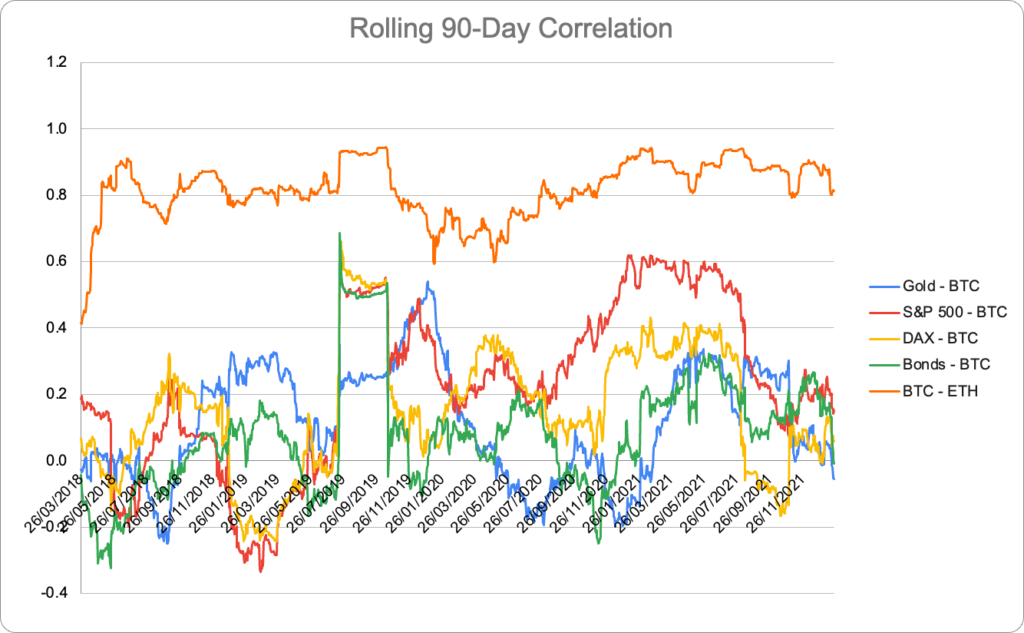

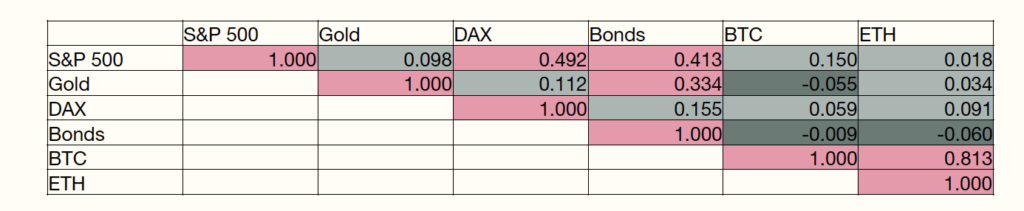

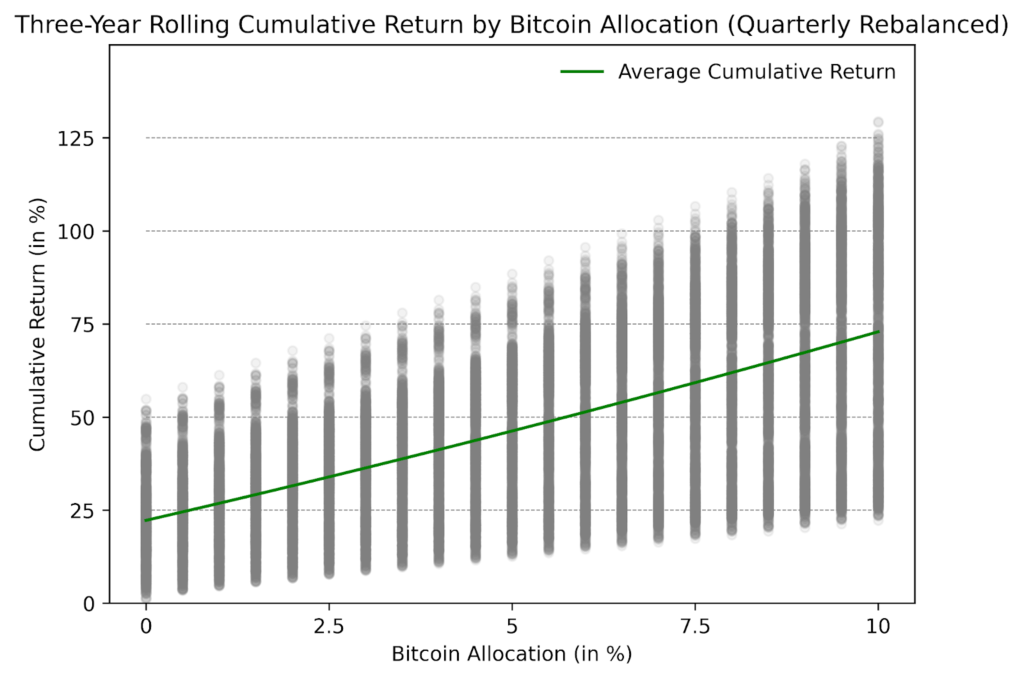

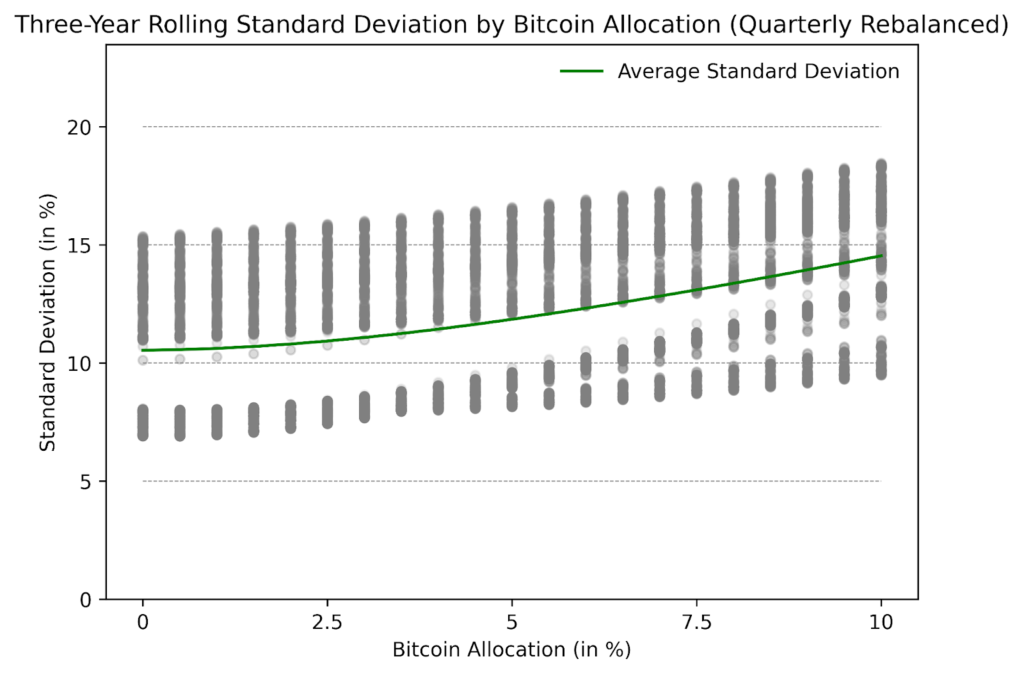

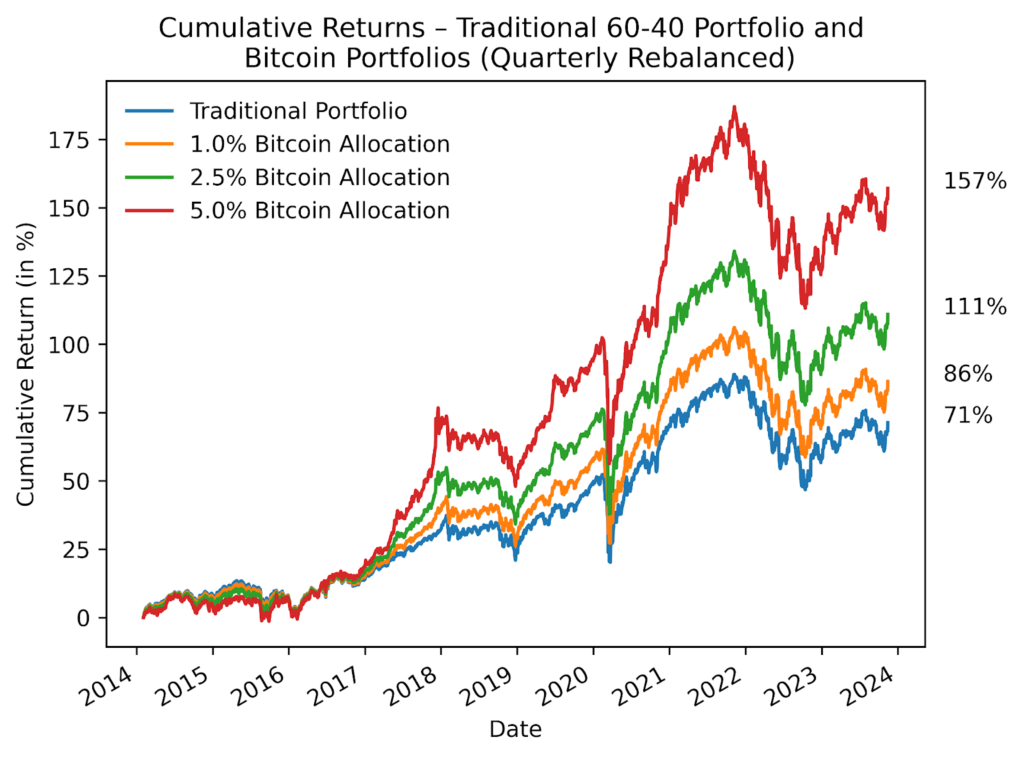

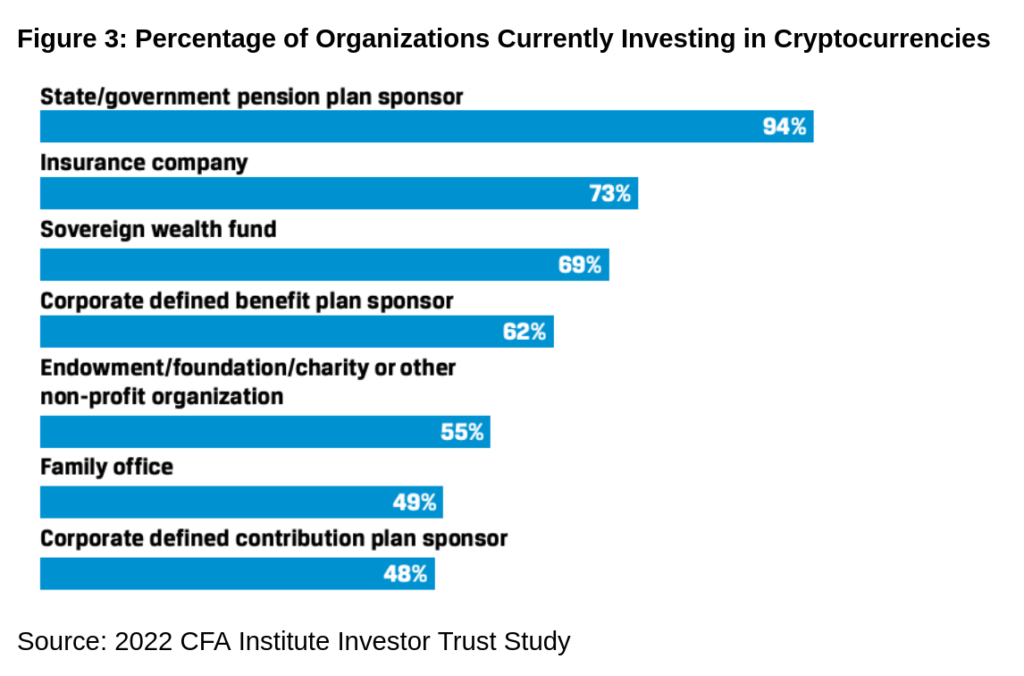

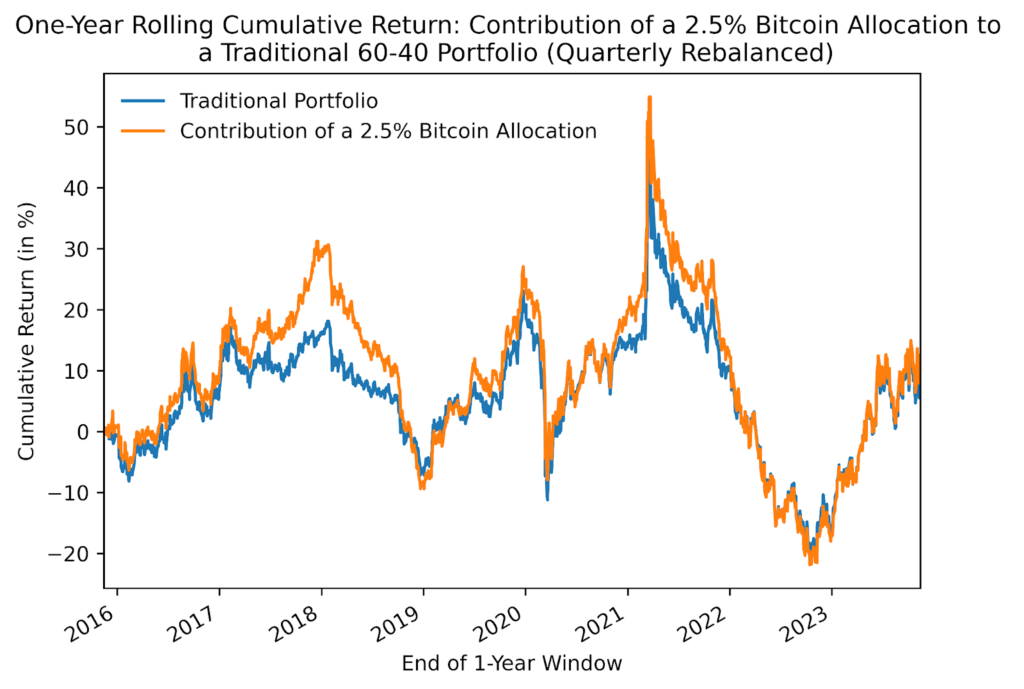

Exploring the dynamic intersection of traditional investment strategies and the burgeoning world of cryptocurrencies, this article