As digital assets continue to grow in popularity, asset managers around the world are increasingly interested in understanding the best approaches for investing in these new types of assets. A recent survey reveals that risk-return ratio is the most important factor for allocating assets to digital investments and that clients requesting such investments are not a major influence. In this article, Thomas Zeltner – an experienced investor with a portfolio containing cryptocurrencies – shares his insights on why he decided to invest part of his assets into crypto and how his team allocates resources accordingly.

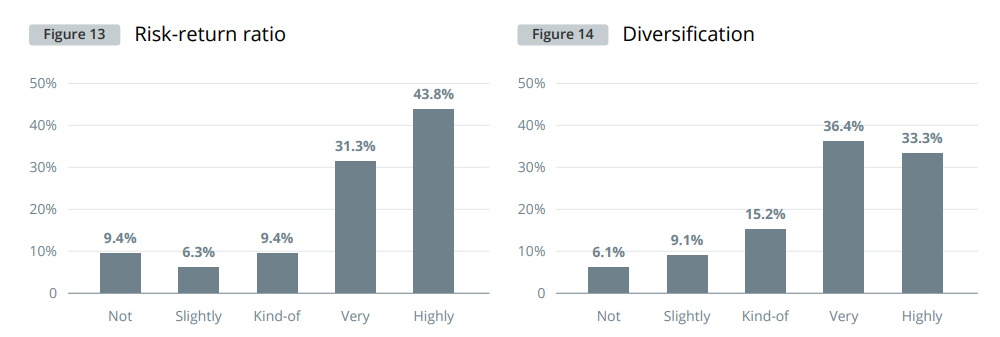

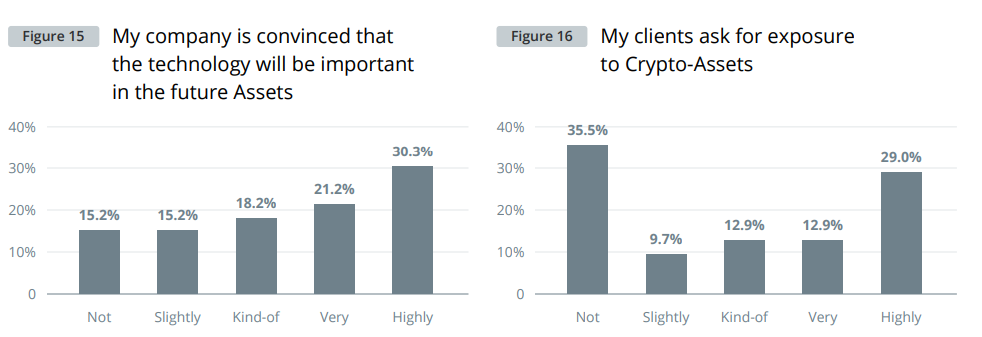

According to the survey results, the most important consideration for investing in digital assets is their risk-return ratio as 44% of respondents rated this characteristic as “highly important.” Most of the responses to “diversification” and “my company is convinced that the technology will be important in the future” are clustered in the middle and slightly skewed to the right of the importance spectrum, meaning that these factors are moderately important. Notably, the survey shows that clients requesting digital assets are not very relevant to the asset managers’ decision to invest in these assets.

Why did you decide to allocate part of your family assets to cryptocurrencies?

Thomas Zeltner: First of all, a 2–3% allocation to Bitcoin in a standard 60/40 portfolio would have increased its Sharpe Ratio significantly. Secondly, cryptocurrencies are a unique diversification opportunity. And finally, every family should invest some of its assets in future technologies.

How do you allocate assets to crypto?

Thomas Zeltner: We weren’t happy with the solutions on the market, as we were looking for active solutions managed by fund managers we trust and at a fair cost. So, we created our own actively managed certificate and hired Demelza Hays, an excellent crypto portfolio manager who we trust and has a fantastic track record. In addition, we needed a bankable product to ensure a scalable process across all our clients’ portfolios.

What percentage of their portfolios should professional investors allocate to invest in crypto?

Thomas Zeltner: This really depends on the personal risk profile and the market outlook. Our peers usually allocate less than 1% or even 0% to the crypto market, while we recommend between 3% and 7% depending on multiple factors. We currently view cryptocurrencies as neutral, but increasingly bullish. We are, therefore, allocating 5%.

How does your crypto portfolio management work?

Kim Wirth: Our performance is a combination of cryptocurrency exposure, staking rewards and premium generation from market-neutral derivative strategies. We follow a coresatellite approach where we invest in large coins, like Bitcoin or Ether, as our core and various smaller altcoins as our satellite. In addition, we apply an actively managed rebalancing strategy that has been designed to exploit cryptocurrency volatility while reducing risk and maximizing the long-term upside.

What coins are you investing in?

Kim Wirth: We currently diversify across three categories. Layer-1 and layer-2 coins as well as exchange cryptocurrencies. We also trade derivatives to implement certain strategies, such as hedges.

How do you manage the risks of crypto exposure from a portfolio point of view?

Kim Wirth: To start with, the crypto product itself can go market neutral or even short if we are bearish. In addition, we optimize our tactical weights for the crypto exposure to manage our overall portfolio volatility. In addition to this, rebalancing is still one of the most powerful tools when used correctly.

How does your cryptocurrency research work?

Kim Wirth: We have a bottom-up approach, which we use to generate a pool of coins and projects which are reliable and promising from our point of view. We then track these coins by using quantitative signals to decide when to buy and when to sell. On top of this pool and these signals, we draw a macroeconomic picture of the world to decide whether we are bullish or bearish on the overall crypto market. This is where we decide what percentage we will allocate within the predefined pool of coins and how much we will invest in the market-neutral strategies consisting of futures and options.

It is clear that when it comes to digital investments, investors must carefully consider their risk-return ratio and diversification opportunities before making a decision. Furthermore, having trusted fund managers who have a good track record can help ensure successful allocation of resources. There is no one-size-fits-all approach as every family’s needs are different. However, taking these factors into account can help families make educated decisions when investing their money into digital assets like cryptocurrencies.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.