The number of potential risks surrounding Digital Assets is relatively high, but risk in and of itself is not an absolute criterion for exclusion for financial institutions. We asked institutional investors about their opinion on risky Digital Assets and about how they evaluate the associated risk. Here are their answers:

Several of the asset managers in the survey mentioned that digital assets are too risky for them. However, financial institutions already invest in risky investments in the traditional financial markets, such as insurance-linked securities, sub-prime mortgages, emerging market treasury bonds, junk bonds, and much more.

Cyber-Crime and Fraud

Operational Risks (e.g. Technological risks)

So why are digital assets different? According to some respondents, in the traditional world, there are indeed investments that are risky. However, they are part of the traditional system and, therefore, cannot fall to zero without causing fundamental problems for the financial system as a whole. Digital assets, on the other hand, deliberately exist outside the traditional world, which is their purpose. Consequently, they are even riskier. Essentially, the asset managers are saying that traditional assets are too big to fail, the central bank and government gives them an implicit safety net in the lower-bound of the price of the asset. However, if a large financial intermediary supports digital assets and digital assets fail spectacularly, the government might actually let that business fail just to show what happens when you invest in a technology that challenges the government’s monopoly on money production and monetary policy.

“Investors are well served when innovation flourishes. I recognize that innovation involves risks, but it is investors who should get to choose the winners and the losers of the market. Regulators should not impede investor choice; rather, they should ensure that investors have access to accurate disclosures about the range of available products, including their risks.”

— Peirce, Securities Exchange Commissioner

Market risks (e.g. Volatility)

