“Money is an honest ledger that individuals use to keep track of real wealth, defined as productive assets. Sorry Facebook but real wealth doesn’t include ‘bank deposits and short-term government securities. That said, thank you Facebook for widening the conversation about what money really is. That is a true service to society. Libra is the first denationalized ‘money’ that billions of people in the world will encounter.”

Key Takeaways

- Libra is challenging the US dollar. If every Western depositor were to move a tenth of their bank savings into Libra,its reserve fund would be worth over USD 2 trillion, making it a big force in financial markets.

- Libra is viewed critically by many economists, politicians, and public intellectuals. Their concerns revolve around privacy, trading, national security, and monetary policy. The Libra Association based in Switzerland will be responsible for managing the financial reserves that back the currency, and this will always be a single point of failure that makes it more centralized than Bitcoin.

- Although many state officials have a negative perspective on Libra, Facebook’s digital currency could turn out to be a boon for government, since Libra could funnel third-world savings into first-world debt. That is why Libra is a wolf in sheep’s clothing.

Will we witness the end of state money monopoly during our lifetime? Andreas Antonopoulos recently gave a speech in Scotland about how the next decade will witness competition between three types of money: state money, corporate money, and decentralized cryptocurrencies.

Over the past decades, the state money monopoly has rarely been called into question. In the 1970s, Nobel laureate Friedrich August von Hayek articulated the idea of competing, non-state currencies in his book The Denationalization of Money. For a long time, Hayek’s ideas were regarded as theoretical thought experiments far removed from economic and political reality and, therefore, received no broad public attention. Five decades later, however, with the advent of the Internet and the development of Bitcoin, we are returning to the debate. The phenomenon of cryptocurrencies has led the broader public to focus on the issue of money, what is money and how to create the optimal money?

Facebook announced that they will be launching a cryptocurrency named Libra. In collaboration with 28 large companies including PayPal, eBay, Visa, Mastercard, and Uber, Facebook has raised USD 280 million and hopes to raise USD 1 billion in total before the launch of the coin in 2020. What is called the Libra Association is projected to reach one hundred different members, which are supposed to be geographically dispersed through the globe. None of the members shall have more than one percent of the votes within the system – not even Facebook. The conglomerate of companies will base their operations in Geneva instead of the USA because of Switzerland’s friendliness towards the blockchain technology. Facebook has plans to integrate a wallet called Calibra on the Facebook messenger applications and on WhatsApp, which combined has over 1.7 billion users around the world. At the same time, Calibra is set up as a regulated subsidiary to ensure there will be a separation of social and financial data. This way, Calibra is aiming not to share customers’ account information or data with Facebook unless the subsidiary is to prevent fraud or comply with certain regulations.

Figure 1: The Founding Members of Libra.

On the more technical side, Libra is structured as an open-source project, allowing all sorts of developers to read, build, and provide feedback.[1] As marketed, this open-source protocol will go by the name of Libra Core, while the Libra network is supposed to be powered by what is called the Libra Blockchain. The latter will be using Merkle trees and a Byzantine Fault Tolerant (BFT) consensus protocol, both of which are technologies associated with the blockchain technology. Nevertheless, Libra will neither be using blocks nor a chain, but rather a single data structure that records the history of transactions and states over time.[2]

The Libra network is referred to as a permissioned blockchain. Unlike Bitcoin, the Libra network is not open for anyone to run a node. As for now, members must be given permission to connect their servers in order to record and validate transactions on the network. Only in the future, the Libra network is supposed to be transitioning to a public blockchain, according to Facebook. This obviously is a bold statement to make. If Libra will be able to pull this off and become a permissionless system, it’d be really one of a kind. If history tells us anything though, chances of the Libra project becoming decentralized are rather weak. In this context, Nic Carter, partner at Castle Island Ventures and cofounder at Coinmetrics, with great irony pointed to a famous quote by Friedrich Engels talking about state become obsolete at one point in time:

“The interference of the state power in social relations becomes superfluous in one sphere after another, and then ceases of itself. The government of persons is replaced by the administration of things and the direction of the processes of production. The state is not ‘abolished’, it withers away.”[3]

As we know today, things have turned out quite the opposite from what Engels imagined. And even if Libra should succeed in becoming more decentralized over time, there remain central points. After all, as long as Libra will be tied to a basket of reserves, there’s always the need for a third party to manage the reserves, which would mean the project would at least have one point of centralized control.

How Libra Could Change the World

The most interesting aspect of this new medium of exchange and its basket of reserves is that the value will not be pegged to the US dollar, which means that it will have a floating exchange rate with the dollar. The currency’s value will be backed by a basket of assets including currencies and bonds from all over the world. Facebook’s stock responded kindly towards this news with a 4 % increase on the day of the announcement as shown in the figure below. Regulators in the US and Russia have already expressed their concerns regarding the currency and rightly so. As longtime Bitcoin enthusiast and CEO of Shapeshift Erik Voorhees has expressed, the fact that Libra is not backed by the US dollar alone, will have profound implications. As Erik envisions, Libra could arguably become a medium-term replacement to any single government fiat currency because it is a conglomeration of many different fiat currencies, which makes it into a more diversified asset.[4] In our age of currency wars, this could be a very desirable feature going forward.

