“I do think Bitcoin is the first encrypted money that has the potential to do something like change the world.”

Peter Thiel

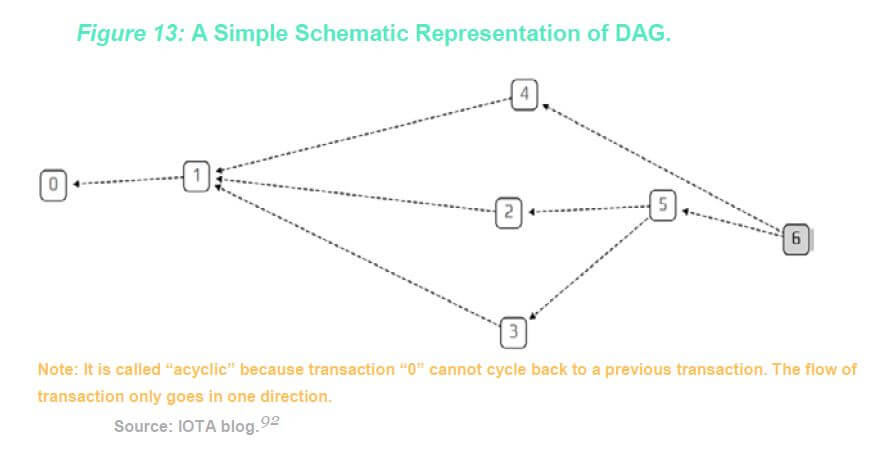

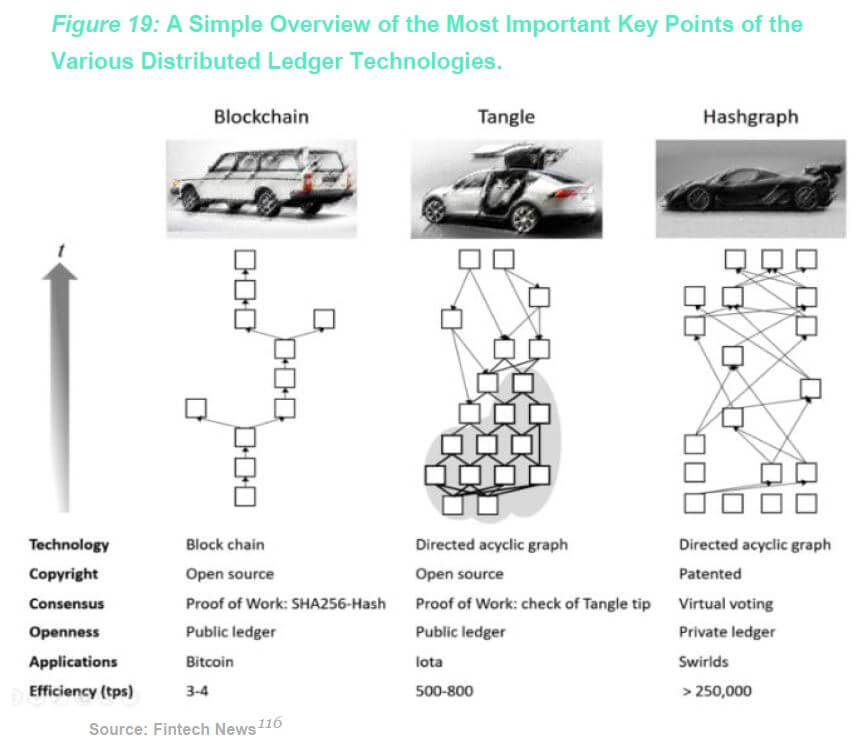

The Bitcoin blockchain is generally regarded as the original blockchain, since it is the first implementation of a new technology that is commonly described today as distributed ledger technology (DLT). The birth of the Bitcoin blockchain 1.0 was followed by the programmable Ethereum version as the blockchain 2.0 and soon the third generation, the blockchain 3.0 in form of IOTA, Nano, or Hashgraph. Splitting the development into these individual stages is a simplification, because the latest generation of the blockchain technology is not even properly characterized as being a blockchain. Rather, the keyword here is DAG or directed acyclic graph. Projects based on this technology aren’t really blockchains. Instead, IOTA, Nano, and Byteball are described as post-blockchain concepts. But why are investors and blockchain users to replace the original blockchain technology with a new “DLT variant”?

