“… Bitcoin is an excellent idea. It fulfills the needs of the complex system, not because it is a cryptocurrency, but precisely because it has no owner, no authority that can decide on its fate. It is owned by the crowd, its users. And it has now a track record of several years, enough for it to be an animal in its own right.

Finally, Bitcoin will go through hick-ups (hiccups). It may fail; but then it will be easily reinvented as we now know how it works. In its present state, it may not be convenient for transactions, not good enough to buy your decaffeinated expresso macchiato at your local virtue-signaling coffee chain. It may be too volatile to be a currency, for now. But it is the first organic currency.

But its mere existence is an insurance policy that will remind governments that the last object establishment could control, namely, the currency, is no longer their monopoly. This gives us, the crowd, an insurance policy against an Orwellian future.”

Nassim Taleb

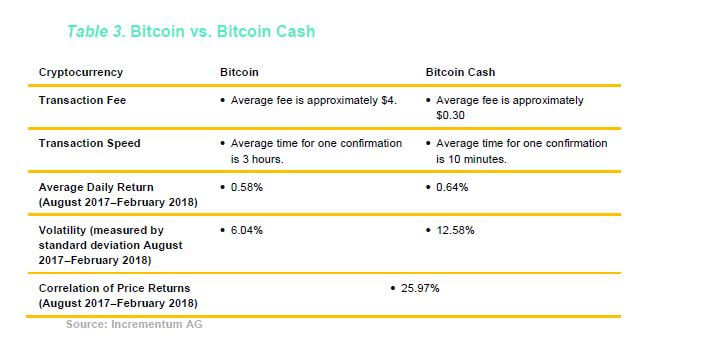

From now on, every edition of the Crypto Research Report will include a chapter dedicated solely to covering coins and tokens that are relevant for financial market participants. At the moment, the most debated coins are Bitcoin and Bitcoin Cash. In this chapter, we will review the arguments being made on both sides, and we explain the steps we are taking to hedge Bitcoin’s risks of being replaced by a better technology.

Bitcoin Cash came into existence on August 1, 2017 after a hard fork of Bitcoin.[1] Believers in Bitcoin have split into opposing fractions. Both groups believe that Bitcoin’s value comes from being a fast and affordable global payment system. The disagreement is about how to achieve that goal. One camp, the Bitcoin Cash camp, believes that Bitcoin should have bigger blocks now. Another camp believes that bigger blocks may be inevitable, but they would like to try all other options before resorting to a hard fork. This camp is researching and developing tools such as SegWit, The Lightning Network, Sharding, and Schnorr signatures. Other camps believe that big blocks will never be a feasible solution to Bitcoin’s scaling problem. To take a step back, the first section explores Bitcoin’s scalability problem. The second section compares the quantitative and qualitative characteristics of Bitcoin and Bitcoin Cash, and the final segment discusses how mining hash power may be a good proxy for sentiment in cryptocurrency markets.

