“2019’s Trillion Dollar Question: How to merge Blockchains?

Yanislav Malahov, Aeternity

Smart Contract Platforms: Who’s the

Smartest in Town?

Grandmother Bitcoin has birthed powerful ecosystems – first and foremost, the

Ethereum empire. From July to August in 2014, the Ethereum Foundation

launched an Initial Coin Offering to promote its concept to Bitcoin owners. As we

already mentioned in our Crypto Concept chapter, the masterminds behind

Ethereum were Vitalik Buterin and Mihai Alisie. They realized that a Turincomplete

blockchain could enable decentralized applications. Vitalik developed the

solidity scripting language to compliment a Turin-complete blockchain. With the

technology built, he founded a new crypto asset and after the code had been

programmed and $18 million worth of Bitcoin had been collected in an initial coin

offering to advance the project, the first Ethereum block was created on July 30th,

2015.

Wrong Dichotomy

Like Bitcoin, Ethereum attracted a network of users – especially a larger spectrum of software developers. Due to the increasing interest, the Ether price also shot through the ceiling and the rivalry between the two camps increased. Some Bitcoin supporters – perhaps a little unsettled by the upturn in Ether prices – saw this new crypto asset as a cheap copy of Bitcoin, which was hardly faithful to true crypto values. On the Ethereum side, some exponents were already saying that the programmable blockchain was far superior to Bitcoin and that the former would make the latter obsolete sooner rather than later. To this day, the two camps are fighting each other on internet forums, on Twitter, and at conferences. While Ethereum maximalists are called heretics, Bitcoin maximalists are seen as the fundamentalists of the crypto world.

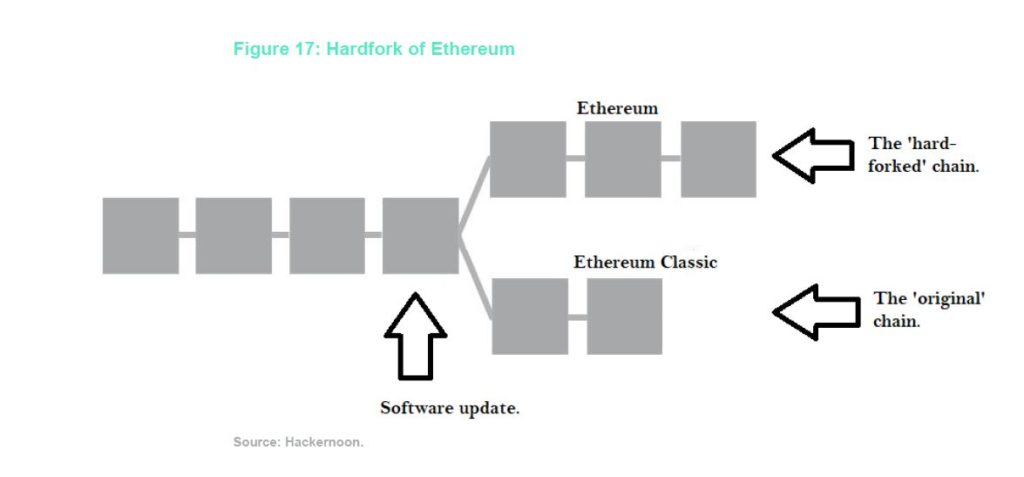

This circus around the title “Only True Blockchain” is ultimately nothing but a clownish pseudo battle. Bitcoin and Ethereum are not direct opponents, since they pursue different goals after all. As an independent store of value, the Bitcoin blockchain must offer the greatest possible security. This implies that Bitcoin must necessarily be based on a more rudimentary scripting language that limits susceptibility to bugs. The purpose of Ethereum is to resolve this trade-off in exactly the opposite way. Because of the greater experimentation and flexibility in programming capability, greater susceptibility to errors is also accepted at the source code level. Events mentioned in the Crypto Concept chapter in this edition of the Crypto Research Report, such as the DAO hack and the parity bug are due to programming errors because of solidity’s complexity. Because the Ethereum approach allows much more in terms of programming, its use case appears much broader, which leads many Ethereum enthusiasts to conclude that Ethereum is the more lucrative project in the long run.

Today, Ethereum is held responsible for the ICO hype during the end of 2017. Quite often the tone is somewhat reproachful: Not only have investors lost a lot of money in this speculative boom, but they have also been led astray by a number of ICO fraudsters and crypto charlatans. But thanks to Ethereum, anyone can launch their token at low cost without having to worry about setting up a blockchain infrastructure. Ethereum has thus taken crowdfunding to a whole new, global level. Financing can suddenly be carried out efficiently, quickly and independently via the Internet.

