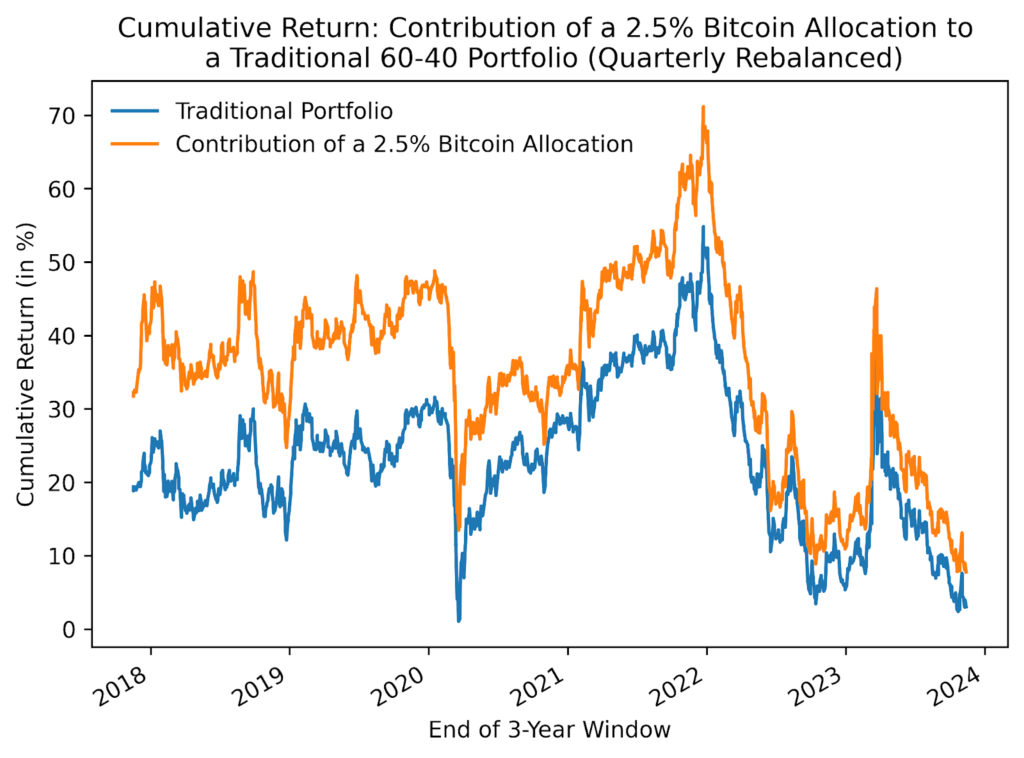

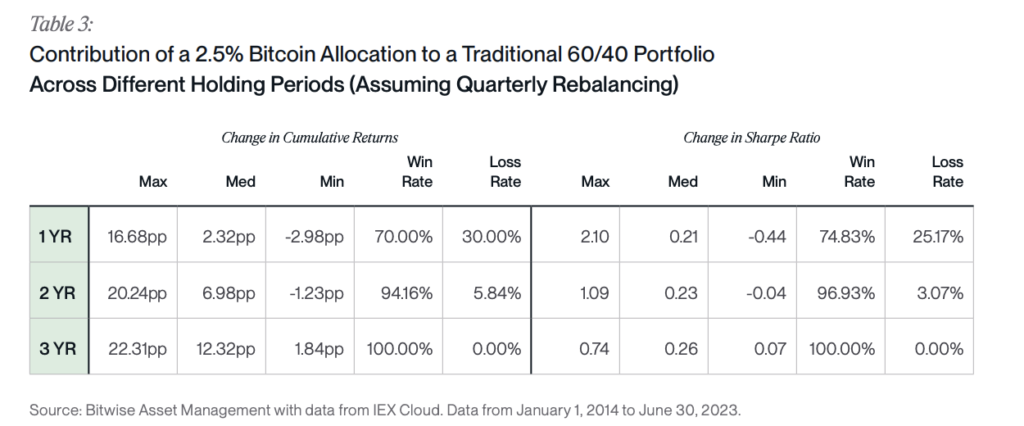

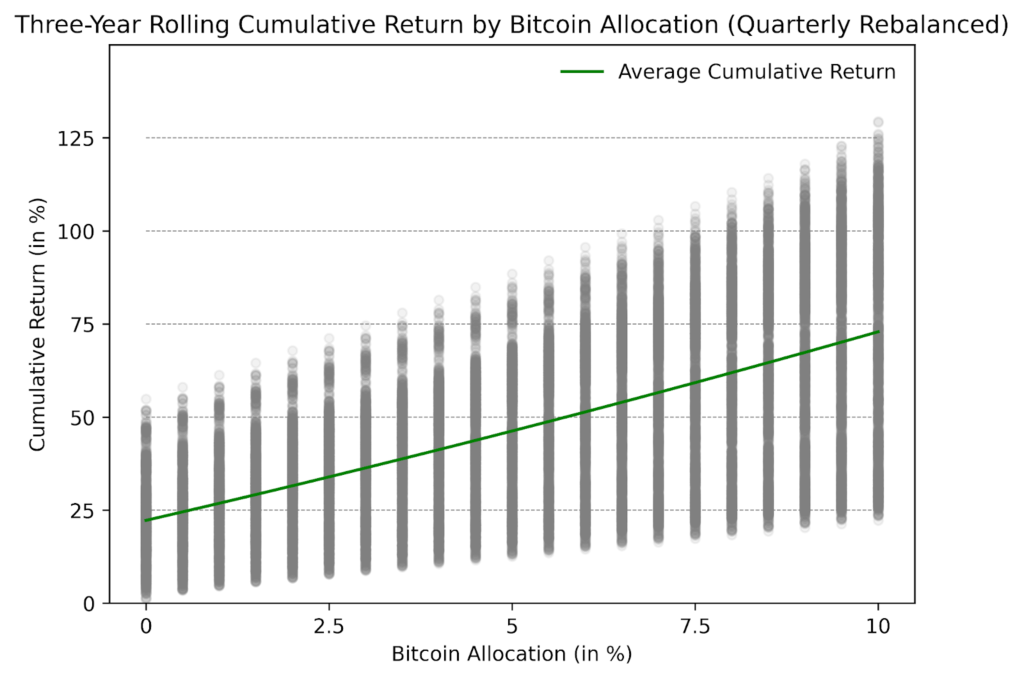

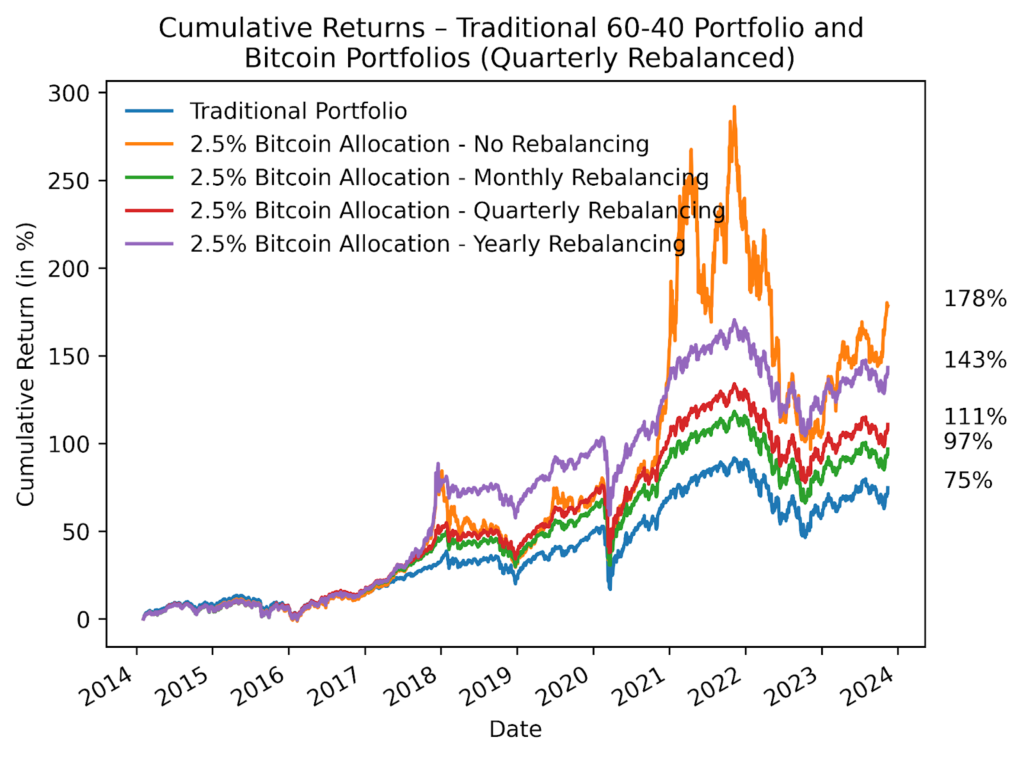

In the evolving landscape of investment strategies, the integration of digital assets like Bitcoin into traditional portfolios has sparked considerable interest and debate among investors. This analysis ventures into the realm of portfolio