The Apparent Weakness of Current Blockchains

In theory, first- and second-generation blockchain technology has already turned the world upside down. There seem to be hardly any fields that could not be fundamentally changed by the blockchain. In practice, however, the situation has been somewhat different.

Currently blockchains such as those of Bitcoin and Ethereum are subject to an unresolved restriction: to date, they have not yet achieved substantial scaling success. This means that all these blockchain protocols are limited in terms of transaction throughput and speed. While legacy systems such as PayPal can process about 200 transactions per second (tps) and Visa even 56,000 tps, Ethereum currently only manages a maximum of 20 tps, while Bitcoin only reaches a capacity of 7 transactions per second. This is why Bitcoin and Co. are currently no match for the incumbent payment systems of our time.[1]

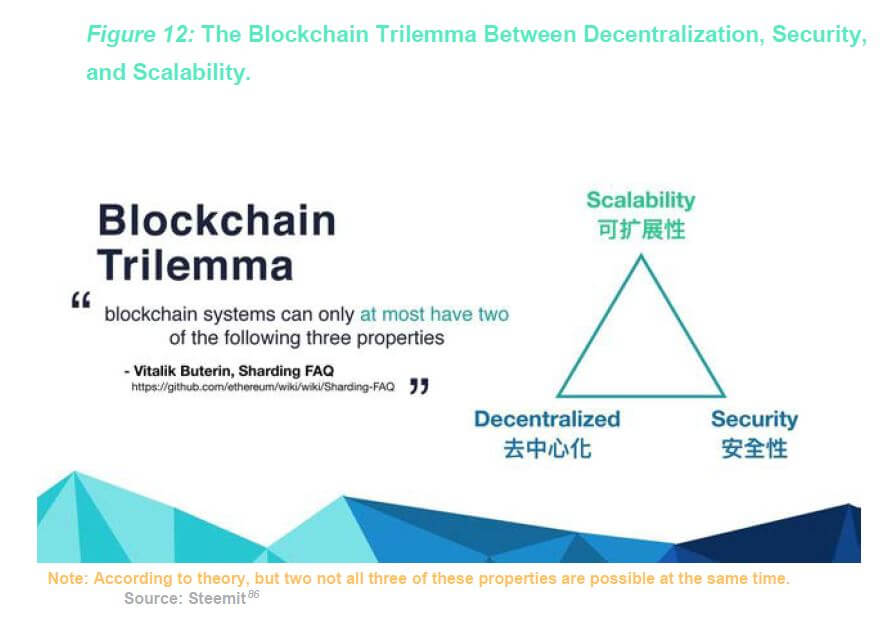

But why does this technical limitation exist at all? The answer is simple: The blockchain protocols are not slow because of some inherent scalability barrier. The restriction is rather the result of a “conscious” decision – to build a decentralized blockchain network.[2] One of the core elements of public blockchains like Bitcoin and Ethereum is to give everyone the possibility to operate a network node. Each node processes every single transaction and therefore has to store the entire transaction history of the blockchain on his computer. Public blockchains are only as strong as their weakest link. Scalability and therefore transaction throughput and speed depend on the capacity of the weakest node. Of course, weak nodes could be discarded, but then the crucial property of censorship resistance would be damaged, as certain network members would be deliberately excluded.[3] Therefore, it is this trilemma between decentralization, security, and scalability that prevents blockchains from achieving the transaction speed and throughput of traditional systems such as Visa or PayPal.

The Blockchain Solution That is Not a Blockchain

Research in the Bitcoin and Ethereum communities is continuously revolving. In each ecosystem, scaling solutions are being developed. On the Bitcoin side, the Lightning Network[4] and RootStock[5] are two of the best-known approaches. In Ethereum, solutions such as Sharding[6], Plasma[7], or Caspar[8] are at the top of the list. Attempts such as the Lightning Network or Sharding suggest that the answer to the scaling question is that not all participants – or network nodes – need to know all the information at all times to keep the network in sync. This approach is something the DAG or directed acyclic graph is based on as well.

