the capital and the votes.

(5) Pre-approval Requirements

Any foreign shareholders of a bank need pre-approval from FINMA. Any change to the organizational documents of a bank must also be pre-approved by FINMA.

(4) Asset Protection

Privileged deposits of depositors are subject to special protection. Deposits in the name of the depositor up to an amount of 100,000 CHF are privileged claims subject to privileged treatment in bankruptcy. Banks must cover 125 % of their privileged deposits with Swiss and covered claims.

Critical Outlook: Securities are also subject to privileged treatment in the event of bankruptcy. Therefore, the question is how cryptocurrencies will be treated in the future in this regard.

- Trading in Cryptocurrencies Which Are Securities

Great, your crypto bank worked out well and you met all the requirements. But that is not enough for you. As CEO of crypto bank, you are now eager to enter the market for cryptos which are tokenized securities.

Trading in cryptocurrencies that are securities requires the trading entity to be licensed as a securities dealer. Securities are standardized, certificated (existing in physical form), and uncertificated (not existing in physical form) financial instruments suitable for mass trading. They are, thus, either offered publicly in a similar structure and denomination or placed with more than 20 clients, unless they are being created specifically for individual counterparties.Don’t worry, you don’t need such a license for trading in utility and payment tokens!

A security can trigger multiple legal consequences when being traded. These consequences are:

- Persons professionally trading in securities will potentially have to apply for a license as a securities dealer (the Swiss equivalent of an investment firm or broker/dealer).

- Facilities allowing for the multilateral trading of securities require a license as a stock exchange or multilateral trading facility (MTF) or must be reported as an organized trading facility (OTF).

- Facilities allowing for the bilateral trading of securities must be operated by a duly licensed operator (the Swiss bilateral version of an OTF, which replaces the systematic internalizer in the EU).

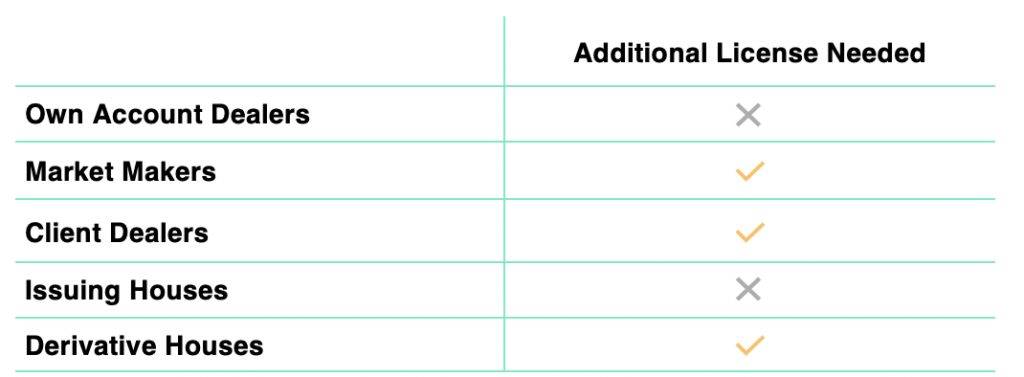

1.) Current Regulation of Investment Firms Professionally Trading/ Executing Security Tokens (Securities Dealer Act)

Your friend Daniel is a securities dealer and you chose him as a cooperation partner for your bank. But dealing cryptos that are securities means you have to meet several requirements:

(1) Swiss-based Securities Dealers

Professional trading in securities typically requires a license as a securities dealer granted by the Swiss Financial Market Supervisory Authority, FINMA. The detailed requirements and licensing process depend heavily upon the place of domicile of the securities dealer and the business activity pursued. A Swiss domiciled securities dealer is any legal entity or partnership that professionally sells or buys securities either:

- on its own account on the secondary market with the intent of reselling them within a short period of time (own-account dealers and market makers)

- on behalf of third parties (client dealers)

- by publicly offering securities to the public on the primary market (issuing houses)

- by professionally creating derivatives and offering them publicly on the primary market (derivative house)

