“The purpose of mining is not the creation of new bitcoin. That’s the incentive system. Mining is the mechanism by which bitcoin’s security is decentralized.”

Andreas M. Antonopoulos

Key Takeaways

- Cryptocurrency Mining can be seen as global arbitrage on electricity prices. Mining firms can strike lucrative deals with energy providers in Switzerland, the U.S., and Scandinavia. To stabilize the capacity of networks, some energy providers are actually willing to pay miners to use electricity during off-peak hours of the day.

- All three of the mining companies interviewed use 100% renewable energy for mining cryptocurrencies. Alpine Tech SA and Blockbase DWC-LLC have minimum investment amounts that are bar most retail investors. Unity Investment AG has a minimum investment of $100.

- Before investing in a mining company, due diligence includes checking whether the mining pool software is secure with no backdoors and that the pool is actually capable of delivering the reward for allocating your computation resources to their pool. With cloud mining services, due diligence includes verifying that the data center exists, that the computer or computers that you are renting exist, and are solely dedicated to your exclusive use, and that their software is secure with no trap doors.

Introduction to Cryptocurrency Mining

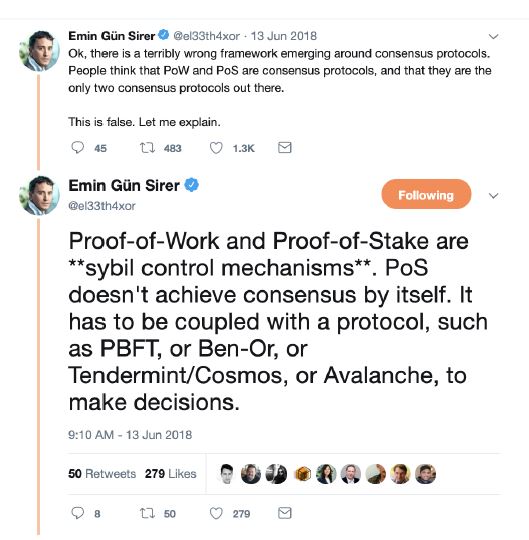

As discussed in the chapter on consensus mechanisms in the June edition of the Crypto Research Report, decentralized networks need a strategy or algorithm for stopping double spends of digital information. Normally, people state that the two main consensus mechanisms employed by cryptocurrencies are proof of work and proof of stake; however, this is wrong.

Recently pointed out to us by Ed Thompson of Web3 in Zug, Proof of Work is not Bitcoin’s consensus mechanism per say. Agreement on the latest state of Bitcoin’s transaction history is based on the longest chain policy. Despite that subtle difference, mining is one of the most important aspects of Bitcoin as well as many other blockchains, because mining serves the purpose of creating a new block in a blockchain.

A block is very similar to a page in a financial ledger that documents the order of any debits and credits to its accounts, along with a third entry performed by an auditor, a miner, that commits these debits and credits to each address account. This is known as triple entry accounting, a significant innovation in accounting. Therefore, the entire blockchain (a chain of blocks), is like all the pages of a financial ledger.

In Bitcoin, a new block is created approximately every 10 minutes. This block contains the most recent set of transactions among Bitcoin addresses, that have been verified among the network of computers. The act of mining is performed by computers configured for mining. In Bitcoin, these miners perform a computation that is known as a Proof of Work function. This Proof of Work function is computationally difficult and requires many attempts by the computers in the network to discover the solution. The computers in the network compete to find the solution to this Proof of Work before the others. The computer that finds the solution before the others is rewarded with a reward of coins from the blockchain. This is how new coins are created and enter the ecosystem.

Mining Business Costs and Risks

With that said, there are real world costs associated with running a computer that performs these computations. These costs are in the form of depreciating hardware assets, electric bills, maintenance costs, labor, as well as many other costs. When the price of the cryptocurrency goes up, these costs can be manageable for sophisticated miners. When the price of a cryptocurrency goes down or flatlines, or if a serious mismanagement of expenses has been overlooked, there is risk in spending more in electricity and hardware than the amount you earn from the rewards of mining. Mining is a very risky business unless you have an enormous number of mines and can out compete others because of cost savings stemming from economies of scale. Even then, many miners suggest that buying cryptocurrency is more profitable and less risky than mining for cryptocurrency. The advantage to mining and earning a reward is that you know where the coins came from because they are being issued directly from the Blockchain itself. When you buy the coins, you might not know where the coins have been along their path before they got to you.