a. Scaling a Blockchain

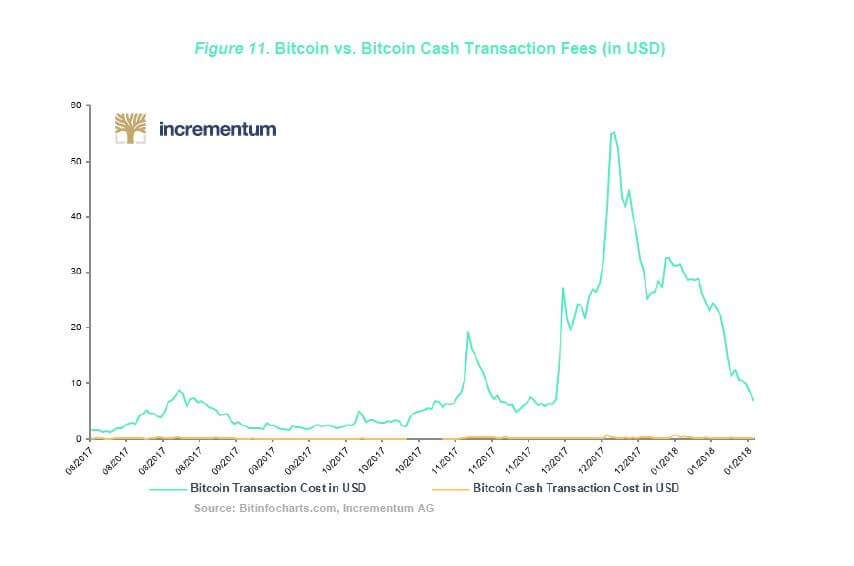

The main problem that the cryptocurrency community is debating is how to garner widespread adoption for Bitcoin. As argued in the featured article of this edition, “Bubble or Hyperdeflation?” Bitcoin’s value can be explained by being a global and permissionless store of value and payment system. However, scalability issues with the blockchain technology are hindering further Bitcoin adoption. The high transaction fees and latency on the Bitcoin network has ruined user experience. The transaction fees on the Bitcoin and Ethereum networks are currently too high to facilitate micropayments. The rise of transaction fees has pushed applications onto other more affordable blockchain protocols. For example, the nanopayment token, Satoshi Pay, uses the Stellar blockchain because their business model relies on low transaction fees.[2]

The drama began when Bitcoin developers proposed Segregated Witness (SegWit) as a solution to the scaling debate. Invented in 2015 by Bitcoin developer Pieter Wuille, SegWit reduces the amount of data required for each transaction. Since each Bitcoin block has a data limit of 1 MB, reducing the data required for each transaction means that the network can process more transactions. Segregated Witness reduces the data required for each transaction by removing data related to signatures or segregating the witness from the transaction.

On February 21, 2016, developers and firms in the cryptocurrency space came together to discuss Bitcoin’s scalability problem. In what became known as the Hong Kong Agreement, members of the Bitcoin community agreed to release Segregated Witness as a short-term solution to the scaling problem. To achieve this agreement, the proponents of Segregated Witness had to find a compromise with the so-called big blockers who wanted to scale Bitcoin by increasing the block size. The compromise was that Bitcoin’s block size would be increased once the developers had built a safe hard fork implementation. This implementation was supposed to increase Bitcoin’s block size from 1 MB to 2 MB.

