Perth Mint’s Gold Token (PMGT), Paxos Global’s PAX Gold (PAXG) token, DIGIX Dao (DGX) vs. buying physical gold with crypto via Vaultoro or Bitpanda

Dear Crypto Asset Investors,

As the investment consultant of the Cayman-based Dash Investment Foundation, I designed a Dash and Gold rebalancing strategy that suggests for the Foundation to buy gold on a regular basis. I had to do extensive research on the fees, stability, liquidity, and risks of several gold-backed tokens.

In the end, the Supervisors and Directors of the foundation, decided not to buy a gold-backed token but rather to directly buy gold from a company that stores the gold on the Foundation’s behalf in vaults in the Alps (Liechtenstein and Switzerland).

However, the Foundation may make a position in one gold-backed token, and the questions that matter the most for us are:

- Do we as the token holder or buyer legally own the gold that backs the token?

- If the company goes bankrupt, do we lose our investment or is our investment ring-fenced on their balance sheet?

- How liquid is the gold-backed token? If the foundation invests in Paxos Global’s PAX Gold (PAXG) token, will we be able to sell our gold-token and close our position?

- How correlated is the gold token with the price of gold? Does it trade at a premium or a discount?

- What are the fees?

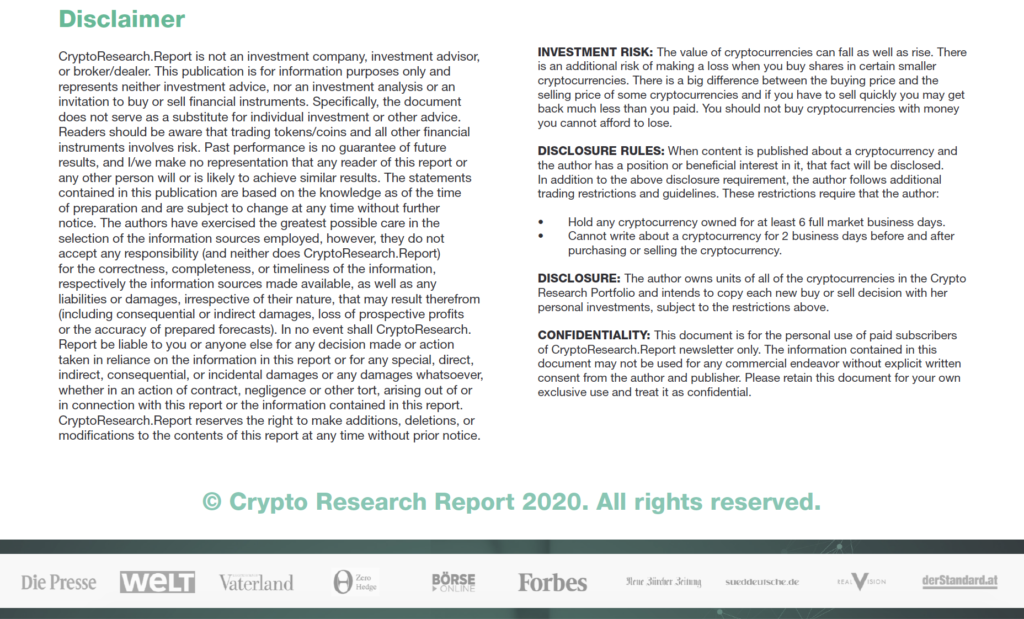

This article briefly compares three gold-backed tokens including the Perth Mint’s Gold Token (PMGT), Paxos Global’s PAX Gold (PAXG) token, and DIGIX Dao (DGX). As you can see from Figure 1 below, the blue dots show that DIGIX Gold Token traded at a discount to the gold price while the gray dots, PAX, traded at a premium until mid-March of 2020, when all gold tokens began primarily trading at a premium. Out of the three coins, Digix Gold Token is the most volatile and Perth Mint Gold Token is the most stable when comparing the price of the coin on the market and the spot price of gold.