Table 3: Which Security Tokens Dealers Need and Additional License

Source: Martin Liebi, PwC,

| “The true game changer is to get an OTF license from FINMA here in Switzerland.” Richard Olsen, Founder of Lykke |

“Own account dealers” (see below) and “issuing houses” (see below) have to be primarily active in the financial sector at an individual and group consolidated level. This means that the main business activity of a group must be in the financial sector. Even sizeable securities trading activities of treasury companies within a group that is pursuing a primary business purpose other than a financial activity are, thus, not subject to the licensing requirements of a securities dealer if the securities trading is closely related to the group’s business activity (e. g., treasury departments of industrial companies). This does not, however, apply to market makers and client dealers, who will have to apply for a license even if the group’s main business activity is not a financial activity.

FINMA Licensing Categorization System

- Trading on One’s Own Account (Proprietary Trading)

Securities dealers trading on their own account will only become subject to a licensing requirement if they pose a systematic risk to the financial system. That is why their gross annual turnover in securities must be at least 5 billion CHF. They typically do not have any clients. Securities dealers trading on their own account generally act in a professional capacity and on a short-term basis. Key aspects of trading on one’s own account include trading without instructions from third parties and taking on risk, which is primarily market risk. In the context of a clearing situation it can, however, lead to a counterparty risk if clients do not advance money to settle the securities.

Trading on a short-term basis means the active management of securities to achieve gains from short-term fluctuations in prices or interest rates within a short period of time. Long-term investments in securities and, in particular, the holding of securities until maturity are not deemed to be trading on one’s own account.

- Trading on One’s Own Account (Market Makers)

Market makers trade publicly in a professional capacity in securities, on their own account and on a short-term basis. They trade publicly because they offer the securities to anybody. They set a firm bid and ask for prices on an ongoing basis or on request (request for quote).

- Trading on Behalf of Third Parties (Client Trading)

| “August 27, 2019. Sygnum and SEBA have both been granted a banking and securities dealer license from the Swiss Financial Market Supervisory Authority (FINMA). This is the first time this license has been awarded to digital asset specialists.” Greater Zürich Area Magazine |

Client dealers handle securities in their own name, but on behalf of clients, in their professional capacity. A professional capacity is assumed if the securities dealer maintains accounts directly or indirectly or acts as a custodian for more than 20 clients.

Whether the securities dealer is dealing on account for the client or on his/her own account is determined based on economic considerations, namely who is bearing the risk of the transaction. If the client is bearing the economic risk, trading activities over the nostro accounts of the securities dealer are deemed transactions on behalf of the client. Client dealers maintain accounts for the settlement of the transactions for these clients or with third parties or keep these securities for themselves or for third parties in their own name.

There are exemptions when no licensing requirement is triggered, such as if all clients are Swiss. Asset managers and investment advisors are not deemed to be securities dealers if they are acting based on a power of attorney, unless they purchase or sell securities to their clients using their own account or securities deposits.

- Placing Cryptocurrencies as Securities (Issuing Houses)

Securities dealers in the form of issuing houses place cryptocurrencies as securities issued by third parties on a professional basis at a fixed price or for commission and offer them to the public on the primary market. A key criterion for whether the placement of cryptocurrencies as securities on the primary market is an activity of a securities dealer is thus whether it is “public.”

An offering is public if it is addressed to an unlimited number of people, in particular by via advertisements in the media, prospectuses, or other electronic means. Offers of securities are made exclusively to qualified investors such as domestic and foreign banks and securities dealers or other enterprises under government supervision, shareholders and partners with a significant equity interest in the borrower and parties affiliated and related to them, and institutional investors with professional treasury departments, meaning the employment of one person on a full-time basis managing the company’s assets, are not considered. An offering is deemed to be “public” even if securities have been placed with fewer than 20 people, but the offering has been addressed to an unlimited number of people who do not have to be exclusively qualified investors.