management with a specific lens on the impact of including Bitcoin, with a modest allocation of 2.5%, on the overall performance and volatility of a traditional investment portfolio over nearly a decade, from January 1, 2014, to November 23, 2023.

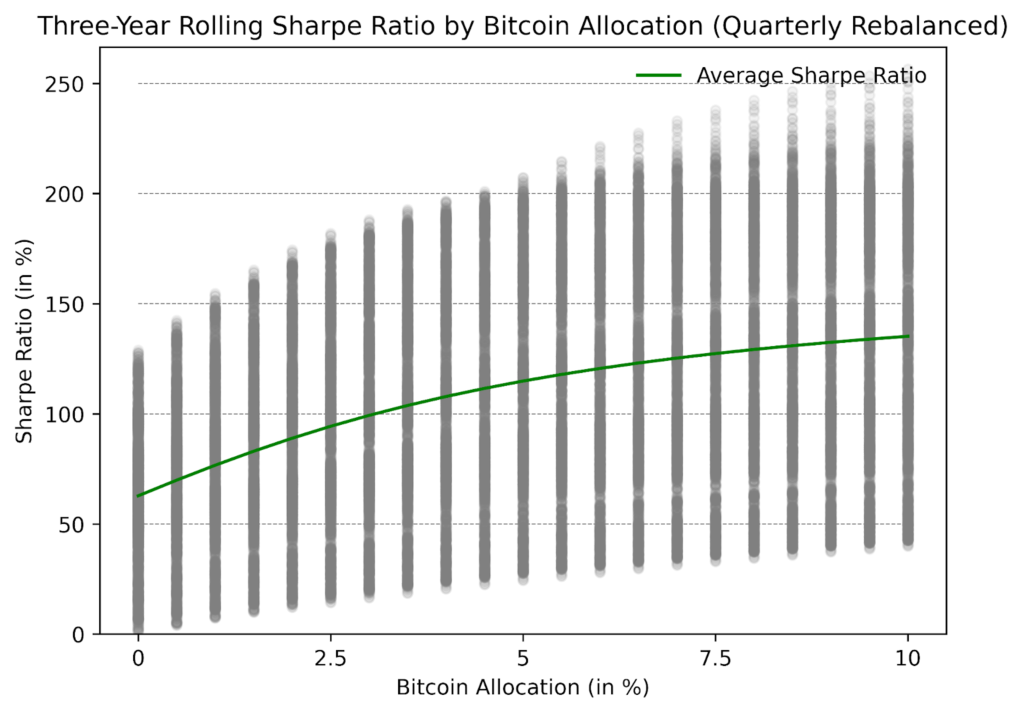

By employing a meticulous approach that examines the three-year rolling cumulative returns day by day, this study illuminates the outcomes of various rebalancing strategies – or the lack thereof – in enhancing portfolio returns while managing risk. Through the clear graphical representation and comprehensive summary statistics, our investigation seeks to offer valuable insights into the optimal integration of Bitcoin in diversifying investment strategies, navigating the trade-offs between return maximization and volatility control.