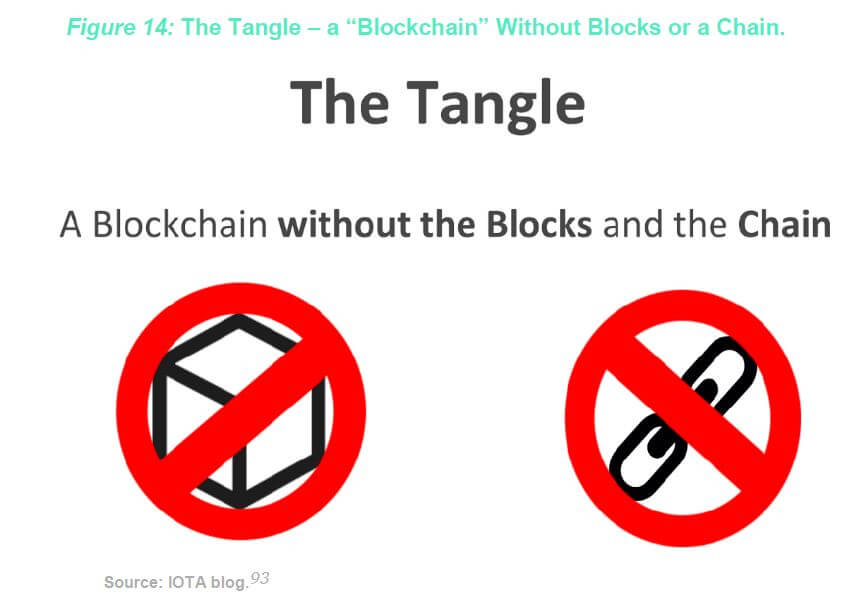

A DAG works according to a “horizontal” scheme, while a blockchain is based on a “vertical” architecture. With the blockchain, miners create new blocks that are added to the blockchain. The “horizontal” structure of DAGs, on the other hand, enables transactions to be linked directly to other transactions without putting them in a block first. This way there is no need to wait for a confirmation of the next block. At the same time, not all network participants have to confirm the block update. Since the DAG concept has neither blocks nor miners, there is no chain of blocks full of transactions and therefore no “blockchain”. The structure of a DAG is much more like a “mazy” network of numerous transactions. This is why it is often referred to as a Tangle – a term that appears again and again, especially in connection with the IOTA project. At its core, however, the Tangle has the same properties as a blockchain: it is still a distributed database based on a peer-to-peer network. Thus, the Tangle is also a validation mechanism for distributed decision making.

How Does the Tangle Work?

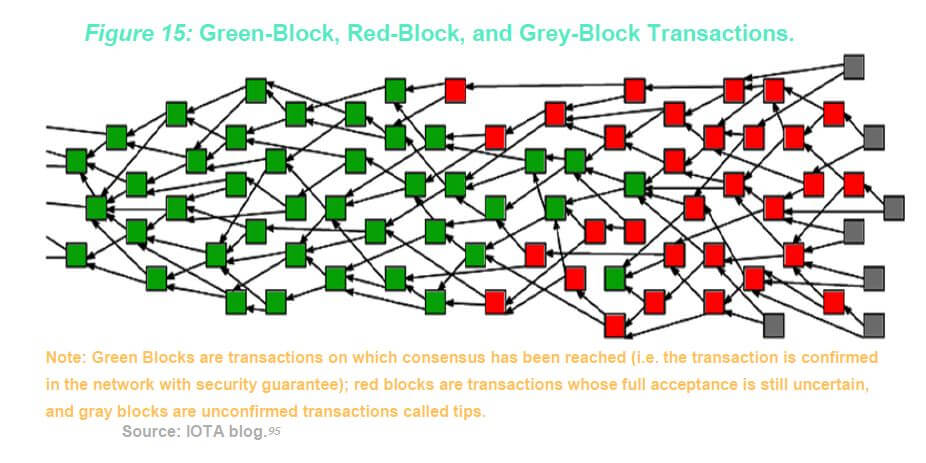

The Tangle is created by linking individual transactions in the network. The linking is a consequence of the fact that each unconfirmed new transaction must confirm one or two additional transactions before the unconfirmed transaction can be processed and confirmed itself. In contrast to the blockchain of Bitcoin or Ethereum, it is not only the miners who are responsible for the confirmation of transactions. In the case of the Tangle, this task of processing and approving new transactions is the responsibility of all active Tangle or network participants. This way not only newly added transactions are confirmed, but the entire transaction history is also indirectly confirmed with it. The “transaction issuer” does not pay a direct fee for processing its own transactions – he/she only indirectly pays (with computer hashing power) by confirming other transactions.

