“In 1924 John Maynard Keynes stated that an excellent economist has to possess a unique combination of gifts. He had to be a mathematician, historian, statesman and philosopher. In regard to Bitcoin, this list needs to also include several more traits. An excellent crypto-economist should also be a software, hardware and blockchain specialist on top of the above. Faced with these almost insurmountable intellectual hurdles it is easy to see why traditional economists have a hard time joining in the discussion.”

Jochen Möbert, Deutsche Bank

Bitcoin flew too close to the sun. Now the eyes of the world are upon the crypto market. With all the consequences that follow. Argentina is the land of tango, steak, and inflation. From one day to the next it can happen that those delicious empanadas cost an unsuspecting tourist 30 to 40 percent more. Locals are accustomed to getting a new menu with every pizza delivery due to higher prices. Many have long since renounced the Peso, which is abused again and again by the government and central bank for public financing. Major purchases are paid for in U.S. dollars. In the countryside, there are even a few communities that organize trade amongst themselves, completely without the use of state money.

Of all places, in 2018 this is the country where the most powerful people on the planet will discuss regulations for Bitcoin and other cryptocurrencies, as Argentina will be hosting the G20. Apparently, the topic is already on the agenda for the meeting in March – according to U.S. Treasury Secretary Steven Mnuchin. He is not alone: the French Finance Minister Bruno Le Maire and the German government have declared Bitcoin a top priority for G20.[1]

The issue at the G20 will of course not be if the deflationary Bitcoin as an actual viable alternative to the broken system of fiat currencies. Rather, the discussion will focus on the looming triple threat: terrorists, money launders, and criminals – all of whom have apparently discovered Bitcoin for their illegal businesses.

Will these discussions lead to anything? Multiple press releases and declarations will most likely be published and cause some disruptions on the cryptocurrency market. However, no one really believes this could kick-start a global set of rules. Even on the off-chance that two states as opposed as China and Japan could come to a consensus, there are countless smaller countries that aren’t going to be part of the discussion at all.

To a certain degree it would be preferable if states would and could control the abuse of cryptocurrencies – and we are not talking about terrorists or money launderers here. The price explosion over the last months of 2017 has given way to an immense wave of criminal activity, scams and hacks. The dip in the market back in January 2018 just caused for the list of distressing occurrences we were collecting for this report to grow at an uncontrollable speed.

Let’s back up and go back to the beginning. There is much more going on in this sector than the call for regulations on the one hand and the surge of illegal profiteers on the other. The new boom has made room for many a promising project of the second and third blockchain generation. The blockchain has not only made it into the mainstream but is also slowly seeping into daily life. More and more existing companies are taking a closer look at the blockchain technology.

We are well aware that the title “In Case You Were Sleeping” is slightly mean. The developments in this field are running at such a speed that even the most attentive spectator is likely to miss a good deal of the action. In this chapter we will try and eradicate the white noise and block out the useless information circulating out there in the Internet and in the media. We will break it down to the most essential pieces so that our readers are better informed. This chapter will consist of four areas which shaped the market in the last months of the year 2017 and the beginning of 2018 :

