Amid the whirlwind of market fluctuations, Bitcoin stands out as an enigmatic player, challenging the conventional wisdom that guides investment strategies. Despite its well-documented volatility, Bitcoin surprisingly does not mimic the movement patterns seen in traditional asset classes like stocks and bonds. This divergence is primarily attributed to its low correlation with these assets, a phenomenon that has intrigued investors and analysts alike.

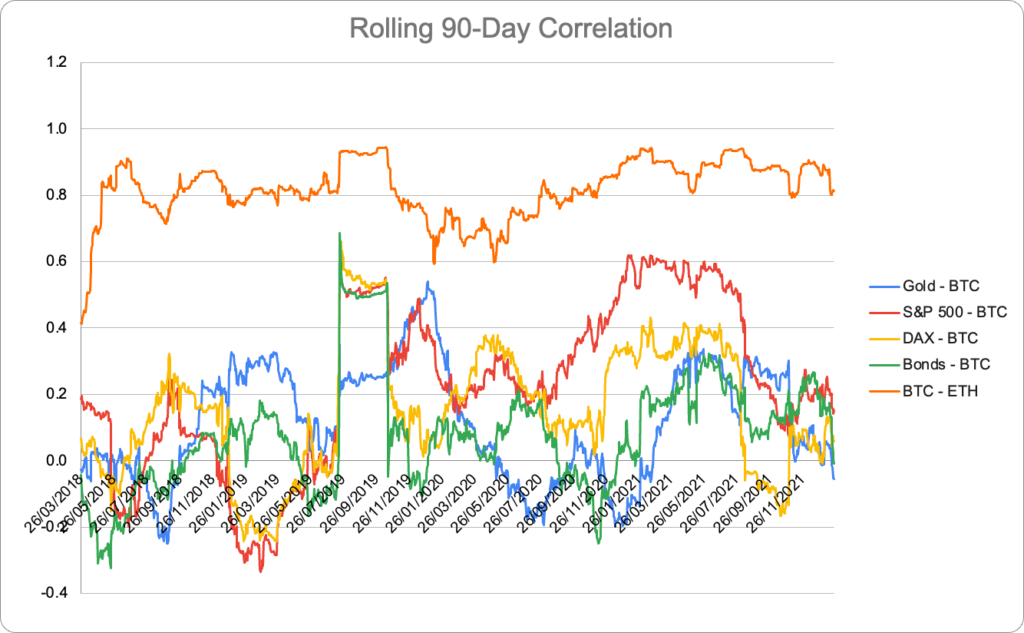

Leveraging detailed analysis, this article aims to unravel the mystery behind Bitcoin’s unique behavior in the financial ecosystem. By examining the rolling 90-day correlation of Bitcoin with traditional assets, we uncover insights into how and why Bitcoin’s market movements offer a distinct narrative from that of conventional investment options.

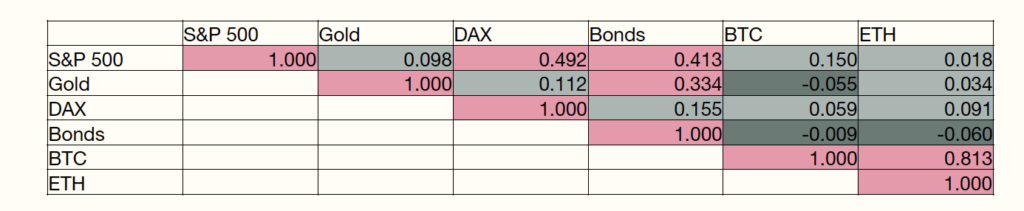

The limited increase in standard variation and maximum drawdown might be surprising since Bitcoin itself jumps around a lot in value. But Bitcoin doesn’t usually move up and down in the same way as stocks or bonds do due to the low correlation. The figures in this article show the low correlation between Bitcoin and traditional asset classes.

Rolling 90-day Correlation of Bitcoin with Traditional Assets

“Classifying Bitcoin has always been a conundrum. Bitcoin’s correlations with traditional assets have perplexed investors with their variability. From inception to 2020, Bitcoin was largely uncorrelated from any asset class, lending the asset a meaningful role as a portfolio diversifier. After the liquidity injections and inflationary impulse in 2020-22, Bitcoin behaved like a risk asset. And more recently, its correlations with risk-on assets have broken down as it has behaved more like gold. So, determining Bitcoin’s nature alongside other asset classes has been fiendishly difficult. Bitcoin’s purest correlation of late has been to changes in the broad money supply, making it a gauge of liquidity of sorts.

As the U.S. nears a reckoning on the debt, and foreign buyers of Treasuries appear ever more scarce, alongside high and growing deficits, a monetization of the debt and a reliquification from central banks seems more likely. Amid these circumstances, Bitcoin would be a clear beneficiary. The likely potential for a spot ETF in the U.S. in Q1 2024 is another potent catalyst, alongside the highly touted quadrannual halving event. While many institutions have been disillusioned by crypto markets amid the credit crunch of 2022 and the subsequent drawdown, much of the largesse has been purged from the markets and the industry is quietly rebuilding. While Bitcoin is in the doldrums today, it endures as a global monetary asset of consequence, and brighter catalysts lie ahead.” – Megan Nyvold, Head of Brand, BingX

Bitcoin has had an unprecedentedly low correlation with traditional asset classes enabling investors to increase their portfolio risk-return ratio. Over the last ten years, Bitcoin’s correlation has stayed low to moderate with traditional asset classes.

Bitcoin Correlation Matrix

The exploration of Bitcoin’s relationship with traditional asset classes reveals a complex and nuanced picture that challenges preconceived notions about market correlations. The data presented in this article, supported by expert commentary from Megan Nyvold of BingX, highlights Bitcoin’s atypical response to market trends and global economic shifts. This peculiar behavior, characterized by low to moderate correlation with traditional assets, positions Bitcoin as a potentially valuable component for diversifying investment portfolios. However, the evolving nature of Bitcoin’s correlations, influenced by factors such as legislative developments, global monetary policies, and internal crypto market dynamics, points to an unpredictable future.

These findings underscore the importance of a nuanced understanding of Bitcoin’s role in the financial landscape, especially considering upcoming catalysts like the potential approval of a U.S. spot ETF and the anticipated Bitcoin halving event. As the crypto industry moves beyond recent setbacks and continues to mature, Bitcoin’s journey remains a compelling case study for investors seeking to navigate the intricacies of modern financial markets with agility and informed insight.