The metaverse, despite its current imperfections, opens up a world of opportunities for businesses to innovate and overcome its inherent flaws. This article explores the potential strategies companies could adopt to build scale in this fragmented landscape, focusing particularly on the inorganic route, or acquisitions. It will delve into the concept of M&A (Merger and Acquisition), the role of valuation multiples, and how a possible ‘metaverse winter’ might affect these.

The discussion will also touch upon past M&A trends in the technology, media and telecom (TMT) sector, which is responsible for a significant portion of metaverse-related M&A deals, and look at the potential targets for future M&A activities. Additionally, it will highlight key end markets like gaming, e-commerce, and the emerging health and fitness market, that could drive metaverse-related M&A activity.

The metaverse, in its current state, is hardly indefectible, but the prevalence of existing inadequacies will only spur opportunities for incumbents to iron out some of the inherent flaws and transform the metaverse into a more consummate state. Considering this status quo, deploying capital to deepen in-house intellectual property (IP) infrastructure may prove to be a very fulfilling proposition over time. However, when you consider that the metaverse is currently a very fragmented landscape, with multiple parties scrambling to reach the top, the more expeditious strategy to build scale and fill gaps in the service portfolio could likely be through an inorganic route — i.e., acquisitions (provided integration challenges are kept to a minimum).

Learn M&A

Inorganic route is another term for M&A. Organic route is when the company spends capital expenditure and R&D to develop their own products/tech. Inorganic route is when they feel they are better off spending money by acquiring another firm that has the requisite tech they need, rather than building it inhouse.

Besides, the onset of a metaverse winter may also bring down acquisition multiples to more palatable levels, thus maintaining the scope for substantial merger and acquisition (M&A) activity in 2023 as well. For example, Microsoft’s acquisition of Activision Blizzard in an all-cash deal for ~$69bn (7.6x EV/Sales multiple, 20.2x EV/EBITDA multiple). A healthy enterprise value (EV) to sales multiple is around 1x to 3x, and a healthy enterprise value to earnings before interest, taxes, depreciation, and amortization is between 11 and 16. In line with higher interest rates, we suspect valuation multiplies will continue to come down over the next year.

For perspective, over the last two years, the technology, media and telecom (TMT) sector, which is typically responsible for 75% of all metaverse-related M&A agreements, engaged in 115 deals, totaling $174 billion in aggregate. The table below sheds light on some of the interesting metaverse-related deals that took place last year.

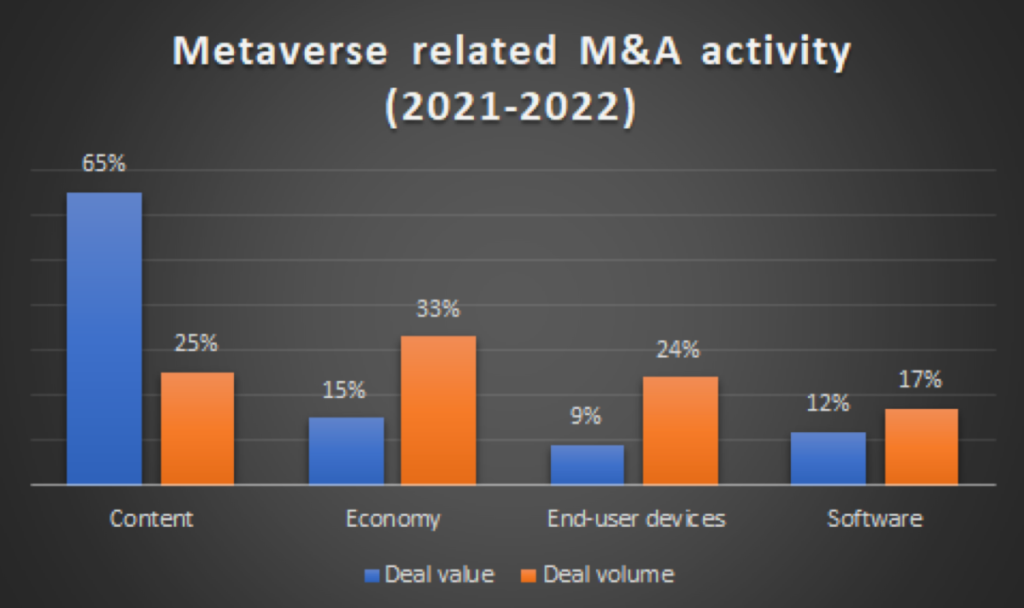

If the past is any indication of the future, entities with content-rich portfolios and libraries are likely to be chief targets for prospective M&A buyers. Over the last two years, content-related acquisitions have accounted for the lion’s share of metaverse-related M&A by value (skewed no doubt by Microsoft’s proposed acquisition of gaming entity Activision Blizzard) while also accounting for a quarter of all deals by volume (the second-highest category).

As far as end markets go, gaming and e-commerce could likely serve as principal hubs of M&A-related activity, as those markets look set to remain the hotspots of the metaverse universe, even by the end of this decade (both of those segments will likely account for 75% of the metaverse-related spending by 2030).

The burgeoning health and fitness market is another promising landscape that could witness greater impetus in metaverse-related M&A undertakings, as 81% of global healthcare executives have already flagged that the metaverse could have a positive impact on their organizations, whilst nearly 50% believe the impact could be transformational.

The metaverse presents an exciting frontier for businesses, with the potential for dynamic growth through strategic acquisitions. As we’ve explored, the inorganic route could be a viable strategy for companies to quickly scale and enhance their service portfolio. Past trends indicate that entities with content-rich portfolios are likely to be the main targets for M&A activities, and markets like gaming, e-commerce, and health and fitness are poised to be the hotspots for metaverse-related spending.

With almost half of global healthcare executives believing the metaverse could have a transformational impact on their organizations, the stage is set for a surge in metaverse-related M&A undertakings. However, the ever-changing nature of the metaverse landscape requires businesses to stay agile, making informed decisions based on careful evaluation of market trends and valuation multiples.