- Bubble & Crash

- Hacks & Scams

- Reaction & Regulation

- Adoption & Trends

a. Bubble & Crash

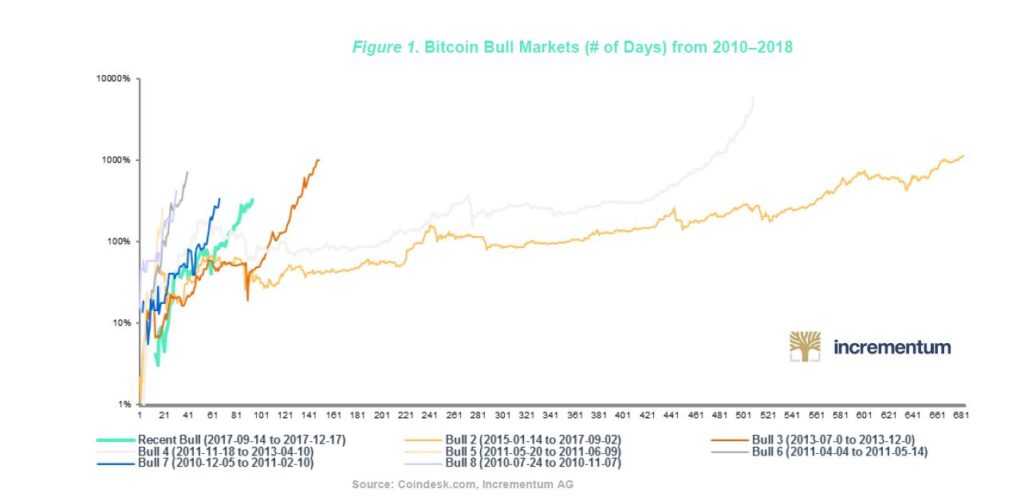

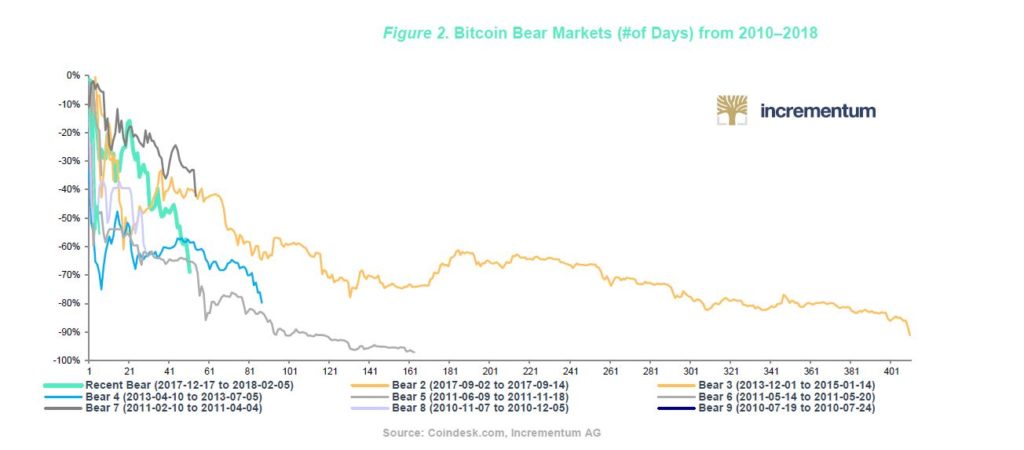

It all happened as it always has. Bitcoin reached an all-time high and then predictably it fell again. All common stages of the classic bubble were accounted for: euphoria, infatuation, denial, fear, desperation. When Bitcoin fell under $7000 and the market capitalization of the whole sector halved, the funeral preparations by nay-sayers were already underway. The fact that cryptocurrencies have already survived five such bubbles, as the brilliant analysis by Michael B. Casey shows, is dutifully ignored by said grave diggers.[2] Figures 1 and 2 show Bitcoin’s largest rallies and drawdowns since 2010.

In general, we are talking about old-school economists who said it from the start: Bitcoin is a scam. On February 2, Nouriel Roubini took the cake by claiming we are witnessing “the largest bubble in the history of mankind” because Bitcoin had lost 60% of its worth.[3] Uber-Keynesian Paul Krugman could hardly contain his joy over the Bitcoin crash – he even created a new word for it: “cryptofreude” alluding to the German word “Schadenfreude” (i.e. to revel in someone else’s pain).

According to Roubini and Krugman Bitcoin will fall to zero and the whole crypto sector will simply dissolve. Of course, this may happen. However, we are still baffled by these economists who so profusely claim to know it better than anybody else. Especially considering that Bitcoin has seen five bubbles, crashes, and recoveries. Each time gaining in worth – which actually speaks in favor of Bitcoin.

