Solana’s implementation is fundamentally different from Ethereum’s. On the latter, programs can hold state; on the former, they cannot. A program’s state is the data it uses.

For example, one piece of data could be an incremental counter that assigns a number to NFTs as they are minted. This incremental counter would be stored in a program’s state on Ethereum, which Solana cannot do.

Instead, Solana uses accounts to store and access data. Accounts can also store multiple addresses to send and receive tokens. Like Ethereum with its ERC-20 standard, Solana also supports tokens built atop it.

Unlike Ethereum, every token needs an address of its own, which is then part of an account. It is a bit similar to Bitcoin’s HD wallets in practice, but with a different implementation and functionality.

To make a long story short, we will look at active accounts instead of unique addresses. Though this number is difficult to pinpoint accurately, research from CoinDesk and Solana Beach arrives at a substantiated estimate of 1.2 million active accounts.

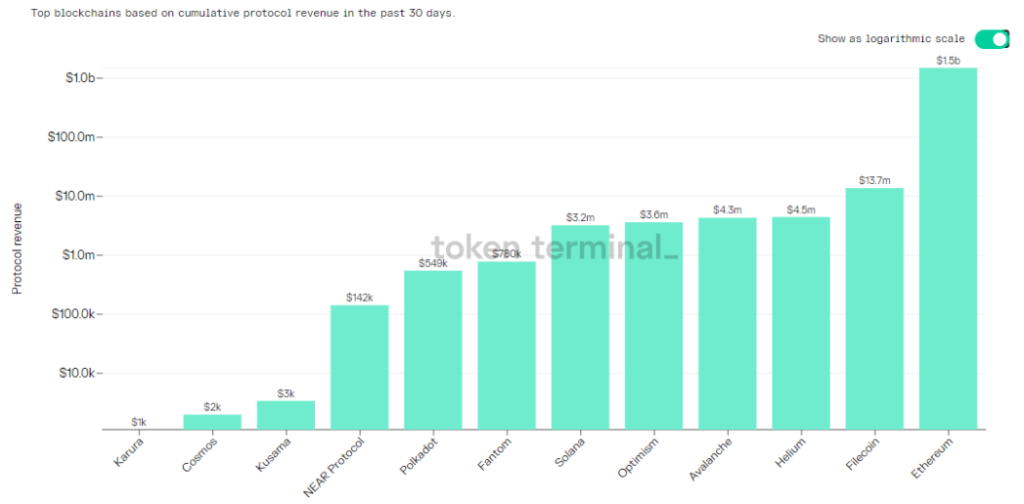

Solana protocol revenue and price-to-sales ratio

One of Solana’s most vital selling points is its low transaction fees. Currently, a transaction costs $0.00025. Transactions on Solana are a bargain compared to Ethereum, where a Uniswap trade frequently costs over $100. Conversely, these low fees lead to lower protocol revenues.

The Graph reports earnings of just $3.2 million for Solana, while Ethereum miners gained $1.5 billion in the 30 days leading up to Nov. 16, 2021.

Looking at the price-to-sales ratio, Solana lands on a multiple of 30,909x earnings, while storage protocol Filecoin has a multiple of “only” 514x.

Solana is in a difficult position from a price-to-sales perspective. On the one hand, it needs low fees to remain attractive for traders and financial applications. On the other hand, SOL’s price is hard to justify at this point.

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.