Transactions in the network that have not yet been confirmed are commonly referred to as “tips”. In order to obtain confirmation, these “tips” themselves have to confirm other transactions. An algorithm called Markov chain Monte Carlo[9] ensures that network participants do not just confirm their own transactions.

The reason why transactions have to be confirmed is obvious: the problem of double-spending must be avoided. As with a regular blockchain, the cryptocurrency units – in the case of IOTA the IOTA token – must be stopped from double-spend attempts. For example, if Alice sends ten IOTA tokens to Bob, Charlie checks Alice’s IOTA token balance before this transaction. If Alice only had five IOTA tokens, then her balance would be too low for the transaction to be valid. Charlie will not want to confirm this transaction because he has an interest in having his own transaction confirmed and this will most likely only happen if he himself does not validate any invalid transactions.[10]

As the name suggests, the Tangle ultimately is a Tangle of transactions. The Tangle has a concept called “confirmation confidence”[11] so that no two separate branches form in this “mazy” cluster of transactions in which Alice has issued the same IOTA token twice. Because this is the level of trust and acceptance that the rest of the Tangle gives to a transaction. Each transaction therefore has a certain percentage, depending on the number of tips (unconfirmed transactions) accepting it. This is intended to ensure that only one branch prevails, namely the one with the larger confirmation confidence.

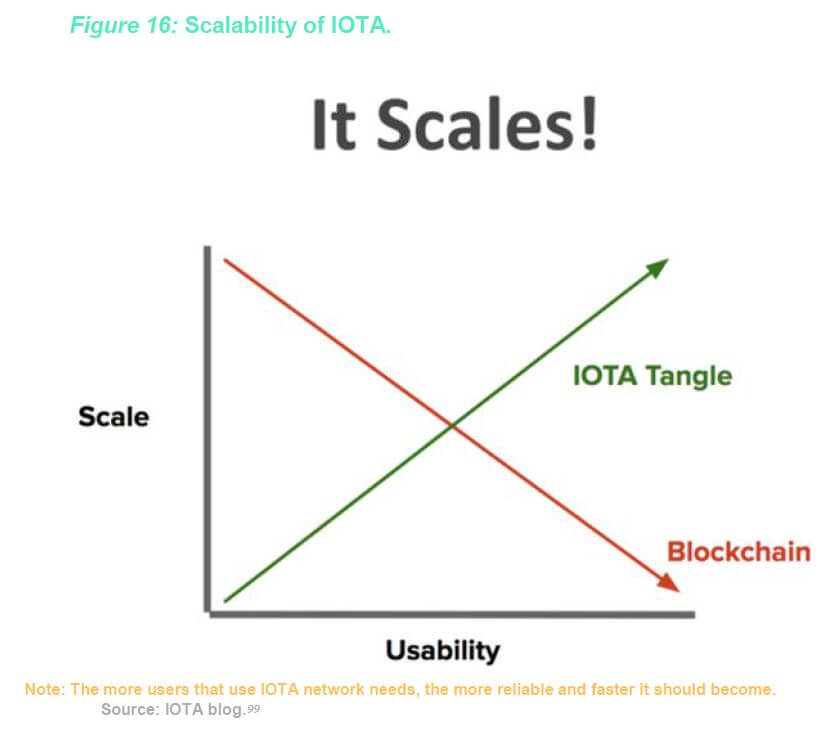

It is this concept that should enable a better scaling of any DAG project. What causes a traffic jam in a blockchain and slows down the network should make a Tangle even safer and faster: The more participants in the network and the more transactions are processed, the better the processing of outstanding transactions – that is what the theory says. As of yet, the IOTA network is still rather small, which is why the claim cannot be validated for sure. However, the largest Tangle projects, IOTA and Nano, indicate that they can currently process ~1,000 and 7,000 tps respectively.[12]

IOTA – The Backbone for an Internet of Things?

