A small change to the Dollar Cost Average strategy increased Bitcoin’s return by 20% over the last decade.

Dear Crypto Asset Investors,

Everyone talks about Dollar-Cost Average (DCA) but no one ever talks about Value Averaging (VA). The article discusses how VA beat DCA for the past 10 years for Bitcoin investors.

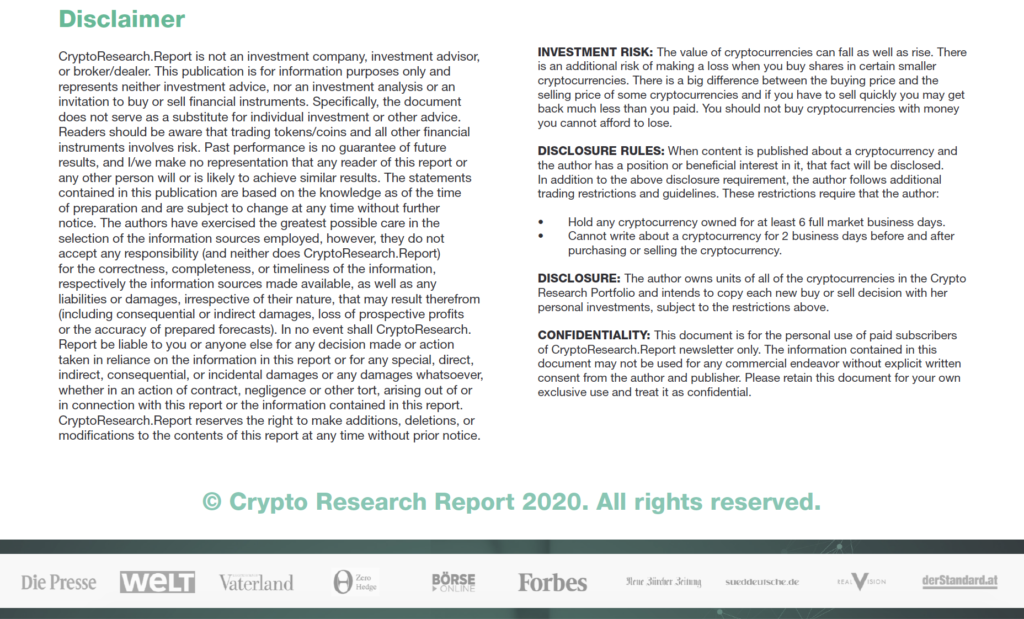

Figure 1: Value Averaging Beat Dollar-Cost Averaging for Bitcoin (2010-2019)

Source: Coinmarketcap.com, CryptoResearch.Report

If you want to invest in Bitcoin and other cryptocurrencies, you have to decide if you want to dump all of your money into Bitcoin at once or spread out your investment over a certain period of time, normally a year.

People tell you to do the latter and spread out your investment over a period of time. The famous Crypto YouTube personality Ivan on Tech tells his listeners to Dollar-Cost Average in almost every episode.

But does Dollar-Cost Averaging really work with Bitcoin? The answer is that DCA works, but Value Averaging works even better as the backtest shows. In our research, Value Averaging beat Dollar Cost Averaging every year of Bitcoin’s existence.

In this article, we compare Buy and Hold, Dollar-Cost Averaging, and a little known strategy that only seasoned stock traders use, called Value Averaging. We also provide the dataset for any analysts that would like to play with the raw data.

When prices are going down in the cryptocurrency market, some sellers panic and sell. Investors that are convinced of the blockchain technology, do not sell, but whether ask, “Should I buy the dip?”

Value Average (VA) investing helps investors to buy more when the price of Bitcoin and other crypto assets are going down during a dip and to buy less when the price of Bitcoin and other crypto assets are going up during a rally.

When an investor wants to invest in an asset, there are two common strategies. The most common approach is just to go all in at once called Buying and Holding. The second approach is to spread out their investment over a period of time, normally a year called Dollar-Cost Averaging (DCA). For example, an investor that wants to buy Bitcoin today and has $10,000 to invest can buy Bitcoin at the current spot price of $8,750, or they could invest $1,000 a month for the next ten months.

