The world of cryptocurrency is constantly evolving, and so are investor attitudes towards it. According to a recent survey by Cointelegraph, nearly two-thirds of professional investors report holding crypto assets in their personal portfolios, marking a significant increase in the past two years.

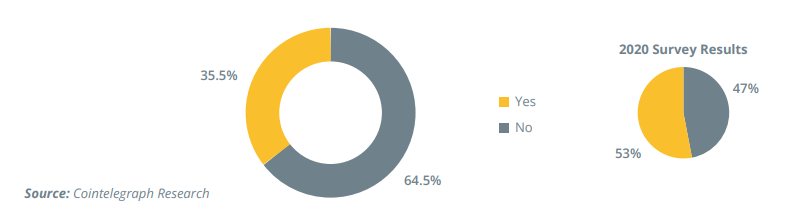

Close to 2/3 of the professional investors say they hold crypto assets in their personal portfolios. This represents a staggering increase of 18% since the last Cointelegraph survey was done two years ago.

What type of investor is your company?

Several case study resopndents stated that they had privately invested in Bitcoin and other digital assets, while their institutions had not yet made any direct investments.

Are you personally invested into crypto assets?

However, the majority of respondents had a high level of decision-making ability within their firm. A possible explanation for this can be that asset allocators are investing with higher risk aversion when investing on the behalf of others than when investing their own wealth.

While such investors may be more inclined to take risks with their personal wealth, the survey also highlights the fact that institutional investors may approach cryptocurrency investments more cautiously, due to the responsibility they have for the assets of others. As the cryptocurrency market continues to mature, it will be interesting to see the evolving attitudes of investors towards this fascinating and often unpredictable asset class.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.