The IOTA project emerged from a hardware startup working on a new trinary microprocessor called “Jinn”[13]. In the future, this hardware component should make it possible for every vehicle, every microwave, and every refrigerator to communicate via the IOTA network without functioning as a normal computer.[14] Since the beginning of its development, the IOTA project, due to its inherent scalability, has seen itself as the predestined solution for the obvious problem of efficient transaction processing in a future machine economy.

Experts today hardly seem to question the fact that our world will develop into one big Internet of Things.[15] Estimates claim that by 2025, there should be over 100 billion interconnected devices and machines worldwide, all of which will have a dozen or more sensors. Already today our smartphone produces huge amounts of data. Imagine how much greater the amounts of data will be when our car becomes a smartcar, our house a smarthome and our city a smartcity. In our times, where data is the digital oil and thus a new treasure, the revenues generated by the data business will be enormous. Of course, these values should not simply be reaped by large tech companies. As a universal agnostic protocol, IOTA could function as a public, decentralized and self-regulating “machine-to-machine network” via which the respective machines can communicate independently without an intermediary and thus transfer values.

A futuristic but often mentioned example is that of a smart car. This intelligent vehicle could have an identity and an “e-wallet” one day. With this equipment, the smart car would be able to pay for various services such as fuel (in the future probably electricity instead of petrol), insurance, washing or road tolls. Even the payment of a parking ticket should be possible, especially because the IOTA network does not have any actual transaction fees and therefore seems to be predestined for “micro-payments”, i.e. very small payments.

The vehicle of the future should therefore not only be a self-driving car – it should also be autonomously paying for services used and also be able to offer its own services. The concept of “mobility as a service” could become more attractive in such a machine economy driven by the IOTA network. Whenever one of the vehicle owners does not need his vehicle, his/her car could offer its driving services to paying passengers. By giving customers a ride and collecting the fee through the e-wallet, the car generates a kind of passive income for the owner instead of simply sitting in a parking lot. As an autonomous economic agent, the possibilities for such a vehicle of the future seem to be limitless. Ultimately, we humans benefit because our time can be optimized in more efficient ways. For example, if a passenger is in an extreme hurry, he/she could also instruct the vehicle to make other vehicles that are in less of a hurry go out of its way – obviously, a fee would be

paid directly to other vehicles via the IOTA network using IOTA tokens for clearing the way.[16]

The founders of the IOTA network are pretty confident: While mankind is already creating the Internet of Things by digitizing things and equipping them with sensors, IOTA should have the potential to make a further step possible: An economy of things in which data and IoT devices are able to share their digital assets autonomously via marketplaces in the new machine economy.

With regard to IOTA, one of the most impressive facts is that the project has succeeded in setting up a foundation in Germany. This is astonishing because Germany is regarded as one of the most difficult countries to establish a foundation. In addition, the IOTA foundation has influential advisors on the board of their foundation. For example, the “Chief Digital Officer” Johann Jungwirth of Volkswagen is a member of the Board of Trustees. Robert Bosch Ventures is also a member of the advisory board and its fund has already made substantial investments in IOTA.[17]

In mid-April, the world’s first charging station for electric vehicles was launched in the Netherlands, where charging and payment can be carried out with IOTA. The charger was installed by ElaadNL, a research institute for innovation.[18] For the IOTA team, this is one of the first steps towards real-world adoption.

Recently, the IOTA team unveiled the long-awaited secret about the so-called Project Q. With Qubic, the IOTA protocol will not only support smart contracts[19] and oracles[20], but also a form of distributed computing. This makes the IOTA Tangle programmable. At the same time, the free micro-transactions should ensure that external and distributed computing power can be used for the IOTA Tangle. Qubic is intended to make unused computing power available for the IOTA Tangle on a global scale in order to further enhance the performance of the IOTA network. According to the founders of IOTA, the Qubic project is one of the most important milestones of the IOTA project.[21]

