In the 2024 Outlook, André Dragosch, PhD., alongside the ETC Group, thoroughly examines the relationship between global economic trends and Bitcoin’s valuation. By analyzing key indicators such as the U.S. unemployment rate and housing market conditions, the report reveals how an impending economic downturn in the United States could paradoxically boost Bitcoin’s price. It also dives into investment strategies to mitigate Bitcoin’s volatility and discusses the evolving landscape of digital asset trading, highlighting IMC’s strategic moves in this space.

The ETC Group’s 2024 Outlook written by André Dragosch, PhD., is an exceptional report on the relationship between global macroeconomic conditions and Bitcoin’s price. Reviewing leading indicators such as the U.S. unemployment rate, the NAHB Housing Market Index, and the regional Fed manufacturing surveys, the report indicates that the U.S. economy might already be sliding into a recession. However, Dr. Dragosch explains that a recession may push Bitcoin’s price even higher, “any material economic weakness, especially in U.S. employment, is likely going to induce renewed monetary easing by the Fed.”

Using data from Bloomberg, the annual maximum drawdowns and returns were calculated between 2010 and 2023. The results show that the maximum drawdown can be pretty significant in Bitcoin’s bear market years. The worst 2022 drawdown saw Bitcoin lose 67% of its value. However, Bitcoin’s annual return was only negative 3 out of the last 13 years, 2022, 2018, and 2014, all coinciding with Bitcoin’s predictable 4-year halving cycle.

Investors can incorporate dynamic or static rebalancing strategies to help avoid the maximum drawdowns associated with Bitcoin’s performance, which ETC Group discusses in their recent report. One example is the rebalancing strategy utilized by the Bitcoin Alternative Investment Fund in Liechtenstein, the Digital and Physical Gold Fund by Incrementum. The strategy automatically rebalances between two uncorrelated assets, Bitcoin and gold, once either asset surpasses a target threshold.

“This report shows that as a fund manager, it makes sense to attribute part of your investments to digital assets, and as a high-frequency trading firm, you should attribute part of your resources to crypto as well. At IMC, we invest capital, time, and people to become as dominant in this space as we are in traditional markets.

Trading in digital assets is evolving rapidly. In some ways, it’s moving towards traditional market trading. At IMC, we particularly love the crypto-specific characteristics, notably the Decentralized Finance space and trading in perpetual futures, a new addition to our portfolio.

IMC is committed to trading crypto and we’re in it for the long run; given the size of our company, the long-term strategy forms the basis for everything we do. Particularly because it takes a lot of time to adapt our systems to new markets and products, as everything we do is automated.

Sharpe Ratio Contribution of 2.5% Bitcoin Allocation to a Traditional 60-40 Portfolio (No Rebalancing)

At IMC, we are excited about the crypto space and we’re looking forward to the next bull run. By making markets more professional and competitive, both on and off chain, and therefore a lot more attractive for everybody, we play our part in building the ecosystem and increasing the chances of that run.”

Michiel Knoers sits on the Board of IMC as the Global Head of Trading. He started at IMC in Chicago in 2012 and worked there for seven years before moving to Amsterdam to lead the European trading team. In early 2021, IMC started trading crypto after acquiring FRIJT Trading and, more recently, Tensor Technologies in Switzerland – both companies set up by former IMC employees.

