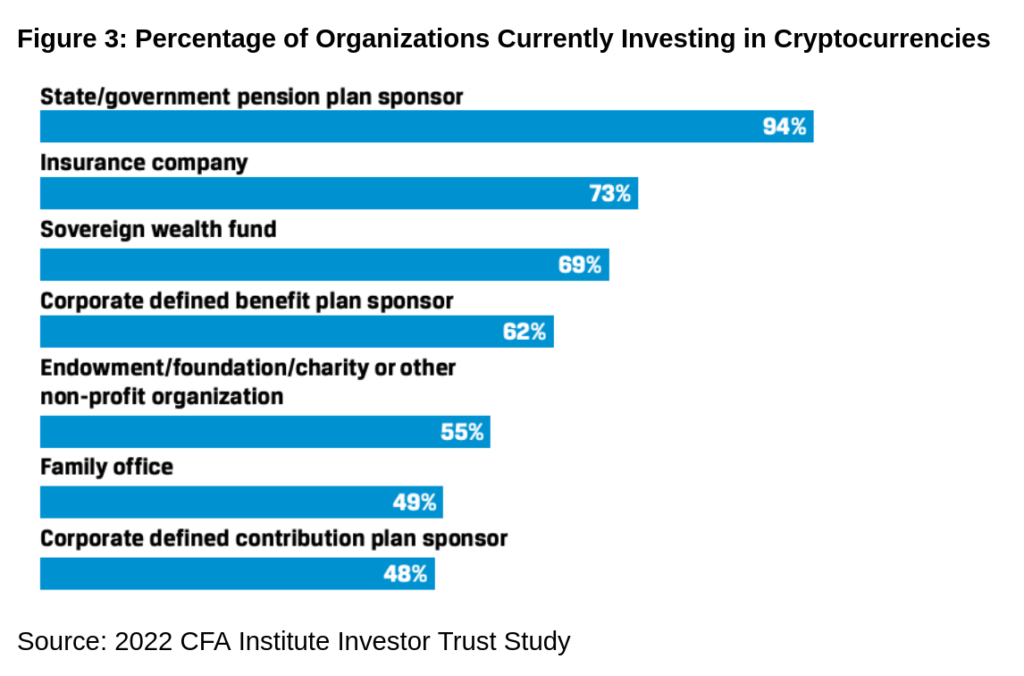

In the evolving realm of global finance, Bitcoin, a pioneering digital currency, has emerged as a popular alternative asset class. As per the 2022 CFA Institute Investor Trust Study, numerous financial entities including endowments, sovereigns, pension funds, and institutional investors, are gradually diversifying their portfolios to include cryptocurrencies like Bitcoin. This article delves into this shift in investment strategies, referencing a survey by Coalition Greenwich that reveals two-thirds of institutional investors’ exposure to cryptocurrencies. Furthermore, we explore the Lindy Effect, a concept that helps understand the perceived value and future stability of an asset class based on its longevity, and how it applies to Bitcoin.

One of the most researched alternative assets is Bitcoin, a pioneer in the world of digital currencies. According to the 2022 CFA Institute Investor Trust Study, endowments, sovereigns, pension funds, and institutionals are already allocating a portion of their investments to cryptocurrencies like Bitcoin, showcasing a gradual yet significant shift in asset allocation strategies.

For the study, Coalition Greenwich surveyed 3,588 retail investors and 976 institutional investors in October and November 2021 from 15 markets across the globe. The survey revealed an astonishing two-thirds of institutional investors have exposure to cryptocurrencies.

“Bitcoin is a compelling asset for institutions seeking diversification and inflation protection, and I expect adoption to accelerate in 2024.” Paul Tudor Jones, Founder of Tudor Investment Corporation (October 2023)

Percentage of Organizations Currently Investing in Cryptocurrencies

The Lindy Effect

It is conventional wisdom that humans look to staying power to judge if something is reliable in the future. If the ground shifts, builders would be weary to build a house upon it instead of looking for solid footing before the start of construction. In the same way, people look to the longevity of an asset class to judge its potential future stability as well. This has led the modern risk manager to look at things like an S&P 500 Index or government-backed bonds as a means of investing today’s capital for “safe” future returns.

The Lindy Effect puts into layman’s terms what economists describe by way of the Regression Theorem. In short, individuals look to the collective subjective value of something in the recent past and project that value to the current and short-term future times. However, this is often a recency bias which can lead people to invest in what has worked before believing it will always work in the future.

The Lindy Effect is often the barometer for commodities like gold and silver, as they have had thousands of years of documented history as a medium of exchange, stores of value, and industrial use. In the same breadth, Bitcoin has only been around since the Genesis Block was launched on January 3rd, 2009. To many, this remains an unproven medium of exchange or store of value as the asset itself lacks longevity in comparison to other asset classes.

To some, Bitcoin is a fad that will burn out like the pet rock. To others, there is an asymmetrical risk involved with flagrantly brushing aside Bitcoin instead of taking an educated look at the potential evolution of money.

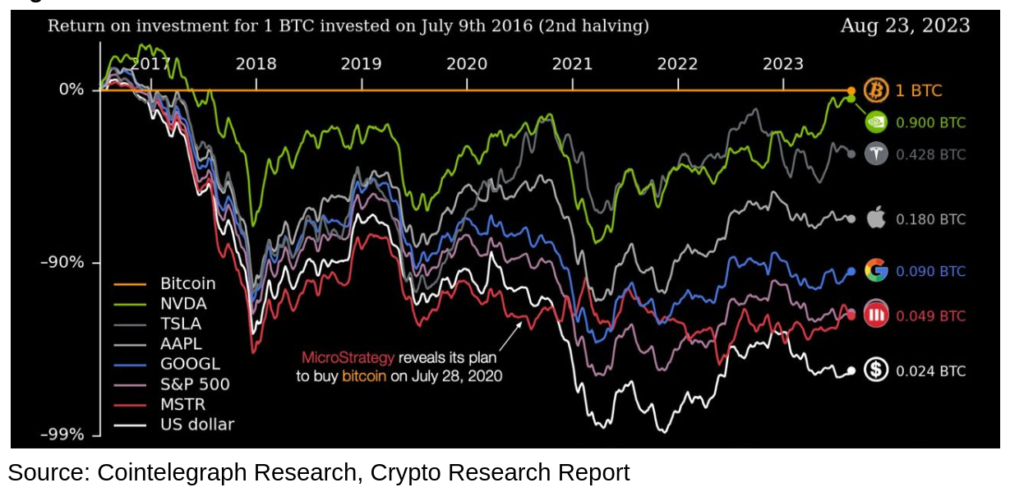

The pivot into Bitcoin has yielded phenomenal returns in contrast to other salient investments, such as Nvidia and Tesla, as shown in the next figure.

Bitcoin’s Return on Investment Since 2016

The perception of Bitcoin as an asset class is varied, with some considering it a short-lived trend while others view it as a significant evolution in the financial system. The Lindy Effect, used as a measure for the reliability of commodities like gold and silver, presents a challenge for Bitcoin due to its relatively short existence since its inception in 2009. However, the increasing interest and investment in Bitcoin by institutional investors indicate a potential shift in this perspective. As we move forward, it will be interesting to observe whether the financial world embraces Bitcoin as a reliable medium of exchange and store of value, or if it succumbs to the test of time.