Most professional investors can point to a formal education when it comes to their expertise in finance. This formal education, however, does not cover information about the Blockchain technology and Digital Assets. It is therefore of importance for institutions venturing into this new industry sector, to educate their employees first. For our report we asked them about their approach to Blockchain education and want to present this information here.

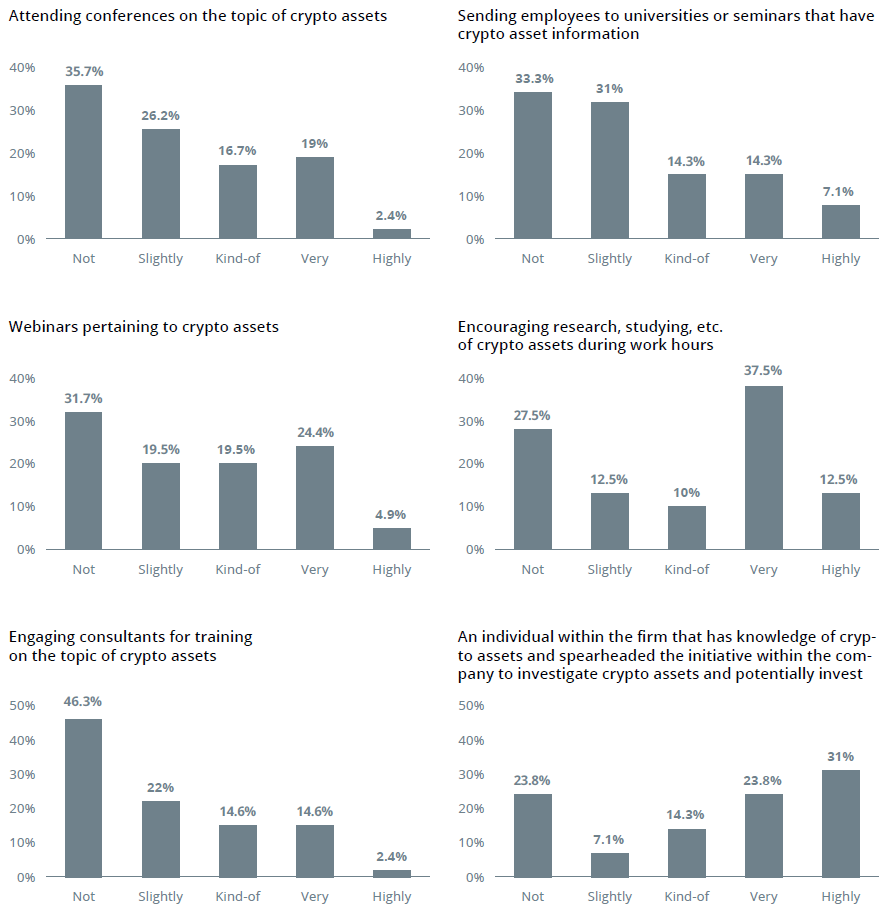

When asking about how financial intermediaries learn about blockchain, the highest ranked sources included encouraging employees to research the topic during working hours and an individual within the firm is spearheading the internal dialogue. Participation in conferences and webinars on crypto also promotes interest in the subject.

There is also a general openness to educational training concerning digital assets, but the survey participants generally do not rely on hiring external consultants or attending university courses in order to learn more.

Digital Assets for me, but not for thee

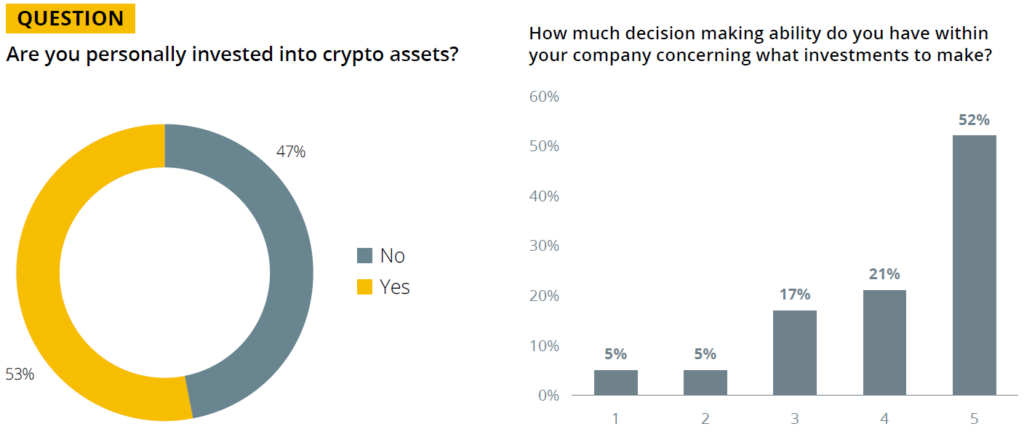

Several of the case study respondents stated that they had privately invested in Bitcoin and other digital assets, while their institution had not yet made any direct investments. However, the majority of the respondents had a high level of decision-making ability within their firm.

A possible explanation for this can be that asset allocators are investing with more risk aversion when investing on the behalf of others than when investing their own wealth.

The majority of the respondents had a master’s degree or above in formal education.

QUESTION: What level of education have you completed?

Education about the Blockchain technology behind Digital Assets is not only important when it comes to choosing an asset to invest in, but also when it comes to safely handling this asset. These technological risks around purchasing and storing an asset can prevent an institution from investing into this new asset class. In the next article we will take a look at these risks to understand what companies fear the most.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.