In the rapidly evolving world of investment, diversification has always been a key strategy for mitigating risk and enhancing returns. With the advent of digital currencies, particularly Bitcoin, investors have found a new asset class to consider adding to their portfolios. This article delves into the impact of incorporating Bitcoin into a traditional 60/40 stock and bond portfolio.

By examining various metrics through detailed figures, we explore how different levels of Bitcoin allocation can affect the overall performance, risk, and return ratio of an investment portfolio. From marginal additions to significant inclusions, we unravel the nuanced relationship between risk and return in the context of Bitcoin investments.

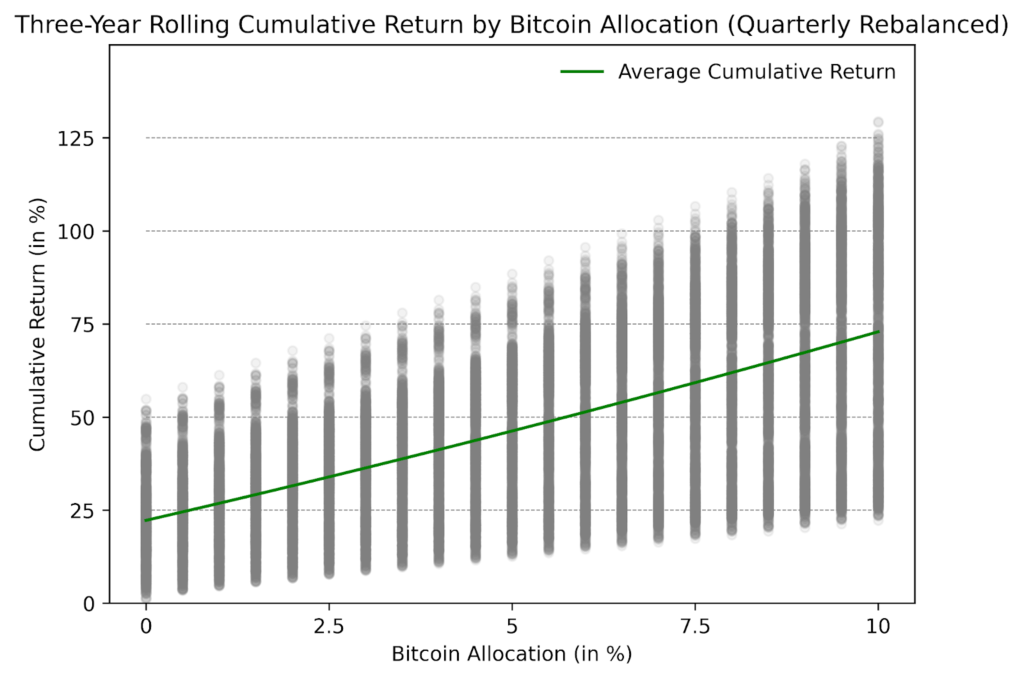

The first line on the left is what happens when you don’t add any Bitcoin to your investment, and the lines that follow show what happens when you gradually add more, up to 10%. These lines aren’t about time moving forward; they’re just about how much Bitcoin you add. What stands out immediately is that the more Bitcoin you added historically, the higher your return was.

Figure 1: Three-Year Rolling Cumulative Return by Bitcoin Allocation (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