Hashgraph – The Latest Excitement Among DLTs

In addition to the Tangle, the term “Hashgraph” is also causing quite a stir on the market. This newly developed technology also falls into the category of distributed ledger technologies (DLT). The idea for Hashgraph was developed by Leemon Baird in mid-2016 and was originally intended for the private corporate sector. The intellectual property in Hashgraph is held by Swirlds, a company founded by Baird.[22] Swirlds distributes a software development program that allows anyone to experiment with the “Hashgraph Consensus Library”. With CULedger, a consortium of 6,000 cooperative banks in North America, Hashgraph has already found a potent customer who uses their private Hashgraph software and has even preferred it to other alternatives such as Hyperledger.[23]

Due to this success in the corporate sector, Swirlds has now launched the “Hedera Hashgraph Platform” with aims to drive forward Swirlds’ patented Hashgraph technology for the development of a public Hashgraph network.[24] While the source code of the Hedera Hashgraph is publicly available and anyone can become part of the Hedera Hashgraph ecosystem as a network node, the project will still have a governance model similar to that of Visa. This means that there will be 39 organizations that will form a kind of leadership council. The exact terms are currently being finalized and the 39 members will be announced.[25] Due to this structure with a management body, splitting the source code to create an alternative project using a hard-fork will not be possible.

How Does the Hashgraph Work?

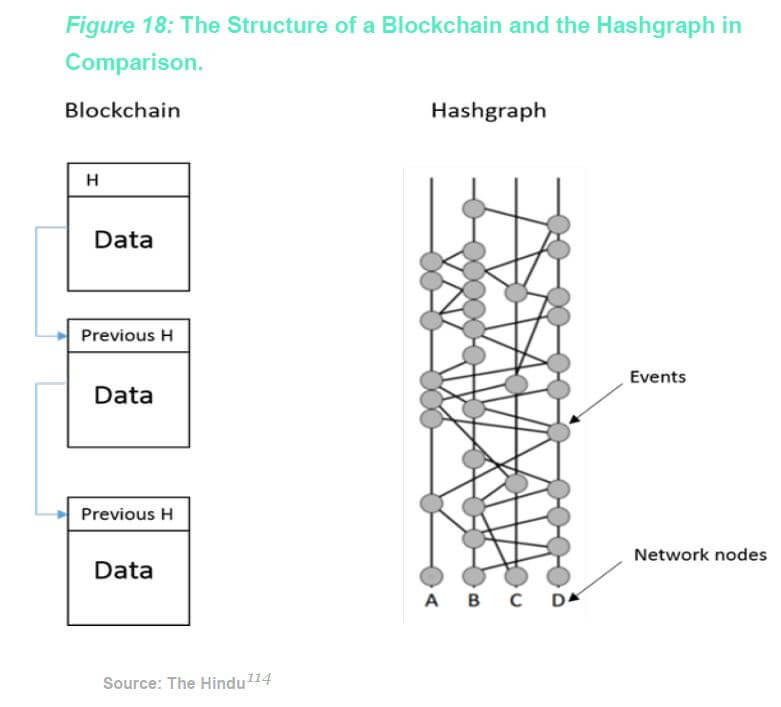

As with the Tangle, the Hashgraph concept is no longer based on blocks that are chronologically put together to form a chain. Instead so-called events, which are hashed to each other – hence the name “Hashgraph”. The following information is contained in these “events”: a timestamp, two different parent hashes and one or more transactions.

While in a blockchain the winning node has the possibility to add the new block with transactions to the existing chain, in the Hashgraph all nodes within the entire network inform each other about the latest status and “exchange” their information with each other. Similar to a Tangle, a connection diagram of “events” or transactions is created, and transactions are arranged according to a chronological time sequence. This transaction history allows a consensus on the sequence of individual transactions.

With the Hashgraph concept, the necessary information within the network is also transferred via the so-called Gossip protocol, a communication protocol. To disseminate information within a network, the Gossip protocol is considered the fastest and most efficient method of communicating between different computers. Each computer passes the received information to a randomly selected computer. This leads to an exponential dissemination of information throughout the network.