Bitcoin Block Reward Emission Schedule

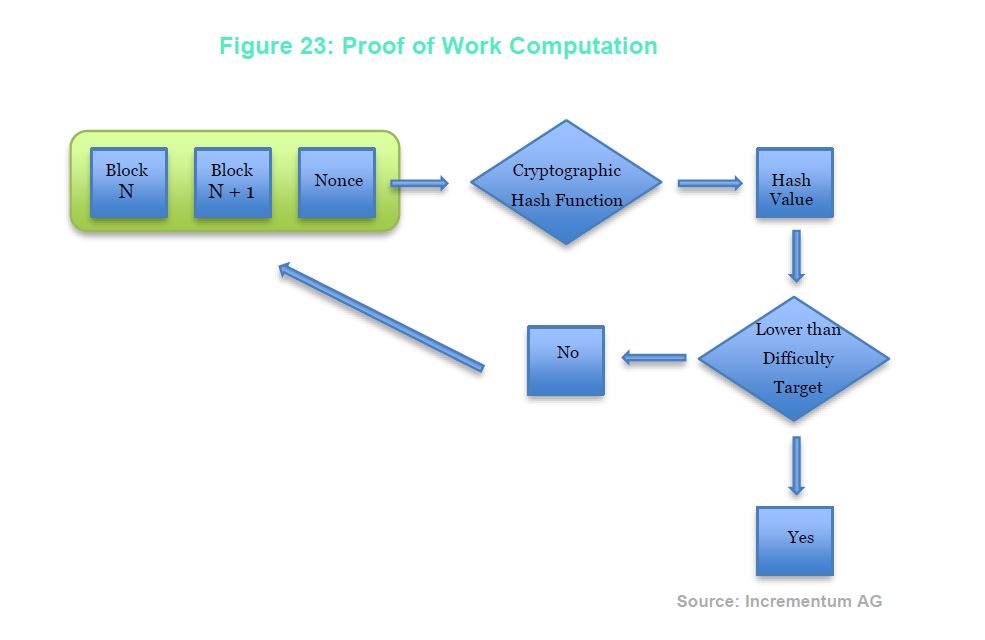

Proof of work uses two main types of financial rewards to incentivize users to maintain the network: rewards and transaction fees. Before confirming a new block of transactions, the miners compute hashes until they find a desirable number that is less than a specific number set by the software protocol called the difficulty target.

In the Bitcoin protocol for example, miners must find the right “nonce”, or arbitrary number, that produces a hash lower than the difficulty target set by the software. This is called a hash-puzzle because the miner must add the nonce to the hash of the previous block in the blockchain. The computational output is a number which basically falls into a target space which is comparatively small in relation to the large output space of the entire hash function.(1) This number becomes that block’s identification number, which is used as an input in the next block’s hash puzzle. The first miner to find a hash that is lower than the given difficulty target will be entitled to “print” new Bitcoins and receive the transaction fees that the senders paid to the network when they broadcasted their payments. The first transaction of every block is a “coin-creation transaction”. The coincreation transaction allows the miner of the block to mint new Bitcoin and to send these new Bitcoin to his or her wallet. In 2016, the value of the block reward was about 25 Bitcoins. However, this rate drops roughly every four years and is currently 12.5 Bitcoins.

There are other variables that must be taken into account to determine the true emission schedule, for example, the number of computers and their total computation capacity. This determines how quickly a block is discovered but that rate is estimated to be every 10 minutes. The network self adjusts the block creation rate every 2016 blocks in order to account for increases or decreases in the amount of computation capacity among the entire network of computers competing to mine the next block.

Updating the Network

In Bitcoin, mining is how all new coins are created. Once the solution to the Proof of Work function is discovered, the computer that found that solution broadcasts their discovery to the network of miners. Once this broadcast is received, the other miners are tasked with crosschecking that solution for verification purposes. Once there has been enough verifications by other miners in the network, a transaction is said to be verified and becomes a permanent record within a block stored in the blockchain.

Security Layers and Known Attack Vectors

Another purpose of a miner is to act as a security layer for the network. There are many known attack vectors for Blockchain and other cryptocurrencies. In Bitcoin’s case, the 51% Attack is where an attacker or group of colluders gain control of 51% or more of the computation power performing the Proof of Work function. With this much computation power, an attacker could potentially begin unraveling the transactions that have been previously verified within a block. However, the attacker must start by attacking or unraveling the most recent block. Once the most recent block has been successfully attacked, each subsequent block which came before, would need to be attacked, and this attack only gets harder and more expensive for the attacker as they attack more and more blocks in the blockchain’s history.

