In an ever-evolving financial landscape, the traditional approach to investment portfolios, often composed of a 60/40 split between equities and bonds, is facing new challenges. With diminishing returns, increasing inflation, and reduced diversification benefits, institutional investors are exploring alternative asset classes to bolster their portfolio performance. This article delves into the growing interest in alternative investments, their potential benefits, and the risks they may pose.

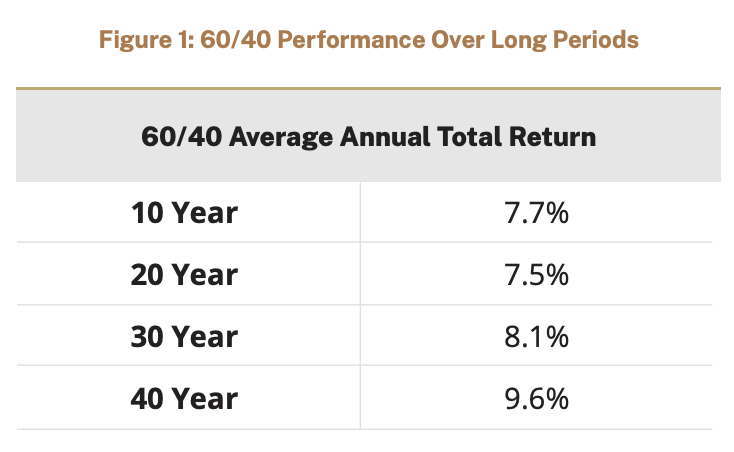

The 60/40 portfolio, traditionally composed of equities and bonds, has served investors reliably for decades, as shown in Figure. However, the conventional portfolio of stocks and bonds is no longer as efficient as it once was. Diminishing diversification benefits, reduced actual returns, and increasing inflation pose significant hurdles for family offices, endowments, and pension funds. With the evolving financial landscape, there’s increasing interest in diversifying this blend to include new asset classes commonly referred to as alternatives.

Institutional investors have significantly allocated resources to alternative investments for many years to enhance their returns. A 2023 survey by Fidelity Investments revealed that pension funds allocate 22% to such alternatives, whereas endowments and foundations dedicate 32% of their portfolio to them.1

Figure 1: 60/40 Performance Over Long Periods with Traditional Assets

Source: New York University. 60% S&P 500 Index, 40% 10-year U.S. Treasury Bonds. Simplify The Case for Alternatives Case Study. The results are hypothetical (data ended 12/31/22), do not indicate future results, and do not represent returns that any investor attained. Hypothetical strategies and indices presented are unmanaged and do not reflect management or trading fees. One cannot invest directly in an index

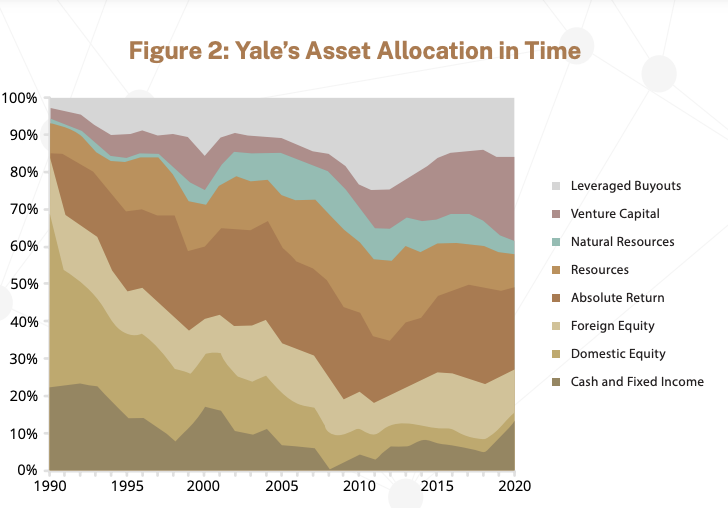

The prestigious Yale University Endowment, a bellwether in the institutional portfolio landscape, has increased its exposure to alternative assets. In the last three decades, their allocation to alternative investments has surged from below 20% to above 77%, as illustrated in Figure 2. This strategic shift has proven beneficial for Yale; over the two decades concluding in June 2022, their portfolio garnered an average yearly return of 11.3%, compared to the 60/40 portfolio’s 7.2%.

Source: Yale Investments Office, 2023, Simplify The Case for Alternatives Case Study.

WHAT IS AN ALTERNATIVE INVESTMENT?

An alternative investment is an investment in assets different from traditional investment forms such as stocks, bonds, and cash. Typically, alternative investments include hedge funds, private equity, real estate, commodities, and tangible assets like art and antiques. They can also encompass newer asset categories like cryptocurrencies. Alternative investments are known for their potential to provide diversification benefits to a portfolio because their returns often have a low correlation to traditional asset classes. However, they may also come with higher fees, less liquidity, and a higher investment threshold compared to traditional investments.

The world of investment is undergoing significant transformation as traditional asset classes like stocks and bonds no longer offer the same level of efficiency and returns. As a result, institutional investors are turning to alternative investments such as hedge funds, private equity, real estate, commodities, and even cryptocurrencies to diversify their portfolios and enhance their overall returns. While these alternative assets come with their own set of risks and challenges, including higher fees and less liquidity, their potential for diversification and higher returns cannot be overlooked. As we navigate this changing financial landscape, it’s clear that alternative investments are playing an increasingly crucial role in institutional investment strategies.