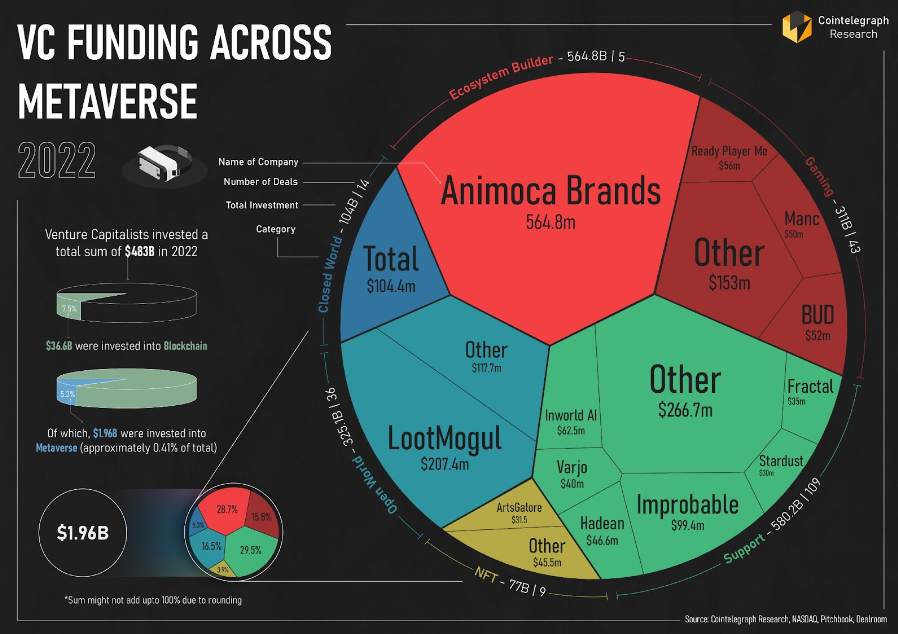

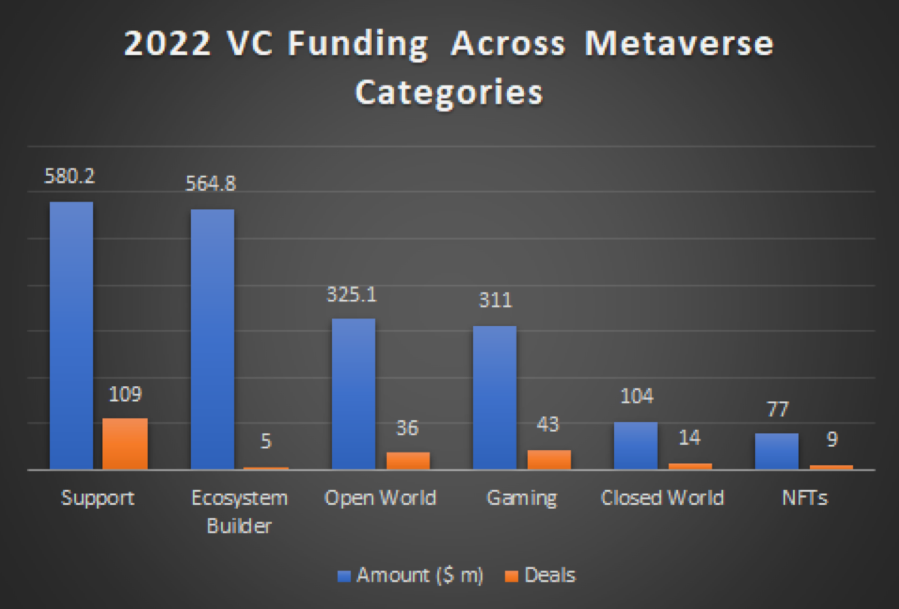

Venture capital (VC) funding in the metaverse has seen a significant surge, with over $2 billion invested in related activities in 2022, according to data maintained by Cointelegraph Research. This database, tracking over 5000 blockchain industry deals since 2012, indicates a shift from predominantly funding open metaverse platforms in 2021 to supporting service entities in 2022. These support services, focusing on customized metaverse architecture, AI, avatar creations, and more, accounted for over 50% of VC deals. The article further explores different metaverse categories, such as Support, Ecosystem Builder, Open World, Gaming, Closed World, and NFTs, and examines the funding trends within each.

Cointelegraph Research keeps a database of all venture capital and private equity deals in the blockchain industry. The database contains over 5000 deals since 2012 and is updated weekly and available for downloading here. According to Cointelegraph Research’s VC database, total VC funding on metaverse-related activities in 2022 surpassed $2 billion in 2022.