So, while Bitcoin is disrupting the creation of money by central entities such as central banks and commercial banks, Ethereum’s revolutionary power lies in providing a real alternative to the centrally organized capital market. Investment banks have always acted as intermediaries between asset managers and companies or states wishing to issue bonds or shares through an IPO. Before Ethereum, there was no technical way around them. Today there is. The venture capitalist business is currently being turned upside down, which is why it is no longer unusual to find venture capital companies such as Andreessen Horowitz or Union Square Ventures on pre-ICO investor lists. The figureheads of venture capitalists have already had to react to the “Etherealization” of investing – a fate that is likely to hit Wall Street as well.

A Non-centralized World Computer

Like Bitcoin, Ethereum is also based on a public blockchain and is therefore ultimately nothing more than a network of tens of thousands of geographically distributed computers, all communicating via the Ethereum protocol. Since Ethereum, in contrast to Bitcoin, can be used to program applications on top of it, the analogy of a world computer applies even better. The Ethereum blockchain functions like a computer. Like a hard disk of a computer, the blockchain stores everything that happens on the Ethereum world computer.

On a programmable blockchain like Ethereum’s, developers can program anything they can program on a local computer. However, the Ethereum world computer differs from an ordinary computer in that it must run according to its programming code and, due to its non central structure, can only be manipulated at extreme costs. At the same time, such a world computer provides immensely high robustness. Since the Ethereum blockchain runs on tens of thousands of individual computers, there is redundancy. The Ethereum “hard disk” does not only exist once and in one place only but is distributed all over the world. The downtime risk is therefore diminishingly small.

Why a Programmable Blockchain?

In the context of Ethereum, the term smart contract is frequently used. It was the Ethereum blockchain that first recognized the potential of these “intelligent contracts” and thus popularized the idea. The Bitcoin blockchain already knows a primitive form of smart contracts. In the case of Bitcoin, these are limited to the simple transmission of Bitcoin units. Since Ethereum is a programmable blockchain, the smart contract functions can be extended almost arbitrarily in theory. In addition to the processing of transactions of digital value units, other assets or securities such as bonds, shares, and even physical assets can also be transferred by means of a smart contract. Ultimately, the most diverse contracts that make up our social life today can be converted into computer code, stored in the form of smart contracts on the blockchain and executed by the Ethereum network in a non-centralized manner. This is the vision that is becoming established more and more in the minds of people as Ethereum grows more popular.

The elegance of a smart contract lies in the fact that it is a digital contract that executes itself according to predefined parameters. In other words, if the contract conditions are fulfilled, the contract is executed according to its content. A comparison with a vending machine helps here. One feeds the vending machine with money and receives the selected goods in return. There is no need for a third party to deliver the goods. The theory behind a smart contract works in a similar way: When you pay a smart contract, you receive the corresponding goods, a transfer certificate, a driver’s license or something else. In addition, the smart contract not only defines the rules and sanctions relating to the agreement, it also enforces them itself.

Gas – an Essential Component Of Ethereum

Ethereum clients are the individual computers that make up the Ethereum network, and execute the programming code defined in a smart contract. Since Ethereum is Turing-complete – a term from computer science – the computers of the Ethereum network are capable of executing code of any complexity. At the same time, Turing-completeness also means that a smart contract or its programming code would be executed endlessly by the Ethereum clients. Such an endless loop would render the Ethereum blockchain non functional, since the execution of a single smart contract would consume the resources of all the computers participating in the Ethereum network.

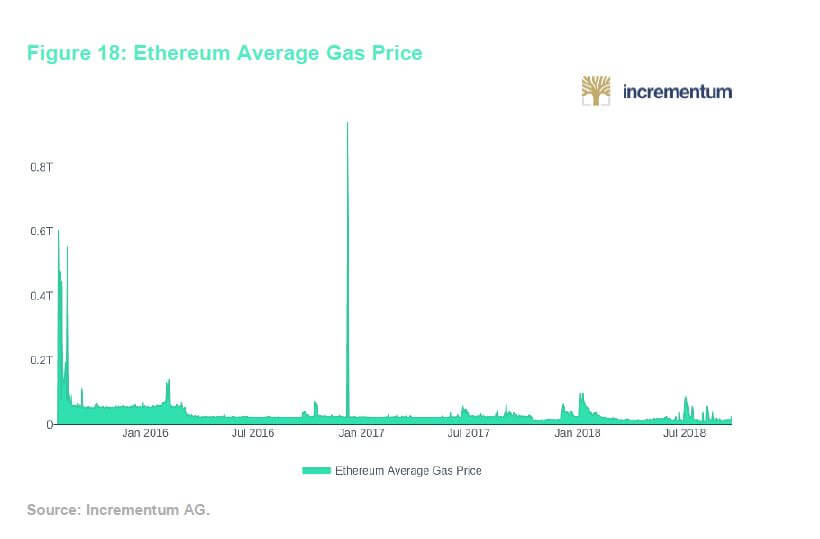

As a solution, Vitalik Buterin integrated a mechanism into Ethereum that enables the Ethereum clients to determine the execution length of each smart contract in order to prevent endless loops. The keyword here: Gas. Each execution of a smart contract costs a certain amount of gas. But this is just a form of expression. Behind every gas price that has to be paid for the execution of a smart contract is a certain amount of ether, the cryptocurrency of the Ethereum blockchain. How much ether it costs, or in other words, how high the respective gas price is, depends on the current utilization of the Ethereum network. Not all smart contracts cost the same gas price. Depending on the complexity, the amount of ether to be paid is smaller or larger.