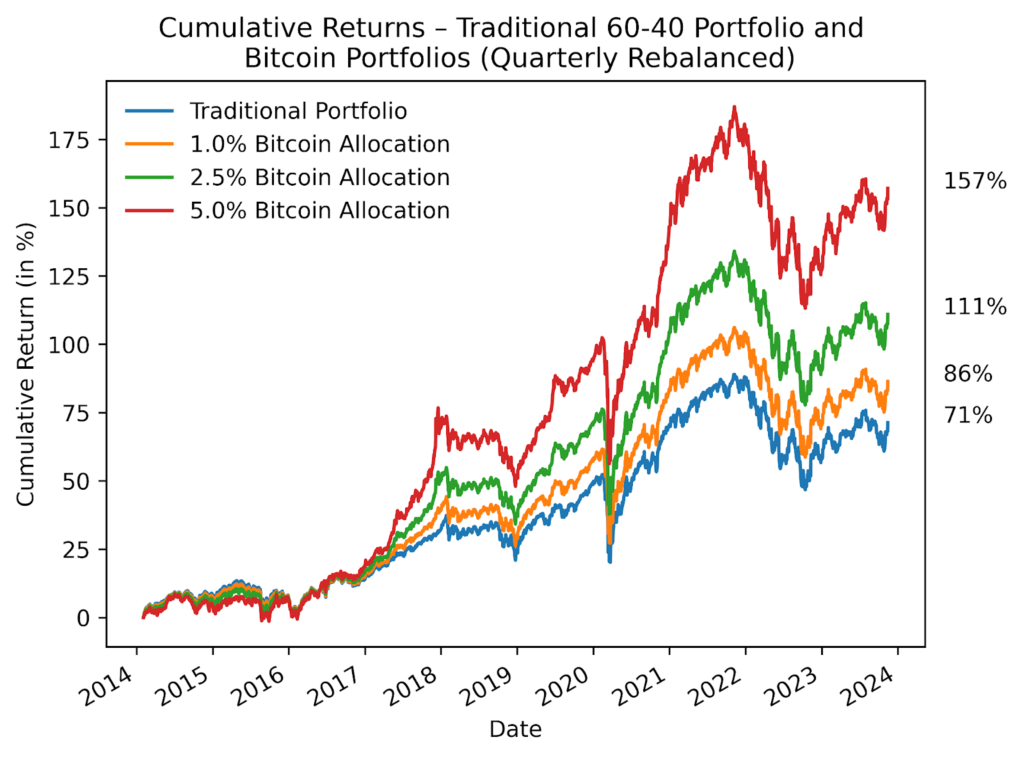

In the following analysis, we assume a 2.5% allocation to Bitcoin and look at the three-year rolling cumulative return for the period between Jan. 1, 2014, and Nov. 23, 2023. This means that we calculate the cumulative return for three years and then move forward day by day. As depicted in Figure 20, no rebalancing provided the best results historically when measured by cumulative return.