Elevated thresholds in the cost of capital, intermittent bouts of market volatility and general economic uncertainty may all put a limit on the ability of global venture funding to stage a strong comeback, following a year in which it was down by 35% YoY.

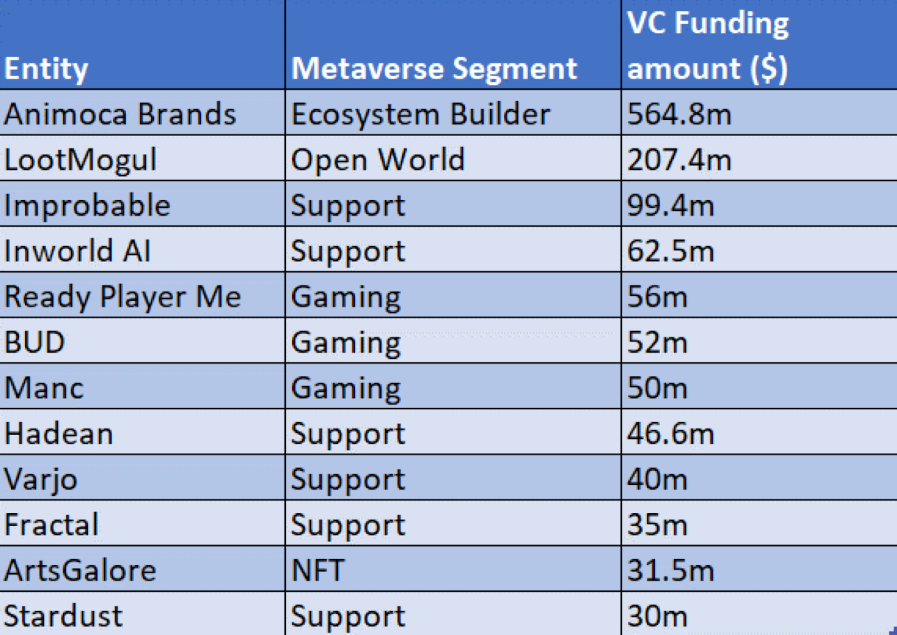

If 2021 VC funding was largely centered around the funding of open metaverse platforms, the predominant texture of deals in 2022 involved support service entities that received over $580 million in funding. Support service startups focussing on customized metaverse architecture, AI, avatar creations, etc. currently account for over 50% of VC deals. While support service-related funding may dominate the volume charts, businesses with strong credentials in ecosystem building will likely attract the most lucrative VC deals in the metaverse.

Metaverse Categories

- Support – This can be an umbrella of metaverse development services which includes building technologies to shape and grow businesses. Eg Meta/Oculus

- Ecosystem Builder – These are projects that aim to provide the tools, and infrastructure required to build a metaverse. Eg. Roots Network

- Open World – The open metaverse is a term used to describe the virtual world beyond any company’s walled garden. It is a single, connected universe where users can interact with each other regardless of which platform they are using. The Sandbox and Decentraland are examples of open metaverse platforms where individuals can create objects and move them across them.

- Gaming

- Closed World – The Closed Metaverse is a metaverse that is not open to the public. It is usually only accessible to employees of the company or organization that owns it. For example, Coca-Cola has its closed metaverse called “Coca-Cola World” that is only accessible to Coca-Cola employees. Other closed metaverses include IBM’s “Second Life” and Cisco’s “Virtual U”

- NFTs

A case in point here is Hong Kong-based Animoca Brands (it garnered $360 million in just one round of funding with Liberty City Ventures, amongst others), which has been making waves in the building of an open metaverse and has already made investments in 30-odd metaverse-related projects. VC investors would likely prefer to fund late-stage ecosystem entities such as this that could then use their expertise to make more discerning choices and divert those VC funds to early-stage startups. The table below provides some context on the type of entities that attracted the big bucks from the VC world last year.

If there’s one area in the metaverse that appears to be going through a phase of enervation, it may well be the “user devices” segment or those companies involved in virtual reality, augmented reality and the virtual worlds where funding has been sliding sequentially for four straight quarters. VC interest may likely have cooled, as there are still ample encumbrances linked to the limited interoperability of these devices. If these devices are still unable to facilitate the linkage and usability of content across different virtual worlds, offered by different vendors, widespread adoption could remain stunted.

In conclusion, despite the challenges posed by elevated thresholds in the cost of capital, market volatility, and economic uncertainty, VC funding in the metaverse has shown resilience. While support services dominate the volume charts, businesses with strong credentials in ecosystem building have been attracting the most lucrative deals. However, it’s worth noting that the “user devices” segment, including virtual and augmented reality, is experiencing a downturn. This could be due to the limited interoperability of these devices, suggesting that there may still be hurdles to overcome in this rapidly evolving sector.