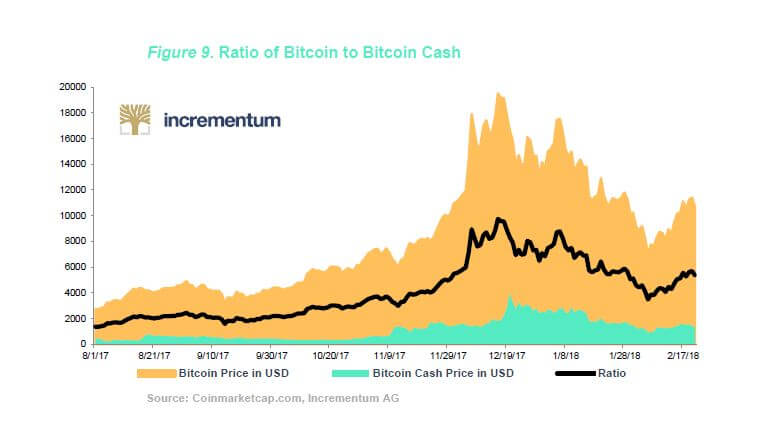

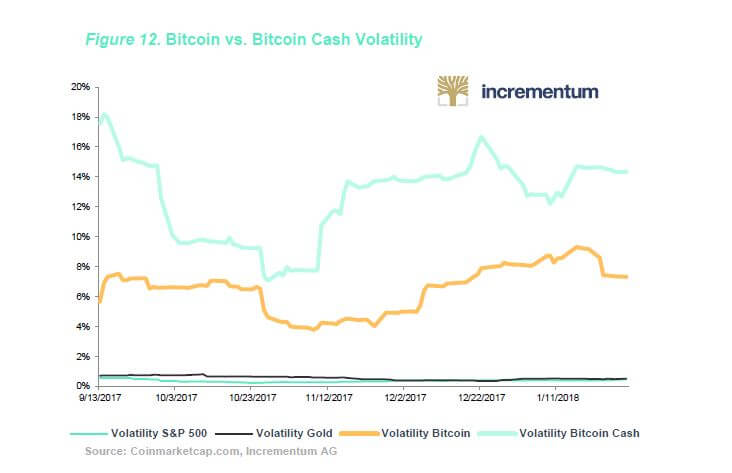

As shown in Figure 11, the Bitcoin transaction fee hit a high of $55.16 on December 22, 2017. Meanwhile, Bitcoin Cash flaunted fees well below $1. Network latency, or how long it takes for a transaction to be confirmed on the network, also reached record times during January. As of now, each transaction takes approximately eight days to be confirmed on the network on average. In contrast, the average time for a Bitcoin Cash transactions confirmation is ten minutes.[3] This number can be compared to Ethereum, which takes approximately two minutes for a transaction to be confirmed in the blockchain. Given the better user experience of Bitcoin Cash, it is no wonder that Bitcoin Cash’s value relative to Bitcoin increased from 0.1 Bitcoin on August 1, 2017 to a high of 0.24 Bitcoin on December 20, 2017. Bitcoin Cash has dropped down to 0.14 Bitcoin or approximately $1,000 per coin since then.

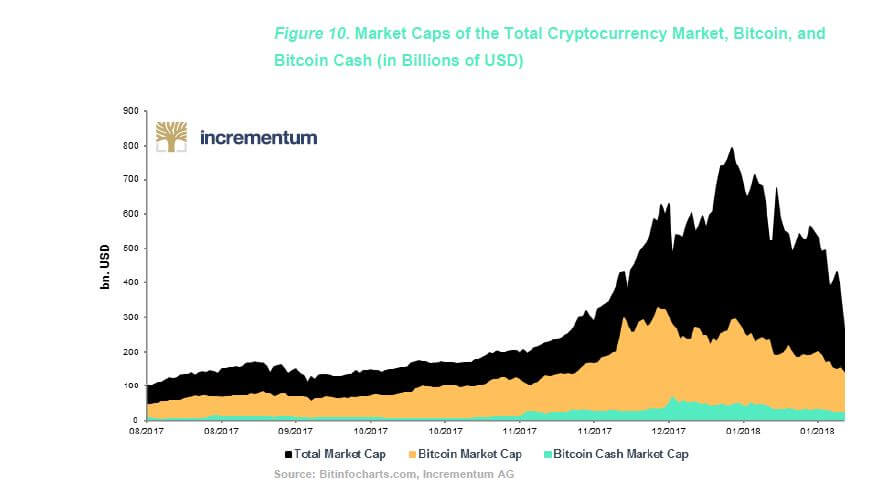

As shown in Figure 10 Bitcoin’s market share to Bitcoin Cash has recovered a bit, but Bitcoin Cash has retained its position in the top five cryptocurrencies for several months. This could signal that market participants are not settled on the debate.

b. Bitcoin versus Bitcoin Cash

There are three main reasons why Bitcoin Cash has not toppled Bitcoin despite having lower transaction fees and confirmation times.

