SOL holders enjoy a variety of options for putting their tokens to work. Non-custodial staking is available in the Exodus wallet or with the native Solana-CLI command-line tool. Staking rewards are around 6%–6.5% APY at the time of writing.

Custodial staking is possible on Binance Earn, Kraken and FTX and, typically, offers fewer earnings. Binance Earn offered 6.5% APY this November 2021.

Then there’s lending on platforms such as Solend or Tulip Finance. Even staked SOL can be lent on Tulip, albeit for a meager 1.79% yearly yield, while Solend offers 3.87% for supplied SOL.

Lending becomes more exciting when providing stablecoins. Solend offers 24% on USD Coin (USDC), and Tulip grants 15% APY on USDC-USDT pairs via Raydium.

Solana initial coin distribution breakdown

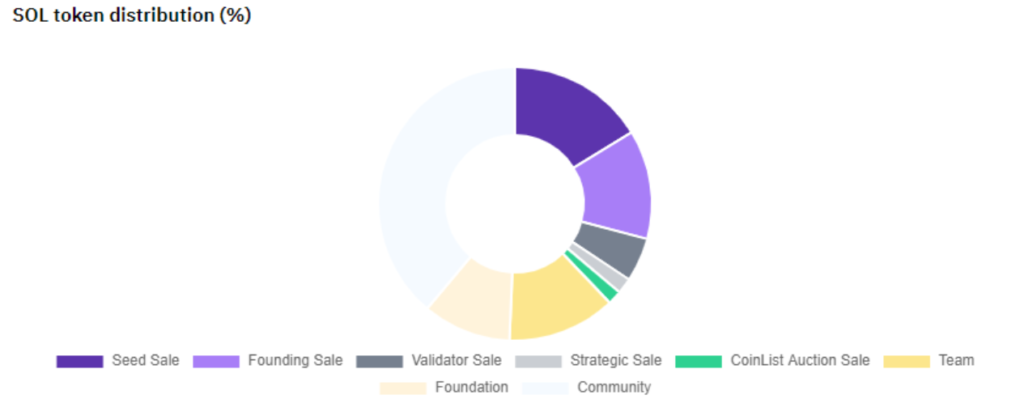

The degree to which Solana is decentralized was the subject of heated controversy on Crypto Twitter this autumn. The pièce de résistance is the number of tokens held by the team and by VC backers. Solana has an initial token supply of 500 million SOL with a yearly inflation rate of 1.5%.

Binance Research found out that the team holds 12.79%, and VCs bought 29.15% of all tokens during the seed and funding sale, a total of 41.94%.

Figure: Solana initial token supply distribution

The pie chart doesn’t include the $314.15-million token sale that Polychain Capital and a16z completed in June 2021, and the exact amount of tokens involved was not published. The exchange price for SOL was $30–$40 in the months ahead, though it’s probably fair to assume that a steep discount was applied, given the scale of the purchase. Presupposing a $20 token price, 15.7 million SOL or 3.14% of the initial supply would have changed hands.

Staking validators have to pay transaction fees on voting and syncing transactions but earn staking rewards as well as block rewards. Running a viable validator requires a stake that produces rewards in excess of transaction costs. In September 2021, the minimum stake required had surpassed $1 million — a significant barrier to entry for new validators.

Despite that, almost 1,200 validators are operational at the time of this writing. The top 19 validators control 33% of all SOL staked and could theoretically halt the network if they colluded.

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.