Figure 1: Stability of Gold-backed Tokens 12/01/2019 – 04/24/2020

Source: Coinmarketcap.com, barchart.com, CryptoResearch.Report

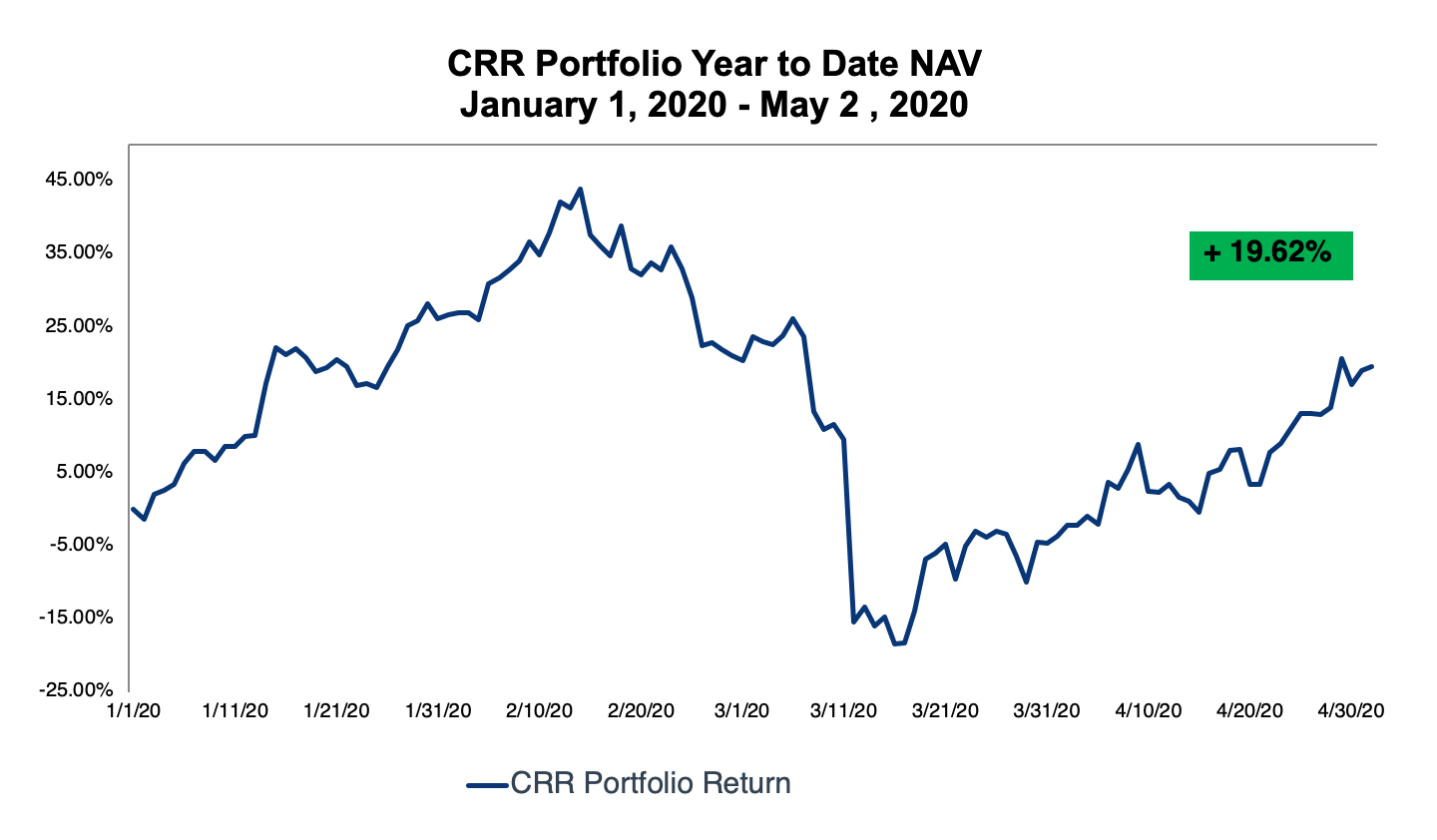

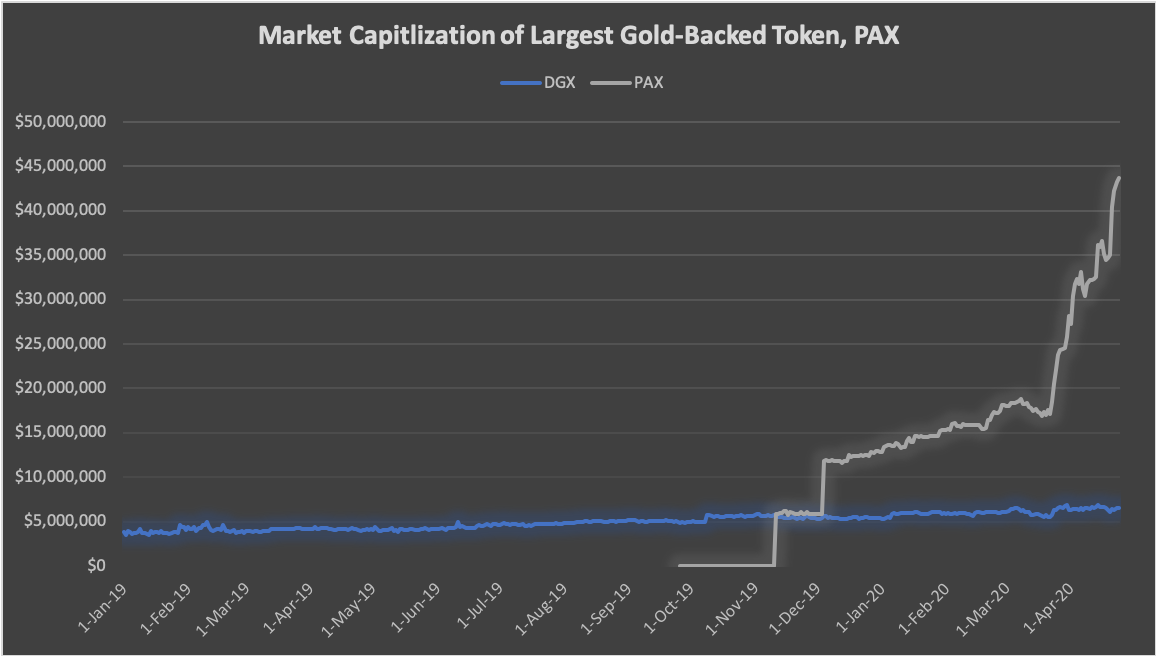

Figure 2 below shows that PAX gold token has the highest liquidity or daily trading volume. However, even PAX’s daily trading volume liquidity is quite low, averaging a little over $ 1 million per day during 2020.

Figure 2: Trading Volume of Gold-backed Tokens 01/01/2019 – 04/24/2020

Source: Coinmarketcap.com, barchart.com, CryptoResearch.Report

Figure 3 shows that PAX is the gold-backed token with the largest market capitalization and liquidity.

Figure 3: Market Capitalization of Largest Gold-backed Token, PAX 01/01/2019 – 04/24/2020

Source: Coinmarketcap.com, barchart.com, CryptoResearch.Report

Perth Mint’s Gold Token (PMGT)