1.) The Proponents of Bitcoin Cash Have Conflicts of Interest

The main proponent of Bitcoin Cash is the early Bitcoin investor Roger Ver who denounced his U.S. citizenship for political reasons. Since 2011, Roger Ver has been an outspoken proponent of Bitcoin and libertarianism. Critics of Bitcoin Cash frequently point out that Roger Ver served ten months in federal prison in the U.S. However, there is plenty of evidence that Roger Ver’s interest in Bitcoin Cash is not purely financial. In 2012, Roger Ver donated money to create the Bitcoin Foundation, which supports the developers of Bitcoin. Additionally, Roger Ver has donated millions of dollars to educational charities such as the Foundation for Economic Education and Angela Keaton’s antiwar.com.

Roger Ver is a frequent guest on talk shows, and his behavior during interviews is notoriously raucous. However, Roger Ver’s profile is not the shadiest profile involved in Bitcoin Cash. Roger Ver is aligned with Jihan Wu, who is the owner of the Bitcoin mining hardware company Bitmain, and Craig Wright, who claims to be Satoshi Nakamoto.

Critics of Bitcoin Cash accuse Jihan Wu of hard-forking the Bitcoin blockchain in order to gain personal wealth. Due to a technology flaw in Bitcoin’s proof-of-work consensus algorithm, accusations have been made that Wu’s company Bitmain was able to gain a competitive advantage over other cryptocurrency miners.[4] As documented by the Bitcoin Core developer Gregory Maxwell, Bitmain may have been able to save $100 million per year. Using a patented technology called AsicBoost, Jihan Wu was able to mine block headers for candidate blocks using less electricity than other miners.

Many Bitcoin Cash supports believe that Jihan Wu was just doing business as usual. After all, savvy businessmen always find ways to cut costs. However, critics of Bitcoin Cash say that Jihan Wu spearheaded the movement to hard fork Bitcoin on August 1, 2017, because he was losing his competitive advantage over other cryptocurrency miners.

Shortly after the Hong Kong Agreement, it became apparent that not everyone in the cryptocurrency community agreed to the dictates passed down from the community members who were present at the meeting. Jihan Wu began speaking out against SegWit in favor of increasing the block size. When SegWit gained enough support in the community, Jihan Wu acted quickly to bring Bitcoin Cash into existence.

Segregated Witness removes the possibility of exploiting the AsicBoost advantage that Jihan Wu has a patent on in China. Opponents argue that miners who mine Bitcoin Cash can covertly use AsicBoost to gain an unfair advantage. Since AsicBoost is patented, Jihan Wu has a legal right to higher profits. The closed-source nature of the AsicBoost protocol can be used to centralize cryptocurrency mining even more than it is already. In Jihan Wu’s defense, he denies that his company ever used AsicBoost. Instead, he claims that he switched to Bitcoin Cash because he believes that having a larger data limit on Bitcoin blocks is the best way to scale Bitcoin.

2.) Increasing the Block Size Gives Miners an Advantage

When Bitcoin Cash did a hard fork from the Bitcoin protocol on August 1, 2017, the total amount of data that could be contained in each block increased from 1 MB to 8 MB. To put this into perspective, downloading 20 emails on to your phone requires approximately 1 MB of data. In the Bitcoin network, 1 MB of data can be processed every ten minutes, which effectively limits the number of transactions on the Bitcoin blockchain to 7 transactions per second.

For years, members in the community have been critical of this limit on the transactions. Several solutions have been proposed, including Segregated Witness, Lightning Network, and increasing the block size with a hard fork. The first two options try to solve Bitcoin’s scaling problem without a hard fork of the software.