In principle, the gas from Ethereum can be compared to the gasoline of a vehicle. Just as petrol makes a vehicle run, gas ensures that a smart contract is executed. Just as a car comes to a standstill when the fuel tank is empty, the Ethereum gas also defines an upper limit for the execution of smart contracts and thus prevents endless loops.

The recipients of ether paid via the gas price are the Ethereum clients who are responsible for the execution of smart contracts. Each smart contract costs a minimum execution price. However, if a higher price is offered, the chances of processing and execution are greater, as Ethereum clients are usually controlled by miners who earn wages by chasing the most lucrative offers.

Can Ethereum Hold Steady?

Whoever buys Ether invests in the first decentralized world computer. As such, Ethereum aims to become the backbone of a future decentralized internet. Should the Ethereum network ever reach this important position, Ether will be the “crypto-fuel” to power the entire Ethereum machinery. Just as the oil age made the Rockefeller family and others rich, Ether owners could one day become the new “oil barons” due to the crypto revolution.

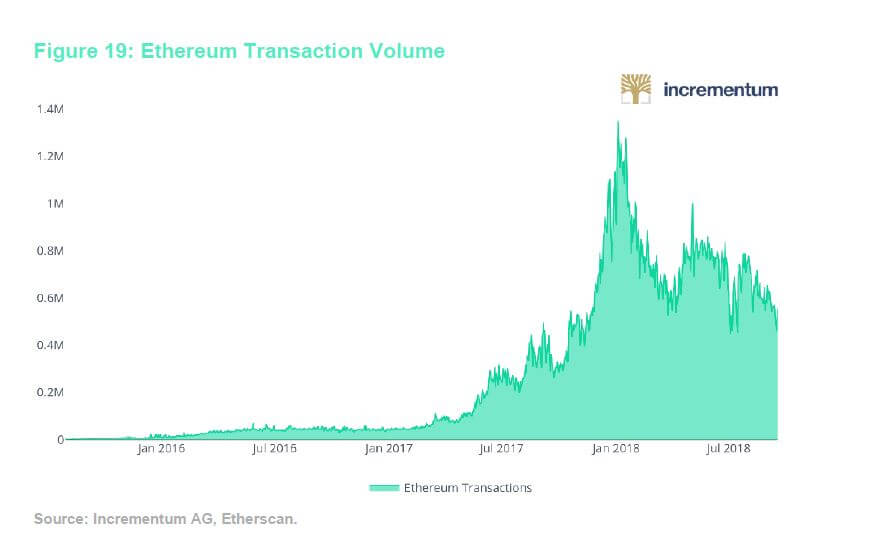

Ethereum is now (only) three years old. Since the first Ethereum block was created on July 30th, 2015, the blockchain has become the second largest crypto asset in terms of market capitalization and already has over 250,000 developers today. To date, approximately 1,800 DApps have been registered. Ethereum is also undoubtedly the most successful blockchain-based crowdfunding platform. Of the top 100 tokens by market capitalization, 94 % were originally built on Ethereum – $13 billion in capital was generated through Ethereum in this way. Of the top 700 tokens by market capitalization, 87 % are Ethereum tokens. This corresponds to $15 billion of the $19 billion collected through the Ethereum platform.

This growth and the resulting dominance have led to the emergence of other smart contract platform projects. Although Ethereum has experienced a meteoric rise, to handle decentralized services and applications on scale that make it a viable alternative to traditional centralized solutions, effective scalability is required. The Ethereum community has recognized this and is working on it – but it has not yet made a significant

breakthrough.

This is where many alternative smart-contract platforms see their chance to outsmart Ethereum. If they succeed in scaling sooner and better, not only the old world but also the new world should be able to build its applications on one of these alternative smart contract platforms.

