In an era marked by rapid technological advancements and shifting economic landscapes, the traditional investment portfolio has seen its fair share of transformations. Among these, the integration of digital assets, particularly Bitcoin, into conventional portfolios has sparked considerable interest and debate within the investment community. This article delves into the empirical evidence provided by Cointelegraph Research and CryptoResearch.Report, examining the impact of adding Bitcoin to a traditional 60-40 stock and bond portfolio. Through a comprehensive analysis spanning from 2014 to 2023, the study sheds light on the potential benefits and risks associated with diversifying into Bitcoin, offering valuable insights for both seasoned investors and newcomers to the crypto space.

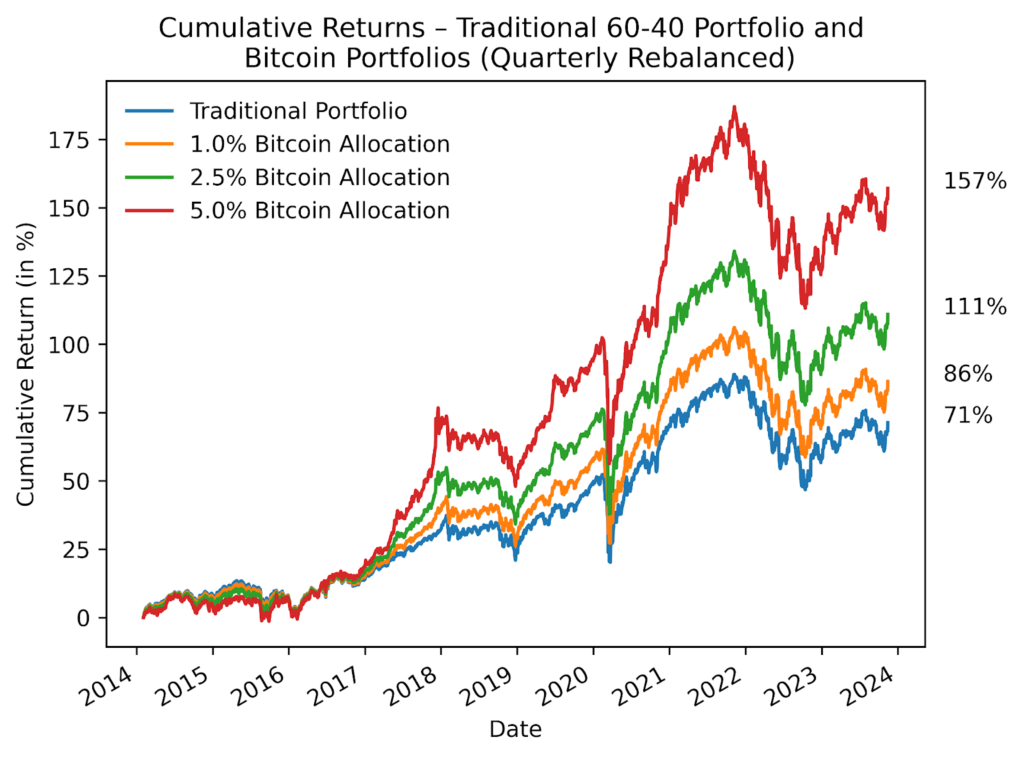

As the figure shows, a traditional 60-40 portfolio with quarterly rebalancing and no exposure to Bitcoin would have yielded a cumulative return of 71% between 2014 and the end of 2023. This would have increased to up to 157% had the portfolio allocated 5% to Bitcoin. Meaning Bitcoin gave over double the total return achieved by the traditional portfolio.