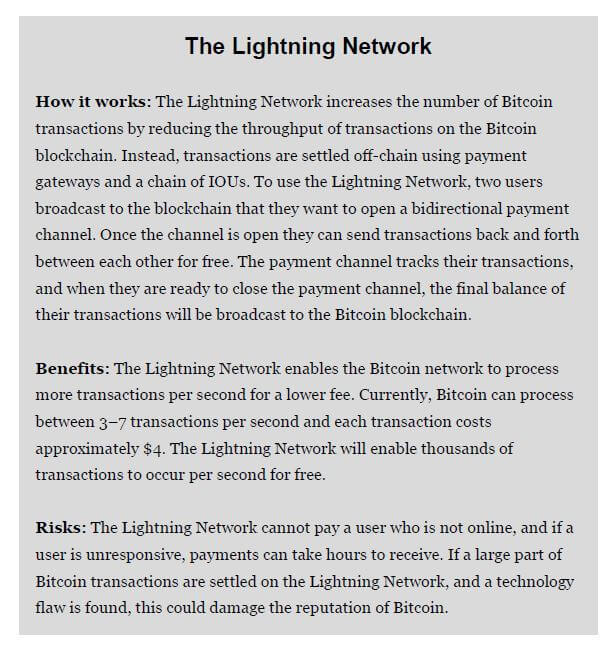

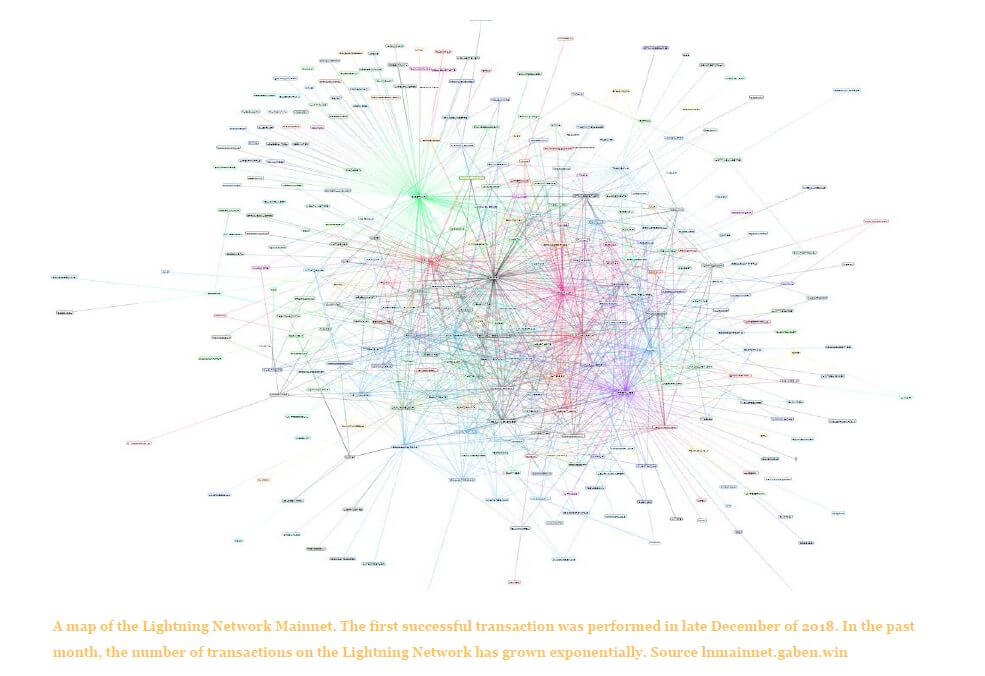

Segregated Witness was introduced to Bitcoin on August 24, 2017, when a soft fork was released to the network. However, most Bitcoin nodes have not upgraded their version of the Bitcoin software, and therefore, Segregated Witness is only used in approximately 14 % of all Bitcoin transactions. In addition to SegWit, the Bitcoin community has been working on the Lightning Network since 2015. Invented by Joseph Poon and Thaddeus Dryja, the Lightning Network is an additional payment system that is built on top of Bitcoin. As discussed in the following section, the Lightning Network is already reducing the costs of using Bitcoin.

“3 million today. Let’s say that in two years, we have 30 million people. To maintain exactly the same level of fees as we have today, we need a block that is 10 MB in order of magnitude bigger. Five years from that, bitcoin gets really successful and we need to get 300 million people to use it. Now we need 100 MB blocks.”