Many investment advisors would recommend do the latter approach, because DCA smooths the portfolio’s volatility and maximum drawdown. DCA especially makes sense in a bear market, when the price of the asset is going down. Imagine investors that went all in during the December 2017 rally to $20,000 a Bitcoin. These investors suffered enormously. If they had dollar-cost averaged in, they would have faired better.

However, there is a simple change to the DCA strategy that has been found to provide even higher results in traditional asset markets like the stock market. This strategy is called Value Averaging (VA).

Here is how value averaging works: Suppose you determine that you want to invest $1,000 in cryptocurrencies. If you dollar-cost-average, this means that you would invest $1,000/12 = $83.33 each month. With value averaging, you take the $83.33 as the goal amount to invest, but some months you invest more (when the price of BTC is going down) and other months you invest less (when the price of BTC is going up).

This is how VA looked in 2019:

- On January 1, 2019, you would have invested $83.33 at $3,843.52 per Bitcoin and received 0.021681514 Bitcoin.

- On February 1, 2019, you should normally have to invest $83.33, so that means that your total investment at this point should be $83.33 (from January) + $83.33 (from February) equal to $166.66.

- Since the price on February 1, 2019 was $3,487.95 per Bitcoin, your original investment from January is now worth $75.62 (0.021681514 times $3,487.95).

- Since the price of Bitcoin went down, you need to invest more this month than the normal $83.33 goal. Specifically, you need to invest $166.66 (how much you should have in your portfolio by now) minus $75.62 (the value of your portfolio).

- This is equal to $91.04. So you should have invested $91.04 at the beginning of February 2019 instead of $83.33.

- Since the price on February 1, 2019 was $3,487.95 per Bitcoin, your original investment from January is now worth $75.62 (0.021681514 times $3,487.95).

- Repeat this calculation every month to determine how much you need to invest.

As you can see in this example, you have invested more because the price of Bitcoin rose, and the opposite would be true if the price had risen.

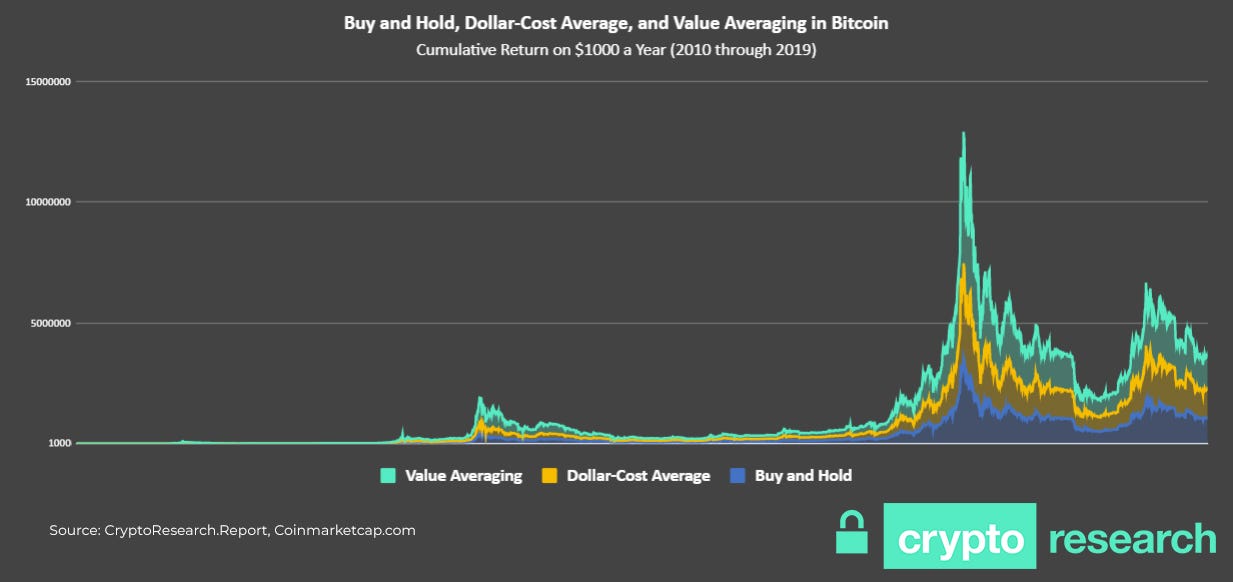

Figure 2: Value Averaging Increased Return Every Year for an Investor that Invested $1000 a Year