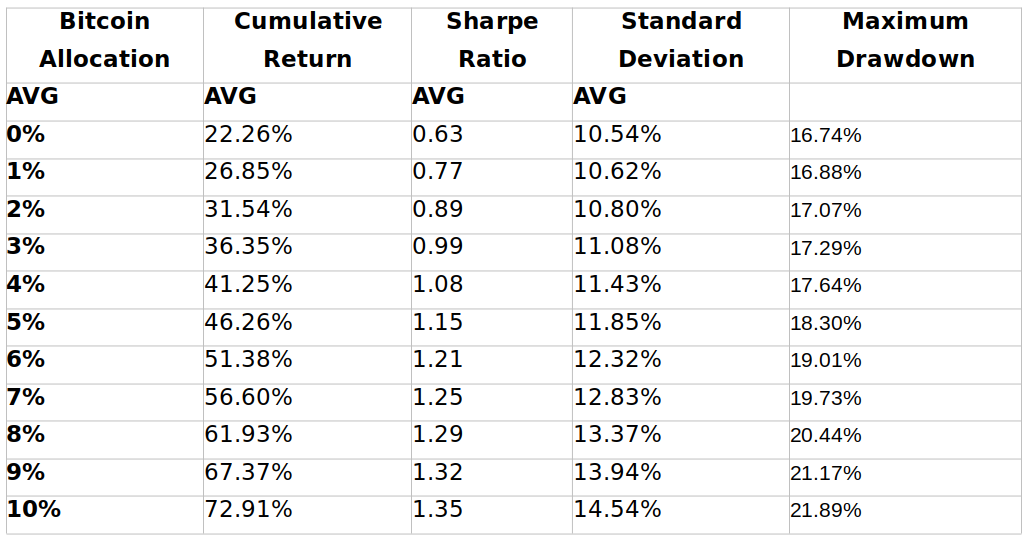

No rebalancing provided a 178% return compared to a portfolio with no Bitcoin, which provided a 75% return. However, rebalancing strategies can reduce risk, especially when combined with uncorrelated assets. Historically, the best rebalancing frequency for Bitcoin was yearly (143%), followed by quarterly (111%), followed by monthly monthly (97%). Essentially, this points out that letting the Bitcoin position breathe as much as possible within the portfolio has historically provided the best results.

Figure 1: Comparing Rebalancing Strategies for Bitcoin in a Traditional Portfolio

