Cryptocurrency has been a topic of much debate in the investment community. While some see it as a valuable asset class, others still view it with skepticism. A recent survey of institutional investors revealed some interesting insights into their perception of crypto assets.

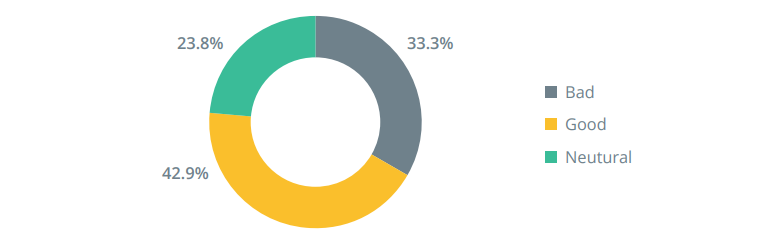

When asked about their perception of crypto assets, a strikingly large percentage of respondents reported a negative view. Unlike other asset classes, there appears to be a strong anti-cryptocurrency strain held by some professional investors.

What Is Your Perception of Crypto Assets?

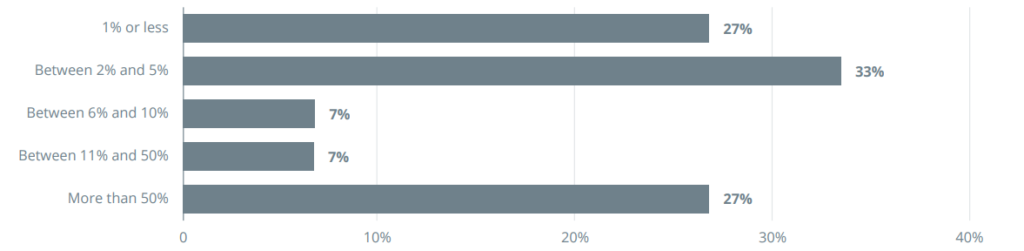

Among the institutional investors who have had exposure to digital assets, 60% of the respondents have 5% or less of their assets under management in crypto assets. Notably, over a quarter of those surveyed have only 1% or less of their AUM in crypto assets.

What Percentage of Your Company’s Assets Are Invested in Crypto Assets?

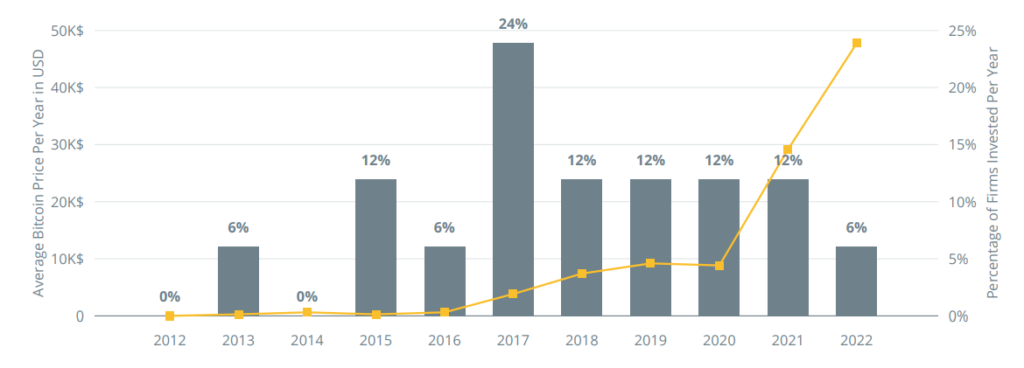

When Did Institutional Investors First FOMO Into Cryptocurrencies?

Nearly a quarter of investors gained exposure to digital assets for the first time during the 2017 bull market. Only 6% of those surveyed invested in crypto assets in 2022 — after Bitcoin’s all-time high on April 14, 2021, when the price was almost $64,000 per coin and Bitcoin had a $1.18-trillion market capitalization.

What Was the First Year Your Company Invested in Digital Assets?

The survey results indicate that institutional investors have a mixed view of crypto assets, with many allocating only a small percentage of their assets under management to them. Additionally, the majority of institutional investors first gained exposure to digital assets during the 2017 bull market, with very few entering the market after the all-time high in 2021. Despite these findings, it’s important to remember that the crypto market is still relatively new and perceptions may change as the industry evolves.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.