Different Ways to Mine

In the early days of Bitcoin, miners would use regular computers, such as a laptop or desktop, and the calculations would be performed using code processed by the central processing units (CPUs) of that computer. When more sophisticated participants started mining, they saw opportunities to improve on how fast they could perform calculations by looking at solvers other than CPUs. This led miners to perform those same Proof of Work calculations using the graphical processing units (GPUs) of their computers. GPU’s are typically capable of performing this Proof of Work calculation orders of magnitude faster as well as being capable of performing multiple calculations simultaneously far beyond a CPUs capability. This eventually led to even more sophisticated technologists entering the space, and miners began using field programmable gate arrays (FPGAs) which are devices that are even faster than GPU’s. Finally, the market evolved into using application specific integrated circuits (ASICs) which are chips designed for the sole purpose of performing a single calculation, and in Bitcoin’s case, the Bitcoin Proof of Work function.

Mining Pools

The cryptocurrency mining industry started with hobbyists who thought mining Bitcoin was a novelty, as no one really knew what the future would hold for Bitcoin. From there, as the block rewards got harder and harder to earn, and hobbyists had a more difficult time earning a reward, we saw the introduction of a concept known as mining pools. A mining pool is where individual miners could contribute their resources to a pool of miners and if one of the pool members achieves the reward, that reward gets split amongst the members of the mining pool. As the stakes increased, we saw the market evolve yet again, where computer manufacturers, graphics card manufacturers, FPGA manufacturers, and ASIC Manufacturers, entered the space by building specialty products for performing cryptocurrency mining. We even saw cloud mining companies develop. Rather than building or buying your own cryptocurrency mining machine, or joining a cryptocurrency mining pool, one could just rent computing power from a company that purchases and maintains the mining machines on behalf of their customers.

Three Interviewed Mining Companies

To bring the theory of mining into practice, we interviewed three cloud mining companies, Alpine Mining SA, Unity Investment AG, and Blockbase Group DWCLLC. With that said, we rely on the companies and people that we interview to give us the facts from their perspectives. As writers of the Crypto Research Report, we must let our readers know that we began this article naively. We held the erroneous notion that not all mining companies were bad actors, and that every company was doing the best they could. Unfortunately, we uncovered very suspicious and concerning information regarding two out of the three mining companies interviewed. We are still presenting this article to you for your information; however, we want to clearly state that we do not endorse these companies, and we hope that each investor does an extremely thorough investigation if they are considering investing in mining companies.

Investigating cloud mining companies to invest in requires proper due diligence, which involves many factors and is not easy to perform or get right. If you lack the sophistication for performing due diligence, seek out those who are capable as well as trustworthy to perform the due diligence for you. Or choose a company that performs this due diligence in a public fashion using cryptocurrency industry best practices. This might include inspections of computer manufacturers to see their manufacturing processes, inspections of cloud mining facilities, inspections of any software code, database accounting to ensure the number of users matches up with the number of machines available, performing financial audits of the company bank accounts, verifying the reserves of the company’s cryptocurrency holdings, among many other things. Due diligence is not something to be taken lightly when evaluating making an investment. If you are considering an investment, never risk more than what you’re willing to lose. Now let’s move onto the first interview.

Alpine Mining Tech SA

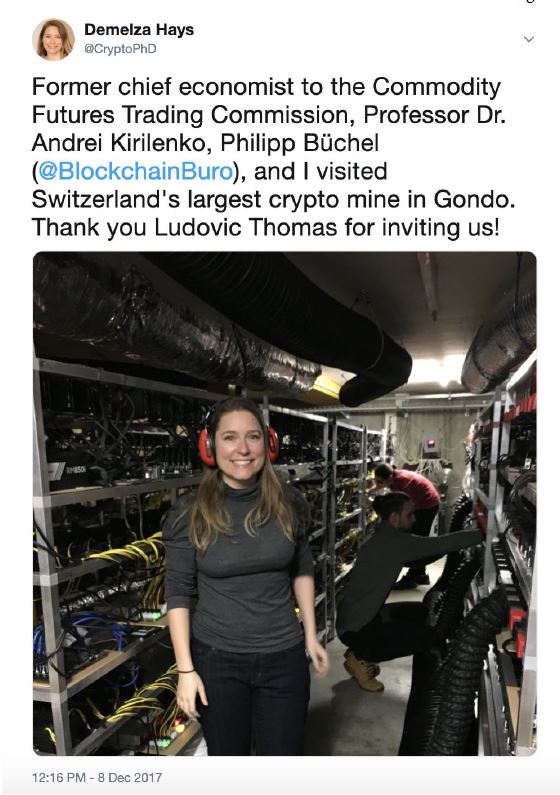

Another company we interviewed was Alpine Mining SA.(2) We spoke with Ludovic Thomas (3), who is CEO and cofounder of Alpine Mining. In the interview, we discussed how Alpine Mining came to be, what services they offer, and how they fit into the cryptocurrency market.

