Digital Assets are a new and very specific group of assets that is increasingly interesting to investors for many different reasons. What are these reasons and is there one specific reason that dominates our survey? This is a question, that we will look at in this article. Another question that may be interesting to other potential investors is the question of ‘How?’ the surveyed companies have decided to invest in digital assets. Because this class of assets is new, the ways of investing also differ from more traditional assets.

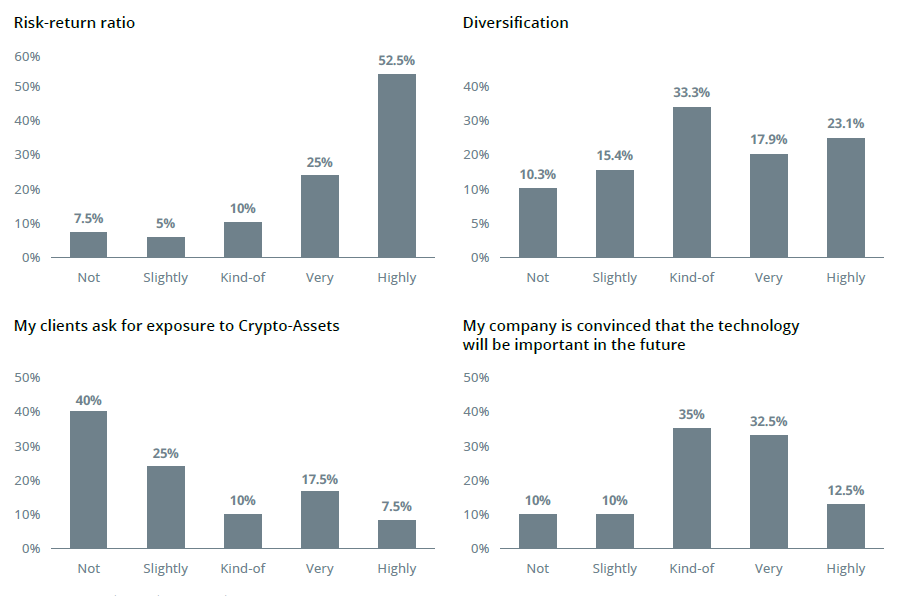

According to the survey results, the most important consideration for investing in digital assets is their risk-return ratio, as 53% of respondents rated this characteristic as “highly important”. Most of the responses to “diversification” and “my company is convinced that the technology will be important in the future” are clustered in the middle and slightly skewed to the right of the importance spectrum, meaning that these factors are moderately important. Notably, the survey shows that clients requesting digital assets is not very relevant to the asset managers’ decision to invest in these assets. As one respondent pointed out, clients requesting digital assets would be their number one reason for investing, but so far, none of their clients had requested digital asset exposure.

Professional Investors prefer Direct Investment

The target group for blockchain-inspired financial products include pension funds, insurance companies, university endowments, high-net-worth individuals (HNWI), family offices, asset managers, banks, and fund of funds from around the world. Usually, these investors are asking for a regulated and easy-access approach to crypto exposure. Some of them want to invest in a new asset class with a great risk-return profile, others want diversification. There are many regulated investment products that give investors exposure to digital assets including long-only single asset or index products, derivative products, bank accounts for prop desk trading, and much more. This report found that professional investors prefer to invest directly in digital assets by buying them on an exchange. Interestingly, professional investors prefer to buy a regulated alternative investment fund before using a broker.

Question: What is your company’s ideal way to gain exposure to crypto assets?

Digital Asset Service Providers

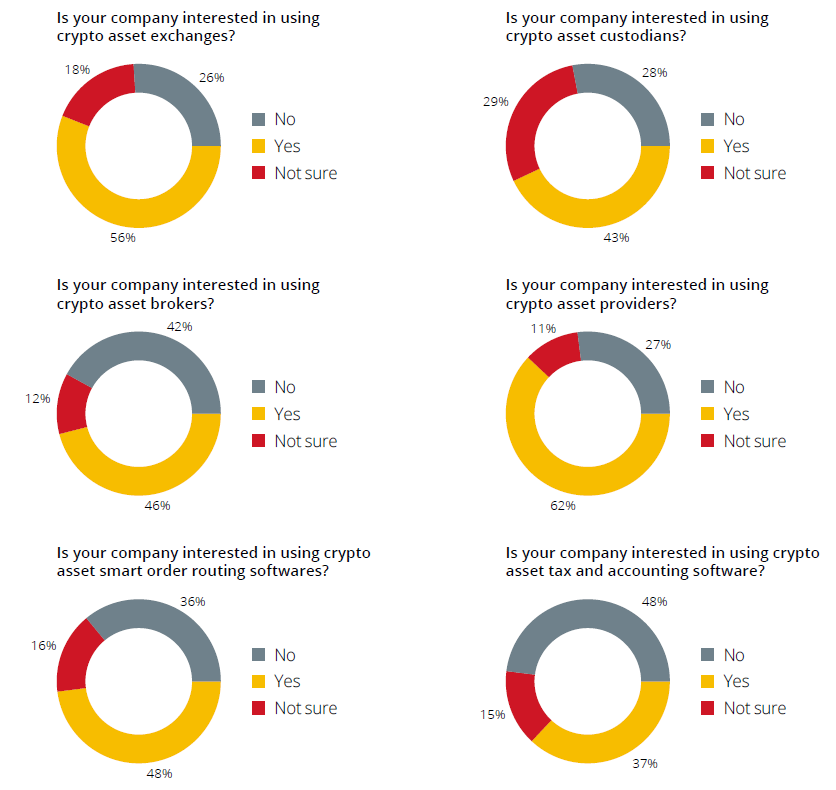

When asked about their use of specialized services for digital assets, respondents were most interested in data. 62% of respondents are interested in using data on digital assets at their company. Leading data providers in the digital asset industry include Coinmetrics (also sold by Messari), Coinmarketcap.com, and Cryptocompare. However, closer to home in Europe, Santiment and IntotheBlock also provide data on a monthly subscription basis. The next most sought after service is trading of digital assets on a digital asset exchange. In the German-speaking region, the only digital asset exchange owned locally is Bitpanda, which is headquartered in Austria. In Germany, Bitcoin.de is a peer-to-peer exchange, which is mostly used by retail investors.

However, there are several exchanges that serve Europe including Kraken, Binance, Bitfinex, Bitstamp, and Crypto.com. Over half of the respondents (54%) are interested in using an over-the-counter desk for the digital asset transactions. The largest OTC-desk operating in Europe is B2C2, based in London. Many brokers in the German-speaking countries offer over-the-counter services but use B2C2 or Cumberland for final execution. Notably, 48% are interested in using smart order routing software. Smart order routing software includes companies such as Blocksize Capital, based in Frankfurt, and CoinRoutes, based in the US.

In this graphics we are looking at all investors that participated in our survey indiscriminately but this does not paint the whole picture. Behind every number there is a company of different size and investment volume. Next week we want to go deeper in the individual numbers and look at how much the size matters.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.