As cryptocurrencies gain more mainstream attention and adoption, institutional investors are looking to enter the market. But what infrastructure is required for these investors to buy and hold digital assets? This article provides an overview of the service providers and intermediaries involved in institutional trades of digital assets, as well as an interview with BBVA Switzerland’s Head of Client Solutions on their approach to offering digital assets to their clients.

What happens if a professional investor decides to buy cryptocurrencies directly? What service providers and intermediaries will be involved in that transaction?

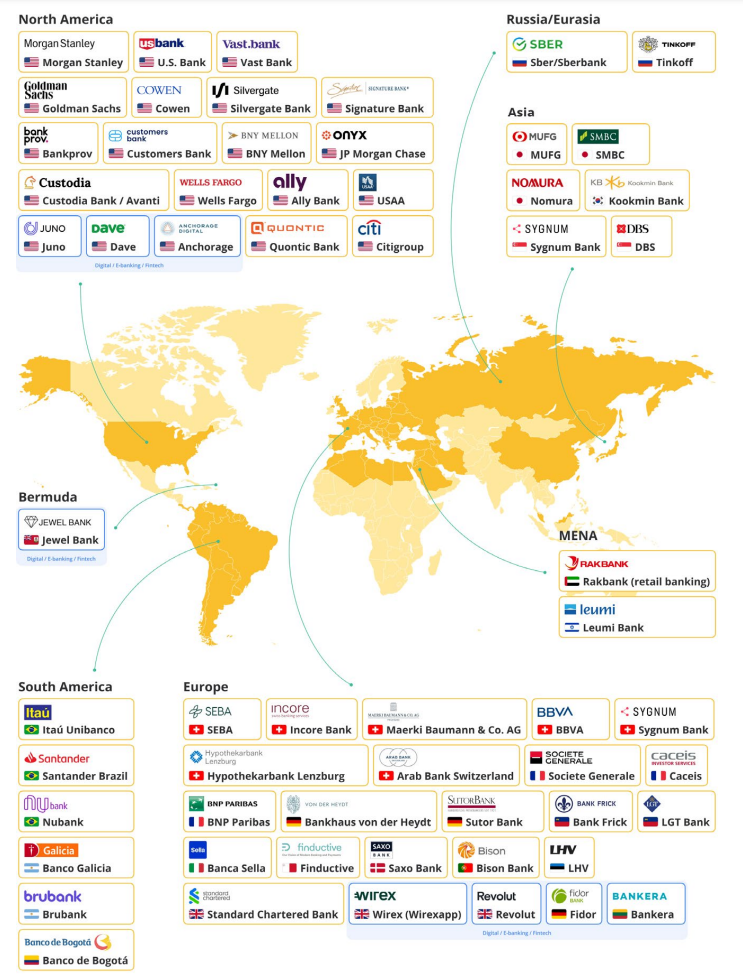

This section focuses on the infrastructure stack that institutional investors required in order to invest in digital assets. An overview of the main banks that facilitate institutional trades of digital assets across the globe is presented in ecosystem maps.

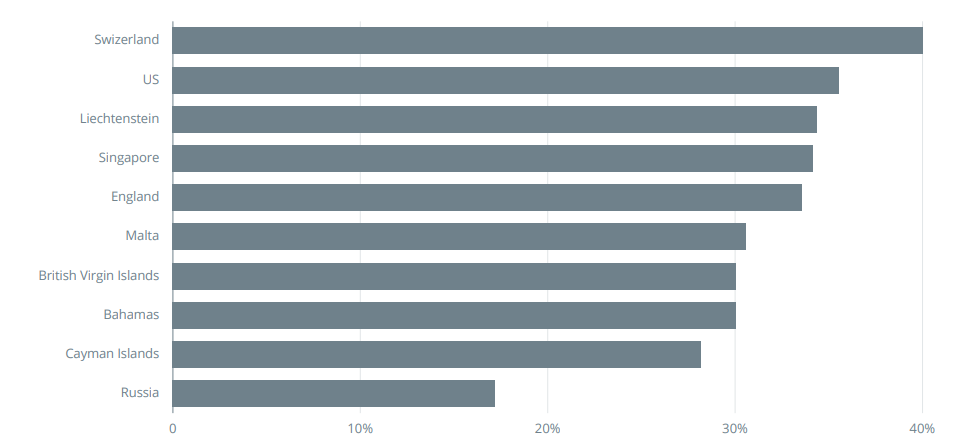

Figure 1: Professional Investor Ranking of Each Geographic Jurisdiction’s Investment Worthiness for the Incorporation of Blockchain-based Financial Products and Companies

Insider Insight Interview with Silvia Ibarra, Head of Client Solutions at BBVA Switzerland

What kind of digital assets does BBVA offer to its clients?

In 2021, BBVA through its subsidiary in Switzerland incorporated the two most important protocols of the cryptoasset market in its value proposition, Bitcoin and Ethereum. The robustness of the Swiss banking system together with a regulatory framework in DLT allows us to be 100% aligned as players in this new space.

Is that for Europeans only?

Thanks to the open architecture of our service, our clients are mainly located in the geographies where BBVA is present. We have detected a strong appetite for cryptocurrencies among Latin America and Europe private banking investors, who want to diversify their investments, from private clients to institutional investors.

Do you have clients explicitly requesting access to cryptocurrencies or digital assets? What’s the sentiment?

The service is exclusively designed for clients seeking diversification in this type of assets and who want to personally manage their portfolios. The main advantage of this service is that they are able to integrate the management of their traditional portfolio with the digital one, while belonging to a bank with international presence, regulated and with more than 150 years of history. In addition, we find that the investor profile that is interested in this type of asset does not respond to a specific age, geography or wealth level, but rather we are increasingly finding a more diverse client profile that is very interested in emerging technology and new trends.

Does BBVA have BTC and ETH products? Any other products planned for the year ahead?

For BBVA Switzerland, the correct direction is more important than speed. We started with the two most important protocols on the market which are also complementary and, of course, we will gradually incorporate new services adapting to the advances in technology, with the most absolute responsibility, always looking for a solid rationale for customers. Large Banks will be able to guarantee the proper and serious transition in a way where technology will be the catalyst to achieve new goals for the finance industry.

Figure 2: Banks that work with Crypto & Blockchain

The adoption of digital assets by institutional investors is an important development in the cryptocurrency space. As more service providers and intermediaries enter the market to facilitate these trades, it will become easier for institutional investors to gain exposure to this emerging asset class. BBVA Switzerland’s approach of starting with the two most important protocols and gradually incorporating new services shows a responsible approach to the adoption of emerging technology in the finance industry.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.