- Creating Cryptocurrencies as Derivatives (Derivative Houses)

Derivatives houses create cryptocurrencies in the form of derivatives, meaning financial instruments whose value is derived from an underlying. They handle this professionally themselves and offer them on the primary market on their own account or on account of a third party. A placement of derivatives with less than 20 clients after a public offer still qualifies as public offer. A placement of derivatives with less than 20 clients does not trigger the requirements of a securities dealer.

| Security Token Derivatives? Many investors erroneously believe that exchange-traded funds in traditional markets like stocks and bonds are derivatives. They actually are not considered derivatives. Rather, they are a separate category of securities similar to mutual funds. Unless they use leverage to enhance the performance over the underlying asset such as the ProShares Ultra S&P 500 ETF seeks to provide investors with returns that equal twice the performance of the S&P 500 index. That is an example of an ETF that is a classified as a derivative. Also, there are investment contracts that qualify as a derivative but not as a security – at least in Switzerland. For example, a tailor-made over-the-counter call option is a derivative but not a security. In the European Union, this is normally still considered a security. |

(2) Foreign securities dealers

Foreign securities dealers are entities that either:

- possess an equivalent license abroad, or

- apply the expression “securities dealer” or an expression of similar meaning in their corporate name, business purpose, or documents, or

- conduct trading in securities.

Foreign securities dealers, meaning entities that are not domiciled in Switzerland, are generally subject to the same requirements as Swiss-domiciled securities dealers, unless the law sets forth different obligations. Securities dealers that are actually managed in Switzerland and execute their transactions mainly out of Switzerland must incorporate in Switzerland and be organized according to Swiss regulations. They will be subject to the regulatory requirements of a Swiss securities dealer. Securities dealers organized under Swiss law are deemed to be under foreign control if a foreign person indirectly or directly holds more than 50 % of the votes or has a material influence on the securities dealer in any other way.

(3) Obligations of a Securities Dealer

Daniel, the security dealer, now clearly knows what forms there are and he is certain about how his firm’s work is seen from a legislative point of view. But still he needs to know what exactly he must do to build up a fully compliant service. Here are the steps he must follow:

(1) Applying for a License

Anyone falling within one of the categories of a securities dealer mentioned above has to apply for a license with the Swiss Financial Market Supervisory Authority, FINMA.

(2) Organizational Requirements

The securities dealer must have a board of directors and a management team. There must be an adequate separation between trading, asset management, and administration. The securities dealer must also establish an internal control system consisting of compliance, risk management, and internal audit. An external regulatory audit firm must also be appointed. It is possible to unify some of the control functions with a specific person.

(3) Capital Requirements

Any securities dealer must have fully paid-in minimal capital of at least 1.5 million CHF. Any shareholder indirectly or directly holding more than 10 % of the capital or the voting rights of a securities dealer or that may in any other way influence the business activities of the securities dealer must meet FINMA’s fit and proper criteria. The provisions applicable to banks regarding their own capital and accounting generally also apply to a securities dealer. Privileged deposits of clients are subject to enhanced protection.

(4) Reporting, Information, and Approval Obligations

Any securities dealer will have to comply with multiple reporting, information, and approval obligations on an ongoing basis. Any change to the preconditions for granting the license, but in particular the articles of association, regulations, material change of business activity, management, board of directors, and external audit firm, as well as build-ups, investments, and divestments of foreign operations, must be pre-approved by FINMA.

Any indirect or direct acquisition or sale of a stake in a securities dealer reaching, exceeding, or falling below the thresholds of 20 %, 33 %, or 50 % of the capital or the votes must be reported to FINMA.

(5) Exception: Algorithmic and High Frequency Trading

Participants in Swiss trading venues that are engaging in algorithmic or high frequency trading activities are subject to enhanced recording requirements and their systems must ensure adequate functioning even in stress situations.