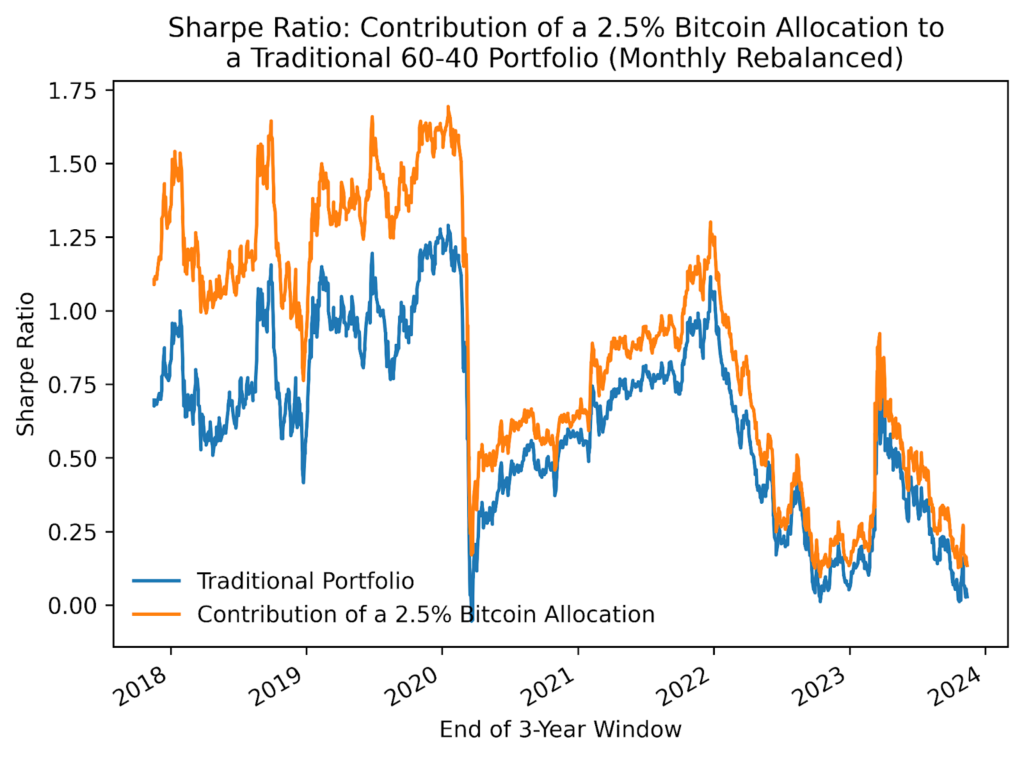

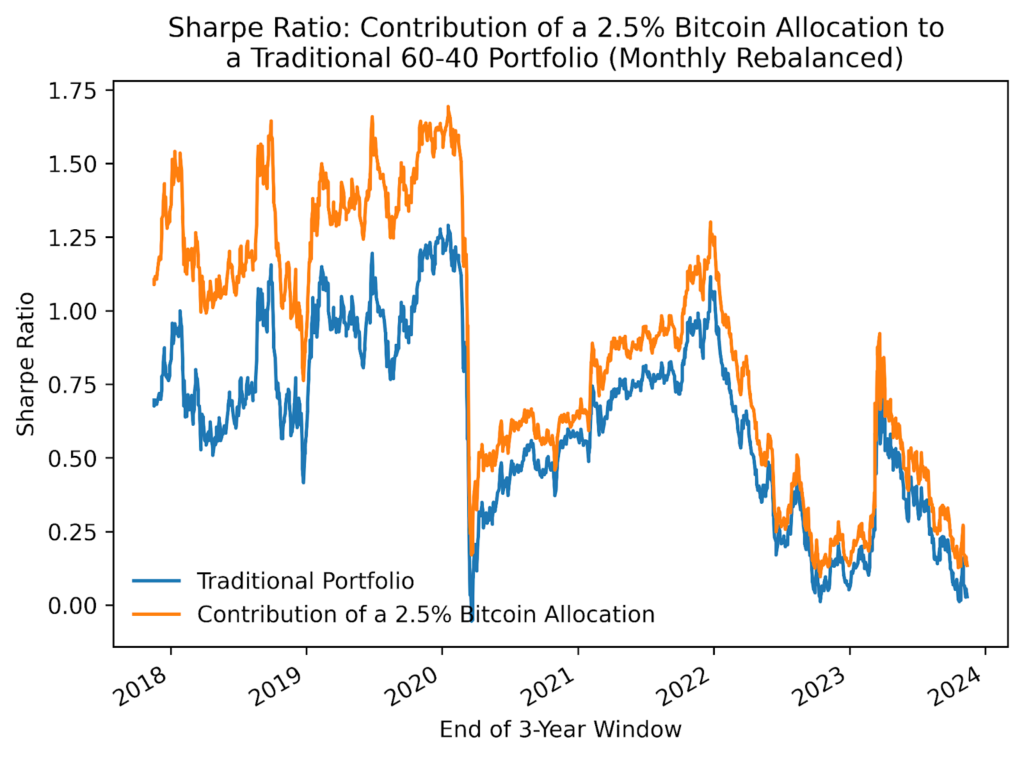

Sharpe Ratio Contribution of 2.5% Bitcoin Allocation to a Traditional 60-40 Portfolio (Monthly Rebalancing)

Throughout the sample portfolios in the backtest, the impact of a 2.5% allocation to Bitcoin to the Sharpe Ratio varied in magnitude, but the average influence was significant at 21.25 percentage points. Crucially, the beneficial effect of including Bitcoin in the investment portfolio did not result in increased volatility. This is evidenced by Figure 22 – 25, which illustrates the enhancement of the Sharpe ratio of a conventional investment portfolio during the same rolling three-year periods.

Similar to the case with cumulative returns, incorporating Bitcoin consistently improved the overall Sharpe ratio of the traditional portfolio for every three-year interval examined in our research. Our study’s results confirm those found by BitWise in their 2023 and 2022 reports on adding Bitcoin to a traditional portfolio.

The ETC Group’s 2024 Outlook, authored by Dr. André Dragosch, provides valuable insights into the dynamics between macroeconomic trends and Bitcoin’s market performance. Offering a forward-looking perspective, the report not only anticipates Bitcoin’s price resilience in the face of economic challenges but also outlines strategic approaches for navigating the crypto market’s volatility. Furthermore, it presents the case for incorporating Bitcoin into diversified portfolios, demonstrating its positive impact on risk-adjusted returns without adding volatility. This comprehensive analysis underpins the growing synergy between traditional finance and cryptocurrency, emphasizing innovation and strategic investment as key drivers for success in the evolving digital asset landscape.