Academia Goes Blockchain

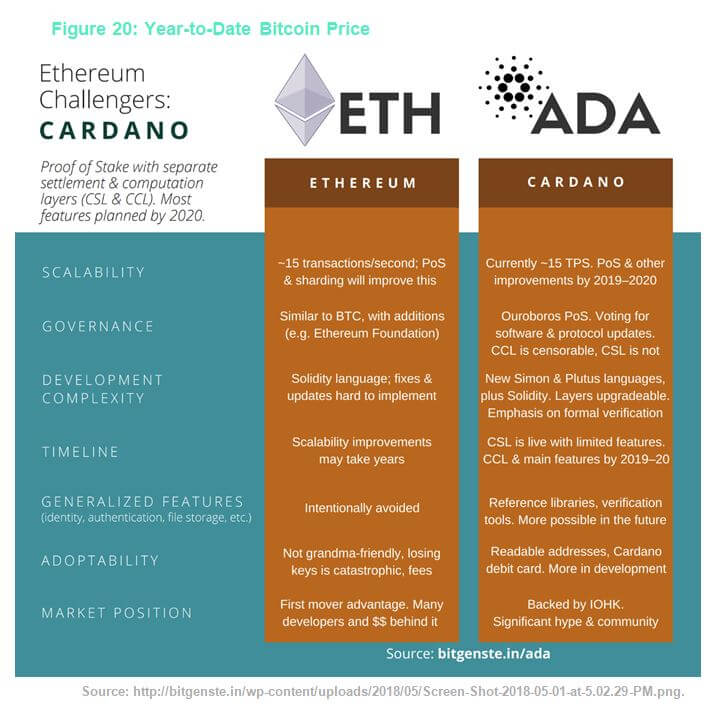

Most smart contract projects try to outpace Ethereum with speed. Such as Cardano, a project that is also described as the “Japanese Ethereum” in the crypto community because it was launched in Japan and is said to have had around 95 % of all ICO investors coming from the land of the rising sun.

Cardano does not focus on speed. On the contrary, the focus is on accuracy and correctness. Cardano was founded by Charles Hoskinson, who worked for Ethereum and BitShares. The fact that Hoskinson is a mathematician clearly mirrors Cardano’s path forward. No other smart contract project is more academically influenced and geared towards mathematical correctness. For the developers behind Cardano, the technical evaluation of the code is the most important thing. It is their intention to subject Cardano protocols to a peer review system and, if possible, to validate any program code with formal verification. A program code can be seen as formally verified once it is mathematically proven that it is correct for all inputs. Although formal verification does not (yet) prove that a code does what it is supposed to do, it does prove that certain errors can be excluded for sure. This kind of formal verification is a new area, and although other projects are increasingly oriented towards it, Cardano wants to be the leader when it comes to formal verification.

Although Cardano already runs on its own main net, many of the features and characteristics of this smart contract platform are still under development. For an outsider, there is little secure information available at the moment. Already today it seems to be clear though: While with many other projects the accounting of value transactions and the execution of smart contract commands are one and the same, with Cardano, these processes are separated into two different “layers”. There is the “settlement layer” for value transfer and the “computational layer” for the application of smart contracts. Cardano hopes that this split will enable it to better reconcile key aspects such as scalability, privacy, regulatory issues, and compliance. The two different layers are also based on two different programming languages. One language is specific and limited but less prone to bugs and other unforeseen programming errors, while the other is more flexible. Depending on the application, one or the other programming language can be used, which is why Cardano offers a certain choice here.

Only time can tell whether this careful way of peer reviewing and formal verification will lead to success in the incredibly fast-moving crypto world. After all Cardano’s peer reviewing appraisal method also has its exquisite critics. Their argument: Academic peer review processes do not always provide certainty and are therefore often not worth the effort. Nevertheless, at Cardano, people just want to

do philosophically, mathematically, and technically clean work. Consequently,

their project could provide the crypto world with some interesting approaches

regarding smart contract platforms going forward.

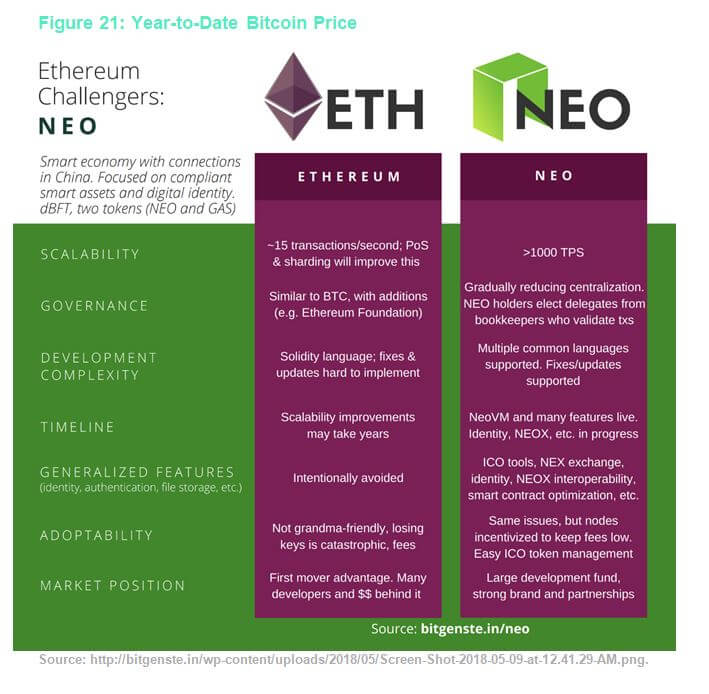

China Takes on Ethereum

Another project, which wants to establish a platform for a future internet comes out of China. Formerly known as Antshares, the project changed its name to NEO in June 2017 and immediately caused a sensation among crypto investors. But soon the question arose among them: Can a blockchain project from China even be successful when the Chinese government took a firm stand against Bitcoin and ICOs in 2017?