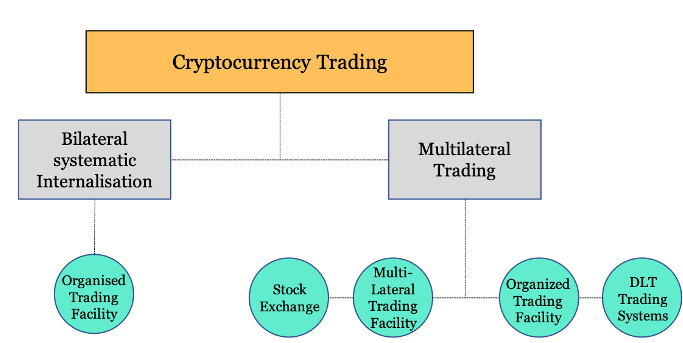

Organized Trading Facilities (OTFs) Regulated by the Swiss Financial Market Infrastructure Act

(1) Bilateral Trading in Cryptocurrencies

Trading arrangements in derivatives or financial instruments related to cryptocurrencies can be an organized trading facility (OTF) that is subject to special regulation. An OTF is, in Switzerland, the catch-all facility for many other trading setups encompassing bilateral and multilateral as well as discretionary and non-discretionary trading activities in both securities and financial instruments, meaning any other financial instruments used for investment purposes while not constituting securities. The Swiss OTF offers a lot of flexibility, which makes it a highly suitable platform for cryptocurrency trading.

An OTF is any trading facility that:

- is governed by a set of rules that is standardized and binding to participants,

- allows for the conclusion of contracts within the scope of application of these rules,

- enables the initiative to trade to come from the participants.

An OTF can only be operated by a bank, securities dealer, trading venue, facility recognized as a trading venue or a legal entity within a financial group that is controlled directly by a financial market infrastructure and is subject to consolidated FINMA supervision. Unlike under MiFID II/MiFIR, a systematic internalizer is not a special category of investment firm/securities dealer but is either a bilateral OTF or a securities dealer if the related requirements are met.

| Critical Point: Credit Suisse and UBS are examples of entities that have OTF licenses. Pre-trade transparency means that the bid and ask spread must be disclosed to the client prior to the trade. Many cryptocurrency brokers are trying to get an OTF license. |

The operation of an OTF is also subject to requirements that ensure orderly trading, transparency and investor protection, such as best execution requirements in the case of discretionary trading. Any operator of an OTF must issue rules and regulations and appoint an independent control function that monitors compliance with these regulations. Pre-trade transparency is required in the case of bilateral and multilateral liquid trading, meaning at least 100 trades on average per day over the last year. Post-trade transparency is only required in the case of multilateral trading. Anyone operating an OTF or intending to do so in the future must report this fact or intent to the Swiss regulator FINMA.

After having reviewed bilateral trading systems, in the following part different multilateral systems will be described.

(2) Multilateral Trading in Cryptocurrencies

| “Unlike under European law, the Swiss law OTF category serves as a rather wide catch-all category.” CapLaw.com |

Cryptocurrencies can be traded on a multilateral basis based on multiple organizational setups depending upon the legal nature of the cryptocurrencies traded and the trading mechanism.

1.) Multilateral trading in Payment and Utility Tokens on the Basis of an SRO registration

Payment tokens and utility tokens can be traded on a

multilateral basis, meaning the simultaneous exchange of bids between several

participants and the conclusion of contracts based on non-discretionary or

discretionary rules, simply based on a registration with a self-regulatory

organization (SRO) for AML purposes.

2.) Multilateral Trading in Asset, Payment, and Utility Tokens

(1) Stock Exchange

The highest regulated entity for trading in cryptocurrencies on a multilateral basis is the stock exchange. A stock exchange means an institution for multilateral securities trading where securities are listed, whose purpose is the simultaneous exchange of bids between several participants and the conclusion of contracts based on non-discretionary rules. A stock exchange can admit to trading payment token and utility token.

Stock exchanges are regulated according to the principle of self-regulation in Switzerland. This means that the law gives certain guidelines and determines certain obligations that must be complied with on a mandatory basis. The operator of a multilateral trading operation has, however, the discretion to determine the organization and the rules applicable to the trading activities of the stock exchange as a default.

A stock exchange must have multiple bodies, such as the admission board, the reporting office, the disclosure office, a trade surveillance office, the regulatory board, the sanctions commission, and the appeals board. It must also have a board of directors, a management, a compliance function, a risk function, and an internal audit function. The organization must be appropriate in terms of staffing and organization to operate a multilateral trading operation. In particular, there are also certain obligations regarding the features and the resilience of the trading system and the IT system, such as pre- and post-trade transparency, algorithmic trading, and guarantees for the orderly trading.

