Options are an important tool for investors to manage volatility risks, and the cryptocurrency market is no exception. While the volume of options traded is still lower compared to futures, there is still significant potential for growth, as shown by the ongoing downtrend in at-the-money implied volatility for both Bitcoin and Ether. This could indicate that the market is maturing and attracting more institutional participation.

Options are one of the most important instruments for investors to hedge against unexpected volatility. Just as with futures, there are some options on digital assets that are issued by traditional institutions and others by cryptocurrency exchanges. Of those, Deribit is by far the most important. More than 95% of all cryptocurrency option trading activity happens on this exchange. The monthly volume of options transactions was between $10 billion and $20 billion for Bitcoin and between $5 billion and $15 billion for Ether-denominated options in 2022.

As you can see, the volume of options traded is about two orders of magnitude lower than that of futures. In traditional financial markets, the ratio of futures volume to option svolume is around 3.9.29 This indicates that derivatives options have a long way to go and represent the vast potential for growth.

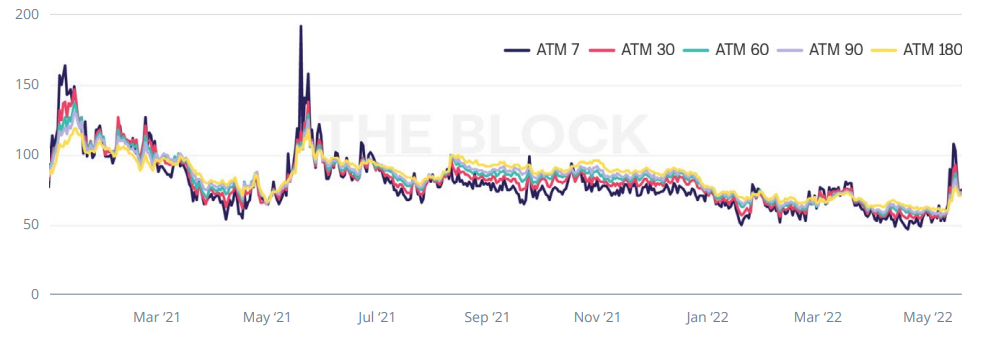

An interesting picture emerges if we look at at-themoney implied volatility. This is a representation of future volatility that traders expect. We can see a slow but steady downtrend in ATM implied volatility for both Bitcoin and Ether. A notable exception is the peak in May 2022 following the demise of LUNA.

This ongoing downtrend is the hallmark of maturing markets and better hedging, which could be indicative of more institutional participation.

Bitcoin ATM Implied Volatility

If we reconsider the chart overlaying Form 13F filings with Bitcoin’s price, we can see that institutional interest is driven by price. When Bitcoin outperforms all other asset classes, even institutions are willing to look past the regulatory uncertainty and volatility and want to get in. But digital asset prices have been mostly sideways or negative YoY.

The cryptocurrency options market has significant potential for growth, as shown by the increasing institutional interest and ongoing downtrend in implied volatility. While the volume of options traded is still lower compared to futures, this could change as the market continues to mature and attract more investors. As such, it will be interesting to see how this market develops in the coming years and what opportunities it presents for investors looking to manage their risks.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.