According to Thomas, Alpine Mining is dedicated to their activities and is a team of young, ambitious people, and they strive to have the utmost in ethics and desire to maintain a solid reputation. Thomas and his business partner Christophe Lillo (4), who is CTO and cofounder at Alpine Mining, bootstrapped the company with their own capital and efforts. They started mining cryptocurrency for themselves and have been mining Ethereum since it was $0.30. They started their first cryptocurrency mining data center at a location in Gondo (5), Switzerland. Gondo is a very small municipality on the Swiss Italian border with only 40 residents. For years, the municipality of Gondo, was trying to attract companies to the area by offering extremely low electricity costs but this small municipality was unable to attract people to the area. Thomas mentioned that this municipality offered the lowest electricity prices in all of Switzerland and that’s what made them decide to set up their first data center in Gondo. They were able to power their cryptocurrency mining data center using the hydroelectricity produced from the local river in Gondo.

They soon realized that they would be unable to scale their operation further because the municipality only had one transformer and there was a limited amount of land for them to expand to. According to Thomas, the transformer provided a total of 1.2 megawatts and half of that was being used by the municipality.

When they first started out mining cryptocurrency, they focused their efforts on coins that were mineable with GPU’s. According to Thomas, Lillo used his technical skills to figure out how to optimize the GPU’s to perform above and beyond their default configuration. This is referred to as “overclocking”. They started out mining for themselves, but eventually opened up their mining operation to others, mainly Swiss customers. Because they chose Gondo as the location for their first data center, they received a lot of exposure in the news and ended up going viral within the French part of Switzerland.

What Services Alpine Mining Offers

2018 was a difficult year for many companies in the mining space. Many companies ended up shutting their doors and declaring bankruptcy. Luckily, for Alpine Mining, Thomas says they avoided such a tragic outcome with their business flexibility. In 2018, they transitioned into being a service provider offering to build cryptocurrency mining data centers for other companies. They signed their first contract with a Hong Kong based company called Diginex and were tasked with building out a first data center in Sweden for Diginex.

According to a press release (6) found on the Alpine Mining website dated May 2018 this partnership was projected to cost around $30 million.

Alpine Mining was tasked with sourcing all the hardware, finding the right locations for the data center, to build out the location for the customer, and to manage the location for the customer. In addition, they needed to assemble all the mining systems, set up and configure the data center with the appropriate monetary tools, and software to increase network efficiency.

This marked the beginning of their cryptocurrency mining data center development as service. According to Thomas, they are also extremely focused on hiring skillful people as they continue to develop their company. Thomas stated that at one point, they were managing 40,000 graphics cards mining various cryptocurrency’s such as Ethereum and Monero.

Conclusion

Alpine Mining is currently going through a transition phase and will most likely be renamed Alpine Tech. Thomas stated that they are still mining cryptocurrencies, but they are now working on creating blockchain solutions for other companies. Thomas mentioned that they will soon be working in collaboration with the university where many of their team members have graduated from. According to Thomas, that project is focused on Blockchain Artificial Intelligence, but the project is currently in stealth mode and Alpine Mining is not publicly announcing details about that project at this time. If you or your company is in the market for building out a cryptocurrency mining data center, you might want to consider reaching out to Alpine Mining to see if they are able to assist you with your needs.

