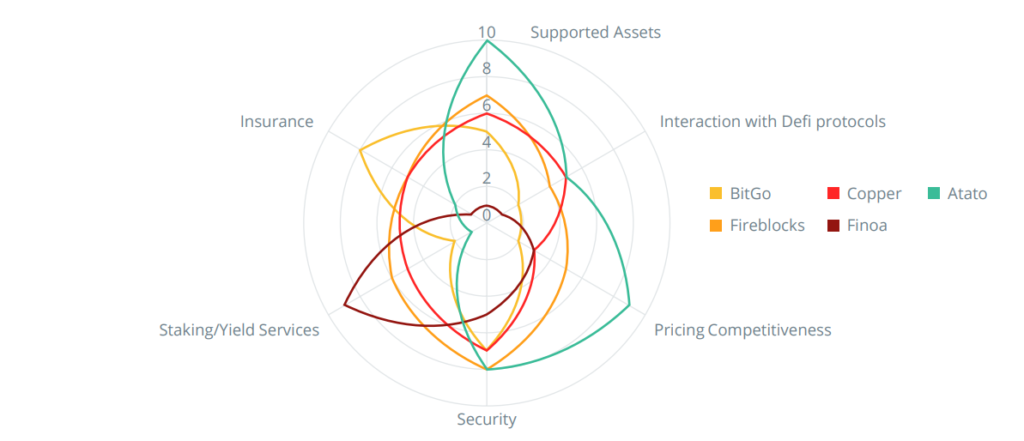

There is not a single crypto custodian that scores highly on every dimension, and custodians exhibit different strengths. The right custodian depends very much on the needs of the client.

An Insider Insight with John Gu, CEO of AlphaLab Capital Group

The OGs (Example: BitGo)

This group consists of qualified custodians whose clients are also highly regulated institutions — e.g., Fidelity, Calpers. Their service offering reflects the conservative trading needs of their client base, and while they may be relatively expensive, they are the ideal choice if your primary goal is to minimize risk.

New Guard (Examples: Fireblocks, Copper)

The “second wave” of custodians has established a dominant position in an adjacent market to the OGs and differentiates itself by offering a broader range of services. As such, they are not primarily focused on minimizing risk. They attract clients — e.g., mid-sized hedge funds — with more complex trading requirements, for whom the trade-off between regulatory certainty and enhanced functionality makes sense.

Challengers/Upstarts/Wildcards (Example: Atato)

This group often originates from non-Western markets. They compete with the New Guard, aiming to offer a similar or improved breadth of service — e.g., Atato’s “Bring Your Own Chain” offering supports all assets, past, present, and future — with enhanced usability and a lower price. They represent an attractive choice for smaller funds or startups with complex needs, higher price sensitivity and a willingness to take a chance on a new player.

Specialists (Example: Finoa)

For investors who require deep expertise in a specific area — e.g., staking services — it may make sense to use a specialist custodian in lieu of or in addition to one of the generalists. In the future, one would expect the specialists to raise their performance across the other axes or for the generalists to raise their game to accommodate specialist needs. For now, a multi-custodian approach may be the best bet.

The above represents the current state of the market and not the end or ideal state. That said, we do not believe that winner-takes-all effects will prevail, leaving one or two dominant players as the main or only viable choice. The crypto investor market is uneven and calls for a range of players to fulfill various use cases. Knowing what you need is therefore key, and (for now at least) performing careful due diligence is paramount.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.