However, the mere dissemination of information within the network is not sufficient to achieve a consensus on the shared information. For this purpose, each network participant must know the exact transaction history and thus the exact sequence of individual transactions, which is ensured by the timestamps already mentioned. Therefore, the Hashgraph consensus algorithm makes use of the “Gossip-about-Gossip” approach. Every computer within the network shares all its knowledge about which network accounts spoke to what, to whom and when. Or more technically speaking: Each computer shares all its knowledge about the Hashgraph, which is the exact order of all transactions ever occurring on the network. Because each network participant always has the current Hashgraph, each computer knows the entire transaction history. All participants know that every other participant within the network has all the relevant information about transactions and their order. This circumstance enables what is called “virtual voting” because all nodes in the network have a copy of the transaction history and information about who received the information at which point in time, each participant can calculate how each other network participant will behave. Therefore, each node knows the decision of the other, without an effective decision, i.e. a “vote”, having been made. On the basis of this “voting without voting”, there is thus a consensus among the network participants, although they do not have to carry out a resource-intensive coordination procedure among themselves.

Interestingly, the voting algorithms used for Hashgraph are already over 35 years old and are used in a slightly modified form. These are so useful because they have a mathematically proven level of security that, to this point in time, cannot be outsmarted. The experts behind Hashgraph therefore claim – and refer to mathematical evidence – that Hashgraph is the only DLT technology to be A-BFT (asynchronous Byzantine fault tolerance). According to them, this means: As long as less than 1/3 of network participants have no intention to defraud the network, a consensus can always be found among the computers about the state of the network and the transaction history.

The Future Vision for Hashgraph

As a form of DLT technology, the Hashgraph is also intended to radically change the structure and organization of today’s Internet and with it the world. It is becoming increasingly obvious that the Internet in its current form has serious shortcomings, some of which are due to original birth defects. Today, large centralized server facilities are the cornerstones of our global Internet. Due to these neuralgic points of attack, things like hacks, spam, BotNet or DDoS attacks[26] are part of everyday online life. Again and again we are reminded of this fact in reality.

Hashgraph sees itself as a potential solution for these problems. With Hashgraph, it should be possible to create an “Internet of Shared Worlds” that minimizes numerous security risks that exist today and at the same time eliminates isolation. Moreover, this new Internet powered by Hashgraph should in the future enable everyone to create their own world, their own community.In addition to inadequate security, the Internet also suffers from isolation. What this means is that the Internet as a whole consists of mass isolated systems that are not connected to each other by default, which makes smooth communication between these separated silos tedious and complex. Although the Internet appears to be a perfectly interlinked network on the surface, it still consists of countless separate worlds whose bridging is very resource-intensive.

The hash graph protocol, which in contrast to conventional blockchain protocols already allows scaling on its basic protocol, is designed to fundamentally change the model of Internet data storage also. According to experts, data storage is to be vastly distributed across and within networks. For the provision of their data storage capacity, corresponding network participants would be remunerated on the spot by means of micropayments. The financing of large centralized server units for data storage would no longer be necessary, say advocates believing in the vision of Hashgraph. At the heart of this new Internet would be DLT technologies such as the hash graph, which transparently capture all important information about the community. If Internet applications were based on Hashgraph technology, participants could be sure that the rules defined by the protocol would be enforced in a fair way for all, as they are secured and enforced by cryptography and mathematics. In this way, the individual communities could communicate smoothly with each other via DLT technologies and reach a consensus in this new world of digitally shared worlds.

Hashgraph connoisseurs also insist on another important point: This technology can also make the Internet faster. Today’s leadership-based Internet, which is based on central servers that have to route all data traffic through the entire system, appears to us to be fast. However, if the Internet were based on a DLT technology such as the Hashgraph, even higher speeds would be possible. With its private Hashgraph network, Swirlds has achieved a higher transaction speed in test attempts than the Visa network currently has. Here too, the visionaries of Hashgraph see another reason why their protocol could possibly improve the existing Internet.

Tangle & Hashgraph – Can They Keep Their Promises?

As described at the beginning of this chapter, innovative approaches such as the Tangle or Hashgraph are seen as the next generation in the still young history of DLT technology. Free market competition is further fueling innovative. The speed with which innovation progresses is astonishing – but the mutual rivalry between the projects often turns into real animosity. The debates degenerate into childish mud battles, which do little to advance the crypto, blockchain and DLT world as a whole. It is difficult for investors to keep track of all the cheap, emotionally charged and often personal accusations and criticisms and to arrive at a reasonable assessment of each cryptocurrency’s potential capital gains.