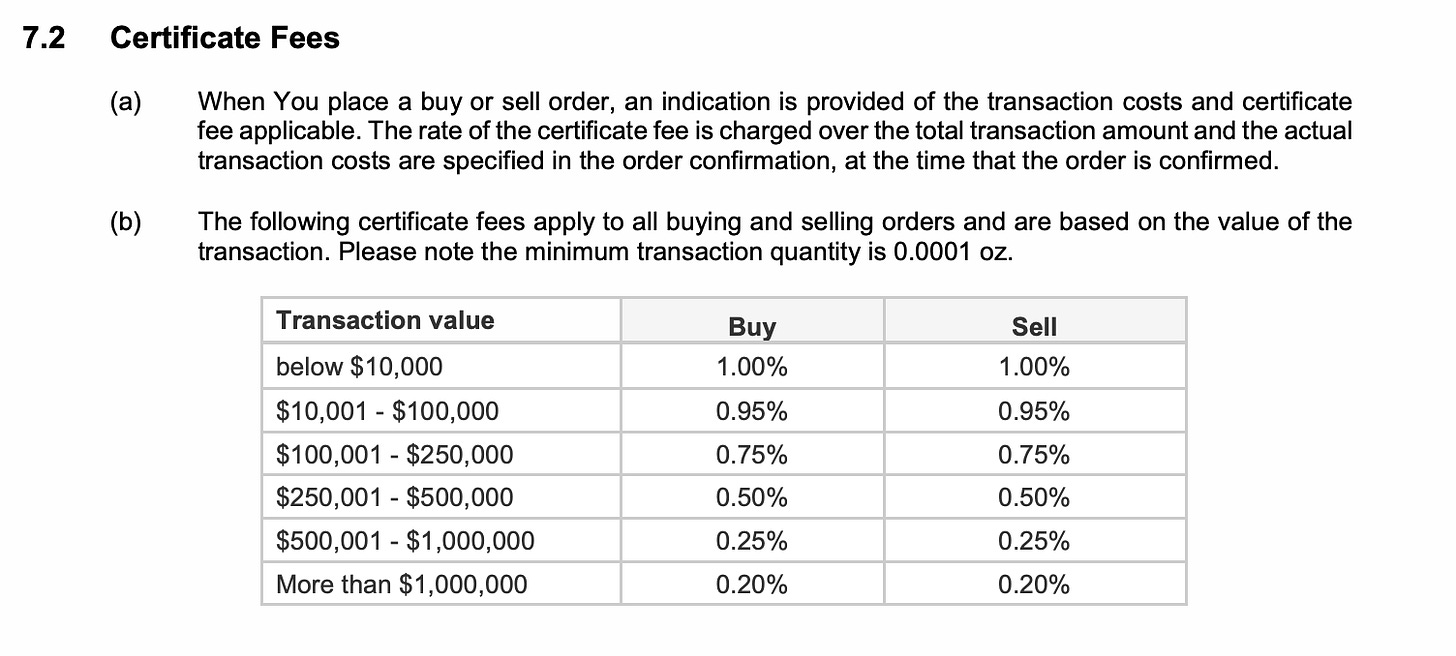

The Perth Mint’s Gold Token (PMGT) is the world’s first digital asset backed by government-guaranteed gold stored at the Perth Mint. PMGT is issued by a company called InfiniGold and trades on the KuCoin Exchange. The Perth Mint is the world’s largest refiner of newly mined gold and has AUD 4.5 billion worth of gold under custody for clients. Each token is backed 1:1 by Perth Mint digital GoldPass certificates which represent one ounce of physical gold held in storage at The Perth Mint. The weight and purity of every ounce of gold backing PMGT is assured by the Mint’s sovereign owner, the Government of Western Australia. Regarding fees, PMGT on their website proudly states that they have apparently no fees for custody, storage, insurance or management. However, if you read the small print in their terms and conditions, you can find they charge a fee called the “certificate fee”. This is basically when you buy or sell gold using their phone application, the company creates a digital certificate that involves creating or destroying an ERC-20 token.

Source: GoldPass Users terms and conditions, PerthMint.com

If you trade PMGT on secondary markets like the cryptocurrency exchange KuCoin, then the certificate fee does not apply. The certificate fee only applies when buying or selling directly to InfiniGold. But be careful what price they charge for buying gold or selling gold, because they may put a spread on top of the spot in order to extract profits. If you have bought Perth Mint Gold Token directly from the issuer before, please comment or email us below about your experience and the spread on gold’s spot that you paid.

Paxos Global’s PAX Gold (PAXG)