With China and its iron measures, it is always complicated. If you look closely, you will see that China has not generally opposed blockchain technology; after all, in its five-year plan, China’s central bank has taken a stance for exploring the possibilities of blockchain technology. It is just that the Chinese government is solely interested in blockchain projects that are predictable and thus controllable. And this is exactly where NEO seems to be entering the picture, probably for good reason and quite intentionally.

It is the declared goal of those responsible behind NEO to focus on speed and regulatory compliance. With NEO, blockchain technology can be used to digitalize assets of all kinds and to automate administration and trade in order to create structures for a smart economy. A digital identity solution seems to be indispensable for this, which is why the NEO Council – the body for the promotion of the NEO ecosystem – already supports a GDPR-compliant digital identity solution with PikcioChain. If a blockchain platform is based on pseudo or even anonymity, it is of little interest for a government – especially one like China – as well as for companies, since regulatory requirements can hardly be fulfilled this way.

At the same time, NEO is also focusing on solutions for the development of privacy and data protection. Through its partnership with OnChain, a company that promotes blockchain projects, NEO wants to enable companies to protect personal data. Founded by Da HongFei and Erik Zhang, who have also created NEO, OnChain is working with governments and corporations to create public and private blockchains that will eventually connect to the NEO ecosystem through OnChain’s decentralized network architecture (DNA).

Like Ethereum and other smart contract projects, NEO already has an open source community for developers and programmers called City of Zion. NEO also has an ICO platform that will allow payment solutions, distributed trading exchanges, and more.

The consensus mechanism of NEO is called Delegated Byzantine Fault Tolerance or dBTF. Behind this term lies a governance model known to us from the traditional world: that of a representative democracy. The NEO token holders appoint delegates, so-called accountants, who ensure consensus and thus maintain the network. There are a total of seven accountants. Compared to Ethereum, the number of nodes validating the network is much smaller. In addition, the NEO accountants still have digital identities and real names – so they are visible to everyone, while the network nodes at Ethereum are anonymous. The fact that the accountants at NEO are known certainly makes sense with regard to the goals of this project. In order to meet the regulatory requirements, the blockchain project must have this degree of transparency.

The delegated accountant model can prevent transactions from having to be validated by all nodes in the network. This way, NEO can handle a higher number of transactions than Ethereum. In addition, NEO transactions are final. This means: Forks, i.e. splitting the blockchain into several chains, are impossible. If the accountants reach a consensus of

66 %, the transaction is not only included in the blockchain but is final and cannot be made obsolete by a fork. One more difference between Ethereum and NEO concerns the programming languages for the development of smart contracts. Ethereum requires Solidity – a programming language specially developed for Ethereum. NEO, on the other hand, supports many of the most popular programming languages. Therein, NEO sees the advantage of enabling traditional developers to program on the NEO blockchain without having to learn a new programming language.

Differences Are Evident

Of particular interest is the fact that NEO, like Ethereum, knows gas. While Ethereum also uses the ether token as gas, NEO has a separate gas token in addition to the NEO token.

The NEO token makes it possible to be a “shareholder” in the NEO platform. As already mentioned, NEO token holders are entitled to appoint the accountants. The share-character of the NEO token is strengthened by the fact that the token is not divisible.

The GAS token, on the other hand, is used to pay for all operations such as transactions in the NEO network and thus functions as a sort of crypto fuel. Payment in the form of GAS tokens is made to accountants, but also to all NEO token holders. A personal NEO wallet is required to collect the GAS tokens.

This decoupling of NEO and GAS is particularly interesting because accounts do have the tendency to keep transaction fees low. The reason is the following: High transaction fees, which only benefit accountants, prevent operations from being carried out on the NEO blockchain. The fewer operations, the less reward NEO token holders receive. This leads them to vote for accountants, who in turn keep transaction fees low.

These are the features that make NEO an interesting smart contract platform. From a macro point of view, however, this platform differs from Ethereum in one fundamental aspect: NEO has apparently placed itself in the service of the Chinese government. Consequently, NEO is by its very nature a planned and top-down orchestrated undertaking, which seems to have been driven primarily by the NEO Council in the interest of the Chinese officials. From NEO’s point of view, this strategy has an intact chance of success. Anyone who manages to get popular in China itself and serves a market of 1.4 billion people can already book his project as a success.

And even if one or more smart contract platforms were to establish themselves in the West, this would not mean the end of NEO. Tech giants from the USA such as Facebook or Amazon provide a good example: Although their dominance in the world outside of East Asia is growing, they have virtually no chance against the domestic platforms in China. Why should this be any different in the area of smart contract platforms?