Andreas Antonopoulos

Unlike SegWit and the Lightning Network, increasing the block size can lead to centralization. As explained by Andreas Antonopoulos, as the size of each block increases, the time it takes for each node to validate that block also increases.

A node cannot begin searching for a new block until they have validated the last block. Therefore, the miner who found the last block has an advantage over the other miners. Even if it only takes seconds for the other nodes to validate the latest block, these seconds could forfeit their chance of successfully finding the next block first. The miner who found that last block can directly begin mining the new block on their old block. This means that the miner who found the last block gains time instead of losing time, which makes the advantage even greater. To compound the problem, large miners are more likely to find the new block because they have a larger share of the mining network.

Critics of Bitcoin Cash argue that larger blocks result in centralization of the miners who validate the transactions. As Jameson Lopp of BitGo discussed on episode 1,064 of the Tom Woods Show, centralization of the network can decrease the security of the network for several reasons. Jameson argues that miners could form a cartel and change the rules of validation. For example, miners could decide that their profits are too low, and they could force a hard fork of the protocol that increases the total number of Bitcoins. Since only a few miners would be validating transactions, the average users of the network would not even be aware that the supply of Bitcoin changed.

In addition to forming a cartel, concentration of miners also makes the network more vulnerable to external attacks. For example, if Jihan Wu’s company and a few other Chinese miners become the main validators of the network, the Chinese government could easily shut down Bitcoin by making mining illegal. Centralization reduces a cryptocurrency’s censorship resistance. Censorship resistance is the ability for any user to make an account or send a transaction without permission. If only certain companies validate transactions, governments can encourage or force those companies to stop certain users from making accounts and sending transactions.

As discussed in the chapter “Bubble or Hyperdeflation”, part of Bitcoin’s value comes from being a global and permissionless store of value. If Bitcoin or other cryptocurrencies become too centralized, their ability to become a global and permissionless store of value decreases. One metric that is often cited as a way to measure the centralization of a cryptocurrency is the number of nodes and the growth of nodes over time of a cryptocurrency. Currently, there are 1,043 nodes running on the Bitcoin Cash network and 10,059 nodes running on the Bitcoin network. However, this metric has limitations. Since no permission is required to run a node, one individual or company can operate several nodes. Therefore, Bitcoin may look more decentralized than Bitcoin Cash because more nodes operate the Bitcoin software, however, this number can be manipulated. A precise measure of centralization does not currently exist.

3.) The Original Bitcoin is Scaling Slowly

If users can send fast and affordable transactions over the original Bitcoin blockchain without the centralization problem of bigger blocks, Bitcoin Cash may slowly lose users. As mentioned in the previous section, the Lightning Network and Segregated Witness are both being used to scale the original Bitcoin blockchain. Currently, 429 nodes are using the Bitcoin Lightning Network and over 1,000 payment channels are open. The Austrian cryptocurrency broker, Coinfinity, successfully completed the first Lightning Network transaction using a Bitcoin Automated Teller Machine (ATM) in early February of 2018. In addition, companies such as Coinbase are implementing Segregated Witness, which will further reduce the amount of data being sent over the Bitcoin blockchain.