Unity Investment AG

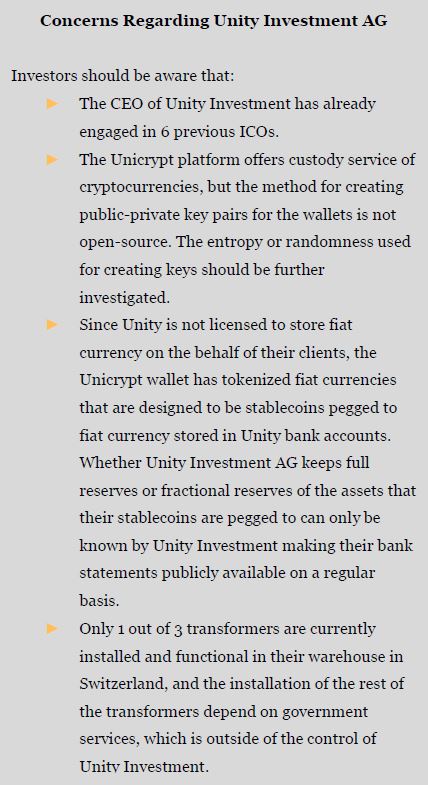

Unity Investment is a Swiss company developing a cryptocurrency mining solution (7). For this interview, we spoke with Richard Kobler (8), Senior Program Manager of Unity. Richard is very knowledgeable about the mining industry. During our interview, Richard walked us through what Unity Investment AG is, opportunities they see in the space and how you can learn more about them.

Beginnings of Unity Investment AG

The founder and CEO of Unity Investment AG is Sean Prescott (9). The Unity Investment office is based in Schindellegi, Switzerland, which is a 40- minute drive to Zürich city. Their mining facility is based in Jona, Switzerland.

When they first got started offering cryptocurrency mining services to their clients, the cryptocurrency markets were experiencing their all-time high prices. In December 2017, Unity Investment was offering their clients the ability to invest in units of mining machines. Richard described a unit to be a bundle of 10 cryptocurrency mining machines. So, when you became a client and you purchased a unit, you would have 10 cryptocurrency mining machines mining for you. In January and February of 2018, the market started to experience a selloff from the all-time highs and Unity Investments quickly realized that the cost of cryptocurrency mining machines started to drop and with that, their own prices had to drop. This put earlier purchasers of the units at a disadvantage to new purchasers of units at a lower price. This is when they began to think of ways to restructure their offering to clients so that it would be fairer to all purchasers, no matter when you decided to get started mining with Unity.

Mining Pool

This is how they came up with the notion of mining participation in a pool with other participants rather than the notion of a unit. For example, if a pool of participants comprised a total of 1 million CHF and each participant purchased 100,000 CHF worth of the pool, then each participant’s share would be 10% of the pool, and therefore, would receive 10% of the eligible mining reward that particular pool of participants earned. 30% of the total mining reward of the pool is allocated by Unity to reinvest into new machines, labor, infrastructure, and other costs, and the remaining 70% of the pool gets distributed to that pools participants as the eligible mining reward.

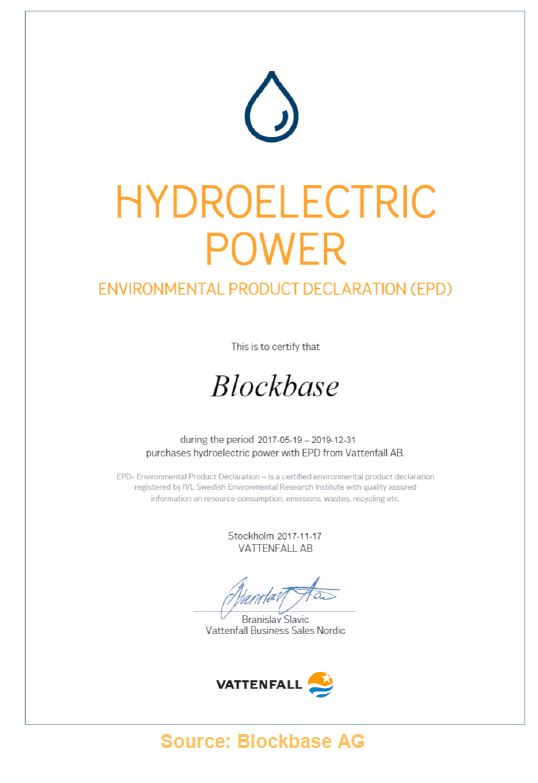

Being that Unity is based in Switzerland, they have figured out how to keep costs under control, mainly electricity, rent, and labor, and are able to operate as lean as possible. They run on renewable energy: 85% of that being hydroelectricity, 10% wind turbines, and 5% solar electricity. Switzerland is also known for having a stable regulatory environment as well as known for providing a very secure physical location close to the Swiss Alps. They have been able to negotiate fairly good terms with the power company, for example, and if they are able to increase their efficiency, they are able to claw back 30% of the costs of electricity that they use, and with very low taxes on the cost of electricity already, Unity appears to be in a great position to compete in this competitive market. According to Richard, there are also no taxes in Switzerland on mining cryptocurrency.

