As cryptocurrency continues to grow in popularity, larger organizations such as hedge funds and decentralized autonomous organizations (DAOs) have to deal with the reality of growing regulation, risk from hackers, and responsibility to their clients. One of the most important factors for these organizations is choosing the right custodian for their assets. However, with the sheer number of options available and the secrecy of the industry, finding the right custodian can be a daunting task.

While self-custody (“your keys = your crypto”) remains the ideal for cryptocurrency purists, larger organizations, such as hedge funds and Web3-native entities, such as decentralized autonomous organizations (DAOs) have to grapple with the reality of growing regulation (by governments), risk (from hackers) and responsibility (to their clients).

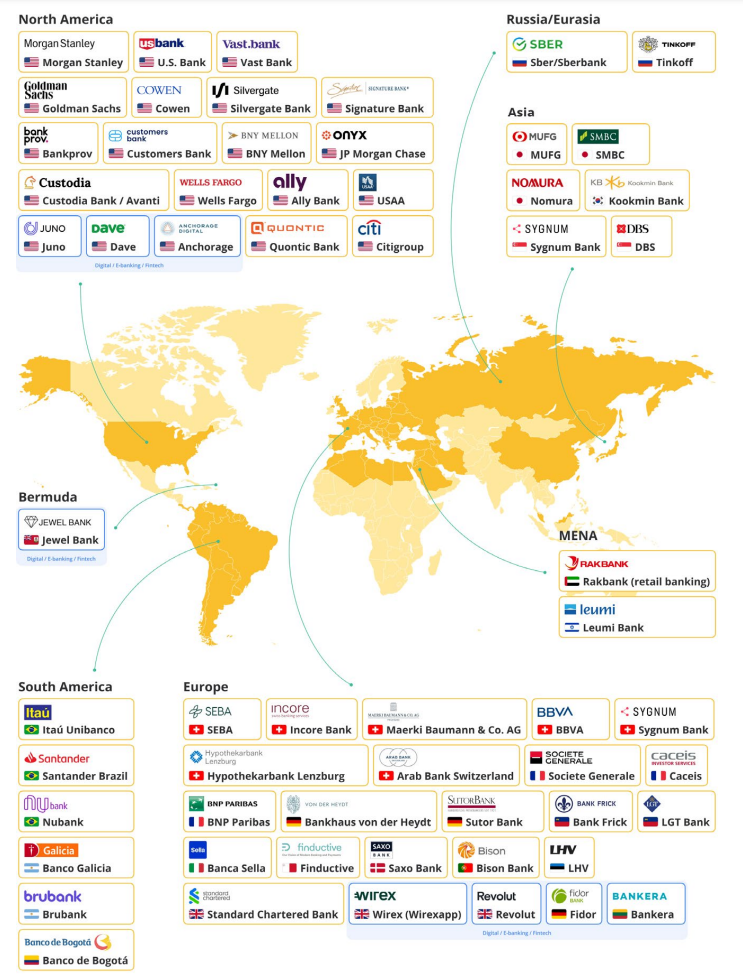

The custody landscape, like everything else, is an emerging field with a range of heterogeneous solutions. In addition to the sheer number of options available, the expected secrecy of the industry makes it difficult to find details unless you are able to ask very specific questions and know the range of the offerings at hand.

We’ve narrowed down the important factors for the potential custody user.

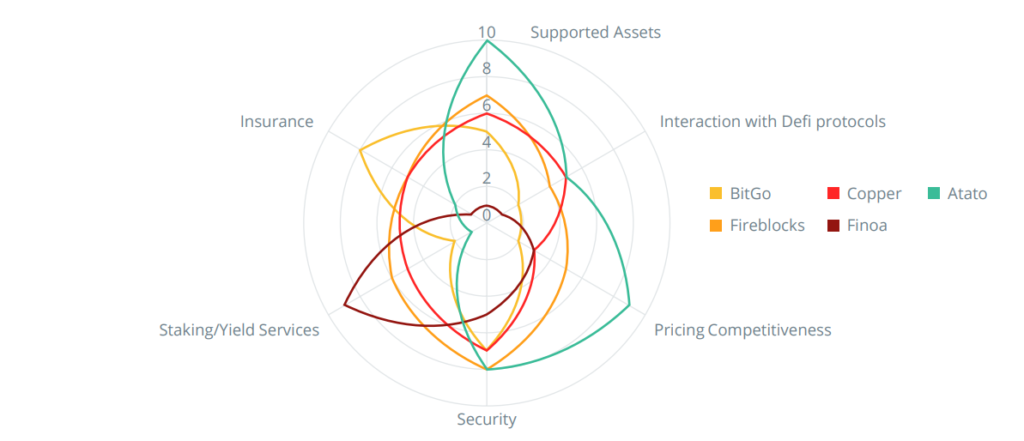

DeFi Connectivity

The sprawling world of DeFi, with its decentralized lenders, trading platforms and native tokens, such as stablecoins, is continuously evolving. The ability to connect and trade seamlessly within and between these protocols is vital for clients, for whom DeFi represents a core part of their strategy.

Staking/Yield Services

Putting your money to work by staking (on a validator node) or earning yield (via DeFi protocols) is an increasingly vital part of crypto investing. It also requires time and effort that could be spent elsewhere, and the ability of a custodian to take on this role represents a distinct advantage for the professional investor.

Supported Assets

History (especially recent history) has shown that there are no “safe” coins, so it is necessary to build a diversified portfolio, not only across tokens but also across chains. Ideally, a custodian should be able to support any asset you bring, but in reality, the ability to add new coins can be constrained in the case of older technology.

Pricing Competitiveness

The traditional pricing structure is to charge based on asset value (assets under custody) and the number of transactions. New providers are increasingly innovating on pricing models, including offering fixed fee subscriptions, tiered by service level, which can mean significant savings in comparison to asset or activitybased fees (which are not capped). Thus, pricing structure (basis points or $) is often more important than price level (25 bps vs. 35 bps).

Security

The most basic and most important service of a custodian is to keep assets safe. There are multiple methods that custodians use to keep your keys secure (MPC, HSM) and various ways in which they can demonstrate the efficacy of these systems (such as audits). Systems ultimately demonstrate their security when they manage to scale without being successfully hacked or experiencing a major code failure. But ultimately, a history of no major hacks or code failures is the truest testament to a system’s security.

Insurance

Since no security system is invulnerable and human beings are fallible, insurance is the last line of defense and should, in theory, provide users with ultimate peace of mind. The reality of crypto custody insurance is often patchy, so even if a custodian claims to be insured, it is important to pay attention to the level and terms of coverage, ideally with an expert trained to read the fine print.

Choosing the right custodian for cryptocurrency assets is crucial for larger organizations dealing with growing regulation, risk, and responsibility. Factors such as DeFi connectivity, staking/yield services, supported assets, pricing competitiveness, security, and insurance are important considerations when choosing a custodian. By carefully considering these factors, organizations can ensure that their cryptocurrency assets are safe and secure.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.