Roubini and Krugman can end up being right, Bitcoin could drop to zero and then disappear. If this should be the case and Bitcoin is already a thing of the past at the time of publication, please accept our sincerest apologies for our harsh tone of voice. Nonetheless, if history has taught us anything it is that mainstream economists such as Roubini and Krugman have a very hard time grasping the matter of Bitcoin. Strangely enough, both do not let an opportunity pass to voice their opinions in the media on a matter they do not seem to understand.

Jochen Möbert from Deutsche Bank explained the predicament of economists as follows: “In 1924 John Maynard Keynes stated that an excellent economist has to possess a unique combination of gifts. He had to be a mathematician, historian, statesman and philosopher. In regard to Bitcoin, this list needs to also include several more traits. An excellent crypto-economist should also be a software, hardware and blockchain specialist on top of the above. Faced with these almost unsurmountable intellectual hurdles it is easy to see why traditional economists have a hard time joining in the discussion.

All’s well that ends well? Not so fast. Möbert also criticizes the other side: “Bitcoin enthusiasts tend to simplify the topic at hand and predict a complete market absorption and completely ignore the negatives of Bitcoin in comparison with conventional currencies and the traditional banking business. They underestimate how many people are actually scared off by a global, decentralized technology outside the legal sphere.”

We could not agree more; however, in Nouriel Roubini’s defense one should add: He recognized the potential for a scam epidemic in the blockchain sphere and rightly so, criticizes it. The problem is, Roubini is convinced that the whole thing is a scam, one huge Ponzi scheme. Even Jamie Dimon, CEO of JP Morgan, has called Bitcoin a scam.[4]

We strongly disagree: This initial scam phase is part of the Wild West stage of any new unregulated market, and Bitcoin and the blockchain have simply a maturing process ahead of them to weed out the bad seeds. In this respect, the crash of the past months is to a certain extent desirable because it is cleansing the market of criminal, half-baked ideas. That is how free market economy works. But it might be a tall order to expect mainstream economists to recall this after more than a decade of bail-outs and quantitative easing.

In our first report we already predicted that it may come to an ICO mania, which in turn would cause a bubble and the inevitable crash. As did many others. Even the founder of Ethereum, Vitalik Buterin, warned of the bubble.[5] Based on current analysis we can also expect it not to have been the last ICO-bubble.

In actual fact larger companies are looking into generating money via ICOs. Some may all the same be more in the category of “marketing-stunt” as the proposed revival of Kodak via an ICO. Others, such as the chat-app “Telegram” that apparently wants to raise up to a billion dollars, should be taken more seriously. Clearly exemplified by the sheer number of self-proclaimed Ethereum-successors (like NEO, EOS or Cardano) we can safely say the ICO craze has not yet reached its peak. These so-called platform coins will probably be the true winners of 2018, but more on that later.

b. Hacks & Scams

No one can deny that the crypto market has a dark side. The dark web itself would not be able to function the way it does without Bitcoin (and privacy coins such as Monero). Hacks and scams have been part of the deal of getting into cryptocurrencies from the very beginning. The rise of Ethereum and the aforementioned ICO boom together with the general growth of the market cap in the last months of 2017 as a whole have increased these dubious developments immensely. As prices began to fall, so did some of the dubious projects. The following chapter will highlight only a few of the possible problems which one is confronted with in the crypto sector.

Hackers Steal Half a Billion – is North Korea to Blame?

In a hack targeting the cryptocurrency NEM, which has great similarities with the hack against the Bitcoin exchange Mt. Gox a few years ago, more than $500 million were stolen in February. Once again it hit a Japanese exchange: Coincheck. It was the same mistake as with the Bitcoin heist at Mt. Gox: Coincheck had stored NEM reserves in a “hot-wallet”, i.e. in an account with connections to the Internet.

Usually exchanges store these reserves in “cold-wallets”, out of reach of prying hacker hands. Although this can be considered the largest crypto theft of all time, amazingly enough the exchange survived the hack. They also stated that they plan to reimburse the affected clients. The plot twist: The South Korean secret police voiced the suspicion that North Korea is to blame for the hack.[6]

Confido and Bitconnect: Gone With the Wind

Bitcoin has already infiltrated our daily usage of language. Without hesitation we talk of blockchains, ICOs and we even say “hodl” when we mean hold. One of the more undesirable words of the new vocabulary is “exit scam”. It describes exactly what we think when we hear the term. It is a scam in which a lot of money is collected, and the initiator then bags it all and makes a run for it.