Nevertheless, one of the more meaningful objections should be briefly described: In the case of a DAG, there is no global network state, since a DAG (Tangle and Hashgraph) has no blocks and is based to some extent on the principle of regional consensus. This means that network participants no longer store all transactions, but only “local” data of their “neighbors” and rely on “other regions” to do the same carefully. The ultimate question here is whether this concept of regionalism can actually prevent double-spend-attacks. To be fair, it has to be said that the same question arises in Ethereum’s scaling companies that want to take advantage of the sharding solution.

There are also fears that the Tangle and Hashgraph will assume a huge data size due to their scalability and that this will lead to centralization among those network nodes who keep the network running. IOTA and Hedera Hashgraph seem to have a solution for this problem: they announced to regularly shorten the Tangle or Hashgraph. Of course, this would mean though that the networks would potentially introduce certain neural centralized points of attack again. Those responsible for either project argue that the coordinators of the Tangle and the leadership council of the Hashgraph only have a supporting function. Once the two projects had reached a certain size and relevance, these “support wheels” would no longer be needed, on which the IOTA coordinators and the Hashgraph Leadership Council would lose influence. By then the problem of too big data pools might have been solved as well. Until then, however, a lot has to happen, and the projects must first achieve the promised scaling. Although both the Tangle and Hashgraph appear promising, they have yet to provide the final and practical proof for what the claim.

[1] See “Why blockchains don’t scale,” Piers Ridyard, Radix, Febrary 8, 2018.

[2] Here the term “non-centricity is deliberately used. The frequently mentioned concept of de-centrality implies that there is a central entity, albeit a weak one. However, this does not apply to Bitcoin and some other blockchain projects, which is why “non-central” seems to be better suited.

[3] See “Hate Bitcoin? This May Change Your Mind,” Peter Shin, Medium, March 10, 2018.

[4] See Crypto Research Report II

[6] See “How to Scale Ethereum: Sharding Explained,” Raul Jordan, Medium, January 20, 2018.

[7] See “Ethereum Plasma Explained,” Lukas Schor of Argon Group, Medium, May 28, 2018.

[8] See “What is Ethereum Casper Protocol?,” Blockgeeks, December, 2018.

[9] See “A Primer on IOTA (with presentation),” Dominik Schiener, IOTA Blog, May 21, 2017.

[10] See “The Tangle: an Illustrated Introduction,”Alon Gal, IOTA Blog, January 31, 2018.

[11] See “The Tangle: an Illustrated Introduction,”Alon Gal, IOTA Blog, January 31, 2018.

[12] See “What it means to have 7,000tps!,” Reddit, January, 2018.

[13] See “Jinn,” CoinMarketCap, 2018.

[14] See “IOTA: The hardware part,” Chris Mueller, Medium, January 6, 2018.

[15] Watch “Jeremy Rifkin on the Fall of Capitalism and the Internet of Things,” Big Think, April 22, 2018.

[16] Watch “IOTA – 100 Billion Reasons Why,” The bIOTAsphere, April 11, 2018.

[17] See “Blockchains vs DAG: Behind the Battle for the Backbone of the Internet of Things And the Future of Cryptocurrency – A History,” Wasim Of Nazareth, Medium, February 16, 2018.

[18] See “World’s first IOTA Smart Charging Station,” Harm van den Brink, ITA Blog, April 19, 2018.

[19] See “Smart Contracts: The Blockchain Technology That Will Replace Lawyers,” Blockgeeks, 2016.

[20] See “Types of oracles,” BlockchainHub, 2018.

[21] See “IOTA and Qubic – The Start of New Era (And The Fulfillment Of A Long Time Dream),” IOTA News, June 42018.

[22] See Swirlds’ website for more information.

[23] See “Swirlds and CULedger Collaborate to Deliver High Performance, Secure, Distributed Applications to Credt Unions,” Swirlds, October 27, 2017.

[24] See “The Future Of Distributed Ledger Technology: Hashgraph Launches Hedera Platform,” Jorn van Zwanenburg, Invest in Blockchain, March 26, 2018.

[25] See “The Next-Generation Internet: Mance Harmon and Hedera Hashgraph,” Bitsonline, May 3, 2018.

[26] See “What is a DDOS Attack?,” Digital Attack Map, 2018.