The adoption of cryptocurrency by institutional investors has been a hot topic in recent years. While it can be difficult to accurately track the involvement of institutional investors in the cryptocurrency market, certain exchanges and data sources provide insight into their activity. In this article, we will examine the trend of institutional investment in cryptocurrency using data from Coinbase and IntoTheBlock.

As most of on-chain trading is rather opaque due to the nature of crypto wallets, one has to refer to proxies to grasp the relevance of institutional investors. Coinbase for instance publishes trading volume for all assets traded on its platform by type of investor.

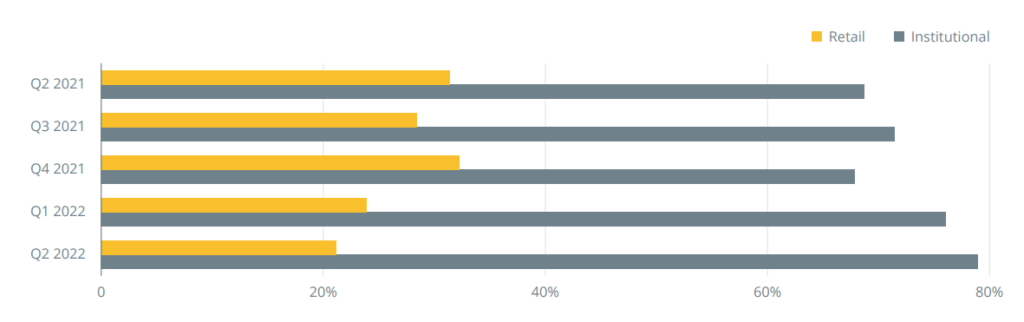

Looking at the share of trading volume, which stood at $217 billion in Q2 2022, one can see that the share of trading volume associated with institutional investors has increased from 68.6% in Q2 2021 to 78.8% in Q2 2022.

Trading Volume on Coinbase

This is an increase of 10.2 percentage points in one year. Although this is just evidence from one of the largest exchanges, it might well be seen as exemplary for the whole sector.

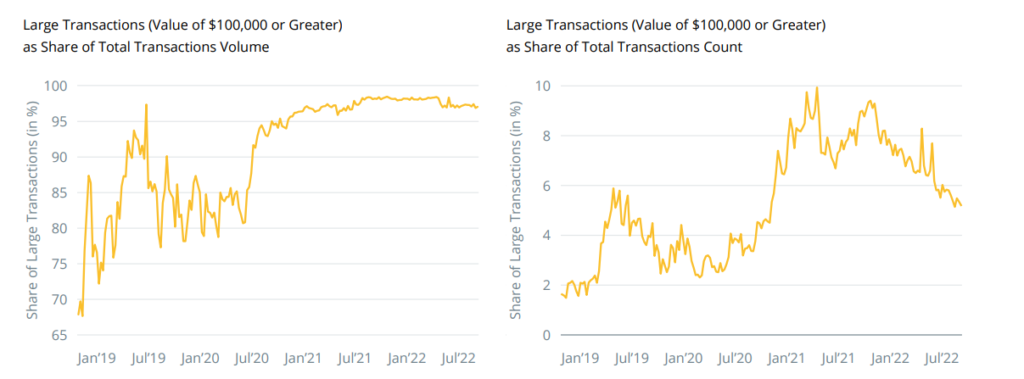

Other sources, such as IntoTheBlock, also refer to the share of large transactions defined as transactions with a volume greater or equal $100,000 as a proxy for institutional activity.

Large Transactions in the Bitcoin Network

Looking at these numbers, one can see that although large transactions make up less than 10% of total transactions, their volume accounts for up to 99% of total transaction volume.

In conclusion, the data suggests that institutional investors have significantly increased their involvement in the cryptocurrency market. This trend is evident through the rising share of trading volume associated with institutional investors on Coinbase and the high volume of large transactions in the Bitcoin network. These findings demonstrate the growing interest and adoption of cryptocurrency by institutional investors.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.