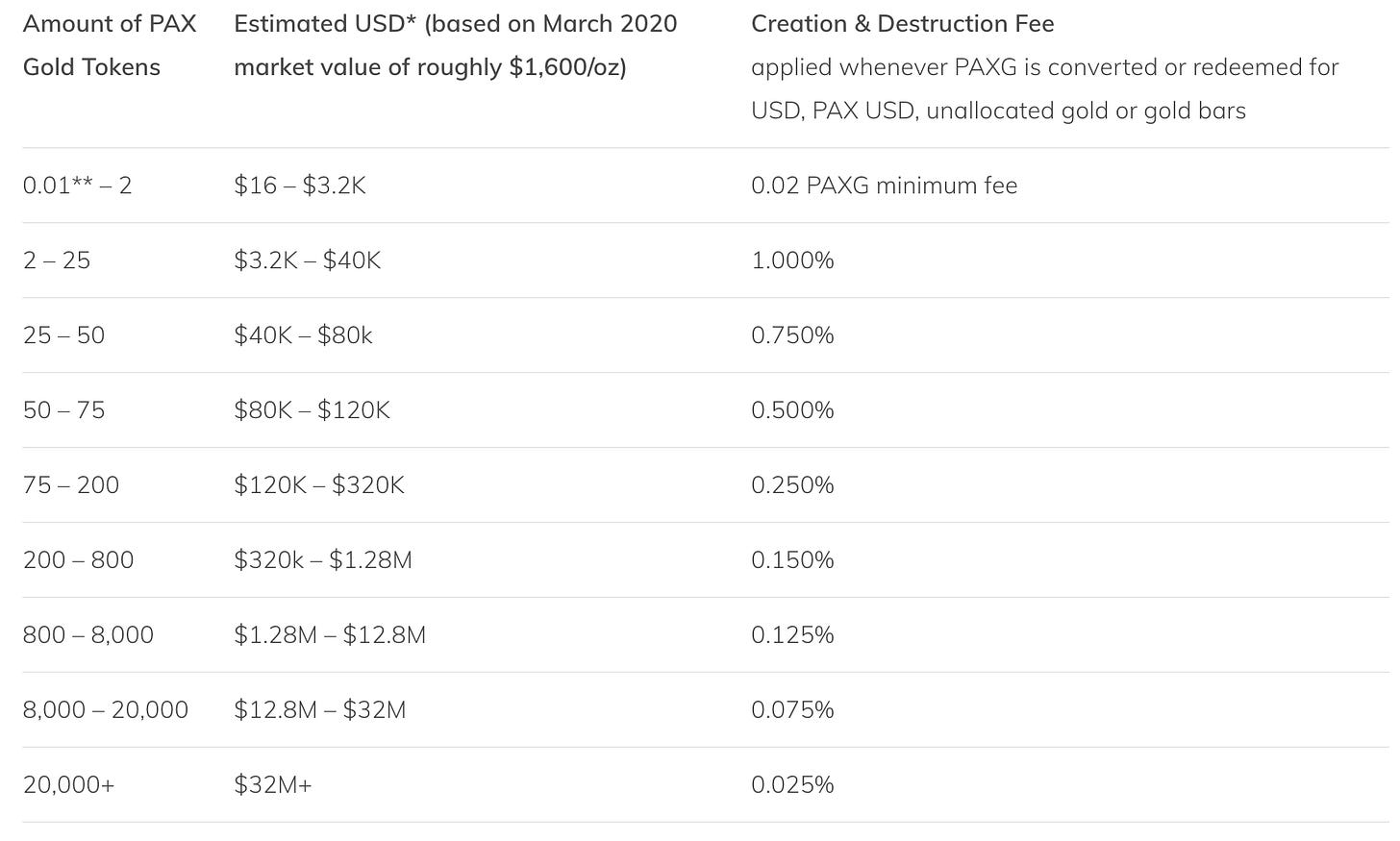

Each token represents one fine troy ounce of a 400 oz London Good Delivery gold bar, stored in Brink’s gold vaults. Anyone who owns PAXG owns the underlying physical gold, held in custody by Paxos Trust Company. Regarding fees, PAX has similar fees to Perth Mint’s Gold Token. For example, whenever you buy or sell PAXG from your Paxos account (on either the wallet or PAX Gold pages), Paxos charges small fees to process both the creation and destruction of PAXG tokens (see fee schedule below). This includes all sales or conversions of PAX Gold to or from USD, PAX, gold bars or unallocated gold. These fees do not apply on the itBit exchange or anywhere else outside the Paxos wallet.

Source: Paxos.com

However, in addition to Perth Mint’s certification or creation/destruction fees, PAX also has fees for transferring. Whenever PAXG tokens are sent via Ethereum, Paxos charges a small (0.02%) transaction fee, and the Ethereum network charges nominal gas fees (in Ethereum). This paragraph is included on their website:

“Sending a PAX Gold (PAXG) token from one ERC-20 address to another, such as when moving funds from a wallet to an exchange, is an on-chain transaction; possession of the token is transferred and recorded on the Ethereum blockchain.