Figure 2: Price Hike of Facebook’s Stock in Response to Libra.

Since the media depicted Libra as a fierce competitor to banks – it is interesting that no single bank has been announced as one of the 28 founding members. Since this is also a competitor to the US dollar, it was no surprise that politicians reacted in a negative tone towards Libra.

For the banks, the Libra project could indeed become a nightmare. In terms of reaching customers, Facebook is way beyond what even the biggest banks like JP Morgan, Citibank, or Goldman Sachs, could ever reach. If every Western depositor were to move a tenth of their bank savings into Libra, its reserve fund would be worth over USD 2 trillion, making it a big force in bond markets.[5] This would certainly affect banks badly, since they would see their deposits shrink, which could then trigger a panic over their solvency. In our world of today, banks have become too big to fail. A competitor like Libra that could seal their fate and be the nail in their coffin, doesn’t come over unnoticed. In a quest to critically assess the newly planned digital currency, economists, politicians as well as other technocrats have turned their attention to Libra.

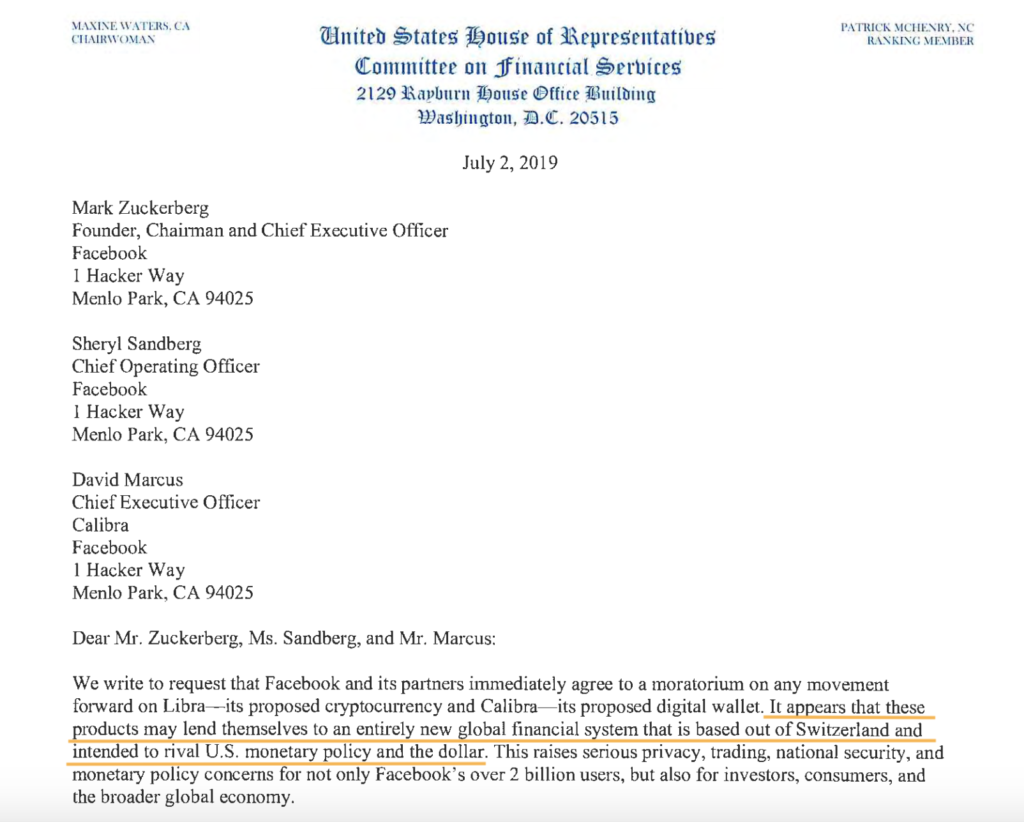

Above all is the US government, which is taking Libra quite seriously. In a letter from the US House of Representatives to Mark Zuckerberg, Sheryl Sandberg and David Marcus, the representatives openly express their concern about Libra being a direct rival to US monetary policy and the US dollar.[6] Consequently, Zuckerberg and his associates were requested to agree to a moratorium on any movement forward on Libra, so issues regarding privacy, trading, national security, and monetary policy issues could be discussed.

Source: Crowd Fund Insider, see reference no. 6.

As always, this is only one side of the coin. In fact, there are also many reasons why the US government should support Facebook’s Libra. The main one being the ability for regulators to access information regarding financial transactions if necessary. As such Libra has already been described as Facebook’s GlobalCoin, since it could enable a global techno-panopticon that could be used by governments around the world to monitor people’s financial affairs.

What sounds bad from a Libra user’s perspective, could, be bullish for Bitcoin in the long run. This could bring the world one step further towards Bitcoin and co., with the next decade witnessing a fierce competition between centralized currencies like Facebook’s Libra, Apple Pay, Google Pay, and decentralized currencies like Bitcoin. Interestingly enough, the genie of private money is out of the bottle. Politicians and other functionaries will have to come to acknowledge that the future will be a future of competing monies – there is nothing anybody can do to stop it.

