Institutional investors have always been a driving force in the crypto market and it’s no surprise that they are primarily holding Bitcoin and Ether. However, as the market for NFTs has grown, institutions are also showing interest in security tokens, stablecoins, and other digital assets. This blog post will explore the current sentiment of institutional investors towards NFTs and what we can expect to see in the future.

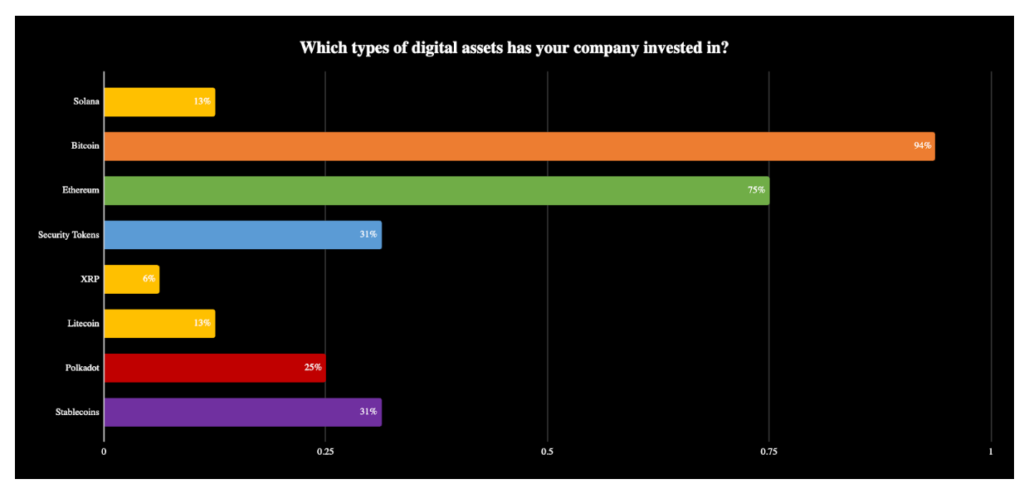

It should come as no surprise that professional investors are primarily holding Bitcoin (94%) and Ether (75%). In addition to the two top digital assets when measured by market capitalization, institutions are also interested in security tokens (31%) and stablecoins (31%). Smaller holdings included Polkadot (DOT) (25%), Solana (SOL) (13%) and Litecoin (LTC) (13%). Several investors mentioned they are also interested in publicly traded blockchain stocks.

When Visa bought a CryptoPunk NFT in August 2021, the purchase created a lot of waves. The company stated that it saw NFTs as a “promising medium for fan engagement.”

Top-tier auction houses Sotheby’s and Christie’s featured eight-figure NFT auctions as the market for natively digital art with blockchain-proofed ownership heated in the summer of 2021. Sotheby’s natively digital auction line featured NFTs from Pak, LarvaLabs and Xcopy, while Christie’s sold Beeple’s “Everydays: The First 5000 Days” for $69 million and curated its “Encrypted” digital art series.

But not all institutions are bullish on NFTs. When ConstitutionDAO, an ad-hoc group of private investors, tried to purchase an original copy of the United States constitution, it was outbid by hedge fund titan Kenneth Griffin. ConstitutionDAO raised $47 million from private investors at an average contribution of just $217. But the transparent nature of its efforts meant that other bidders knew exactly how high it could bid.

We see future NFT demand by institutional investors to fall into two categories:

- Acquisition of “blue-chip” NFT projects, similar to Visa’s purchase of a CryptoPunk.

- NFTs as certificates of ownership of other underlying assets.

Number two has been spearheaded by Uniswap, where a user receives an NFT representing their liquidity position. Since some liquidity providers can be extremely profitable, these “utility NFTs” can represent ownership of a yield-bearing asset.

Overall, the interest and sentiment of institutional investors for NFTs is positive. However, without a solid regulatory framework and likely without deeper liquidity and more sophisticated instruments, institutions will not invest heavily in NFTs.

The interest and sentiment of institutional investors towards NFTs is positive, but without a solid regulatory framework and deeper liquidity, institutions will not invest heavily in them. We expect to see institutions acquire “blue-chip” NFT projects and use NFTs as certificates of ownership of other underlying assets. The future of NFTs is promising, but it will take time and development before they become a mainstream investment option for institutions.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.