As institutional investors venture further into the realm of Bitcoin, the question of secure storage becomes increasingly crucial. The unique characteristics of digital assets require specialized solutions that ensure both the safety and accessibility of significant portfolios. This article examines the different categories of custody—centralized Bitcoin custody, centralized fiat custody, and self-custody—highlighting how the roles of brokers and custodians have evolved over time.

From companies like Bitcoin Suisse that combine brokerage and custody services to innovative solutions like Etana Custody that facilitate fiat transactions discreetly, we explore the diverse landscape of custody options. Moreover, we delve into the revenue models of these intermediaries, outlining how they generate income through various fees and investments.

After an institutional investor buys Bitcoin via an exchange, broker, OTC desk, or miner, the next question is, “How can I safely store Bitcoin?” In the evolving landscape of digital assets, the secure storage of Bitcoin has emerged as a paramount concern, especially for institutional investors managing significant portfolios. The unique nature of cryptocurrencies necessitates storage solutions that offer both rigorous security and seamless accessibility.

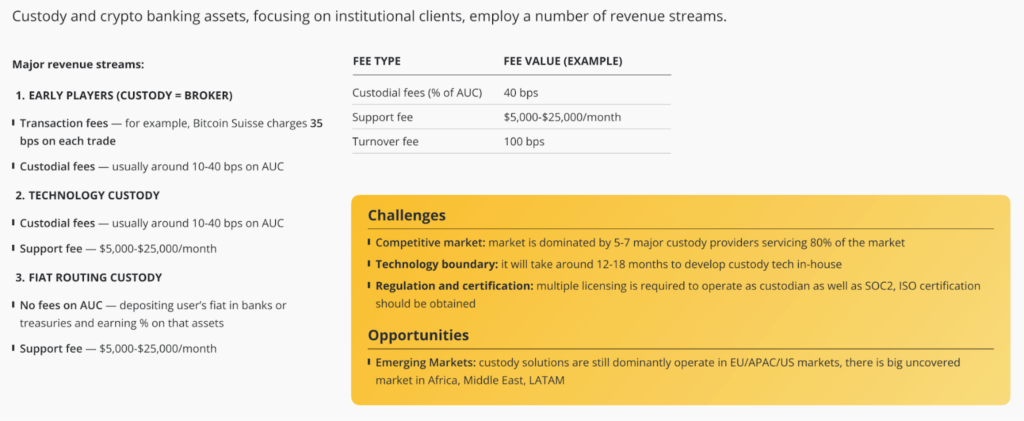

This chapter breaks custody into three main categories: centralized Bitcoin custody, centralized fiat custody, and self-custody. The earliest firms in the Bitcoin ecosystem fulfilled both the role of broker and custodian since few companies existed in the space. For example, Bitcoin Suisse in Switzerland is both a custodian and a broker. Over time, the different roles became specialized, and companies focused solely on custody emerged. There are different types of Bitcoin custodians, including custodians that take delivery of Bitcoin and Bitcoin custodians that use white-label storage technology and then sell to third-party companies that want to store their client’s assets in a familiar interface. In addition to Bitcoin custodians, fiat custodians work with Bitcoin companies.

For example, when an investor has fiat sitting on an exchange such as Kraken, that does not mean that Kraken is storing the fiat in Kraken’s corporate bank account. Kraken and other exchanges cannot hold onto fiat for customers. They must rely on banking partners such as Bank Frick in Liechtenstein to facilitate fiat withdrawals and deposits. Since many banks faced backlash from regulators for facilitating Bitcoin purchases, a new category of fiat routing software companies arose. Companies such as Etana Custody, based in Denver, Colorado, allow banks to hide behind the Etana brand to avoid negative media and regulatory consequences. Etana does not take custody of the fiat currency held by Kraken users but rather routes the fiat transaction to a series of member banks that handle settlement.

Revenue Steams of Bitcoin and Fiat Custodians

Source: Cointelegraph Research

Each intermediary charges fees for their service, and not all intermediaries are made equal. Bitcoin custodians that are also brokers, such as Bitcoin Suisse can charge basis points on order amounts plus ongoing custody fees. Bitcoin custodians that sell white-labeled software such as Copper can charge a wide scale of fees on assets under custody plus monthly support fees. Fiat custodians such as Etana Custody earn income by investing exchange users’ fiat into treasuries and earning a percentage on those assets. None of the yield from the treasuries is passed back to the original owner of the fiat.

The following sections delve into the various institutional-grade storage options available, ranging from specialized Bitcoin custodians to self-storage practices. Additionally, it sheds light on the pivotal role of fiat custodians in the crypto ecosystem, the importance of wallets tailored for substantial transactions, and the growing domain of insurance tailored to mitigate risks associated with digital assets. As we navigate through each segment, we’ll introduce some of the industry’s leading service providers and products, aiming to equip investors with the knowledge to make informed decisions in this rapidly advancing arena.

In summary, the secure storage of Bitcoin and fiat currency is a multifaceted challenge that requires tailored solutions for institutional investors. This article has provided an in-depth look at the various types of custody available, from specialized Bitcoin custodians and self-storage practices to the critical role of fiat custodians in the ecosystem.

By understanding the different revenue streams and fee structures of these intermediaries, investors can better navigate their options. As the digital asset market continues to evolve, staying informed about the latest developments in storage technology and services is essential for safeguarding investments and maximizing returns.