(2) Multilateral Trading Facility

A multilateral trading facility (MTF) means an institution for multilateral securities trading whose purpose is the simultaneous exchange of bids between several participants and the conclusion of contracts based on non-discretionary rules without listing securities. An MTF differs thus from a stock exchange only in so far that securities are not listed on an MTF. Payment token and utility token can, next to securities, also be traded on an MTF.

The organizational requirements and the required staff are almost identical to the ones required for a stock exchange. The only real difference results from the fact that securities are not listed on an MTF but admitted to trading.

(3) Organized Trading Facility

An organized trading facility (OTF) is an establishment that allows, next to the bilateral trading in securities or financial instruments for the exchange of bids, also for the multilateral trading in securities or other financial instruments whose purpose is the exchange of bids and the conclusion of contracts based on discretionary rules or the multilateral trading in financial instruments other than securities whose purpose is the exchange of bids and the conclusion of contracts based on non-discretionary rules.

An OTF must either be operated by a licensed bank, securities dealer or the authorization or recognition as a trading venue. The law requires some obligations regarding conflict of interests, transparency, and orderly trading. Within these guidelines, the operator of an OTF has, however, a vast discretion to self-regulate the OTF.

(4) DLT Trading System

| “The Swiss proposal can be seen as confirmation of the positive attitude of the Swiss government towards DLT and strikes a good balance between self-regulation, supervision, and alleviations for smaller marketplaces.” Martin Liebi, PwC |

The Swiss lawmaker is planning to introduce soon a new category of multilateral trading facility specifically made for DLT-securities amongst many other key legal changes addressing pressing needs (such as, but not limited to the bankruptcy treatment of crypto assets and a new category of securities called DLT securities etc.). The key differentiating features of this license category will be that one license covers the entire trading and post-trading (settlement and custody). Although a similar setup like a stock exchange is required, FINMA can on a case-by-case basis relieve the license holder from certain requirements depending upon the risk profile and the scope of activity. Participants can be either natural persons or licensed entities.

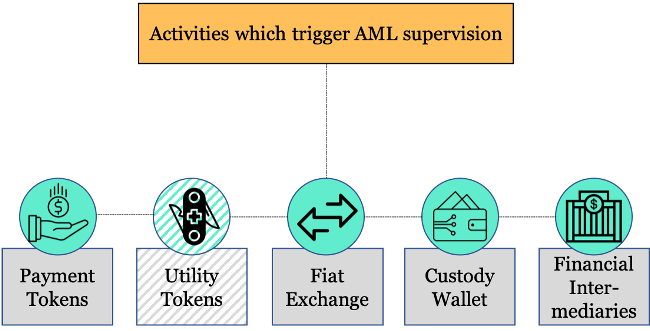

Anti-Money Laundering Obligations

Cryptocurrency Activities Subject to Anti-Money Laundering Supervision

1.) Payment Tokens

The issuing of payment tokens constitutes the issuing of a means of payment subject to this regulation as long as the tokens can be transferred technically on a blockchain infrastructure. This may be the case at the time of the ICO or only at a later date.

2.) Utility Tokens

In the case of utility tokens, anti-money laundering regulation is not applicable as long as the main reason for issuing the tokens is to provide access rights to a non-financial application of blockchain technology.

3.) Exchange of Cryptocurrency into Fiat Money

The exchange of a cryptocurrency for fiat money is subject to AML requirements.

4.) Custody Wallet

The offering of services to transfer tokens if the service provider maintains the private key is a financial intermediary activity subject to AML requirements.

5.) Banks, Securities Dealers, and Asset Managers

Securities dealers and banks duly licensed by FINMA are financial intermediaries. They are subject to the requirements of Swiss anti-money laundering provisions. Any other trading activities not subject to a license as a securities dealer are not subject to the Swiss anti-money laundering regulations (unless they concern a payment token). Asset managers of individual portfolios are also subject to anti-money laundering supervision but are not subject to FINMA authorization.

