To date, Polkadot has raised roughly $200 million from investors from two sales of its DOT cryptocurrency, making it one of the most well-funded blockchain projects in history.

In October 2017, Polkadot raised a staggering $144 million in its token sale, which was one of the largest on record at the time. But Polkadot also had the misfortune of being one of the many victims of a hacking incident that was using Ethereum wallets at the time, resulting in some of Polkadot’s funds being inaccessible — an issue the Foundation fortunately managed to resolve.

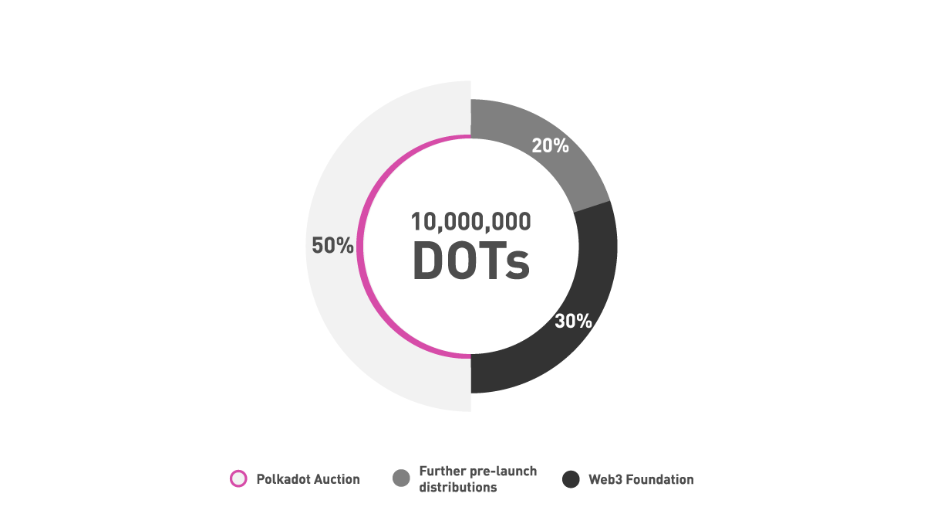

The total token supply of Polkadot was 10 million, which is far smaller than other digital currencies (Bitcoin has a rather small supply of 21 million tokens in total). Polkadot had its first crowdsale from Oct. 14 to Oct. 27, 2017, during which it sold 50% (5 million DOT) of the total supply through what was called a Spend-All Second-Price Dutch Auction.

Polkadot was redenominated on Aug. 21, 2020, after the Polkadot community approved a redenomination proposal. The redenomination did not affect the actual supply of DOT but changed the number of Plancks (the smallest unit of DOT, analogous to Satoshis in BTC) that constitute 1 DOT. Before the change, 1 DOT was 1e12 Plancks, while it is now 1e10 Plancks after the change.

The average transaction fee currently on the Polkadot networks is 0.1 DOT or $3.8. Polkadot uses a weight-based fee model as opposed to a gas-metering model. As such, fees are charged prior to transaction execution; once the fee is paid, nodes will execute the transaction. Fees on the Polkadot Relay Chain are calculated based on three parameters:

- A per-byte fee (also known as the “length fee”).

- A weight fee.

- A tip (optional).

The length fee is the product of a constant per-byte fee and the size of the transaction in bytes. Weights are a fixed number designed to manage the time it takes to validate a block. Each transaction has a base weight that accounts for the overhead of inclusion — e.g., signature verification — as well as a dispatch weight that accounts for the time to execute the transaction. The total weight is multiplied by a per-weight fee to calculate the transaction’s weight fee. Tips are an optional transaction fee that users can add to give a transaction higher priority.

Together, these three fees constitute the inclusion fee. This fee is deducted from the sender’s account prior to transaction execution. A portion of the fee will go to the block producer, and the remainder will go to the Treasury. At Polkadot’s genesis, this was set to 20% and 80%, respectively.

So does Polkadot have an advantage over Ethereum and its other competitors? Next week we will present you a summary article on Polkadot before we are moving on to Algorand, the last Ethereum competitor that we will analyse in depth!

This article is an extract from the 80+ page Scaling Report: Does the Future of Decentralized Finance Still Belong to Ethereum? co-published by the Crypto Research Report and Cointelegraph Consulting, written by ten authors and supported by Arcana, Brave, ANote Music, Radix, Fuse, Cryptix, Casper Labs, Coinfinity, Ambire, BitPanda and CakeDEFI.