Ethereum might also experience some influence by interest groups such as Consensys or the Ethereum Enterprise Alliance, its ecosystem nevertheless tries to generally uphold the philosophy of organic growth. In this sense, Ethereum is more of a platform emerging out of a spontaneous order. Because of these different intentions, the two projects are difficult to compare. While NEO strives for an advanced future that is adapted to the existing actors and circumstances, Ethereum is working on a new future to which the current companies and states will have to orient themselves someday.

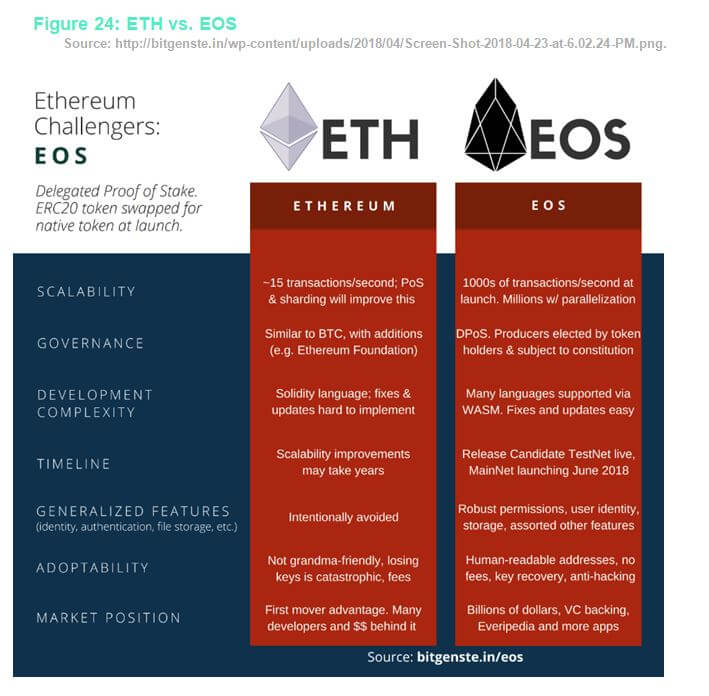

EOS – Ethereum’s Biggest Competitor?

In doing justice to the drama of the crypto world, some of these smart contract counterparty platforms bear the name “Ethereum-killer”. Probably the most prominent of these projects is EOS, also called “Ethereum on Steroids” by some. While Ethereum is an established blockchain project with a fully functional platform, EOS is still in its infancy. Following the largest ICO ever carried out on Ethereum, which raised a record $4 billion, EOS held its Mainnet launch in June this year, switching from an ERC-20 token based on Ethereum to its own blockchain, the EOS blockchain.

Although EOS ultimately also enables the programming of smart contracts, there are some important differences. For example, Ethereum smart contracts are developed using JavaScript/Solidity. Smart contracts on the EOS blockchain, on the other hand, must be written in C++. Since this programming language is not as common and user-friendly, some programmers see this as an entry threshold that could put EOS at a disadvantage compared with other smart contract platforms. At the same time, EOS is supposed to feature the implementation of C/C++ libraries in the future, which would considerably expand the possibilities for developers.

Unlike Ethereum, EOS’s consensus mechanism is based on the so-called Delegated Proof of Stake or DPoS for short. This type of consensus finding was invented by EOS founder Dan Larimer. As with NEO, DPoS entitles every EOS token holder to choose validators in a voting process. Analogous to the motto “one person, one vote” the voting process follows: one token, one vote.This also means that those who have more EOS tokens have a greater influence on the voting result.

The validators are called EOS block producers because they produce the EOS blocks in mutual agreement and check their correctness in order to maintain the functionality of the blockchain. In total, EOS token holders will have to elect 21 block producers who are effectively capable of managing the blockchain and keeping the network secure and functional. They are rewarded for their work with new EOS tokens. If a block producer does not do its job well and, for example, validates invalid transactions, his status as a block producer can be revoked. The reconciliations are carried out approximately every two minutes. In principle, it is therefore possible to change validators every few minutes. In addition to the 21 active block producers, there are about one hundred other block producers in standby mode. If a block producer is deselected for whatever reason, one is being elected out of the reserve.

The idea of the EOS founders behind this structure is as follows: Because the task of actually processing and validating the transactions is delegated to only 21 block producers, the basic protocol and, thus, the actual blockchain itself should be able to be scaled to enable millions of transactions per second. In reality, the EOS project has so far completed a maximum of 3,097 transactions per second successfully. In an objective comparison, EOS has performed significantly better than Ethereum, even though the actual goal of millions of transactions has hardly been achieved. But EOS is not only capable of processing a larger number of transactions per second – the transaction speed is also higher. After just one second, the blockchain reaches finality via a newly added block.