Once the term was only used for shady exchanges that eventually took off with their investor’s money. Since the ICO boom, new versions of the old trick have arisen: in comes Confido. This coin was distributed via ICO at the beginning of November 2017. We will spare our readers from having to read about the details of the apparent “business model” of the coin. The ICO raised a total amount of $375,000 dollars. This money then quickly vanished together with the founders. On November 14, 2017, the coin was worth $1,20, it subsequently crashed to 2 cents. The website, blogposts, and all social media channels of Confido: deleted.[7]

The prize for the most dramatic exit, however, still goes to Bitconnect. Without exaggeration, this is probably the biggest rip-off the crypto market has seen so far. Bitconnect promised its investors ridiculous returns. All they had to do was invest their Bitcoins in Bitconnect. The extent of the whole story is not known, but the Bitconnect token had a market cap of more than 2.5 billion when the whole operation came crashing down. At the height of the game the value was more than $400, after the crash it was merely $5.[8]

Sadly, frauds like these have become commonplace on the crypto market. Similar scams in Spain and in Austria have recently been discovered.[9] The simple fact that these Ponzi schemes do fall apart as soon as the price begins to sink is not further noteworthy, they always do in the end. What sets Bitconnect apart, however, is the sheer volume of the whole operation. Plenty of Bitconnect advocates actively posted on YouTube and in turn gained more followers and investors. Unfortunately, the end of Bitconnect, whose founders are still unknown, has not lead to the end of YouTube scammers, nor to the improvement of the YouTube crypto content. But this in itself would be worth a whole chapter.

What else?

Sadly, if they are not careful, investors can also lose money due to minor hacks. These hacks or scams sometimes do not make it into the media, as they are almost seen as part of the deal. Here is a minor example: Hackers targeted the Blackwallet website and stole $400,000 worth of XLM. A similar case occurred to the Monero wallet mymonero.com in which a hacker managed to get away with money in the form of Monero in mid-December.[10]

This story never broke out of the Monero-Reddit thread into the wider view of the public, as seemingly only a small portion of investors were damaged. Both cases seem to be based on skillful phishing tactics which enabled the hackers to gain access to the DNS servers. Worst of all, it is almost unavoidable for users to become victim of such attacks.

Users of the popular exchange Etherdelta had to learn this the hard way when more than 300 ETH – at the time worth $250,000 were plundered from the site.[11]

Iota users who used an online seed-generator when creating their wallet would also come to regret this later: Iota coins in the total worth of almost $4 million were silently removed from the wallets of these users in January. The way in was via the online seed generator.[12] Needless to say, such heists occur predominantly when the prices are high and there is much to gain. We therefore expect to see a pick-up of fraudulent activity as soon as the bull market resumes in full.

c. Reaction & Regulation

Even if you tried to follow the news regarding various plans and statements for regulations of cryptocurrencies by different states and government authorities 24/7, you would still be bound to miss half of it. It has become the fashion of the day for politicians and jurisdictions to try to understand the phenomenon that is the blockchain, and they are desperately trying to keep up with it and its consequences. This has given way to a mass of attempts to create a regulatory framework on the go. Everyone is confronted with the same problem. In a very good paper concerning this issue, Jochen Möbert from Deutsche Bank highlights one core obstacle. “Attempts for a regulatory framework are faced with the complication that a global, decentralized currency has many alternatives.”

As previously mentioned, discussions have reached the highest levels of government and will be a topic at the G20 summit. Möbert is skeptical if these talks can be constructive: “The implementation of international regulations, for example on G20 level, is all the more illusory as different attitudes of governments world-wide towards regulatory needs in this sector are already apparent. For example, Canada and Japan are obviously aiming for a more Bitcoin-friendly regulatory framework.”