Unity only invests in ASIC powered cryptocurrency miners. They have a partnership with Bitmain and currently have around 1000 ASIC miners. The mining facility is 3000 M² and the machine inventory includes the Bitmain S9, L3, and A3. They have also placed orders for the S15. Having a range of machines allows them to mine various cryptocurrencies, including Bitcoin, Bitcoin Cash, and Litecoin – basically any cryptocurrency that is mined using the SHA-256 or Scrypt hashing function. In addition, Unity has engaged BDO AG as their auditor so that potential investors have more confidence in their operation. They also encourage all potential investors to come to their offices as well as visit there mining facility to see the operation.

The Unicrypt Platform

Unicrypt (10) is a product developed by Unity Investments that is an online portal that provides access for clients to their account as pool participants. Unicrypt also introduces a proprietary algorithm known as Proactive Mining (11). Proactive mining has been developed by Unity and is unique because every minute, the algorithm scans various blockchain’s and checks the prices of each blockchain that they support for mining, and based on a proprietary risk to reward ratio, the algorithm determines which cryptocurrency to mine at any given point in time. Once the algorithm has determined which cryptocurrency to mine, it sends instructions to each of the machines to mine that cryptocurrency.

Additional Businesses Outside of Mining

The Unicrypt platform has two other cryptocurrencies created by Unity. The first is the Unity Aurix Coin, and the second is the Unity ExaCoin. Aurix is purportedly backed by physical gold and all deposits are verified through auditors and stored securely in vaults; however, the amount of gold actually tokenized in these coins is unknown to us, and Unity Investment has not released any public documents regarding the quantity of physical gold stored in their vaults or the quantity of tokens that are backed the gold. ExaCoin is backed by Fiat, either CHF, USD, GBP, or EUR. These coins are ERC 20 tokens and investors are able to convert their cryptocurrency into either Aurix, ExaCoin, or both.

Conclusion

As with all things crypto, always do your own due diligence before participating in any project. We highly recommend for anyone interested to visit their mining facility, office building, and to meet Mr. Prescott and the rest of the team in order to begin proper due diligence on Unity Investment (12). Visits are by appointment only.

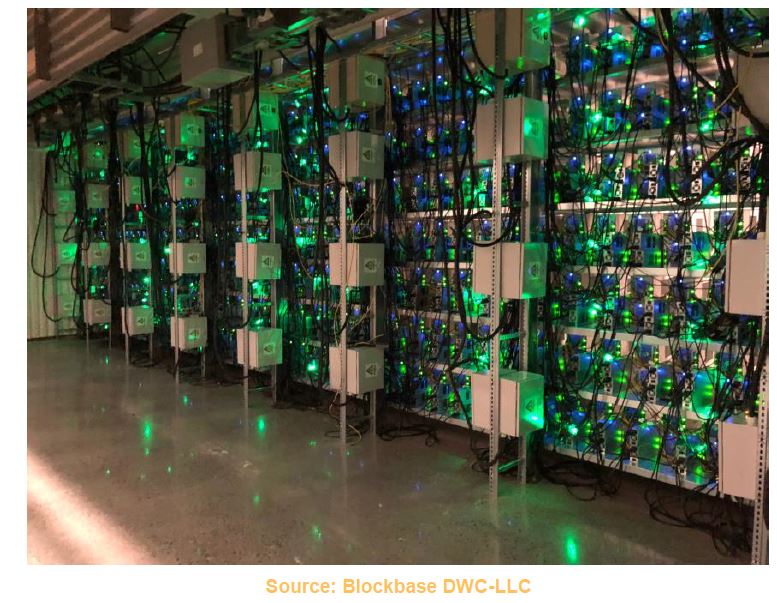

Blockbase Group DWC-LLC

For the final interview, we spoke with Vlado Stanic (13), the Founder and CEO of Blockbase Group DWC-LLC (14), which is headquartered in the United Arab Emirates, with mining facilities based in Sweden.(15) In the interview, we learned how Stanic got his start in cryptocurrency mining, the history that led to the creation of Blockbase Group, and also received insight into how their business operates.

Scrappy Startup to Large Operation

Stanic first learned about Bitcoin in 2013 and was turned on to the technology after reading the Bitcoin whitepaper. He started his first cryptocurrency mining company in 2015 based in Austria, by raising money from friends and family. Soon thereafter he partnered with his now Chief Technology Officer, Alexander Dietrich (16), who also provided startup capital. Together, they setup their first cryptocurrency mining company, named Techdisplay, which was based in Austria. Techdisplay’s first data center was setup near a hydroelectric power plant inside of a shipping container.