draws inspiration from the seminal Bitwise report to investigate Bitcoin’s utility within a classic 60-40 investment portfolio. Cointelegraph’s researchers have embarked on a detailed analysis to uncover the ideal duration for holding Bitcoin, ranging from one to three years, focusing on its impact on portfolio returns through the lens of rolling cumulative return and Sharpe ratio metrics. This inquiry, rooted in a scenario where Bitcoin constitutes a 2.5% portfolio allocation with quarterly rebalancing, promises to offer invaluable insights into the strategic incorporation of cryptocurrencies in traditional investment paradigms.

Paying Homage to the original Bitwise report, “Bitcoin’s Role in a Traditional Portfolio,” Cointelegraph researchers studied the historical optimal time horizon for holding Bitcoin by calculating the rolling cumulative return and Sharpe ratio measures for holding durations ranging from one to three years. This was done using a benchmark scenario of a 2.5% Bitcoin allocation and conducting rebalancing quarterly.

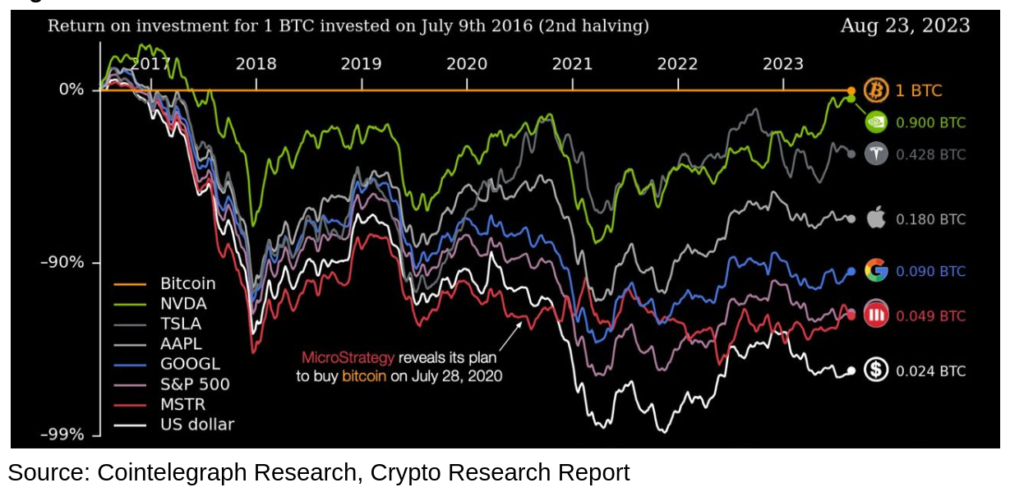

Figure 15: One-Year Rolling Cumulative Return: Contribution of a 2.5% Bitcoin Allocation to a Traditional 60-40 Portfolio (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

