Over the last year we have seen legislation waking up to the promises and dangers of blockchain technology and hope that they can provide clarity and guidance that enables innovation while protecting investors and consumers. The importance of this can also be seen in additional important surveys that were made about the crypto industry in the last couple of years and that we have not taken a look at in last weeks article.

The third report we want to include is the State Street Digital Assets Survey from October 2021. The report finds that:

- 82% of respondents are allowed to hold digital assets.

- 21% actually hold them, although most plan to increase their exposure.

- 56% expect cryptocurrencies to be common in modern portfolios within the next three years.

- Asset holdings are driven by smaller funds. Sovereign wealth funds are mostly prohibited from investing.

- Similar to the PwC report, funds prefer direct holdings for unleveraged long positions.

- Custodial solutions are the most important building block for respondents because cybersecurity concerns are paramount blockers.

- Decentralized finance (DeFi) and nonfungible tokens (NFT) are seen as the biggest drivers of disruption.

- 52% believe blockchains will enable real-time settlement in the financial markets at large.

Finally, the Bitwise/ETF Trends 2022 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets report features some very promising indicators:

- 94% of financial advisors received questions about crypto from clients.

- 47% of advisors reported holding digital assets for themselves.

- Client accounts with digital assets in them grew from 9% to 16%.

- Crypto equities like Coinbase stock trumped the list of investments (46%), with Bitcoin (45%) and Ether (41%) not far behind.

- 60% reported regulatory concerns as the biggest deterrent.

- 53% viewed crypto as too volatile.

- 34% had trouble with applying valuation methodologies to digital assets.

- Apart from regulation, 46% said that better custodial solutions would make them reconsider digital assets.

- 44% wanted a spot-based ETF to invest in.

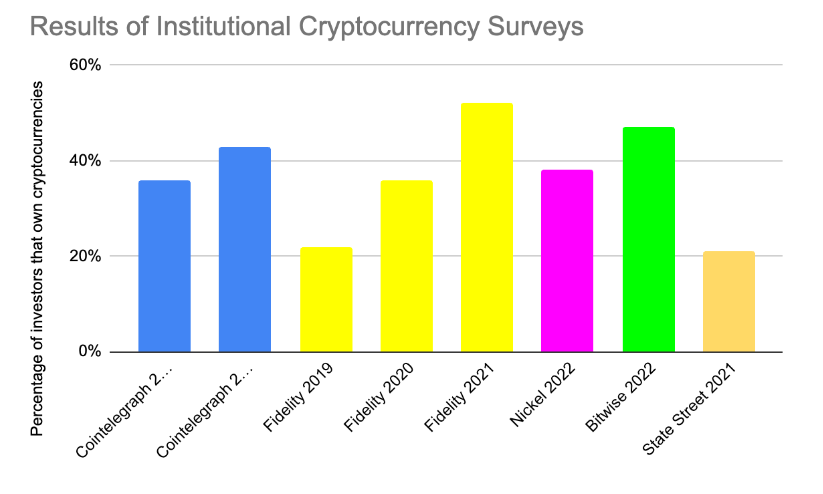

Comparing the results of the 4 surveys done in 2022 on professional investment in cryptocurrencies, 45% of institutional investors have exposure to digital assets. If there’s a common ground among these reports, it is that concise regulation and good custodial solutions would unlock investments on a massive scale. These two are clearly correlated, as custodians have some legal responsibility and are likely waiting for clarity themselves.

This article is an extract from the 70+ page Institutional Demand for Cryptocurrencies Survey co-published by the Crypto Research Report and Cointelegraph Consulting, written by multiple authors and supported by Flow Trader, sFox, Zeltner & Co., xGo, veve, LCX, Finoa, Lisk, Shyft, Bequant, Phemex, GMI.