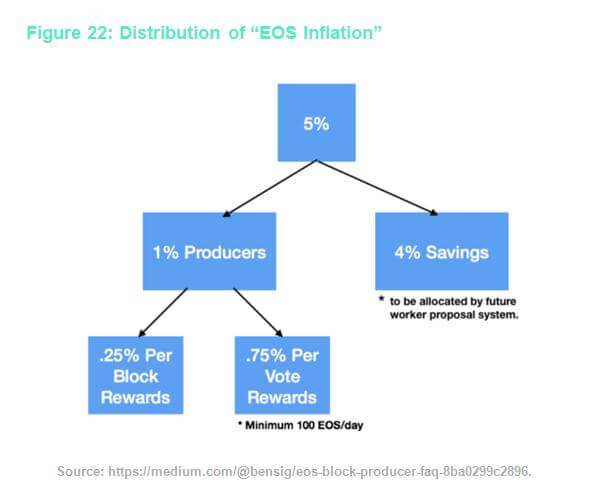

Inflation as a Reward

Interestingly, no transaction fees are envisaged to make EOS work as they are regarded to be more of an obstacle by the EOS founders. In this context, they often refer to an example concerning Facebook: Facebook servers process over 50,000 likes per second and ultimately each of these likes represents a transaction. If one had to pay a transaction fee each time on a blockchain-based social media platform, this would be detrimental to the customer experience. While at Ethereum, the miners who validate transactions and add them to the blockchain are paid for this service through transaction fees, the validators within the EOS system are not remunerated with transaction fees for their verification work. To be fair, it has to be said: Ethereum is also working on second- or third-layer scaling solutions to mitigate the problems described above.

But how are the EOS block producers remunerated instead? They receive newly created EOS tokens through the EOS protocol. Each year, five percent more EOS tokens are produced. In concrete terms, this means that the EOS token stock is inflated by five percent a year. Of these five percent, the block producers each receive one percent as a reward for validating the transactions. The remaining four percent will be placed in a separate pool, from which proposals for improving and further developing the EOS blockchain will be financed. EOS also aims to ensure that block producers cannot share their earnings with those from whom they receive their votes. This way, “buying of votes” should be prevented.

From a cryptoeconomic point of view, transaction fees not only serve to provide incentives but also prevent malicious players from spamming the blockchain network with an unnecessarily large number of transactions. EOS, on the other hand, prevents such spam attacks by making blockchain bandwidth usage dependent on the number of EOS tokens. Anyone who owns one percent of all tokens is entitled to one percent of the entire bandwidth of the network. In order to increase the chances of a targeted network overload, the attacker must increase his possession of EOS tokens, which causes ever-increasing costs. Spam attacks are therefore not ruled out, but they are economically expensive.

Anyone who wants to develop a DApp (decentralized application) on Ethereum will, as it were, make use of the computing power of the Ethereum miners and pay for it with ether gas. EOS, on the other hand, is based on an ownership model: If you hold one-thousandth of the EOS network, you also have one-thousandth of the computing power combined on EOS Blockchain. This ownership model enables DApp developers to realistically estimate their hosting costs at any time.

Attacking Ethereum

EOS is also committed to revolutionizing the concept of crowdfunding once again. Today, the Ethereum platform can be used to collect funds directly via an ICO – also known as a token sale. One issues a token and in return receives Ether, Bitcoin, or other cryptocurrencies. It is inevitable that fraudsters, swindlers, and charlatans will also receive financial resources this way. It is the hope of EOS sympathizers that crypto projects will migrate away from Ethereum in the longer term and switch to EOS for crowdfunding. This was the case, for example, with Everipedia, a for-profit competitor of Wikipedia.

The EOS ecosystem knows no ICOs or Token Sales, only the Airdrop. If a project wants to finance itself via the EOS blockchain, its EOS-based tokens are passed on to the EOS community free of charge via Airdrop. After the tokens of the project have been distributed via Airdrop, the market determines the value of the tokens according to the law of supply and demand. The team behind the project can then sell a percentage of its own tokens to raise money for the project. However, it seems somewhat unclear how a token distributed over an Airdrop without capital can gain value in the first place and thus be accepted by the market.

At best, the venture capital fund created within the EOS ecosystem should come into play here. Behind this fund is the company Block.one, which conducted the ICO for the EOS token in 2017. The venture capital fund is intended to make strategic investments in various projects based on the EOS Blockchain. It is only natural that this venture capital fund should be used to invest in promising projects that also want to carry out an Airdrop via the EOS blockchain. Of course, the question then arises as to how strongly Block.one influences crowdfunding on EOS. After all, a certain pre-selection takes place through the venture capital fund, which is not the case with Ethereum. The tradeoff is between allowing fraud on Ethereum or censoring innovation on EOS.

What About Decentralization?

The decisive question crypto investors are asking themselves today: Who will prevail in the long term? Ethereum or EOS? Are there any clues? Investors, for example, are focusing on the most prominent people behind the two projects: The battle between Ethereum and EOS has thus also turned into a battle between Vitalik Buterin and Dan Larimer. Some Ethereum supporters refer to Buterin’s allegedly astronomically high intelligence quotient, which would make him an even greater genius than Larimer. The opposite side meanwhile refers to the crypto projects BitShares and Steemit, which both originated from Larimer and would lead him to triumph. In the end, these comparisons are interesting, but they have little relevance for the future of the two smart contract projects.