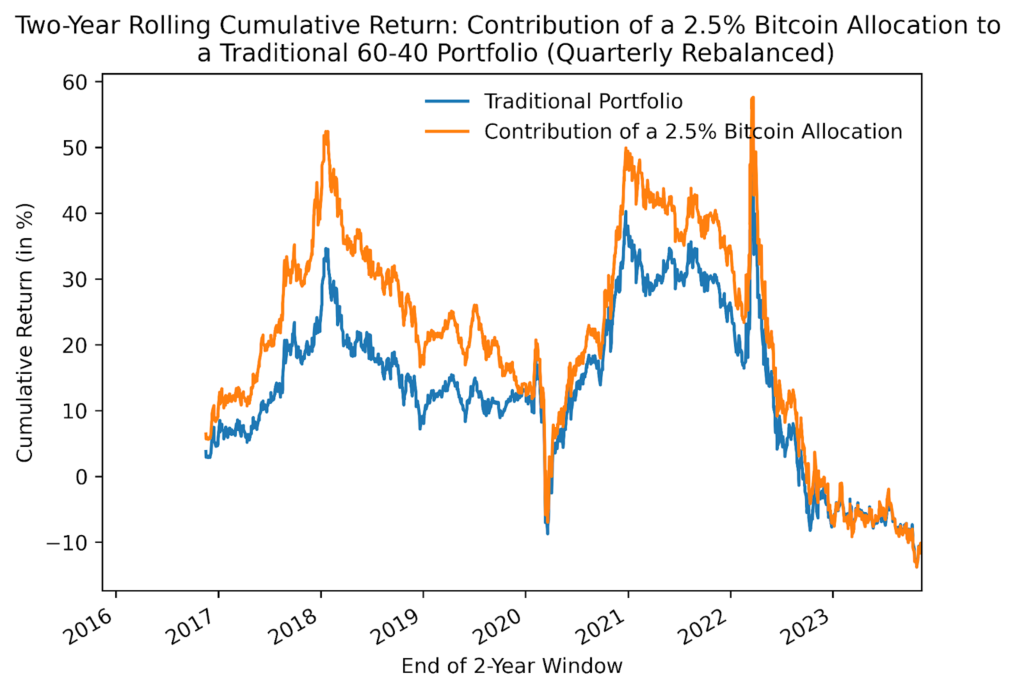

Figure 16: Two-Year Rolling Cumulative Return: Contribution of a 2.5% Bitcoin Allocation to a Traditional 60-40 Portfolio (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