Two Scenarios for Regulators

Bitcoin is not even used by 1 % of the world’s population, but Bitcoin is ruffling the feathers of the top 1 %. Even the highest political bodies will have to get used to being increasingly confronted with this issue.

Scenario One: Governments are Really Against Libra

Various high-profile US officials have raised concerns about Libra. In June, the chairman of the US Federal Reserve, Jerome Powell, spoke at a hearing before the US Senate in which he was asked several times about privately issued currencies such as Facebook’s Libra, but also about decentralized cryptocurrencies, such as Bitcoin. Powell stated, “Libra raises serious concerns regarding privacy, money laundering, consumer protection, financial stability.” Because of a whole lot of open regulatory questions, the project “cannot go forward” without having clarification on matters concerning regulations and the law in general. This is also why the US central bank had already met with Facebook representatives before the announcement of Libra and set up a working group to work tête-à-tête with the tech giant.

Taking the same line was Treasury Secretary Steven Mnuchin, signaling concerns that Libra could be a criminal’s tool for money launderers and terrorist financiers. Counterarguments pointing out the fact that the US dollar is by far the most laundered currency in the world were played down by Mnuchin referring to the fact that the US anti-monetary standards are among the strictest in the world. The treasury secretary’s message was clear: Regulators will do everything to protect the stability and integrity of the overall financial system from abuse through private monies. As he stated, they will make sure that Bitcoin doesn’t become the equivalent to Swiss numbered bank accounts.[7]

From a more skeptical perspective, it could be said that concerns about money laundering and terrorist financing are just a pretense. What politicians and other state officials are really worried about is losing their monopoly power over money, which enables them to buy votes from voters by promising “free” stuff and then quickly turning on the printing presses. But to camouflage their plea for money they don’t have, officials disguise their criticism as a lack of trust vis-à-vis Facebook and their endeavor to launch a private currency.

However, the regulators seem to have come to grips with what the new development of corporate money and cryptocurrencies really means. There’s a high chance that the regulatory screws will be tightened going forward, which will affect cryptocurrencies like Bitcoin as well.

Scenario Two: The US Government Figures Out That This is Good

Rahim Taghizadegan of Scholarium in Vienna cleverly pointed out that western governments should actually be in support of Libra. Since Libra will hold a significant amount of western government debt and their currencies, this can actually facilitate an enormous redistribution of wealth from the Asia, the Middle East, and South America to the western world. Since each Libra will be fully backed, this means that Libra can tap into global household savings and use those savings to buy US and European government debt and fiat currency. Along the same lines, Pascal Hügli, a journalist from Switzerland and frequent contributor to this report, has described Libra as a sort of tool allowing the first world to extend its expansionary monetary policy to the third world. In his view, Libra is one more attempt at keeping our fading era of paper money from coming to an end – an end that is inevitable and is slowly but surely ushered in by the new digital age accompanied and fostered by Bitcoin and things coming from it![8]

So contrary to current political opinions, Libra could

actually turn out to be a life buoy for the dollar by propping it up for

another decade while Facebook quietly siphons of savings from households in South

America, Africa, and Asia and into the coffers of the US government via bond

purchases. Since third world savings would be funneled into first world debt

via government securities, the governments’ respective currencies, especially

the dollar, would appreciate, or at least not depreciate as quickly as would

absent Libra. Although it is true that the Libra Association isn’t bound to

back Libra with US treasuries, there is a realistic chance that Libra and US

government will go hand in hand to negotiate a win-win deal for both of them.

[1] S“Libra will be open-source under an Apache 2.0 license, allowing developers to read, build, provide feedback, and take part in a bug bounty program. Testnet is launching soon. Mainnet will be launched in 2020.” [Tweet], Larry Cermak, Twitter, June 18, 2019.

[2] See “Your Guide to Libra,” VerumCapital, 2019.

[3] Quote tweet], Nic Carter, Twitter, June 18, 2019.

[4] See “Thoughts on Libra (and my first tweetstorm!): first, zoom out for a second and realize how far this industry has come. The biggest companies in the world are now launching cryptocurrencies. BOOM.” [Tweet], Erik Voorhees, Twitter, June 18, 2019.

[5] See “Weighing Libra in the balance. Facebook wants to create a global currency,” The Economist, June 22, 2019.

[6] See letter of the House of Representatives to Mark Zuckerberg, Sheryl Sandberg and David Marcus, July 2, 2019.

[7] See “Are you saying cash has never been used for illicit purposes, @joesquawk asks in response to Mnuchin’s concerns about #btc ‘We are going to make sure that bitcoin doesn’t become the equivalent to swiss numbered bank accounts’ says @stevenmnuchin1” [Twitter Video], Squawk Box, Twitter, July 18, 2019.

[8] See “You Don’t Want to Help Bank the Unbanked!,” Pascal Hügli, Medium, June 26, 2019.