The adoption of cryptocurrencies by institutional investors, such as pension funds, insurance companies, and asset managers, is an important development in the crypto space. In this article, we will examine the extent to which cryptocurrency holdings and trading volume are dominated by retail or institutional investors.

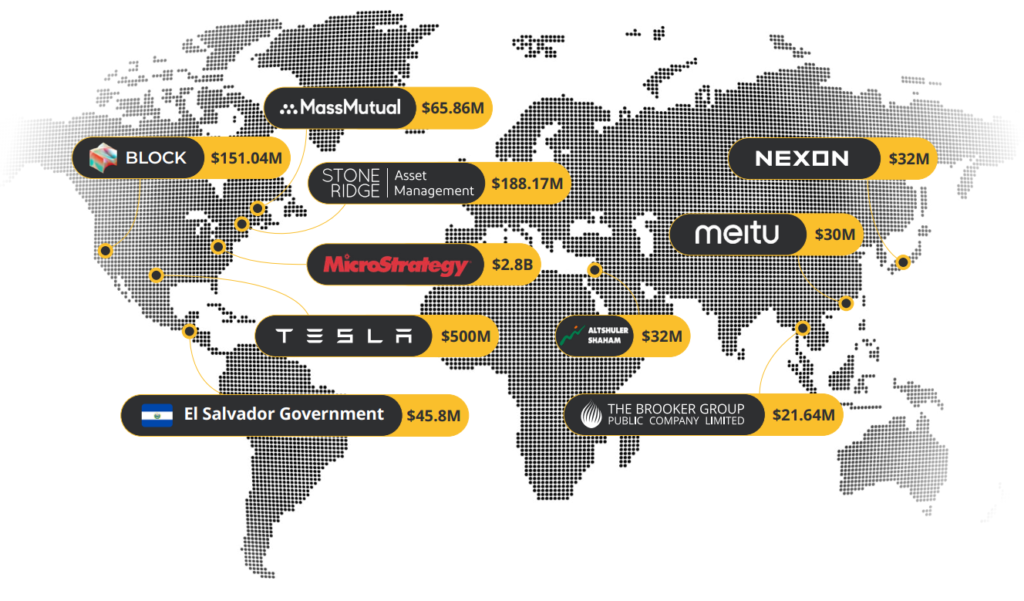

The target group for blockchain-inspired financial products includes pension funds, insurance companies, university endowments, high-net-worth individuals, family offices, asset managers, banks and funds of funds from around the world. For Cointelegraph’s list of the world’s top 10 largest institutional cryptocurrency investors, we focus on TradFi companies that have disclosed their cryptocurrency holdings.

Map of Largest Institutional Cryptocurrency Investors

An important question in the context of cryptocurrency adoption is to what extent holdings and trading volume are dominated by retail investors or institutional investors. As more activity from institutional investors demonstrates a mainstream adoption of cryptocurrencies, observers of the crypto space have a keen eye on this development.

Institutions Hold 1.39 million+ BTC

Identifying the holder of a particular crypto wallet is a challenging task. While some large wallets may belong to (individual) whales, other large wallets may belong to crypto exchanges and thus represent the holdings of many investors, retail and institutional. One crypto exchange may also own several distinct wallets. Hence, distinguishing between retail and institutional holdings is inaccurate at best.

“It’s a great speculation. I’ve just got something over one percent of my assets in Bitcoin. Maybe it’s almost two. That seems like the right number right now. Every day that goes by that Bitcoin survives, the trust in it will go up….I am not a hard-money nor a crypto nut. At the end of the day, the best profit-maximizing strategy is to own the fastest horse… If I am forced to forecast, my bet is it will be Bitcoin.”

Paul Tudor Jones, Founder of Tudor Investment Corporation

Popular outlets such as bitcointreasuries.net estimate the total number of Bitcoins held by public companies, private companies, governments, and other funds to be around 1.39 million BTC. Given the total number of Bitcoins mined, this would amount to a share of roughly 7.2%. Naturally, this is a rough estimate as there may be more Bitcoins in certain wallets belonging to institutional holders. Thus, these numbers may be seen as a lower bound for institutional holdings. Given that the numbers only refer to Bitcoin, holdings for the entire crypto sector might look differently.

It is difficult to accurately distinguish between retail and institutional holdings in the cryptocurrency market due to the challenges of identifying the owner of a particular crypto wallet. Despite this, the increasing interest and investment from institutional investors in the crypto space demonstrates the mainstream adoption of cryptocurrencies.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.