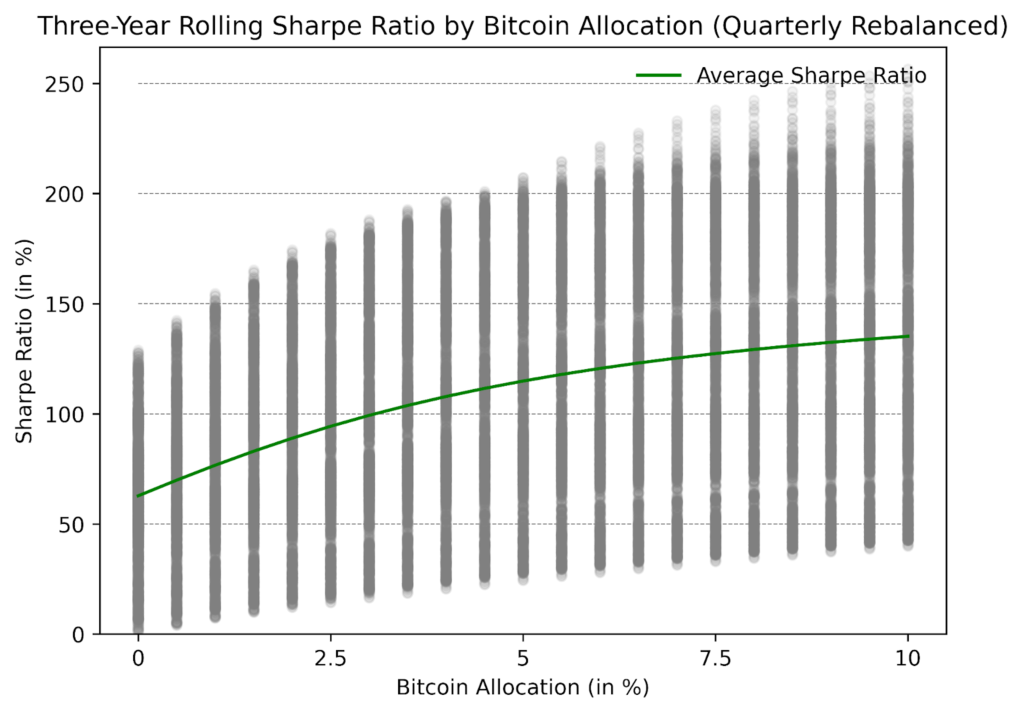

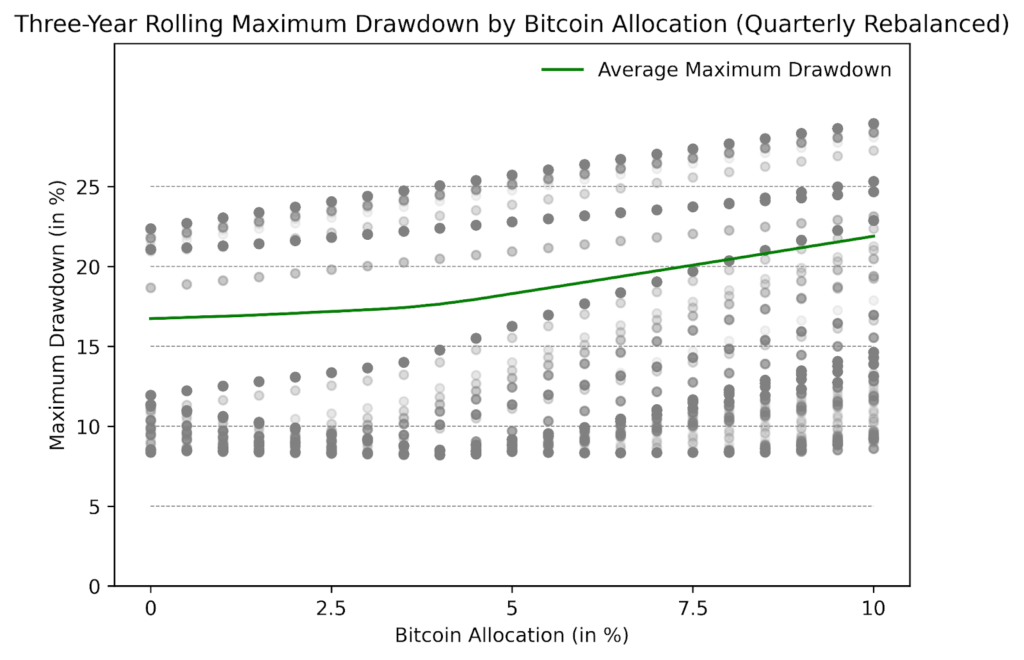

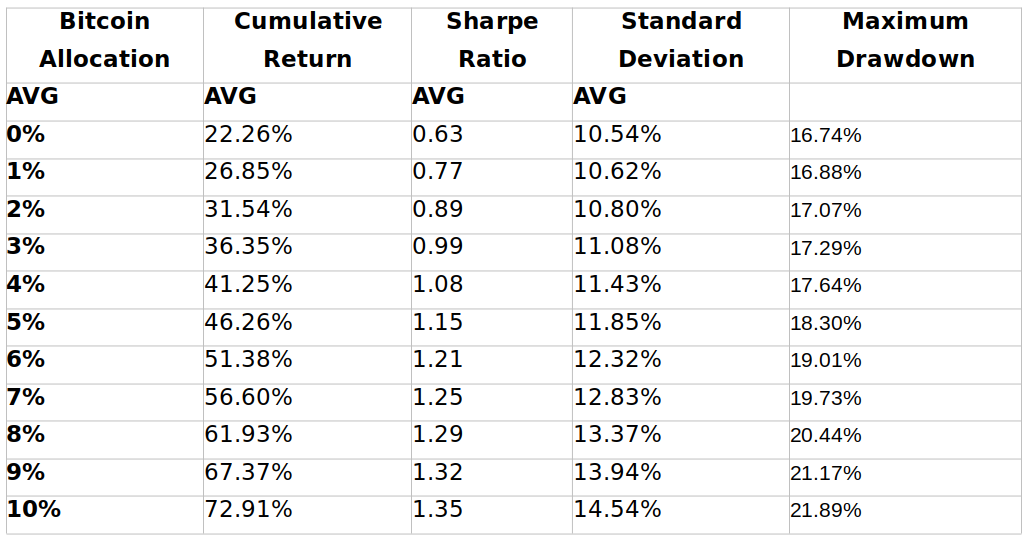

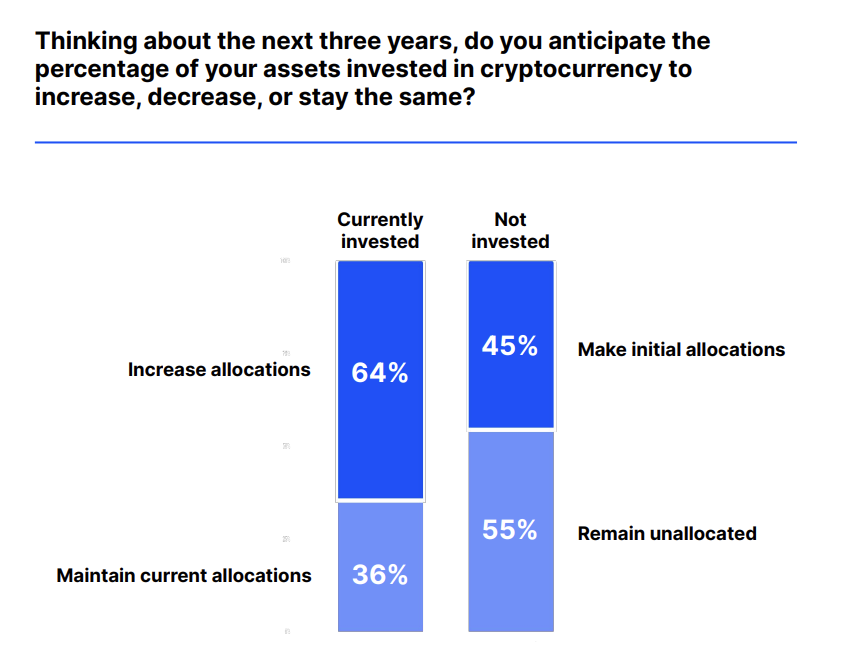

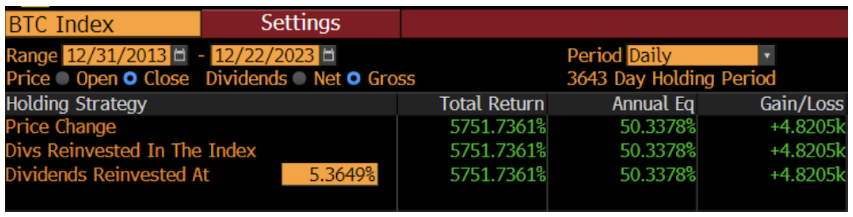

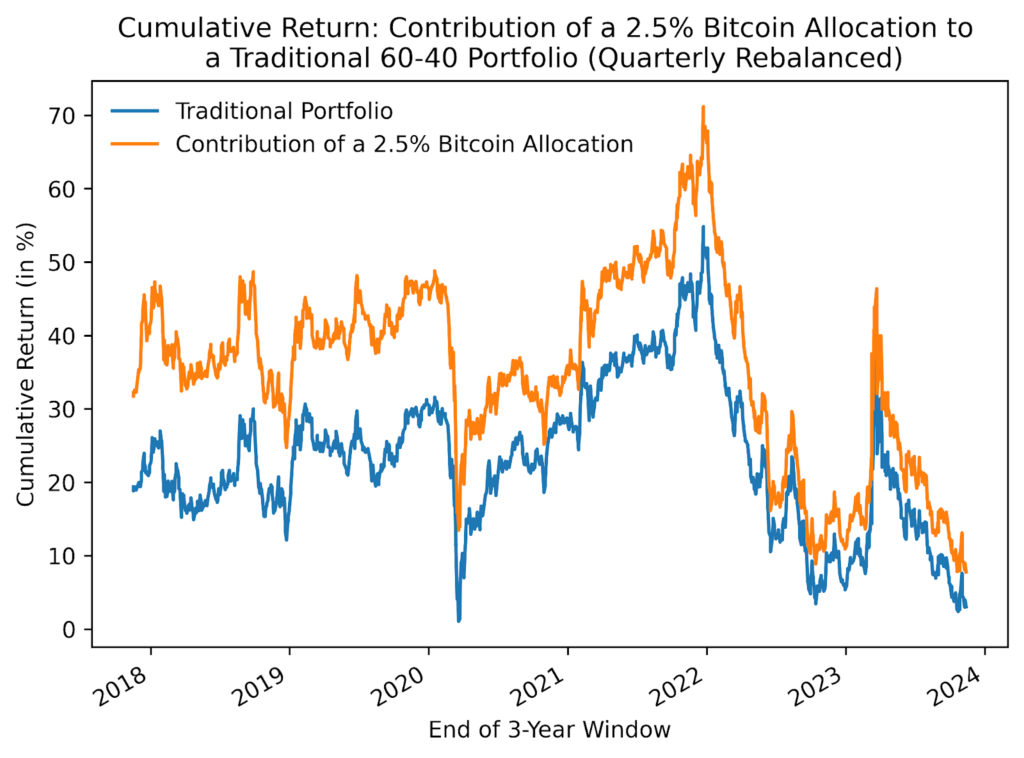

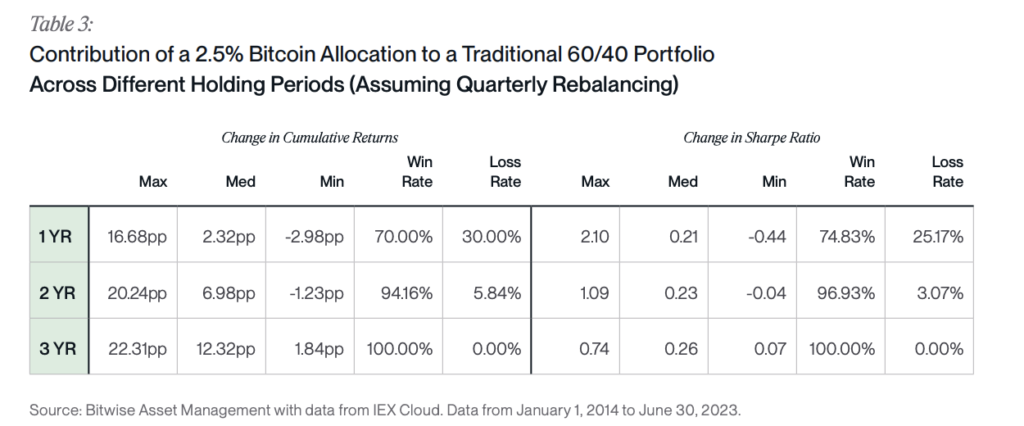

As can be seen in Figures 15 through 17, the contribution of 2.5% Bitcoin to a traditional portfolio’s return remains positive throughout most of the sample period. The same holds for the two-year and three-year rolling returns. This can also be seen in Figure 11, where the median contribution over three years stands at 12.88 percentage points. The three-year holding period also features a higher win/ loss ratio compared to other holding periods. Let’s look at the three-year rolling cumulative return. The win rate is 99.94%, meaning that nearly every three-year holding period between Jan. 1, 2014, and Nov. 23, 2023, provided positive returns for investors.