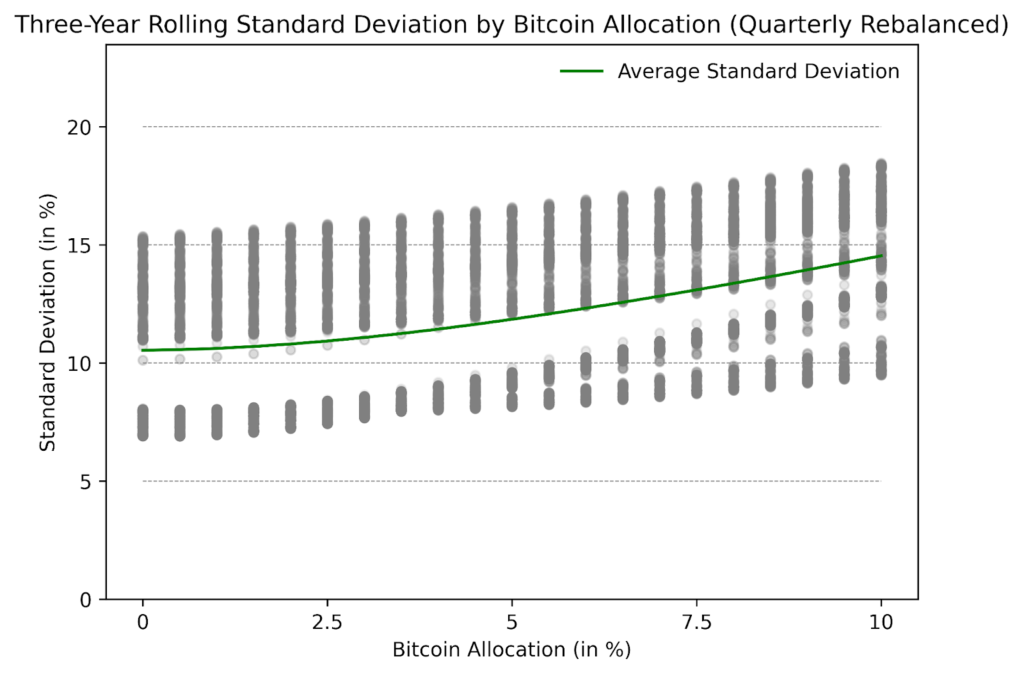

While adding Bitcoin to a global 60/40 stock and bond portfolio increased the cumulative return, there’s a catch: it can also make things more unpredictable or risky. Figure 2 shows what happens to the volatility when Bitcoin is added. Although the risk increases, it doesn’t just go up in a straight line. Instead, there is a curvature in the line. This means that if you only add a little bit of Bitcoin, like between 0.5% and 2%, it doesn’t make your investment much riskier. But as you add more Bitcoin beyond that, things can get unpredictable pretty quickly.

Figure 2: Three-Year Rolling Standard Deviation by Bitcoin Allocation (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

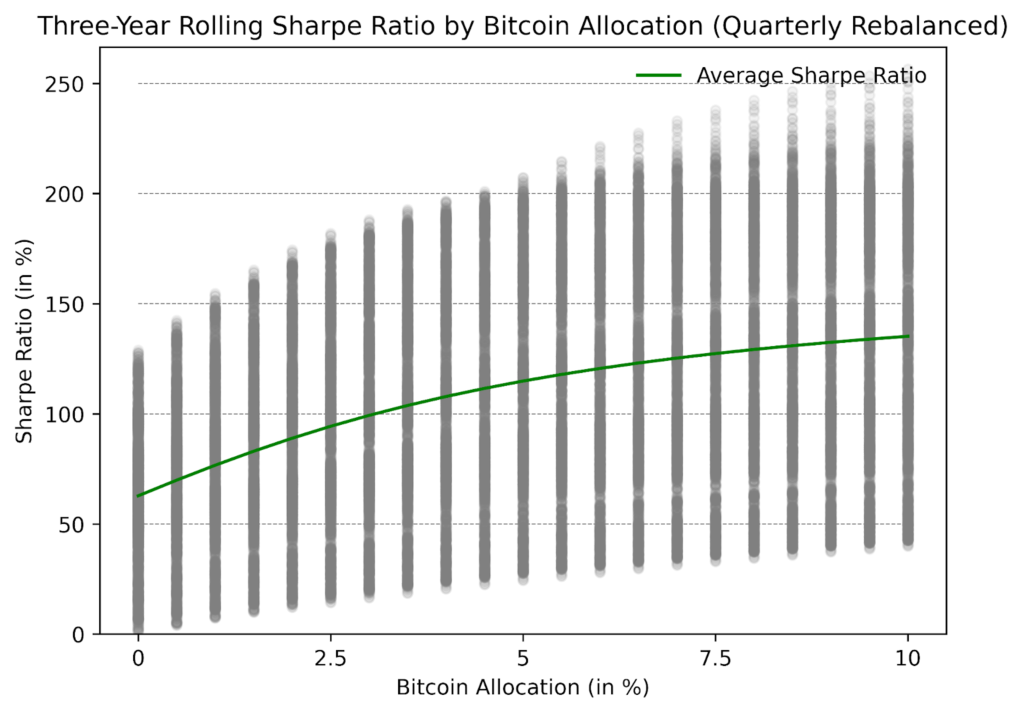

In Figure 3, we mix the info from Figure 1 to look at the portfolio Sharpe ratios. The shape of this graph is pretty interesting: it goes up quickly at first and then levels off as you put more Bitcoin into your investment. This chart says that when you add some Bitcoin to your investment, it usually means you’re getting more return for the risk you’re taking. But there is no such thing as a free lunch: once you start adding more and more Bitcoin, especially after about 5% of your total investment, this extra benefit doesn’t increase as much as the risk does. So, adding a bit of Bitcoin can be helpful, but after a certain point, adding more comes at the cost of significantly higher risk. Based on historical returns and mean-variance optimization, the optimal amount of Bitcoin to add to the portfolio ranged from 3% to 5%.