There are two kinds of fees that occur when you send PAXG on the blockchain:

- Standard ‘gas’ fee: Sending digital assets on Ethereum, requires computing power, or ‘gas.’ Just like any other Ethereum token, PAXG requires standard gas fees paid in ETH to compute the transaction.

- PAXG on-chain transaction fee: PAXG charges an additional fee. That fee is set to 0.02% of the amount of PAXG sent on the blockchain.

For example, if you want to send 10 PAXG from one Ethereum address to another, and you want to ensure that the receiver gets at least 10 PAX after fees, you should send at least 10.0020004001 PAXG total to cover the cost of the on-chain transaction fee. If you initiated a transfer of 10 PAXG, the receiver would get 9.998 PAXG after fees.”

Digix Dao (DGX)

There are two tokens associated with this company: DGD and DGX. The one that matters for the gold market is DGX, which equals one gram of standard gold.[1] The company reportedly procures its gold from LBMA-approved refiners. The tokens are issued by Pte. Ltd. in Singapore, and the gold is stored at The Safe House in Singapore.

DGX does not have a creation/destruction fee or certification fee like PAX and Perth, but DGX does have a storage fee, and they also have a transfer fee similar to PAX. Every time a DGX transaction takes place on the Ethereum Blockchain, a 0.13% transfer fee is charged. There is also a 0.60% per annum storage fee that is charged on account balances.

Conclusion

To summarize the three gold-backed tokens, we find the Perth Mint’s custodial risks and fees to be the lowest, however, PAX has the highest liquidity, which matters. DGX has the highest fees.

In the cryptocurrency world they say, “Not your keys, not your crypto.” Well, the parallel for gold would be something like, “Not your vault, not your gold.” All of these gold-backed stablecoins have counterparty risk. Perth’s vaults could be seized by the government or Perth Mint could freeze just one person’s gold account if instructed to do so by the government. Therefore, diversification in custodians is a good rule of thumb, and even owning some physical gold privately to eliminate counterparty risk is an option as well.

In addition to the Paxos Gold-backed token’s daily liquidity and market capitalization, the coin pays an annual interest rate of 4% on cryptocurrency lending platforms like Crypto.com. The Crypto Research Report portfolio has 15% allocated to PAX Gold, and is staking that gold on Crypto.com.

Perth Mint’s Gold Token would almost be the best gold-backed token on the market, except, you can only trade the token on KuCoin Exchange currently. In contrast, PAX is traded on reputable exchanges like Kraken.

As an alternative to buying a gold-backed token, companies like Bitpanda and Vaultoro allow users to directly buy gold with cryptocurrencies. Vaultoro’s solution for example allows investors to own the underlying physical gold and the gold is held in custody by Vaultoro at Philoro Vaults in the Alps. Vaultoro’s solution has a 1.9% fee for buy or sell limit orders and and a 2.5% fee for boy or sell spot orders. Vaultoro also has a spread between spot and bid-ask, therefore, the amount of premium that you pay can be quite high. Liquidity is also an issue since the Vaultoro orderbooks do not have that many trades.

