Which investment contracts can be tokenized may vary from country to country (and even between regions within a country) based on which country the issuer is in, which country the investors are in, what type of investment contract is being tokenized, and what class of investors is being targeted.

Some companies issuing security tokens prefer to call the offering a “regulatory compliant token offering” rather than security token offering, because the latter can be a legal admission by the company that the assets being sold are securities.

Different jurisdictions define tokens in different ways, and a popular approach is to let the tokens be treated as needed in each given jurisdiction instead of a uniform classification for the whole world. For example, In the US, a token can be a security where in another country it is a utility token (see XRP in U.S. vs. Japan(1)).

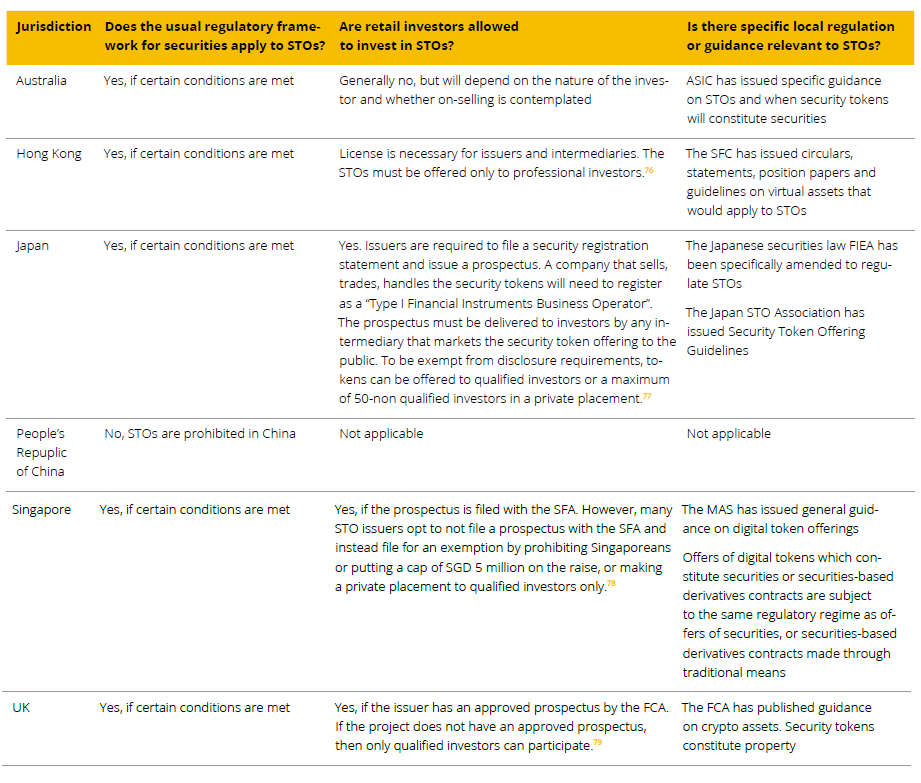

STOs are already regulated in major financial jurisdictions such as the U.S., the U.K., Hong Kong, Singapore, and Japan. Most regions allow retail investors to invest in security tokens if the issuer has an approved prospectus. However, there are regions such as Hong Kong that only allow security tokens to be sold to professional investors and other regions such as China that have outlawed security tokens.

In continental Europe, STOs are not currently regulated at an EU level, but a draft proposal for regulation of the use of distributed ledger technologies in financial services was published in September 2020. A few countries in Europe have designed new legislation for security tokens including Liechtenstein’s Blockchain Act, Switzerland’s DLT Act, Luxembourg’s Bill 7637(2), and the German ministerial draft law for the introduction of securities in electronic form.(3)

Overall, all the EU countries have similar rules. If an STO qualifies as a transferable security, then EU securities laws apply to the token. Basically, if the project has an approved prospectus then it can publicly offer the tokens and anyone can purchase them regardless if they are retail or professional. Otherwise, only qualified investors can participate.

Security Token Regulation per Country

Regulations is not static. It is constantly changing and it can change in many different directions, making the issuance of Security Tokens easier or harder depending on difference systems that the companies have to navigate through.

This article is an extract from the 90+ page Security Token Report 2021 co-published by the Crypto Research Report and Cointelegraph Consulting, written by thirteen authors and supported by Crypto Finance, Blocklabs Capital Management, HyperTrader, Ten31 Bank, Stadler Völkel Attorneys at Law, Riddle&Code, Coinfinity, Bitpanda Pro, Tokeny Solutions, AlgoTrader, and Elevated Returns.