Source: Coinmarketcap.com, CryptoResearch.Report

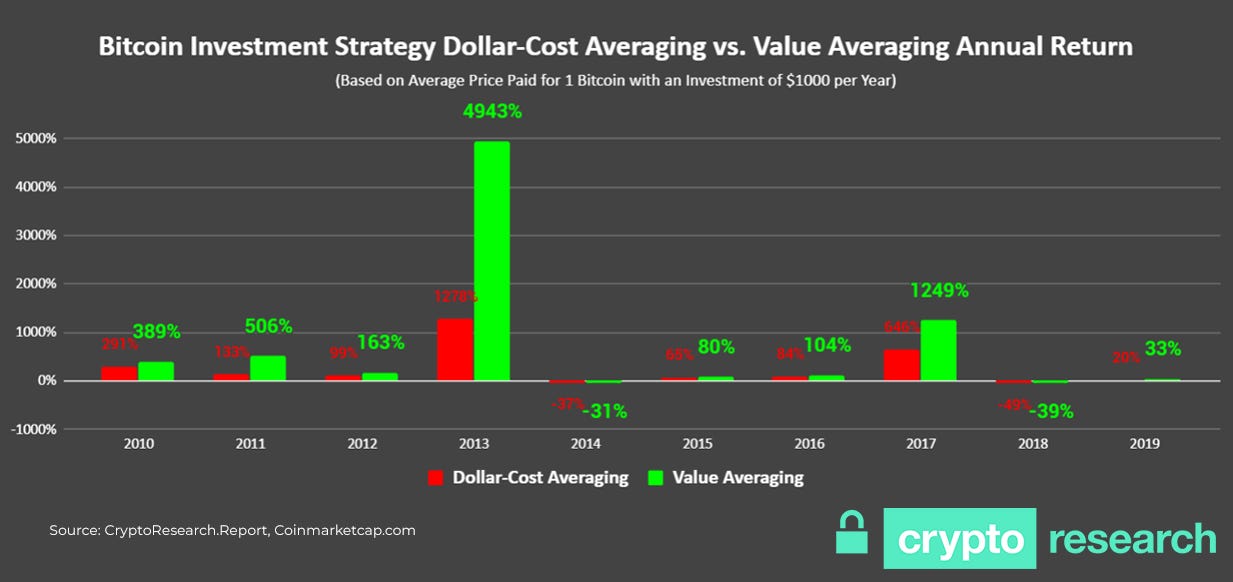

So what would a sample strategy look like for 2020? If the price of Bitcoin goes down, the Value Averaging strategy suggests to buy more.

Figure 3: Sample 2020 Value Averaging with Fake Bitcoin Prices

*These values are fake values. Source: Coinmarketcap.com, CryptoResearch.Report

As you can see, some months the strategy says not to buy any cryptocurrencies at all. This is because the portfolio grew enough in value to reach the target invested amount. This is one benefit of the Dollar Cost Averaging strategy compared to Value Averaging. With Dollar Cost Averaging, you at least buy a little amount every month, which means more satoshis in the end or “stacking sats” as they say online, even if you paid more for them than you would have with Value Averaging.

This article was originally published in March to the subscribers of the Crypto Research Report weekly newsletter. If you would like to receive professional financial analysis without waiting, subscribe.

THIS SECTION IS FOR OUR MEMBERS ONLY. TO SEE OUR ENTIRE PORTFOLIO IN THIS WEEK’S CRYPTO RESEARCH NEWSLETTER, SUBSCRIBE HERE: HTTPS://CRYPTORESEARCHNEWSLETTER.SUBSTACK.COM/