Winners and Losers

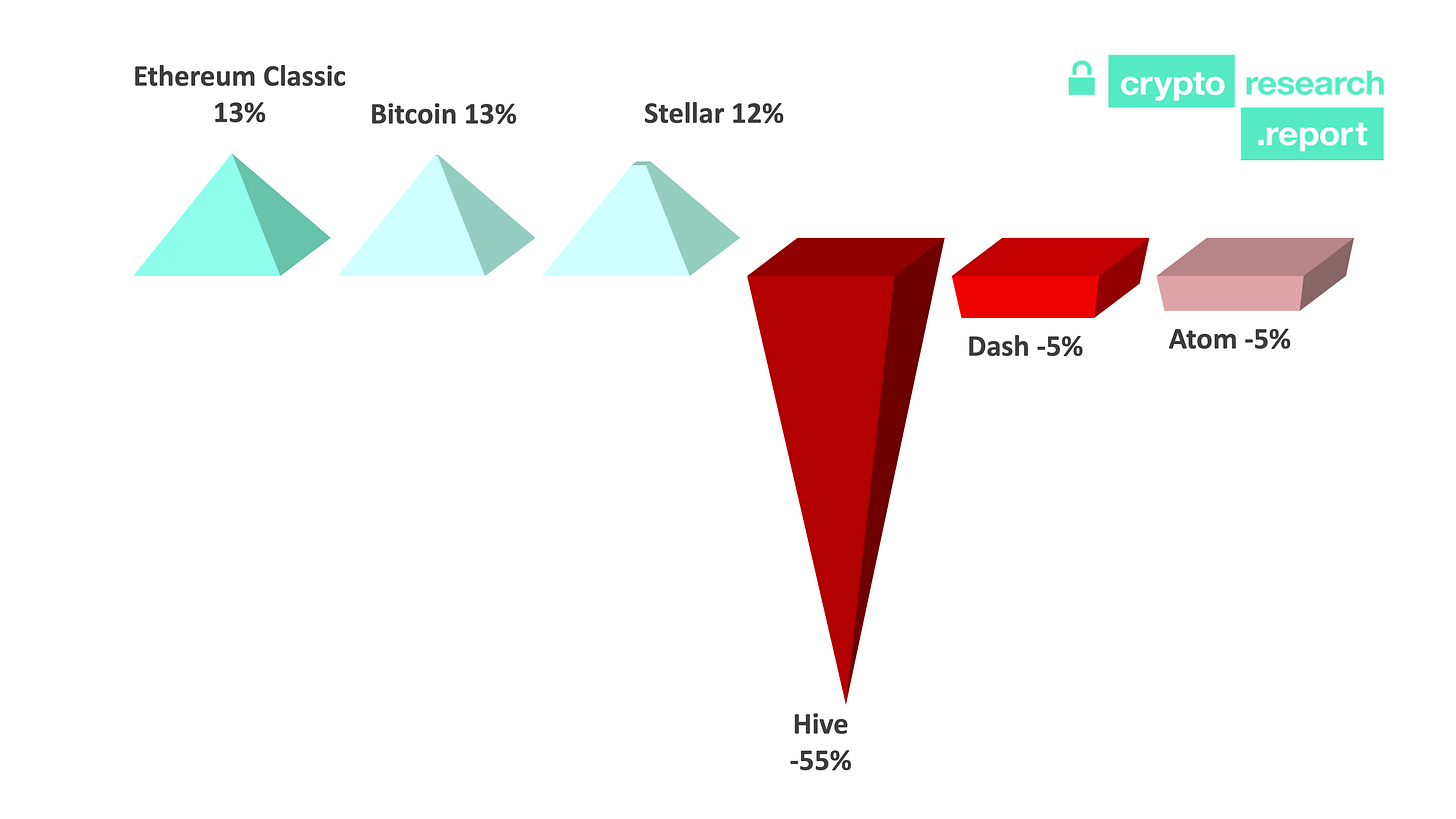

What comes up, must go down. Last week, Hive pumped 525%. This week, down 55%. The week’s biggest losers also include Dash with -5% and Atom with -5%. Dash’s correction may be because their annual reduction in supply by 7% just occurred last week, and the price pumped prior to the reduction in supply. The CRR Portfolio contains two of the coins that are in this week’s biggest loser list.

On the biggest winners list, we have Ethereum and Bitcoin both up 13%, and Stellar up 12%. The CRR portfolio is holding one of the coins that are in this week’s biggest winner list.

Figure 1: Largest 7-Day Returns for Top 50 Market Capitalization Coins

Source: Coincodex.com, CryptoResearch.Report

Crypto Research Report Portfolio

Almost two weeks ago, we added MimbleWimble Coin (MWC) to the portfolio and we have gained 78.87% so far. We bought in at $13.49, and the price is currently $24. We added the coin after having a very deep and close talk with one of the founders of the coin, who remains anonymous, but is open to discussing the technical concepts of privacy. He or she is truly an expert on Internet privacy.

This week, we closed our position in Zcash after speaking with the CTO of Ledger, Charles Guillemet, about Zcash’s inflation bug that means we are unable to prove the total supply of the coin. There could be an infinite amount of Zcash, and we would not know.

Our second trigger of five triggers to sell Crypto.com’s CRO at 0.064 was briefly breached this week (please see newsletter from March 29), So, we are planning to sell the second tranche of our CRO once CRO’s price hits 0.064 again. We bought into CRO on March 26th for 0.044. We are up 27% on this trade over the last five weeks.