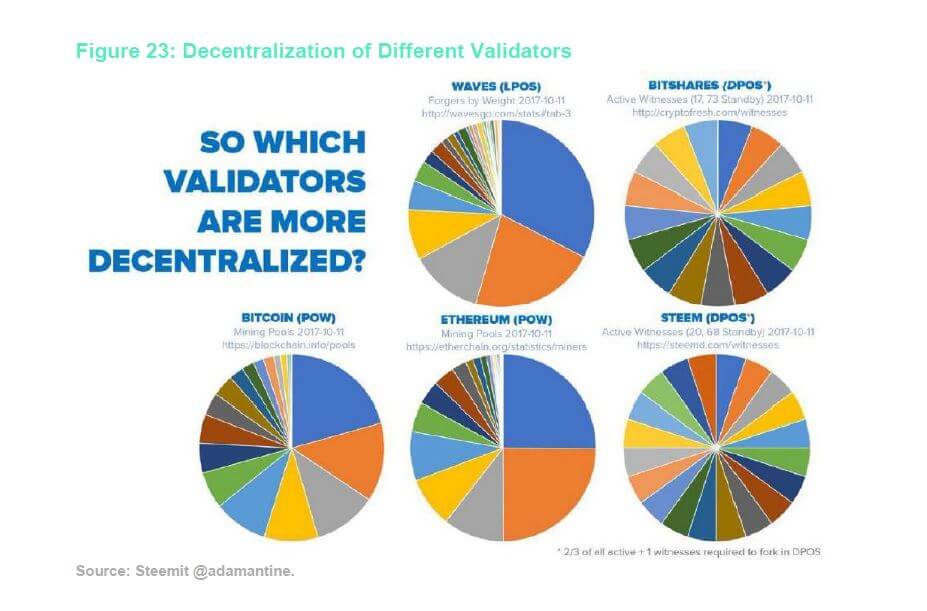

More revealing are project-specific debates that were initiated by Vitalik Buterin and Dan Larimer, among others. In the theoretical debate, the question of decentralization ranks at the top of the list. In the case of the EOS blockchain, it is ultimately a comparatively small number of nodes that maintain the network. In a world like that of crypto, which is committed to the decentralization of social structures, a blockchain concept with only 21 block producers naturally arouses suspicion. Is EOS decentralized enough or do the 21 block producers not rather remind us of a cartel or an oligarchy? Many honest crypto experts still consider it technically impossible to escape the blockchain trilemma, according to which there are inherent trade-offs between security, scalability, and decentralization, at the level of the basic protocol.

On the EOS side, there are some exponents for whom decentralization is not an absolute value. Since decentralization is always associated with mathematical and economic costs, compromises must be made in this respect in order to achieve the goal of mass scaling DApps. In their view, EOS is just as decentralized as the scaling intention requires. The fact that there are just 21 block producers can be traced back to Larimer’s previous experience with his other DPoS systems BitShares and Steemit. This number is therefore not engraved in stone or better written in code. In the light of new findings, it could also be changed, according to their arguments.

Other advocates of EOS do not consider the EOS blockchain to be less decentralized than Ethereum at all. They point out, for example, that at Ethereum three parties account for more than 50 % of total hashing power. If these three actors were to play together, the Ethereum blockchain could be successfully attacked and transactions could be spent twice. They also argue that Larimer’s earlier projects BitShares and Steemit have shown that DPoS systems are more decentralized than than proof of work used by Ethereum and Bitcoin because proof of work has an inherent tendency towards centralization due to economies of scale. Interestingly, it seems as if the EOS community generally consists more of people who prefer a certain amount of leeway to exert influence instead of a total inability to supervise. One can read the argument again and again that it can be considered sensible for “democratically” elected block producers to be able to intervene in the interest of the EOS community during emergencies such as a hack or bug.

A Fight That Is None?

Ethereum, EOS or another smart contract platform? The discussions about who will win the race are likely to continue for some time. Ethereum has by far the most developers, has many influential companies thanks to the Enterprise Ethereum Alliance, and is still by far the most widely used crowdfunding platform. EOS has become accustomed to its own blockchain by now and unites three of the most renowned crypto investors behind it, Mike Novogratz, Peter Thiel and Jihan Wu.

However, this fight is based on the assumption that only one smart contract platform is optimal. Most likely there is enough room for more than one winner because different applications require different blockchain infrastructures. The battle for supremacy among these platforms is reminiscent of the tug-of-war between the various operating systems in the early years of the computer and internet age. Just as several operating systems exist today with Mac, Windows, and Linux, no single winner is likely to emerge this time either. DApps can even run on multiple smart contract platforms simultaneously. Bancor, a blockchain protocol for the creation of smart tokens, for example, has already announced that it will use EOS as a foundation alongside Ethereum.