Japan is a noteworthy exception in several regards.[13] Bitcoin is a legal payment method, and the general public seem to not have few if any reservations regarding the cryptocurrency. A different analyst from Deutsche Bank even suggested that (at one point at least) almost 40 % of the total crypto volume came from Japan.[14]

Other Bitcoin-friendly countries are small and well known within the international finance sector. We are of course talking about Switzerland and Singapore. The latter, which is extremely popular for companies wanting to initiate an ICO, has already expressed in quite clear terms that they do not intend to ban the trade of cryptocurrencies. As the Deputy Primeminister Tharman Shanmugaratnam puts it: “This is an experiment. It is still too early to say if cryptocurrencies will prevail.”[15]

Switzerland is very keen to show how open it is towards Bitcoin and the blockchain. The area of Zug has unofficially been named “Cryptovalley”, and in some places you can even pay your taxes via Bitcoin – this is rarely taken advantage of, but it is a statement. The Swiss Finance Minister Johann Schneider-Anmann has made such a case for cryptocurrencies that the Crypto Finance Conference in St. Moritz felt the need to give him an award for his efforts. His reasoning for his positive approach towards cryptocurrencies reads as follows “Innovations have helped this country achieve greatness. We have now finally reached an innovative moment in the finance world. Cryptocurrencies are part of the fourth Industrial Revolution. We are merely looking to see what new possibilities it can bring.”[16] Russia’s Sberbank is also betting on Switzerland as their location in regard to cryptocurrencies.[17]

Until recently, Austria had a finance minister who was and proud fan of Blockchain, Harald Mahrer.[18] He even initiated the “Blockchain Roadmap Austria”. However, after the last elections he stepped down, and since then nobody else seems responsible for the matter. A positive development and sign that the topic may still be taken seriously is the founding of the Institute for Cryptoeconomics at the University for Economics in Vienna.

Like in many other European countries, the Austrian government is waiting on directive from the European Union on how to proceed regarding any regulations. The Union itself has so far only taken one vital step. That is to include crypto dealers and exchanges to the money laundering regulations. This means the same “know-your-customer” (KYC) which apply to banks also apply to the crypto market.[1] Interestingly enough, back in 2015 the European Court of Justice already ruled that sales tax should not apply to Bitcoin.

Nonetheless, the question still arises on a regular basis. We believe, so far, Europe seems to be doing quite well in matters of the crypto market. This observation is further supported by the fact that no European measure has led to disruptions, panic, or huge falls in the market, as they were always well foreseeable and in good measure.

A further European country – outside the EU – which has a made a name for itself on the Bitcoin-friendly side of things is Iceland. Many Bitcoin mining farms are to be found there due to fortunate weather conditions and cheap power supply.

China, on the other hand, has opted for a less friendly and more chaotic approach. Not a day goes by in which the West is safe from dreadful news from the Yellow Dragon. The meme “China bans Bitcoin” has reached cult status in the scene. Peking has in part started to tackle one topic after the next since the second half of 2017. First, they forbade ICOs, then all exchanges were expelled from the People’s Republic, lastly even Miners, that had sprouted in China due to very low energy prices, were silently asked to leave. A complete ban on crypto trading lies in the air, as even the “Great Firewall”, China’s prime Internet censorship tool, was used to deny Chinese users access to international market platforms.[20] [21] [22]

This strict approach has many a reason: Firstly, China has an authoritarian government. Just because the country opens itself up to capitalism, does not mean that it was ever part of the plan to give billions of Chinese economic freedom and independence – at least not without the “protection” of the yuan. There is also a great worry that assets will slowly but surely make their way out of the country and most probably to the United States of America. Russia, also under authoritarian rule, has similar issues. The main difference being the Chinese hunger for and joy in gambling.