Source: Cointelegraph Research, Crypto Research Report

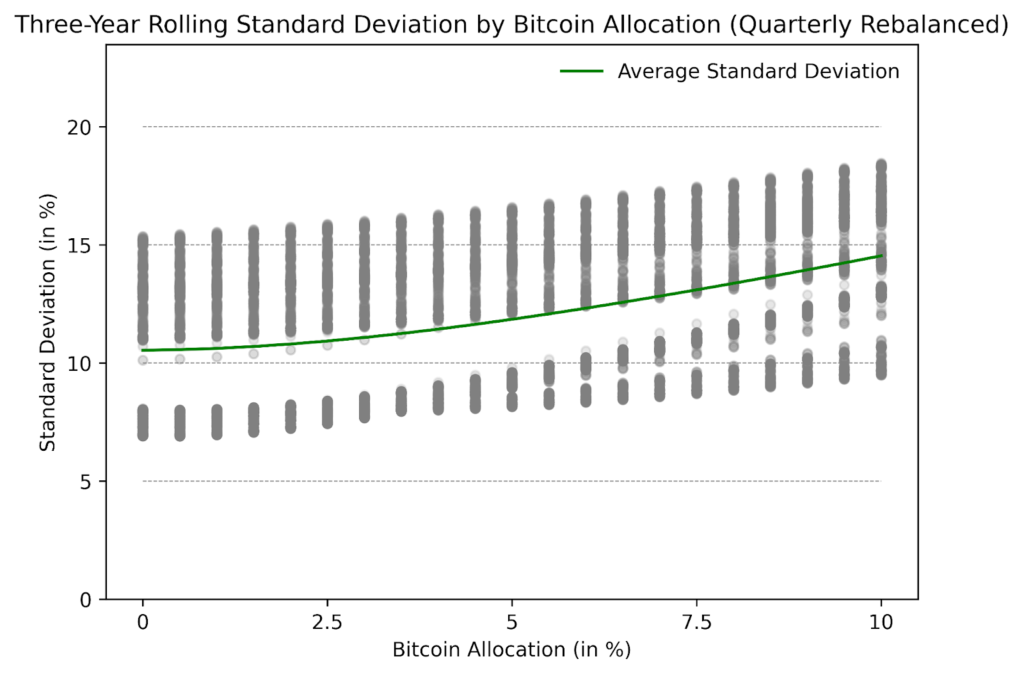

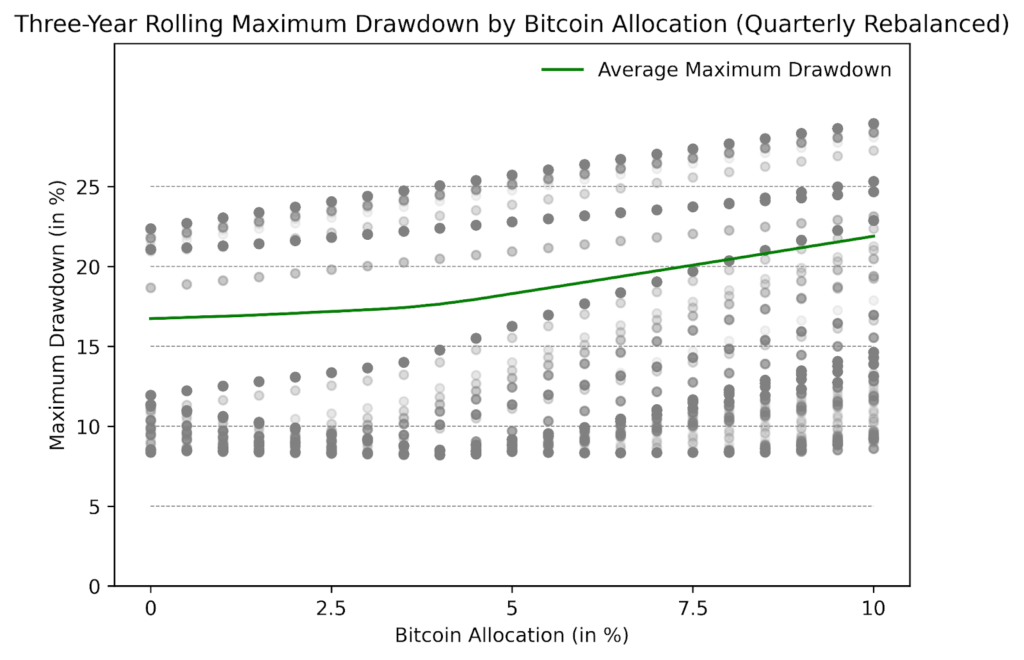

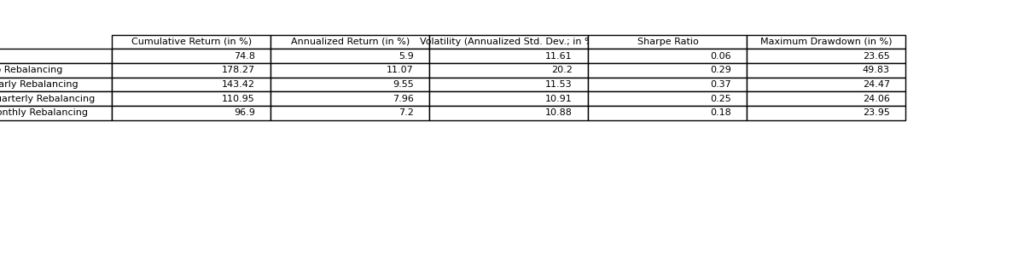

The summary statistics chart shows that the lowest volatility rebalancing strategy for Bitcoin was monthly with a 10.88 annualized standard deviation. Interestingly, the traditional portfolio without Bitcoin had more volatility than a portfolio with 2.5% allocated to Bitcoin and rebalanced monthly, quarterly, or yearly. The lowest maximum drawdown rebalancing strategy was monthly as well. Therefore, a conservative approach to Bitcoin would include a single-digit allocation to Bitcoin with a monthly rebalancing strategy.

Alternatively, investors could avoid transaction fees associated with selling Bitcoin on a time-based trigger such as a month or quarter and instead set a target range for the Bitcoin allocation to move between. Once the Bitcoin allocation surpasses a certain threshold, for example, 5%, the excess Bitcoin could be sold on the spot or with covered call options. Dynamic rebalancing strategies for Bitcoin have outperformed time-dependent strategies historically.

Figure 2: Summary Statistics of Bitcoin Rebalancing Strategies

Source: Cointelegraph Research, Crypto Research Report

The exploration into the strategic allocation of Bitcoin within traditional portfolios reveals a nuanced landscape where the balance between risk and return is delicate. The empirical evidence suggests that a laissez-faire approach to portfolio rebalancing, particularly concerning Bitcoin, has historically yielded superior returns compared to more active rebalancing strategies. However, the allure of higher returns does not come without its counterpart of increased risk, prompting a deeper consideration of rebalancing frequencies and strategies to mitigate volatility.

Notably, the analysis underscores the efficacy of dynamic rebalancing strategies over their time-dependent counterparts, offering a compelling case for a more nuanced, threshold-based approach to managing Bitcoin allocations. In this intricate dance of numbers and market movements, investors are guided towards informed decisions that align with their risk tolerance and investment goals, marking a significant step forward in the sophisticated integration of cryptocurrencies into diversified portfolios.