They got their start by filling the shipping container with custom built GPU cryptocurrency miners and began mining Ethereum. During this time, they also started onboarding their first cryptocurrency mining clients which allowed them to grow. They helped their customers figure out which GPU’s made the most economical sense and began buying GPU’s in bulk, anywhere from a few hundred, to 1000 to 2000 at a time, from hardware suppliers in both Hong Kong and Europe. They eventually ran into issues with keeping these rigs cool because running GPUs all hours of the day at its highest level of performance creates a tremendous amount of heat. According to Stanic, some of the GPUs caught fire because the heat was so great.

Techdisplay eventually grew from one shipping container to three shipping containers, and suddenly faced scalability limitations. Three shipping containers full of mining machines was the maximum number of containers the hydroelectric power plant was able to support with its energy production. These limitations were partly due to the winter months when the flow of water slowed due to freezing, causing the production of energy to drop. Stanic described that when the snow is melting there is a large flow of water which produces a lot of energy, and that the opposite occurs when everything is frozen. In order to keep growing they decided to explore their options.

In the quest for finding a more scalable solution, Stanic learned of Sweden, where the energy tax laws were beneficial compared to other parts of the world. Initially, Techdisplay had planned to move their shipping containers to Sweden. Stanic traveled to Sweden in February 2017 to investigate, then in March 2017, they set up Blockbase in Sweden, and by May 2017 they started their new mining operations. They eventually sold the shipping containers based in Austria, and the cryptocurrency mining infrastructure to another Austrian-based cryptocurrency mining company because moving everything to Sweden would have taken a great deal of effort.

Blockbase Mining-As-A-Service

For those who are familiar with KNC Miner, one of the original ASIC Bitcoin manufacturers, they had a mining facility based in Sweden. KNC Miner met the unfortunate fate of going out of business, but this unfortunate outcome became an opportunity for Stanic and Blockbase, as they were able to move into the facility of previously occupied by KNC Miner (17). One of the benefits of the Swedish mining facility of Blockbase, is that it also makes uses of hydroelectricity to power the data centers. According to Stanic, this energy is 100% clean and green energy.

The website describes Blockbase to be mining-as-aservice and lists that they offer three purchase options for potential customers interested in mining: “Order Miners in Bulk”, “Buy Hosted Miners”, and “Send us Your Machines”. For the first two purchase options, they source, setup, and configure all of the desired mining hardware for the client, and all of the equipment is owned by the actual client, not by Blockbase. If a client has their own mining machines, the client could send them to Blockbase for hosting, but the website lists a minimum quantity of 1000 machines.

For those who don’t have their own machines, one of the other packages available seem more appropriate. The website does mention on the pricing page (18) a minimum purchase of 30,000 EUR worth of mining machines and the “Standard” plan is priced monthly, with 58 EUR per kilowatt per month. If you pay by the half year, there is a 6% discount applied, with a rate of 55 EUR per kilowatt per month. If you pay by the year, there is a 13% discount applied, with a rate of 51 EUR per kilowatt per month.

As for their inventory, Blockbase offers a Canaan AvalonMiner 841 (19), which is an ASIC machine produced by the company Canaan (20), and this is used to mine Bitcoin. The website lists these machines as currently in stock. As for the power consumption of these ASICs, they consume 1290 watts, and produce a hashrate of approximately 13.6 TH/s. The other mining machine options available is a GPU Miner P 102 100 (21), used for mining cryptocurrencies such as Ethereum, Monero, and Zcash. These machines are listed to be on backorder and require a 50% deposit per machine. As for the power consumption of the GPU miners, they consume 1582 watts, and produce a hashrate of approximately 380 MH/s.

99% Uptime

Stanic described how Blockbase is different from other mining services in the space, in that they offer a 99% uptime guarantee. Mining machines do experience failure due to continuous and rigorous operation, and when a failure happens to a client’s machine, that client is exposed to downtime until the machine is fixed. Sometimes this could take weeks for a manufacturer to repair the machine if it is under warranty, and by this time, the client will most likely lose money on their investment because when the network difficulty increases and more mining machines come online competing for the block reward, the window for achieving profitability with a mining machine gets smaller and smaller. To fix this exposure to risk, and to guarantee a 99% uptime, Stanic described, for example, that they could purchase an additional 20% of machines, so that in case a machine goes down, they are able to replace the failed machines with a new machine quickly, so their clients are back online mining right away and experience very little downtime. Further, Blockbase has implemented an online portal that allows clients to connect their own cryptocurrency addresses for receiving their rewards, and the rewards are paid out daily.