The same goes for South Korea where the Bitcoin mania has reached a pinnacle unheard of on these shores. The government has also introduced regulations in the vain hope to cut back the hype. Even though western media has reported the ban of exchanges, this has yet to be realized.[23] The crypto bug has reached all levels of the nation. Civil servants and politicians have been caught having used insider information of the government’s steps to profit from certain crypto trades based on this knowledge.[24]

India’s finance minister Arun Jaitley apparently called for a ban on Bitcoin and caused a ripple through the crypto market. India’s Bitcoin industry and western media reacted turbulently until his statement was corrected as he had actually said in a speech that Bitcoin cannot be accepted as a legal method of payment. This may not be praise and support, but it is also far off from a ban. India has set up a research team to look into the subject in more depth.[25]

The USA have done the same, under the name Task Force. U.S. authorities are having a hard time dealing with the topic of Bitcoin. Nonetheless, a hearing of the managers of CTFT and SEC at the beginning of February was largely welcomed by the community. The authorities of course used this chance to voice criticisms and underline how necessary regulations are for the market – but generally the optimism and belief in a long-term chance of survival toward cryptocurrencies and the blockchain was surprising. Subtext: Bitcoin is here to stay. [26]

d. Adoption & Trends

Bitcoin and the crypto sector as a whole have undergone a huge surge this past year. The exchanges already had a hard time coping with all-time highs of many altcoins this past summer. The boom that was to follow in the winter months put this new and very young infrastructure for blockchain assets to the test. Many of the large, international exchanges had to halt the registration process of new customers for a couple of weeks. Others were simply not attainable in certain parts of the world. For example, the ever-popular exchange Kraken in Europe. The app Coinbase is already known for hiccups in the system when the price moves drastically in either direction.

It therefore comes as no surprise that more and more suppliers are rushing into the market hoping to pick up some crumbs of this profitable cake. Take the Asian exchange Binance, for instance. A mere few months old and already it is classified as a top league player. And this trend shows no sign of stopping. More established providers, especially in the field of finance apps, have made first moves to expand into the crypto market. One of the most famous is Revolut which lets you buy Bitcoin, Ethereum, and Litecoin.[1] It does have one major drawback though, the app does not let you store your amassed wealth of coins on a wallet. According to Revolut, their clients do not ask for this option that is why it is not offered. This is astounding because this means that next to long-term investors and the altcoin gamblers there are casual Bitcoin buyers out there who only want to profit from the price. By extension this leads to an ever-growing number of proxies for Bitcoin in the form of certificates or CFDs.

In 2017, Ethereum was a huge game changer in the world of crypto. It introduced the concept of smart contracts and ICOs into the blockchain. It did not take long for imitations and competitors to appear in the market. Antshares, now called Neo, rose to fame in the summer months and is known as “the Chinese Ethereum” as it also has smart contracts on the blockchain which in turn acts as a platform for other products and tokens. One of the founders of Ethereum set up a further competitor: Cardano; and then there is also Icon, “the Ethereum of South Korea” and last, but definitely not the least, EOS, the “Ethereum killer”.

Which of the above will be the last one standing? Will more than one or even none survive? At this moment in time nobody can really tell. For now, all we can say is that these platforms seem to be more attractive for investors than singular projects or the “old school” cryptocurrencies. It is very likely that Ethereum can use its first-mover advantage, together with technological advances and a huge community of developers, to extend its lead on the competition in 2018. A so-called flippening, in this case that Ethereum takes the first spot in the market, is well in its reach, especially as banks such as UBS and Barclays have Ethereum on their radar.[28]

Yet another player who has specialized in “simple ICOs” and has caught people’s eyes with the projects Mobius and Kik is Stellar (XLM). The chat app Kik initiated their ICO on Ethereum before they decided to swap to the Stellar blockchain. “We’ve been using Ethereum to date, and to be honest I call it the dial-up era of blockchain,” said CEO Ted Livingston. Another company betting on the Stellar blockchain with its cryptocurrency MobileCoin will be Moxie Marlinspike’s chat app Signal, the ICO is said to happen this year.