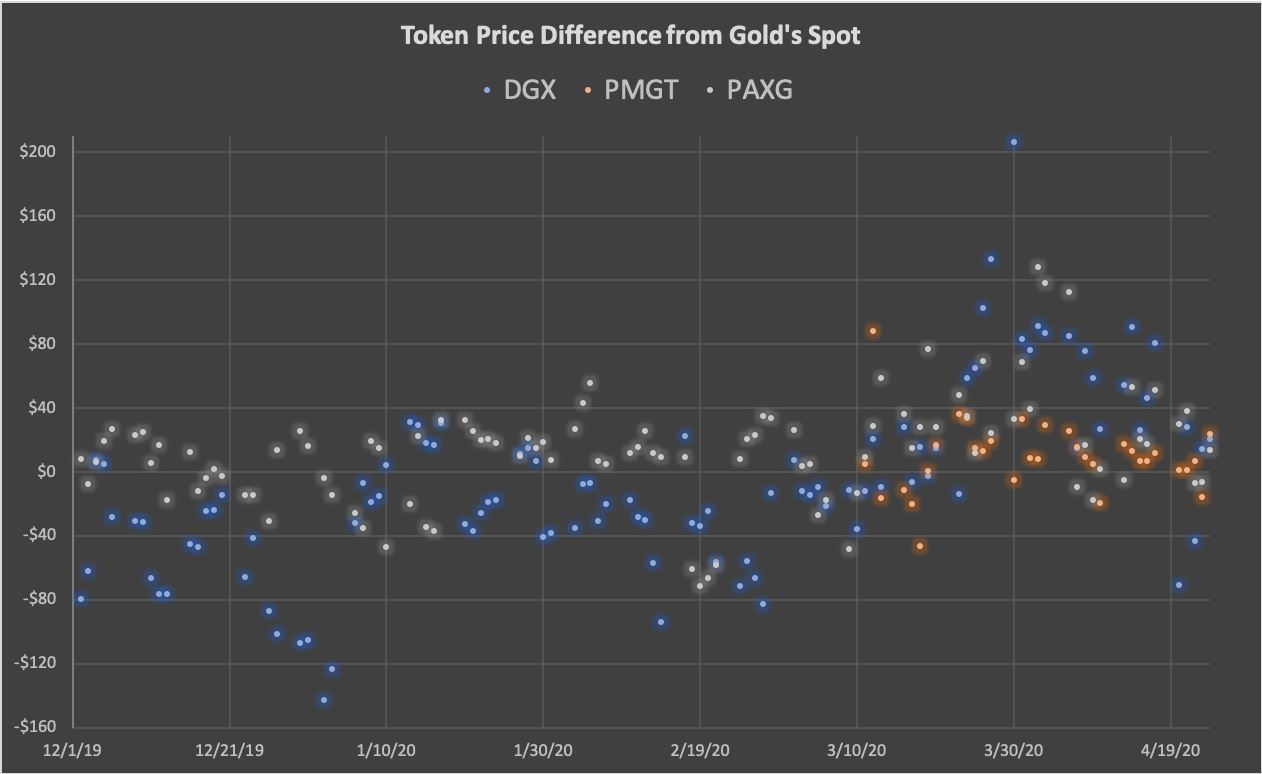

The CRR Portfolio is up 19.62% for the year.

Source: Price Data from Coinmarketcap.com, CryptoResearch.Report

The Crypto Research Portfolio is staking Dash on the Celsius network and earning 6.71% per annum. The portfolio is also earning 8.32% on USDC and 2.53% annual interest on Bitcoin on the Celsius network. We are also earning 12% APR on our CRO coins and 4% on our Pax Gold coins on Crypto.com.

Beware! The popular crypto lending company, Celsius, has changed all of their Bitcoin and Dash addresses for all clients. This means that all Celsius users should create new Bitcoin and Dash addresses. Any Bitcoin or Dash sent to old Celsius addresses after May 1st may result in permanent loss.

That’s all for this week folks! If you would like to read our free 50-page quarterly report supported by Coinfinity AG and Falcon Private Bank please visit www.CryptoResearch.Report. The report is available in English and German.