Digital asset futures have become increasingly popular among professional traders due to their liquidity and market sentiment indicators. Perpetual swaps, which are never settled, dominate the digital asset futures market. Open interest, a measure of active futures positions, has increased significantly over the past year, particularly during bullish periods.

Digital asset futures are almost exclusively perpetual swaps (mostly called perpetuals or just “perps”), which means they are never settled.

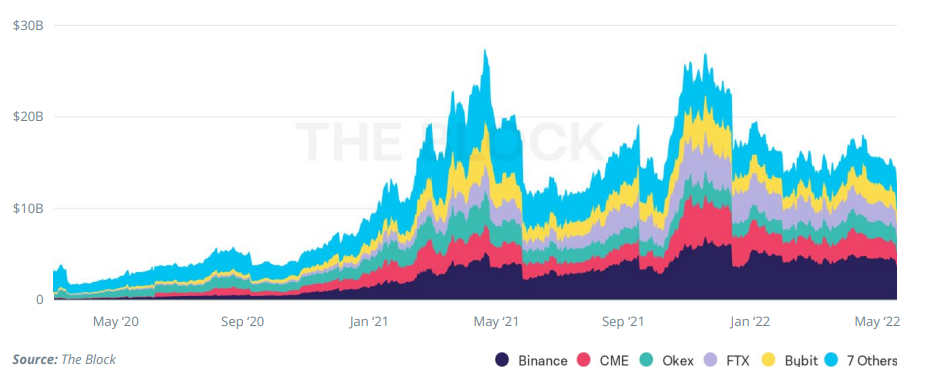

Open interest is a great measure of future liquidity. Open interest measures the value of active futures positions held. It increases when more contracts are opened than closed on a specific day. Looking at the development of open interest shows peaks during bull markets in the spring and winter of 2021. The overall level has increased by about 30% in 2022 compared to last year and by more than five times from 2021 to the year before.

Open Interest of Bitcoin Futures

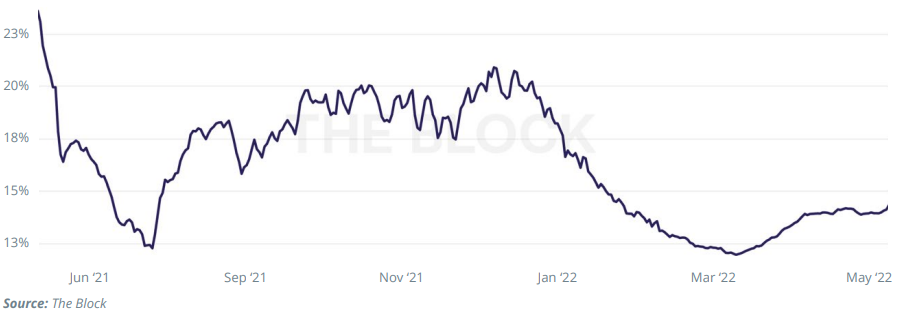

Comparing the liquidity of futures to the spot market reveals why derivatives are so attractive to professional traders. Spot markets offer a fifth to an eighth of the liquidity of derivatives markets for Bitcoin and a quarter to a fifth for Ether.

The volume of traded Bitcoin futures is between $1.5 trillion–$2 trillion worth in any given month, about slightly less than half of that for Ether. Compared to the traditional futures market, where a multiple of this is traded every day, it is a small change.

Bitcoin Spot to Futures Volume

Another important metric to consider is funding rates. Perpetual funding rates indicate the market sentiment. Put simply, positive funding rates mean long traders pay short traders so that the price of the perpetual aligns with the spot price. If funding rates are consistently positive, markets are bullish. Consistently negative funding rates are found in bear markets. Both Bitcoin and Ether funding rates have been hovering around 0%, which aligns perfectly with the slowdown in institutional interest from Form 13F filings and inflows into digital asset funds.

As the digital asset market continues to evolve, perpetual futures are becoming an important tool for professional traders seeking liquidity and market sentiment indicators. While Bitcoin and Ether dominate the digital asset futures market, other cryptocurrencies such as Ethereum Classic, SOL, XRP, Tether, and BNB are also gaining traction. As the industry continues to grow, it will be interesting to see how digital asset futures evolve and what new metrics and indicators traders will use to inform their strategies.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.