Figure 17: Three-Year Rolling Cumulative Return: Contribution of a 2.5% Bitcoin Allocation to a Traditional 60-40 Portfolio (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

This shows that even investors who bought in at the top of the market can still have positive performance as long as they wait at least three years to sell. An alternative to waiting three years to sell is to avoid buying in at the top. This may sound difficult, but it’s easily achievable. Investors can dollar cost or value cost average their investment over time to avoid going all in at one point in time.

Figure 18: Contribution of a 2.5% Bitcoin Allocation to a Traditional 60-40 Portfolio Summary Statistics

Source: Cointelegraph Research, CryptoResearch.Report

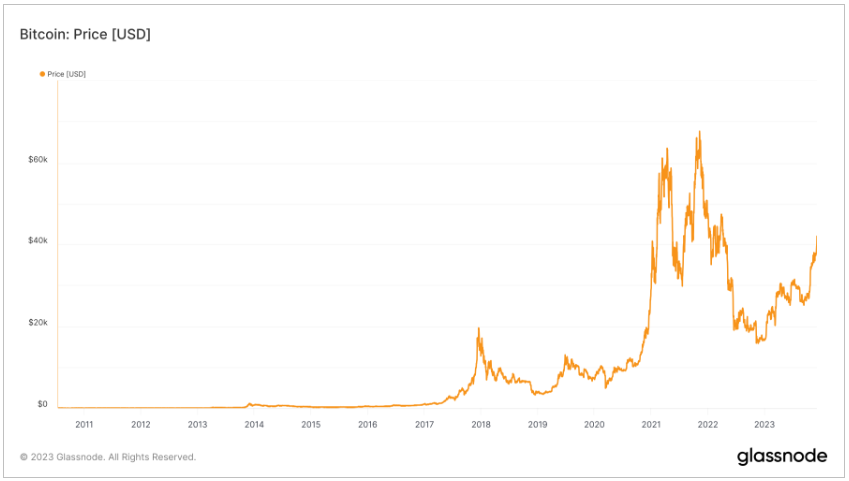

Dollar-cost or value-cost averaging over time is an easy and prudent approach to building a position in Bitcoin. Selling puts on CME or Deribit can also be used to build a position in Bitcoin while simultaneously earning premiums. For investors who want to build a position quickly without staggering their investment over a few months, Bitcoin’s price has often seen significant spikes in the fourth quarter of the year, suggesting a seasonal trend.

Figure 19: Bitcoin’s Best Quarter Has Been Q4 Historically

The research presents a compelling case for including Bitcoin in traditional portfolios, showcasing its positive influence across various holding periods, especially over three years. This period notably offers significant returns, emphasizing the advantage of strategic patience and investment timing. It also highlights practical methods like dollar-cost averaging and strategic put selling as effective risk management and investment strategies. In essence, the study provides actionable insights for those looking to meld the realms of cryptocurrency with traditional investment approaches.