Conclusion

Overall, Stanic seems very knowledgeable about mining cryptocurrency and Blockbase appears to have a great location in Sweden with a long mining history. For the most part, the pricing of the service seems out of reach for the hobby miners and seems more like a service for well-funded companies who are serious about getting into the mining space. Stanic and Blockbase welcomes all their potential clients to visit their facilities in Sweden to check out their operations, and anyone interested in doing so, should reach out to them through their website. Always do your own due diligence71 before making any investment decision.

No Room for Trust in A Trustless World

One of the greatest innovations of Bitcoin is being able to transfer digital money in a peer to peer fashion without having to trust a centralized intermediary. Many refer to Bitcoin as trustless, there is no need to trust person or entity, all that is required is to trust the computer source code, the math, and the cryptography behind the system. Being that the computer code is open source, this allows anyone in the world with a computer and internet access to perform an audit.

The moment a centralized intermediary comes into play in the cryptocurrency ecosystem, trust is required. Purchasing specialty cryptocurrency mining equipment, using a mining pool, or renting computation power from a cloud mining service requires extreme trust. With cryptocurrency mining equipment manufacturers, you must trust that the supply chains for sourcing the materials are in place, that the materials arrive on time and on budget, that the machines actually get assembled and delivered, that the software on those machines is secure with no backdoors, and that those machines actually perform as their supposed to, among many other factors. With a mining pool, you must trust that the mining pool software is secure with no backdoors and that they are actually capable of delivering the reward for allocating your computation resources to their pool. With cloud mining services, you must trust that the data center exists, that the computer or computers that you are renting exist and are solely dedicated to your exclusive use, and that their software is secure with no backdoors.

With that said there have been many companies who have been leading examples by following industry best practices that security conscious consumers would expect. There have also been many poorly managed cryptocurrency mining operations, bad actors, and outright scams. In the early days of Bitcoin, companies began popping up claiming they were going to manufacturer specialty computers or chips for mining Bitcoin or other cryptocurrencies and they would offer “presales” of their equipment on fancy looking websites with incredible statistics. After the “presale”, the company would suddenly disappear, leaving unsuspecting purchasers at a loss of their hard-earned Bitcoin or fiat currency. In addition, there were incidents with mining pools that were compromised, whether from insiders or from external hackers, and the miners who contributed their precious computation resources had to suffer the consequences and loses. There have also been cloud mining operations that claimed to have data centers full of specialty mining computers without actually having the number of computers, or even any at all at their disposal for their customers.

We would like to point out important information to those who are new to the cryptocurrency space. It is unwise to give someone access to your private keys. In the same thought pattern, unless you are in direct possession of or control over the cryptocurrency mining machine, and that machine has open-source software that has been audited or reviewed by the community passing a community credibility check, you are essentially giving someone else access to your private keys. Make sure you trust the service provider who manages your cryptocurrency mining machines for you.

(1) Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and Cryptocurrency Technologies. New Jersey: Princeton University Press.

(2) See https://alpinemining.ch/en/

(3) See https://ch.linkedin.com/in/thomasludovic1991

(4) See https://ch.linkedin.com/in/thomasludovic1991

(5) See “Cryptocurrency mining to restore Alpine village’s goldrush fever”, swissinfo.ch, January 10, 2018

(6) See https://alpinemining.ch/2018/05/14/communique-de-presse-mai-2018/

(7) See https://unityinvestment.ch/

(8) See https://www.linkedin.com/in/richard-kobler-0310252/

(9) See https://www.linkedin.com/in/seanprescott/

(10) See https://unicrypt.com/

(11) See https://unityinvestment.ch/#proactivemining

(12) See https://unicrypt.com/contact

(13) See https://zw.linkedin.com/in/techdisplay

(14) See https://blockbasegroup.com/

(15) See https://blockbasemining.com/

(16) See https://at.linkedin.com/in/alexander-dietrich-b90681154

(17) See https://blockbasemining.com/mining-farm-sweden/

(18) See https://blockbasemining.com/pricing/

(19) See https://blockbasemining.com/hardware-servers/asic-miners/

(20) See https://canaan.io/

(21) See https://blockbasemining.com/hardware-servers/gpu-miners/

(22) See “The Blockbase Mining Connections”, The Financial Telegram, June 30, 2018