c. Hash Rate as a Proxy for Market Sentiment

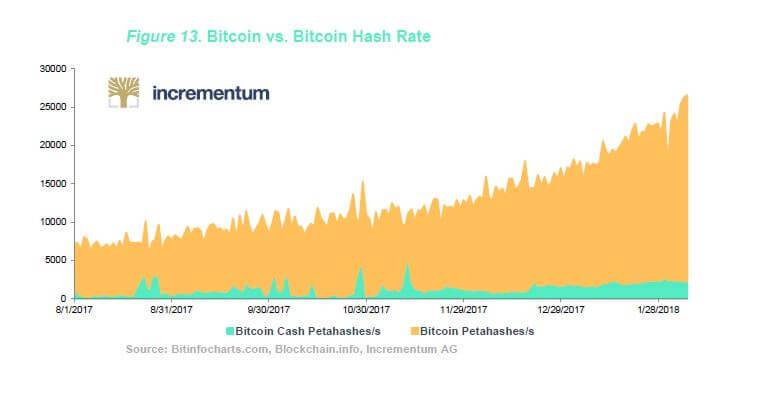

A proxy for how much “community support” a specific cryptocurrency has is mining hash rate.[5] If a proof-of-work coin, such as Bitcoin, has more hash power than another coin, such as Bitcoin Cash, this is a sign that more people support the former. Large investors, such as exchanges, buy cryptocurrencies from miners directly to save money on exchange fees. Subsequently, miners have more information about demand than average investors. Furthermore, many miners are directly in contact with the developers of the coins that they mine. To forecast earnings and costs, miners can ask developers if and when they plan to change the coin’s mining algorithm. For example, miners who are concerned that Ethereum will switch to proof-of-stake can ask Ethereum developers when they plan to release the proof-of-stake algorithm Casper on the network. Miners use this information to decide which graphics cards to buy because specific cards are better at mining specific algorithms.

In addition to being a metric for a coin’s popularity, the hash rate measures the security of a blockchain network. Blockchains that have more hash power are more secure than blockchains with less power. This is because double spends and 51 % attacks are harder to perform on blockchains that garner larger amounts of capital investment. The website gobitcoin.io tracks the cost of attacking the Bitcoin network over time. If an adversary wanted to attack Bitcoin, they would need to invest approximately $6 billion in hardware alone. This figure does not include electricity costs or cooling. As shown in Figure 13, Bitcoin’s mining hash rate has been considerably higher than Bitcoin Cash’s, which signals that Bitcoin is more secure and more popular than Bitcoin Cash. However, the Bitcoin Cash network still has a much higher hash rate than other cryptocurrencies. This means that Bitcoin Cash is still a potential threat to Bitcoin.

Conclusion

Blockchains are inherently slow and expensive databases, and the cryptocurrency market is divided on how to solve these problems. What we are seeing is the free market at work. Professional and institutional investors that are willing to pay high fees are using Bitcoin, while users who are less willing to pay high fees are switching to other coins such as Dash, Ripple, and Bitcoin Cash.

Bitcoin Cash is one way to hedge the risk that Bitcoin fails. If code errors are found in second-layer technologies such as the Lightning Network, Bitcoin’s price will be negatively impacted. However, Litecoin, Dash, and lesser-known forks of Bitcoin, such as Feathercoin, also offer a hedge against Bitcoin’s experiment with the Lightning Network and Segregated Witness. Bitcoin has a stronger hash rate than Bitcoin Cash, meaning that Bitcoin is a better store of value because it is more secure. Also, Bitcoin’s code repository on GitHub is more active than Bitcoin Cash’s, which signals that more brainpower is being contributed to solving Bitcoin’s problems. Like putting eggs in many baskets instead of one, prudent investors are diversifying their portfolio across a basket of coins.

In the next edition of the Coin Corner, we plan to focus on “post blockchain” coins such as Hashgraph, and we will cover two other money coins that have unique technological features: Monero and IOTA. If there are specific coins that you would like to have covered, please email us at Crypto@Incrementum.li.

[1] For more information on hard forks, please refer to the “Crypto Concept” chapter at the end of this report.

[2] https://medium.com/@SatoshiPay/satoshipay-partners-with-stellar-org-4288ae0baa72

[3] If a cryptocurrency user pays the highest fee to send a transaction on the Bitcoin network, the average time for that transaction to be confirmed is the same as a transaction on the Bitcoin Cash network: ten minutes.

[4] https://themerkle.com/what-is-asicboost/

[5] Adam Hayes, “What Factors Give Cryptocurrencies Their Value: An Empirical Analysis,” SSRN (March 16, 2015), https://ssrn.com/abstract=2579445.