1.) Registration With a Self-Regulatory Organization or with FINMA if not FINMA-Supervised

Financial intermediaries not supervised by FINMA must register with an AML self-regulation organization or directly with FINMA. They will then become subject to the client and beneficial owner identification and transaction surveillance requirements set forth in the applicable directives of the self-regulation organization.

2.) FINMA-Supervised Entities

| “Swiss Federal Council continues to monitor developments around blockchain/DLT.” Financefeeds.com |

Banks and securities dealers have to comply with the verification of the identification requirements of contractual parties and the establishment of the identity of the controlling person and the beneficial owner according to the Agreement on the Swiss Banks’ Code of Conduct with regard to the exercise of due diligence (CDB16). Compliance with these requirements is audited by the external auditor on an annual basis.

3.) General Obligations of All Financial Intermediaries Subject to AML Obligations

(1) Identification of a Contractual Party

Financial intermediaries undertake to verify the identity of the contracting partner when establishing business relationships. The execution of transactions involving trading in securities must exceed 25,000 CHF in the case of an account opening.

(2) Establishment of the Identity of Controlling Persons and Beneficial Owners

| Critical Point: Form A is used to disclose the beneficial owner or if you go to a bank counter at LGT and you try to exchange a certain amount of euros and Swiss francs above a certain threshold, then you need Form K. |

If an operating legal entity or partnership has one or more controlling persons with voting rights or capital shares of 25 % or more, these are to be identified in writing. Controlling persons are those natural persons who effectively have ultimate control over the company. Whether these persons exercise control directly or indirectly via intermediate companies is irrelevant. A controlling person must generally be a natural person. The contracting partner must confirm the name, first names and actual domiciliary address of the controlling person in writing or by using Form K.

The financial intermediary requires from its contracting partner a statement concerning the beneficial ownership of the assets. Generally, the beneficial owners of the assets are natural persons. If the contracting partner declares that the beneficial owner is a third party, then the contracting partner has to document the latter’s last name, first name, date of birth, and nationality, along with his/her actual domiciliary address, or the company name, address of registered office, and country of registered office using Form A.

(3) Business Relationships and Transactions with Increased Risk

Financial intermediaries have to determine business relationships and transactions that are subject to increased risk. The initiation of such business relationships and the execution of such transactions are subject to enhanced due diligence requirements. Such business relationships must be approved by the management.

(4) Organization

Financial intermediaries must establish an organization that allows for efficient compliance with the applicable anti-money laundering regulations and, in particular, has to designate a dedicated anti-money laundering function. New products must be checked by the securities dealer for their compliance with the applicable regulations. Securities dealers must establish an effective mechanism for the surveillance of transactions and business relationships based on an IT system.

4.) Regulatory Requirements Regarding Payments on the Blockchain

Switzerland has already implemented the FATF standards on virtual asset services providers (VASP). These apply to crypto exchangers, wallet providers, and trading platforms. FINMA has made it clear that information regarding the person giving the payment instruction and the beneficiary must be submitted in case of a payment made on the blockchain like in any other payment made between banks (e. g., SWIFT). Any such payment must also be made between two entities registered for AML purposes (unlike the FATF recommendations that allow also for payments between non-AML-registered entities). Payments are only possible between two clients of the same AML-registered entity or between wallets of the same client held with the AML-registered entity. Payments to third parties outside of the scope of influence of the AML-registered entity making the transaction must be identified like an own client (identity, beneficial ownership, and actual transaction power) by means of adequate technical measures. In case of exchanges fiat-vs-payment tokens and the involvement of an external wallet must the exchanging entity check who has the power to transact about the wallet by means of adequate technical measures.

This more restrictive implementation of the FATF-VASP standards will force wallet providers to become registered for AML-purposes to allow for the execution of payments. Such registration can be done on a voluntary basis with an SRO for AML purposes in Switzerland. It will also require an exchange of information between the two entities executing the payment because there is yet no system available that can transmit the data required for the identification of the contractual party and the beneficial owner.