Figure 3: Three-Year Rolling Sharpe Ratio by Bitcoin Allocation (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

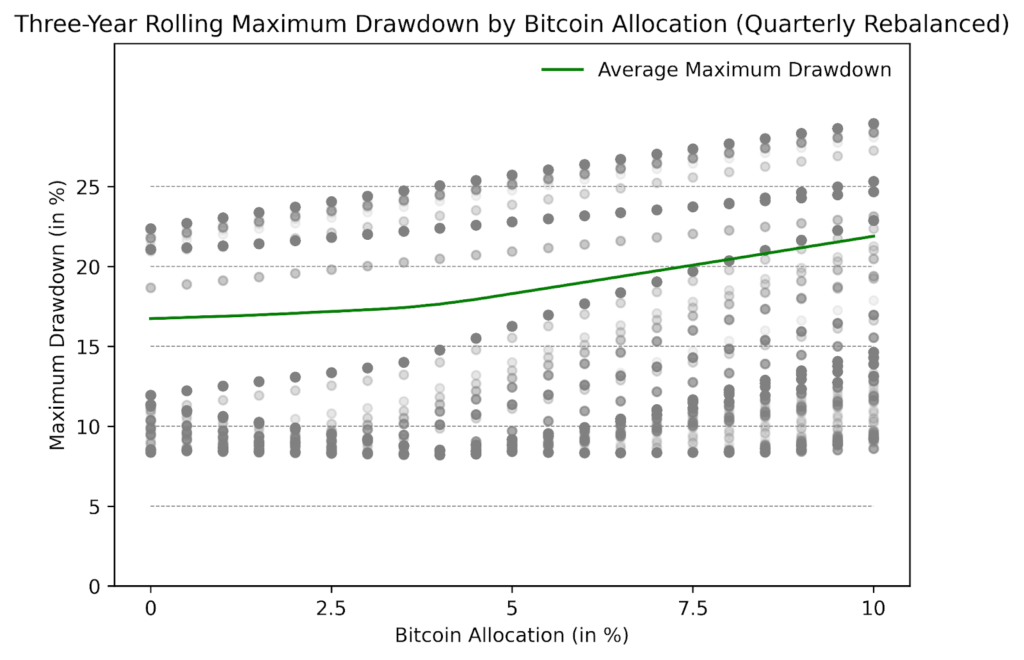

Figure 4 shows how different amounts of Bitcoin affect the biggest drop, or ’maximum drawdown,’ in an investment’s value. Similar to the Sharpe Ratio chart, the green line on the graph indicates that, on average, adding a little bit of Bitcoin, like between 0.5% and 4.5% of a 60/40 stock and bond portfolio, doesn’t change the maximum loss much over three years. Allocation over 5%, the effect on the biggest drop starts to grow a lot. For institutional investors with a low-risk appetite, sticking to a Bitcoin amount of 5% or less of the total investment may be the best from a risk-adjusted and maximum drawdown perspective.

Figure 4: Three-Year Rolling Maximum Drawdown by Bitcoin Allocation (Quarterly Rebalanced)

Source: Cointelegraph Research, CryptoResearch.Report

In conclusion, the exploration of Bitcoin as a component of a diversified investment portfolio reveals a delicate balance between risk and return. The data presented through various figures underscores the potential for enhanced cumulative returns with the strategic addition of Bitcoin, albeit with an accompanying increase in volatility. The sweet spot, according to historical data and mean-variance optimization, appears to be within the 3% to 5% range of total investment allocation.

Beyond this threshold, the risk-return trade-off becomes less favorable, highlighting the importance of cautious and informed decision-making when integrating Bitcoin into investment strategies. For investors seeking to navigate the complexities of adding digital assets to their portfolios, these insights offer valuable guidance on achieving a risk-adjusted approach that aligns with their financial goals and risk tolerance.