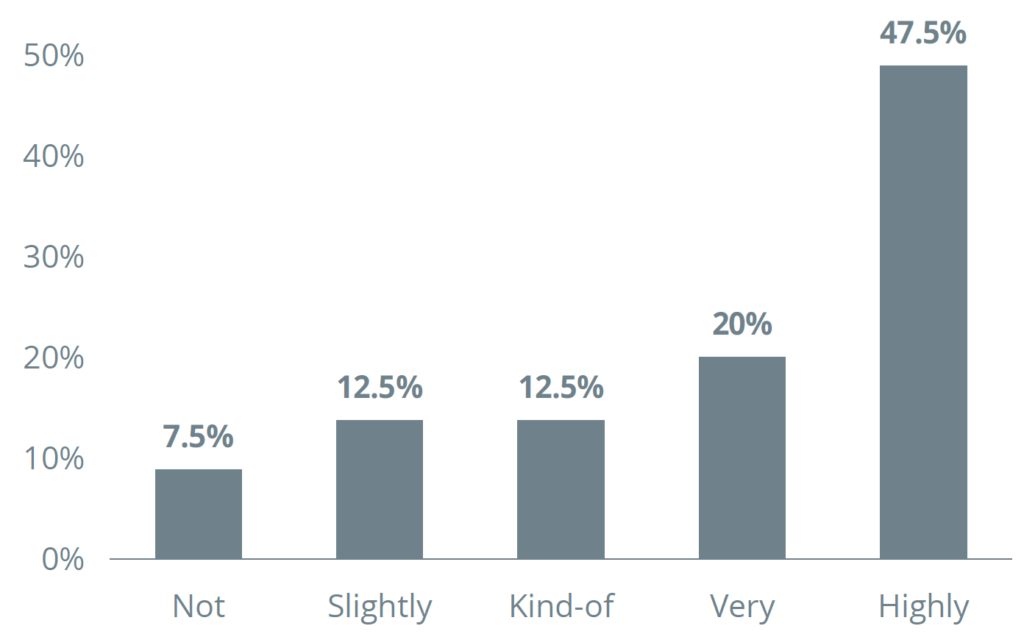

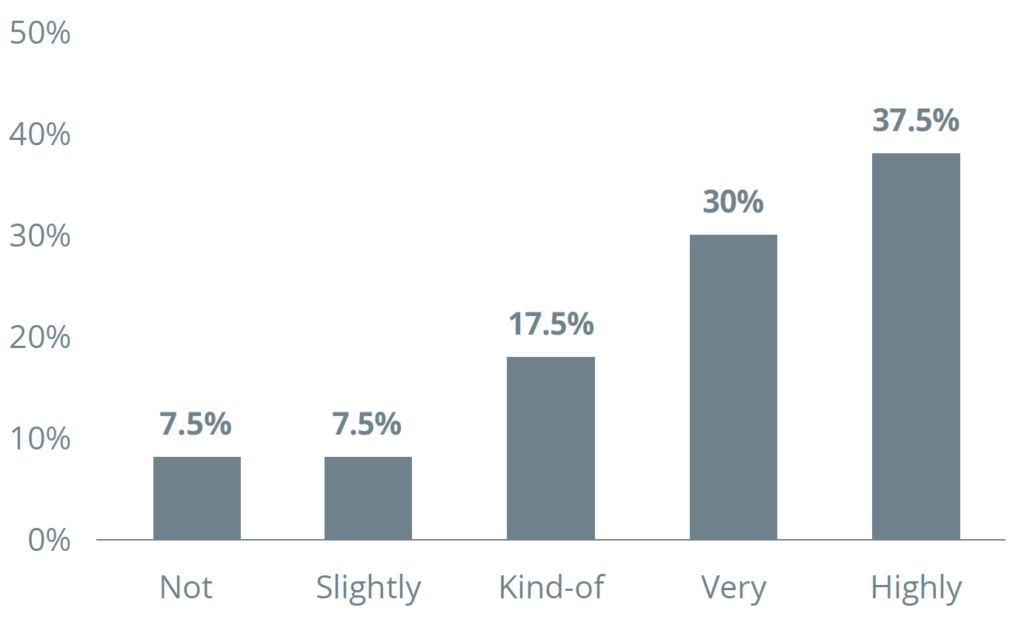

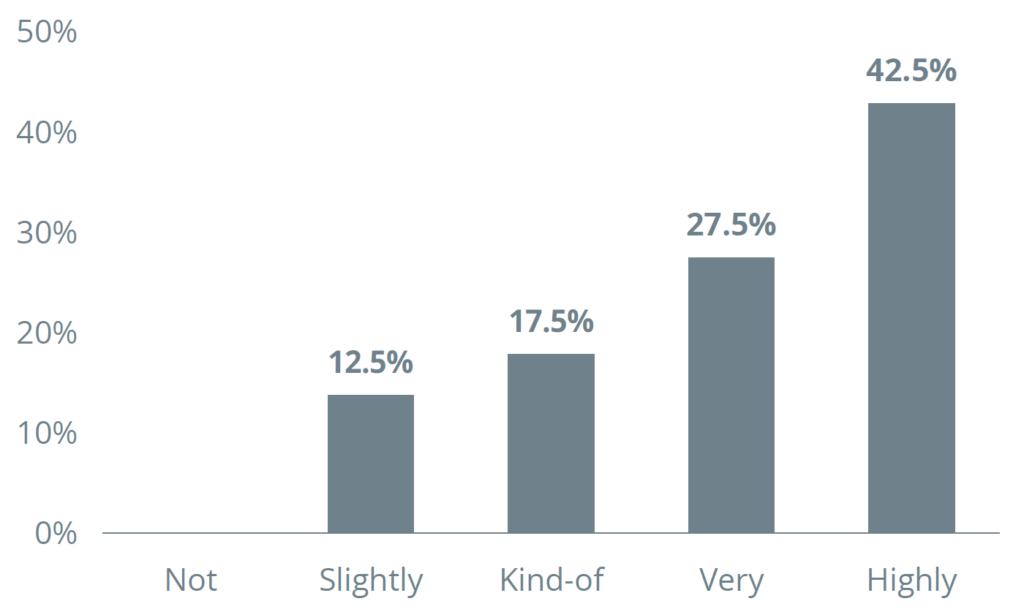

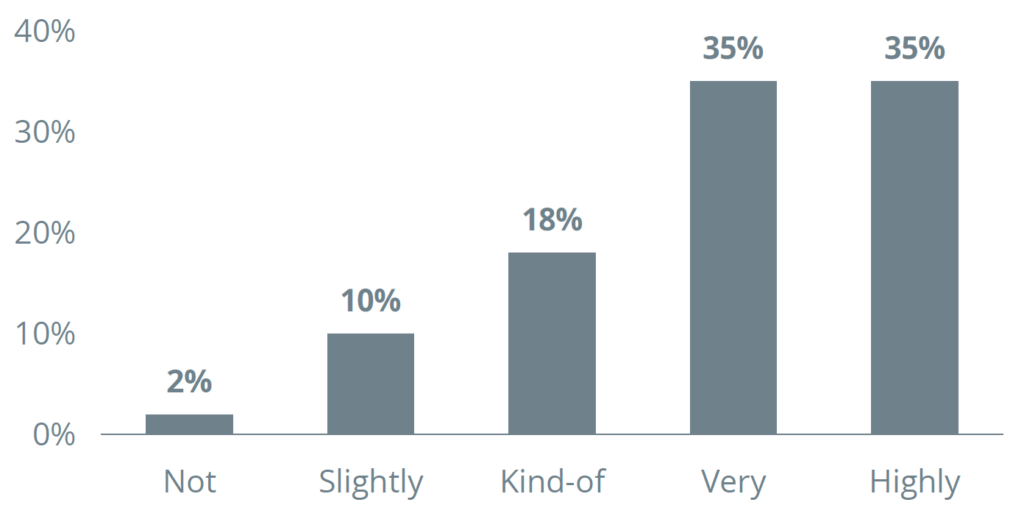

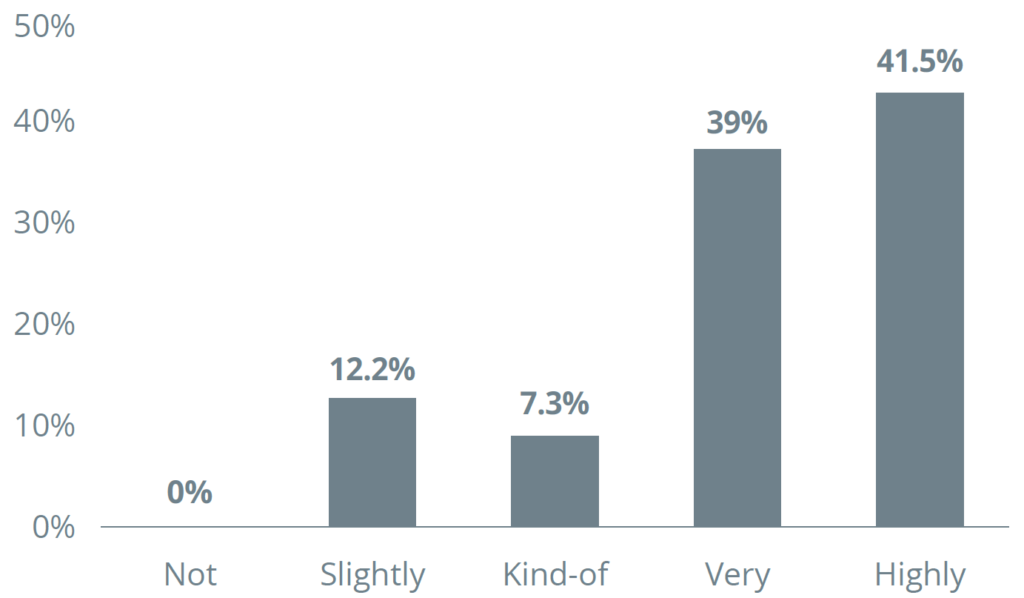

Asset managers were asked to rate the importance of perceived risks when investing in crypto assets; the possible risks were the following: market risks (e.g. volatility), liquidity risks, operational risks (e.g. technological risks), cyber crime and fraud, and regulatory risks. All of the risks mentioned are in the “important spectrum” of the charts. However, the most important risk for those surveyed was regulatory risk, as almost 80% of the sample fell in the “important region” of the graph. With approximately 71% and 70% of responses in the “important region”, market risk and liquidity were ranked as the second and third most important risks, respectively. Operational and cyber crime risks have the same number of responses in the “important region” (~ 68%).

Liquidity risks

A specific risk was mentioned that is not related to digital assets, but rather to the bank’s entire business model. Some banks fear that if they offer bank accounts to blockchain-based companies and offer clients the ability to invest in digital assets, they would lose their US dollar correspondent banks. This is a relevant concern as some banks have already lost their US dollar correspondent bank because they moved into the digital asset space. One respondent mentioned that their correspondent bank softly warned them that if they were to invest in digital assets, their banking relationship with the correspondent bank would be damaged or even terminated. It’s probably not a coincidence that these correspondent banks have the most to lose if digital assets eclipse the dollar.

Layering in money laundering is the process of making the source of illegal money as difficult to detect as possible by progressively adding legitimacy to it.

Regulatory Risks

“If cryptocurrencies fail to provide easy liquidity, then they fail as mediums of exchange, one of the principal roles of money.”

— Michael Parsons, Former Cardano Foundation Chairman

For many institutions these risks are already outweight by the benefit of accessing a new revenue stream and they are therefore already invested into this asset class or they are at least planing to do so. We spoke with Stefan Andjelic from Raiffeisen Bank International and will present his insight into this topic in next weeks article.

This article is an extract from the 70+ page Discovering Institutional Demand for Digital Assets research report co-published by the Crypto Research Report and Cointelegraph Consulting, written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo.