It will surprise no one to hear that a growing number of institutional investors have already invested in cryptocurrencies with increased global awareness and crypto marketing. But which institutions are we talking about here? This is a crucial question when it comes to accurately classifying the scope of this statement, since the term “institutional investors” covers a very wide range of institutions.

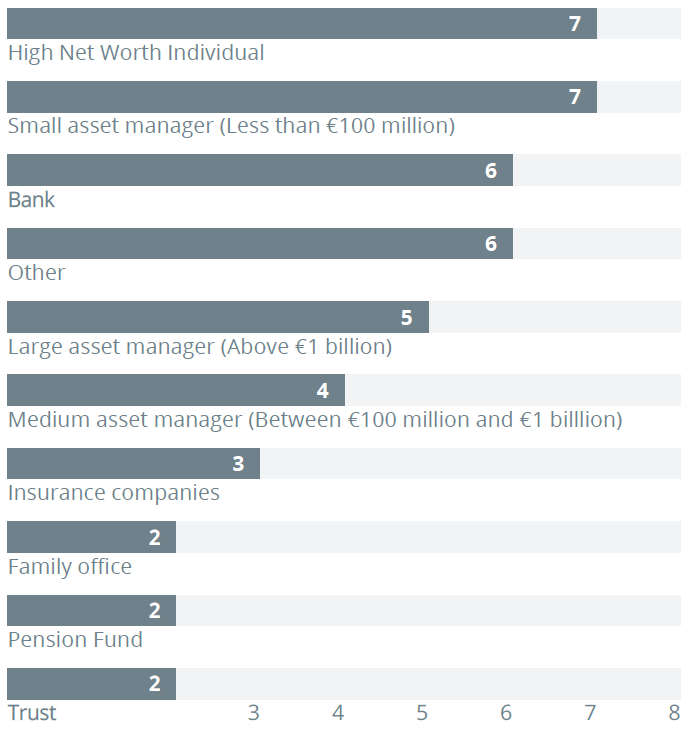

Multiple types of professional investors responded to this survey including trusts/foundations, small asset managers (less than €100 million), medium asset managers (between €100 million and €1 billion), large asset manager (above €1 billion), insurance companies, pension funds, high-net-worth individuals, family offices, and banks. The majority of respondents are small asset managers and high-net-worth individuals, both of whom account for about 32% of the total respondents.

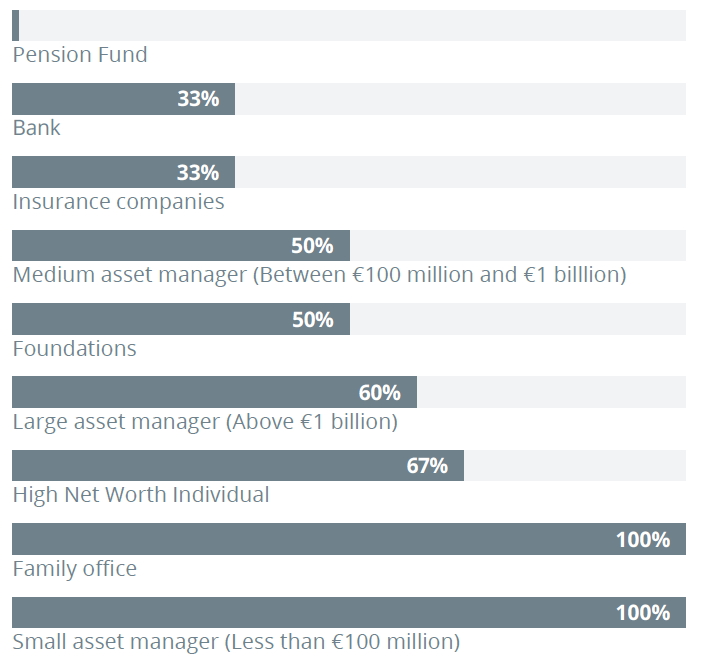

Smaller asset allocators, such as family offices and boutique wealth management companies, are more likely to invest in digital assets than larger financial service providers, such as banks and pension funds, according to the survey results. All 14 of the small asset allocators and family offices responded that they already own or plan to own digital assets in the future. This is compared to zero out of the two pension funds, one out of the three insurance firms, and two out of the six banks that were surveyed.

Many banks stated that they would like to offer their clients the ability to buy and sell digital assets; however, the decision that needs to be made by the C-Suite executives is whether to build up their internal infrastructure or outsource the trading and custody to a third-party broker or exchange.

Question: What type of investor is your company?

Percentage of Each Investor Group that Owns or Plans to Own Digital Assets

Using Existing Infrastructure or working with a Broker to Invest in Cryptocurrencies?

For example, the Swiss giant in core banking systems, Avaloq, was mentioned multiple times by respondents. Avaloq is offering trading and custody solutions for investing in digital assets. If a bank buys the Avaloq digital asset module, the ability to invest in digital assets could be expanded to the bank’s entire customer base, and retail clients would even be able to buy and sell via their e-banking and mobile-banking applications.

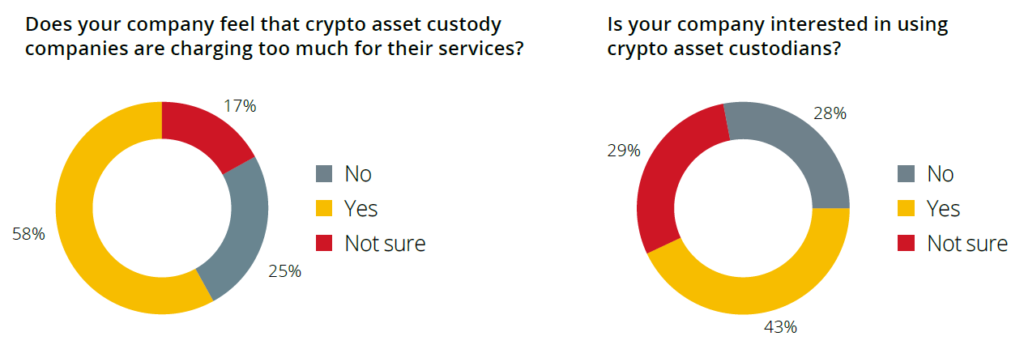

However, the banks said they are hesitant to purchase software solutions to bring digital asset investing to their clients. The infrastructure and services are considered to be too expensive still. Custody solutions in particular are comparatively expensive. The main reason for this is believed to be a lack of competition. The banks would need to have significant demand for digital assets from their clients in order to justify the expense. As more traditional players enter the digital asset industry, prices should fall in this regard.

Information is of very great importance for investors in cryptocurrencies. Because of the highly speculative nature of this sector, weighing the risk is only sufficiently possible when a given project has been examined from all sides. This expertise is something that many institutions have yet to acquire. We will take a closer look at this process in the next article of this series.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.