Tokenomics, the economic models behind cryptocurrency tokens, are a crucial aspect of any blockchain-based project. These models dictate how tokens are minted, distributed, and managed, playing a significant role in their value and functionality. This article explores four primary tokenomic models: the fixed supply model, the deflationary model, the inflationary model, and the dynamic supply model.

Each of these models has its unique features, advantages, and potential drawbacks. Additionally, the article delves into the token distribution patterns in metaverse tokens, highlighting the importance of fair distribution in fostering network effects, incentivizing participation, and maintaining price stability.

Tokens play a vital role in the decentralized metaverse ecosystem by facilitating the exchange of value and ownership. They also provide a means for tokenholders to engage in the decision-making process through governance proposals.

A carefully designed tokenomics model is key to aligning the incentives between different stakeholders in the metaverse. The first step toward designing tokenomics is deciding whether the platform will have a single- or multi-token system. A single-token system works best for metaverse platforms that have a limited scope of token utility.

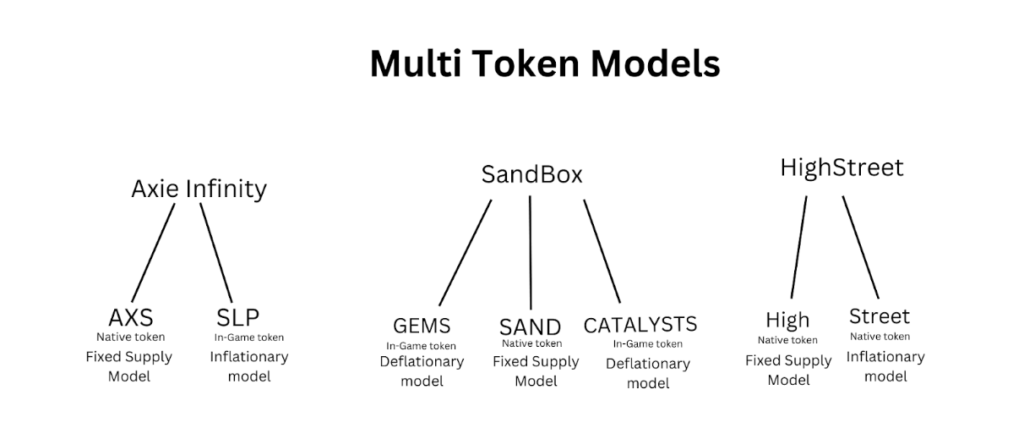

A multi-token model is ideal for a complex metaverse ecosystem, where projects might want to have more than one token to serve different purposes. In a multi-token model, each token has its own unique use case and value proposition, and they are often designed to work together in a symbiotic relationship to create a more robust and functional ecosystem. Each token can have its own schedule and can be inflationary or deflationary.

The use of multiple tokens can help to improve liquidity, incentivize different types of users, and create more opportunities for value creation and distribution. However, managing a multi-token model can be complex and requires careful design and implementation to ensure that the different tokens work together effectively and efficiently. It is also important to ensure that the supply and demand for each token are balanced to avoid over- or under-valuing any particular token in the ecosystem. The multi-token model is most commonly used by play-to-earn metaverses.

The tokens can be then further categorized into four main models:

- The fixed supply model: This is the simplest and most common form of tokenomics model. In this model, a protocol mints a fixed supply of tokens either at the genesis or using an emission rate to mint the supply over a period of time.

- Deflationary model: In a deflationary model, the supply of tokens decreases over time, either through a token burning mechanism. The token could be burned through different mechanisms (such is the case for Decentraland). 2.5% of the total MANA utilized is burned whenever someone purchases land in the metaverse. The primary purpose of the deflationary model is to increase the token value as the adoption increases. A major drawback of a deflationary model is that a scarcity in supply could occur in case the platform experiences a constant surge in the number of users.

- Inflationary model: An inflationary model is the exact opposite of a deflationary token model. In this model, there is no limit on the number of tokens that could be minted, and there is an inflation rate that increase the circulating supply of the tokens over time. This model is useful to boost liquidity of a project by offering high staking rewards to the users. However, on the downside, the token is prone to hyperinflation in the long run, which can devalue the token and reduce investor confidence. This model is seldom used in a single-token system and is often a part of a multi-token system.

- Dynamic supply model: This model does not impose a limit on the supply of tokens. Instead, it incorporates a burn rate to introduce scarcity, and as demand for the token grows, the algorithm adjusts the supply accordingly by increasing it. However, given the poor track record of algorithmic tokens, this model has yet to reach significant adoption.

Token distribution patterns of metaverse tokens:

The token distribution pattern plays an important role in the success of the tokenomics model of a project. A fair distribution would create network effects, incentivize participation, and maintain price stability. The pattern of token distribution varies from project to project, keeping the metaverse design and the hierarchy of stakeholders in mind as seen in the chart.

However, there are a couple of recurring patterns:

- Token emission towards community incentives is higher than that for most projects, indicating the community-first approach of decentralized metaverse.

- A dedicated distribution for the ecosystem is not the priority, and projects are more reliant on the treasury for the ecosystem growth.

Understanding tokenomics is vital for both project developers and investors in the blockchain space. The choice of model – be it the scarcity-driven deflationary model, the liquidity-boosting inflationary model, or the flexible dynamic supply model – can significantly impact a project’s success and token value. Moreover, the pattern of token distribution can shape the community’s engagement and the overall growth of the ecosystem.

As seen in decentralized metaverses, a community-first approach with high token emission towards incentives can drive participation and growth. However, it’s also important to note that each project’s unique needs and goals would dictate the choice of tokenomic model and distribution pattern. As the blockchain and metaverse landscape evolves, so too will the strategies and models employed in tokenomics.