The largest ICO in the pipeline for 2018 is yet another chat app: Telegram. It is held in high regard already and the company plans to collect $1 billion with their cryptocurrency Gram. There are no official plans yet, although, there is a whitepaper circulating on the Internet. This largest ICO is, however, supposedly taking place on the “old school” Ethereum blockchain.[29]

If Kik, Signal, and Telegram as relatively small players in the social media and chat sector are already creating crypto coins, how long will it take Facebook and Co. to do the same? And if Robinhood, Revolut and Cash as small players in the finance sector are betting on cryptocurrencies, how long can your trusted old bank wait before it finally catches on?

[1] Sujha Sundararajan, “Mnuchin Calls for Crypto Regulatory Talk,“ Coindesk, Feb 2, 2018, https://www.coindesk.com/mnuchin-talk-crypto-regulation-g20-summit/.

[2] Michael B. Casey, “Speculative Bitcoin Adoption/Price Theory,” Medium, Dec 27, 2016, https://medium.com/@mcasey0827/speculative-bitcoin-adoption-price-theory-2eed48ecf7da.

[3] “US-Ökonom Roubini: ‘Die Mutter aller Blasen platzt jetzt’,” Die Presse, Feb 2, 2018, https://diepresse.com/home/wirtschaft/boerse/5365158/Bitcoin_USOekonom-Roubini_Die-Mutter-aller-Blasen-platzt-jetzt.

[4] Hugh Son, Hannah Levitt and Brian Louis, “Jamie Dimon Slams Bitcoin as a ‘Fraud’,” Bloomberg, Sep 12, 2017, https://www.bloomberg.com/news/articles/2017-09-12/jpmorgan-s-ceo-says-he-d-fire-traders-who-bet-on-fraud-bitcoin.

[5] Avi Mizrahi, “Ethereum Founder Vitalik Buterin: We are in an ICO Bubble,” Finance Magnates, Sep 11, 2017, https://www.financemagnates.com/cryptocurrency/news/ethereum-founder-vitalik-buterin-ico-bubble/.

[6] Sohee Kim, “North Korea Susptected for Hatching Coincheck Heist,” Bloomberg, Feb 6, 2018, https://www.bloomberg.com/news/articles/2018-02-06/north-korea-is-said-to-be-suspected-of-hatching-coincheck-heist.

[7] Arjun Karpal, “Cryptocurrency start-up Confido disappears with $375,000 from an ICO, and nobody can find the founders,” CNBC, Nov 21, 2017, https://www.cnbc.com/2017/11/21/confido-ico-exit-scam-founders-run-away-with-375k.html.

[8] “Cryptocurrency Market Capitalizations,” CoinMarketCap, https://coinmarketcap.com/currencies/bitconnect/

[9] Nikolaus Jilch, “Ermittlung gegen ‘Optioment’: Ein Bitcoin-Pyramidenspiel aus Österreich,” Die Presse, Jan 31, 2018, https://diepresse.com/home/wirtschaft/boerse/5363950/Ermittlungen-gegen-Optioment_Ein-BitcoinPyramidenspiel-aus.

[10] https://www.reddit.com/r/Monero/comments/7kmzkv/psa_regarding_recent_reports_of_mymonero_thefts/

[11] Stan Schroeder, “Cryptocurrency exchange EtherDelta got replaced with a fake site that steals our money,” Mashable UK, Dec 21, 2017, https://mashable.com/2017/12/21/etherdelta-hacked/#rKj9VSYqwqqJ.

[12] Avi Mizrahi, “IOTA Attacked for Subpar Wallet Security Following $4m hack,” Bitcoin.com, Jan 22, 2018, https://news.bitcoin.com/iota-attacked-for-subpar-wallet-security-following-4m-hack/.

[13] https://www.ft.com/content/b8360e86-aceb-11e7-aab9-abaa44b1e130

[14] Tyler Durden, “One Bank Believes It Found The Identity Of Who Is ‘Propping Up By The Bitcoin Market’,” Zero Hedge, Dec 14, 2017, https://www.zerohedge.com/news/2017-12-14/one-bank-believes-it-found-identity-who-propping-bitcoin-market.