How Adding Bitcoin to a Traditional Portfolio Would Have Impacted Returns

Source: Cointelegraph Research, CryptoResearch.Report

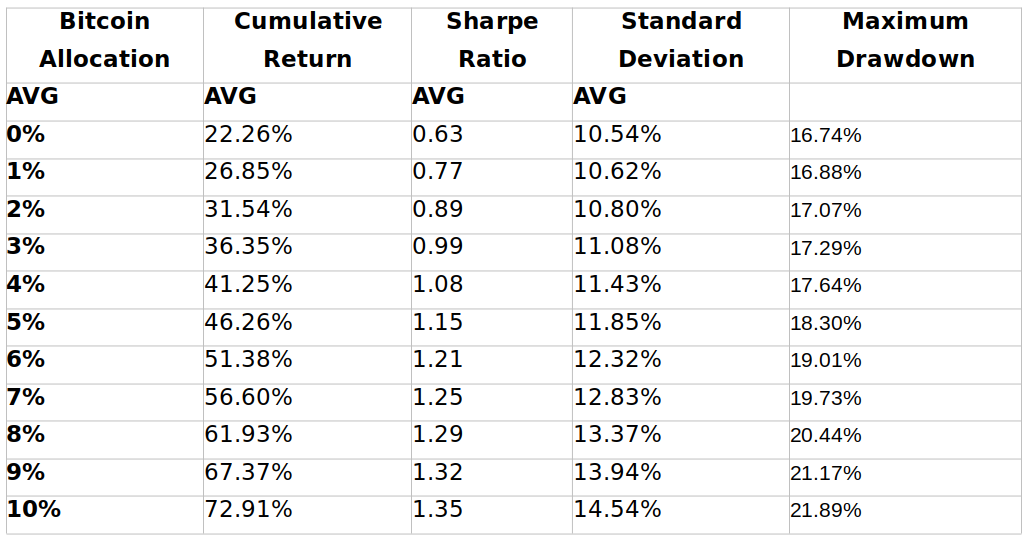

However, not all investors had the foresight or ability to invest in January 2014; therefore, the Cointelegraph Research team constructed a backtest that does not rely on arbitrary start and end dates. Instead, a rolling analysis was done on over 6,000 unique portfolios with one-, two-, and three-year holding periods. The rolling analysis also shows a doubling in the total return. A 5% allocation to Bitcoin in a 60/40 global stock and bond portfolio returned 46.26% on average compared to 22.26% for traditional portfolios without Bitcoin.

The next figure shows that these phenomenal returns did not come at the cost of significantly higher risk or higher drawdowns due to Bitcoin’s low correlation with traditional assets. Traditional stock and bond portfolios held for 1 to 3-year time horizons between 2014 and 2023 had an average Sharp Ratio of 0.63 and an average drawdown of 16.74%. Adding a 5% allocation to Bitcoin with quarterly rebalancing increased the Sharpe Ratio to 1.15 and the maximum drawdown to 18.30%, meaning that the portfolio’s risk-adjusted return increased by 82.5%.

Portfolio Performance Metrics

Source: Cointelegraph Research, CryptoResearch.Report

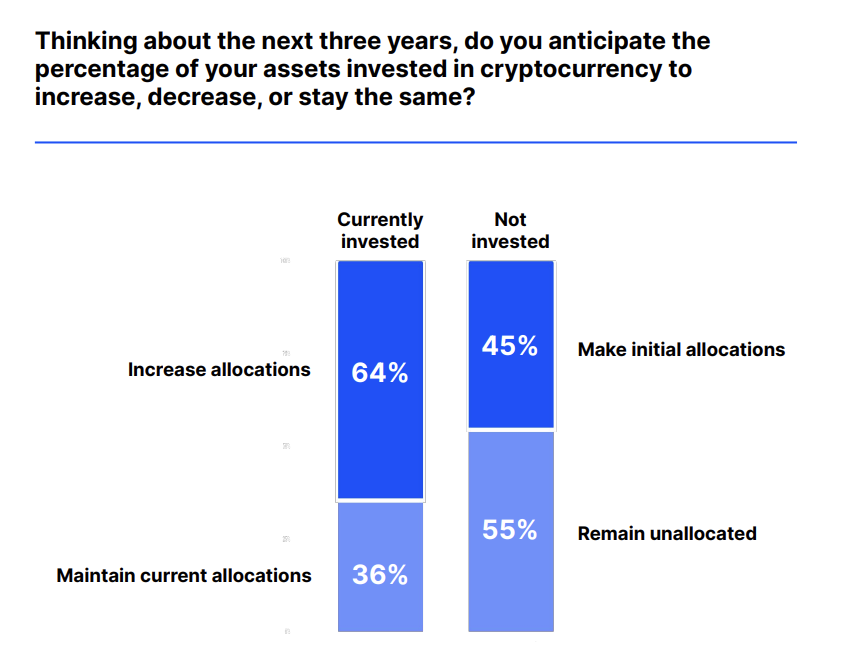

In November 2023, Coinbase conducted a research survey in collaboration with Institutional Investor to gain a comprehensive understanding of the attitudes and future perspectives of institutional investors regarding digital assets. Using an online questionnaire, the study asked questions to 250 institutional investors from the U.S. including hedge funds, asset managers, and allocators with $1B+ in AUM and $50M+ in some cases.

The survey revealed that 64% of existing investors anticipate boosting their investments in digital assets over the next three years. Additionally, 45% of the surveyed institutional investors who currently do not have crypto investments are planning to allocate resources to them in the coming three years. In terms of market outlook, 57% of the institutional investors surveyed are optimistic about cryptocurrency prices increasing in the next 12 months, a significant increase from just 8% who held this belief in October 2022. Moreover, the respondents expressed a belief in the potential of blockchain technology to supplant traditional payment and trade settlement systems in the future.

The exploration into the effects of incorporating Bitcoin into traditional investment portfolios reveals a compelling narrative of enhanced returns without proportionately escalating risk. The data, meticulously gathered and analyzed over various periods and through different portfolio configurations, underscores the substantial upside that a modest allocation to Bitcoin can contribute to overall portfolio performance. Furthermore, the positive sentiment among institutional investors, as highlighted by the Coinbase and Institutional Investor survey, signals a growing acceptance and optimism towards digital assets. As the financial landscape continues to evolve, the findings presented in this article serve as a critical reference point for investors contemplating the integration of cryptocurrencies into their investment strategies, highlighting the delicate balance between innovation and prudence in the pursuit of superior returns.