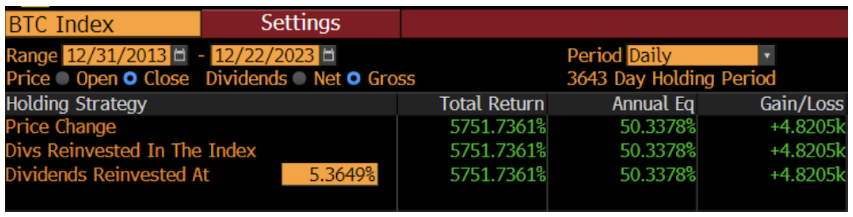

In the dynamic and often unpredictable world of cryptocurrencies, Bitcoin has emerged as a standout performer, demonstrating remarkable resilience and profitability over the years. Despite facing significant price fluctuations and criticisms, Bitcoin has managed to maintain an upward trajectory, proving itself as a viable asset for investment portfolios. With an annualized return of 50% since 2014 and a total return of 5,751.74%, Bitcoin has not only recovered from its lows but also significantly outperformed traditional investment options. This article explores the various benefits of incorporating Bitcoin into a traditional investment portfolio, drawing on recent research and data analysis to provide insights into optimal allocation strategies and the potential impact on portfolio performance.

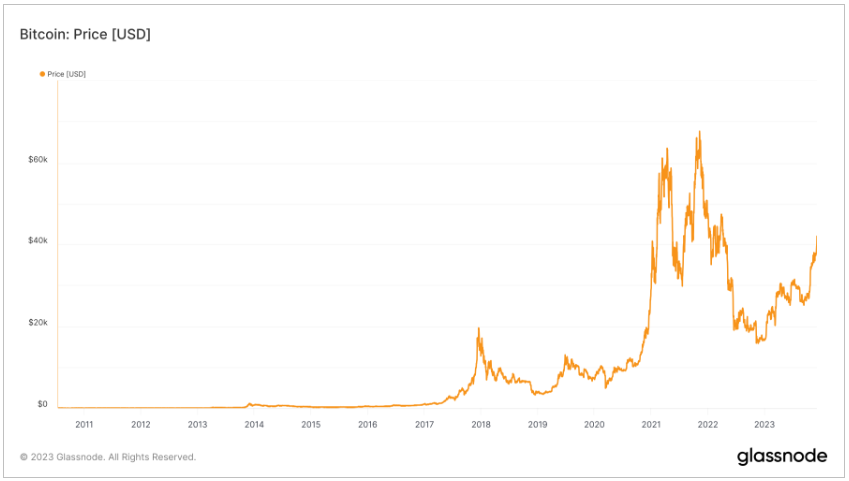

In 2023, Bitcoin experienced a phase of recovery. Bitcoin often receives media coverage relating to its price volatility. The value of Bitcoin has indeed fluctuated dramatically since its inception in 2009. Occasional collapses have attracted the allegation that Bitcoin is a Ponzi scheme. On aggregate, however, there has been a solid upward trend, and the asset has recovered from price drawbacks. Bitcoin’s annualized return has been 50% per year since 2014, and a total return of 5,751.74%, as reported by Bloomberg. Using data going back to 2010, Bitcoin’s annual return rate stands at an impressive 230%, dwarfing the Nasdaq 100 Index, the second-best performer, by tenfold. Comparatively, large U.S. stocks yielded a 14% annual return, high-yield bonds grew by 5.4%, and gold saw returns of 1.5% in the same period.

Bitcoin Annualized Return Has Been 50% Since 2014

Including Bitcoin in a traditional investment portfolio can enhance performance in various ways. Here are the main benefits covered in the subsequent sections:

- Improved Performance: Research suggests that small allocations of Bitcoin can have a positive impact on risk-adjusted returns when compared to other assets.1

- Diversification: Bitcoin is recognized for its low correlation with traditional markets, which can provide superior risk-adjusted returns.2

- Hedge Against Inflation: Investors might be interested in adding Bitcoin to their portfolios for purposes such as hedging against inflation3 and global financial uncertainty due to its properties as a scarce, secure, and price-inelastic digital commodity. It also has portability features that allow it to function similarly to money.4

Each of these points suggests different ways in which including Bitcoin in a traditional investment portfolio can influence its performance. The overall impact on an individual’s portfolio could vary depending on multiple factors, including the proportion of Bitcoin, the rest of the portfolio’s composition, and the broader economic and market conditions. It’s advisable for investors to carefully consider their own risk tolerance and investment goals and perhaps consult with financial advisers before making the decision to include Bitcoin in their portfolio.

Bitcoin Price 2010 – 2023

To understand the statistical impact of adding Bitcoin to a traditional portfolio, Cointelegraph’s research department replicated the 2020 Bitwise study, “The Case for Crypto in an Institutional Portfolio,” which was later updated in the 2023 Bitwise report, “Bitcoin’s Role in a Traditional Portfolio.”

Using the most recent data, Cointelegraph’s researchers answer three key questions that investors ask when allocating a portion of their portfolio to Bitcoin:

- How much Bitcoin should be added to a portfolio?

- How long should the position be held before selling?

- How often should the portfolio be rebalanced?

In the analysis we look at the three-year rolling cumulative return for the period between Jan. 1, 2014, and Nov. 13, 2023. We consider rolling analyses advantageous as they address worries about selective time period choices and offer a more comprehensive understanding of how frequently and significantly a Bitcoin allocation affects a portfolio across various market conditions. In rolling analyses, rather than selecting random start and end dates, we establish a specific duration for the holding period (one year, two years, or three years) and examine every possible holding period of that length within our data. The sample portfolios allocate up to 60% to the Vanguard Total World Stock ETF (VT), up to 40% to the Vanguard Total Bond Market ETF (BND), and a range of 0 to 10% in Bitcoin. The analysis used the 3-month treasury rate of 5.45% as the risk-free rate.

The inclusion of Bitcoin in a traditional investment portfolio offers a unique opportunity to enhance overall performance, diversify investment holdings, and hedge against inflation and economic uncertainty. The compelling data and research findings presented throughout this article underscore Bitcoin’s potential as a strategic asset capable of contributing positively to risk-adjusted returns. While the decision to allocate a portion of one’s portfolio to Bitcoin should be made with careful consideration of individual risk tolerance and investment goals, the evidence suggests that even modest allocations can yield significant benefits. As the financial landscape continues to evolve, Bitcoin’s role in investment portfolios is likely to grow in importance, providing investors with new avenues for achieving their financial objectives.

1Butterfill, James. “Bitcoin’s role in an investment portfolio.” CoinShares, 9 September 2020, https://coinshares.com/research/Bitcoins-role-in-an-investment-portfolio.

2“Should Bitcoin Be A Part Of Your Portfolio? Backtest, Allocations, And Simulations – Trading Strategies – Quantified Strategies.” Quantified Strategies, 2 October 2023, https://www.quantifiedstrategies.com/should-Bitcoin-be-part-of-your-portfolio/.

3“How Bitcoin may impact your portfolio.” Fidelity Investments, 23 January 2023, https://www.fidelity.com/learning-center/trading-investing/Bitcoin-investment-considerations.

4“Bitcoin in a Portfolio: The Impact and Opportunity.” Galaxy Digital, 2 October 2023, https://www.galaxy.com/insights/research/Bitcoin-in-a-portfolio-impact-and-opportunity/.