[15] Lubomir Tassev, “No Strong Case to Ban Crypto Trading, Singapore Says,” Bitcoin.com, Feb 7, 2018, https://news.bitcoin.com/no-strong-case-to-ban-crypto-trading-singapore-says/.

[16] “Bundesrat über Kryptowährungen: ‘Die Schweiz soll zur Krypto-Nation werden’,” SRF, Jan 19, 2018, https://www.srf.ch/news/wirtschaft/bundesrat-ueber-kryptowaehrungen-die-schweiz-soll-zur-krypto-nation-werden.

[17] Sperbank setzt für Cyberwährungen auf die Schweiz,” Handelszeitung, Jan 30, 2018, https://www.handelszeitung.ch/invest/sperbank-setzt-fur-cyberwahrungen-auf-die-schweiz.

[18] https://futurezone.at/thema/start-ups/oesterreich-will-zentrum-fuer-blockchain-technologie-werden/288.232.922

[19] “EU: Einigung auf strengere Regeln für Bitcoin-Handelsplattformen,” Die Presse, Dec 15, 2017, https://diepresse.com/home/wirtschaft/boerse/5339451/EU_Einigung-auf-strengere-Regeln-fuer-BitcoinHandelsplattformen.

[20] Lulu Yilun Chen and Justina Lee, “Bitcoin Tumbles as PBOC Declares Itinitial Coin Offerings Illegal,” Bloomberg, Sep 4, 2017, https://www.bloomberg.com/news/articles/2017-09-04/china-central-bank-says-initial-coin-offerings-are-illegal.

[21] Chao Deng, “China Quietly Orders Closing of Bitcoin Mining Operations,” The Wall Street Journal, Jan 11, 2018, https://www.wsj.com/articles/china-quietly-orders-closing-of-bitcoin-mining-operations-1515594021.

[22] David Meyer, “China Enlists Its ‘Great Firewall’ to Block Bitcoin Websites,” Fortune, Feb 5, 2018, http://fortune.com/2018/02/05/bitcoin-china-website-ico-block-ban-firewall/.

[23] Dahee Kim and Cynthia Kim, “South Korea says no to ban cryptocurrency exchanges, uncovers $600 million illegal trades,” Reuters, Jan 31, 2018, https://www.reuters.com/article/us-southkorea-bitcoin/south-korea-says-no-plans-to-ban-cryptocurrency-exchanges-uncovers-600-million-illegal-trades-idUSKBN1FK09J.

[24] Kevin Helms, “South Korean Officials Caught Trading On Insider Knowledge of Crypto Regulations,” Bitcoin.com, Jan 18, 2018, https://news.bitcoin.com/south-korean-officials-caught-trading-on-insider-knowledge-of-crypto-regulations.

[25] Sindhuja Balaji, “India Is Not Banning Cryptocurrency, Here’s What It Is Doing Instead,” Forbes, Feb 6, 2018, https://www.forbes.com/sites/sindhujabalaji/2018/02/06/india-is-not-banning-cryptocurrency-heres-what-it-is-doing-instead.

[26] Lucinda Shen, “Bitcoin Traders Are Relieved at CFTC and SEC Cryptocurrency Senate Hearing Testimony,” Fortune, Feb 7, 2018, http://fortune.com/2018/02/06/bitcoin-price-cftc-sec-cryptocurrency-hearing/.

[27] “Am Handy tummeln sich die Banken,” Die Presse, Dec 17, 2017, https://diepresse.com/home/meingeld/aktien/5340102/Am-Handy-tummeln-sich-die-Banken.

[28] Michael de Castillo, “UBS to Launch Live Ethereum Compliance Platform,” Coindesk, Dec 11, 2017, https://www.coindesk.com/ubs-launch-live-ethereum-platform-barclays-credit-suisse.

[29] Mike Butcher & Josh Costine, “Telegram plans multi-billion dollar ICO for chat cryptocurrency,” TechCrunch, Jan 8, 2018, https://techcrunch.com/2018/01/08/telegram-open-network.